Yesterday, weed stocks were generally green. The day before too. This brought about a load of folks on social media talking about how ‘cannabis is back!’ and ‘the bear market is over!’

Ugh. Seriously, you guys. It’s not over. Not by a long shot.

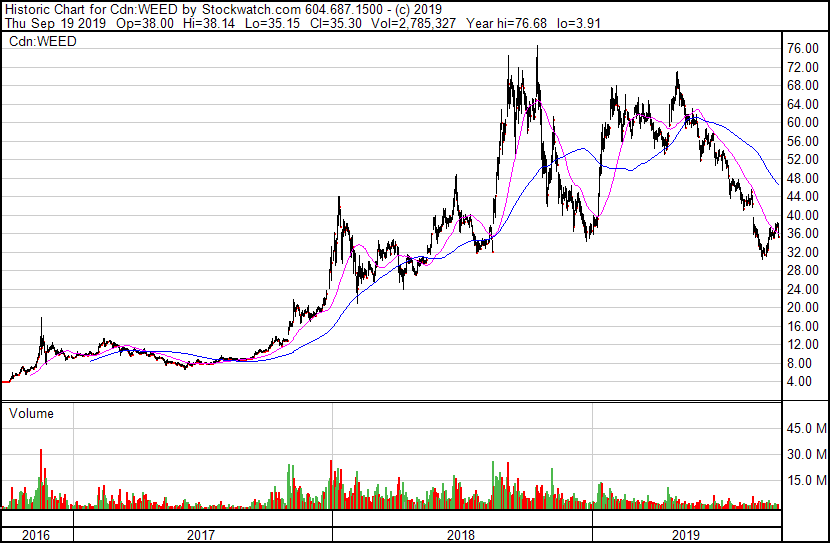

Currently, Canopy Growth Corp (WEED.T), the big bellwether of the cannabis sector, has over a billion dollars in short selling bets against it. Aurora (ACB.T), which is also up there in market cap and name recognition, is close to the billion mark in shorts. There are $4.5 billion in short bets in weed right now which is a lot considering the widely used estimate on the size of the cannabis industry has been $5 billion in Canada.

For the uninitiated, short selling is when you borrow a stock, usually from your broker, and then sell it today, planning to buy it back later at a lower price and make a little profit on the difference. Essentially, you’re betting the stock will drop.

Retail investors like to think that a small band of rogue corporate misfits do all this shorting, and that they can squeeze them by buying more of their favourite company’s stock, and that ‘this too shall pass’, but the truth is the folks shorting cannabis stocks right now are the guys that usually offer those companies financing.

At times, they’ll offer both financing AND short sell the borrower at the same time.

This is a bet not just on a continued downturn in the sector, but on a financial apocalypse. It’s the sort of lending that organized crime usually engages in.

“Oh, you need a grand to get high? Sure honey, here’s the cash. It comes with 50% interest per week. If you come up short, pick a street corner and buy condoms in bulk.”

On the public markets, there’s usually less crack dependency to deal with, but just as much whoring at the end.

Let me make this really clear for the guys in the back: If the company you like doesn’t have cash on hand to cover two quarters of losses at the most recent loss rate of that company, they’re fucked.

I mean, they’re actually in trouble. Real trouble. Not ‘oops, guess we’ll have to sell something’ trouble or ‘the stock is cheap but we have to do a financing anyway’ trouble, but ‘how the hell are we going to pay the rent?’ trouble. The sort of condition where the receptionist is taking home the potted plants on the weekend because she’s not sure if the office will be locked come Monday morning.

They’re screwed because the financing available right not comes with massive strings.

And by ‘strings,’ I mean nooses.

I took part in a private Hemptown debenture a while back because I know they have the money to repay me and I know they’re earning revenue. I was in a C21 Investments (CXXI.C) debenture before that for the same reason. But if large funds are taking part in any debenture involving a Canadian cannabis company with less cash in hand than they need to cover their quarterly losses, that deal comes with barbed wire wrapped around it and a quart of lubricant on the side.

Debentures, usually, are simple loan arrangements than can convert to stock or cash. But lately they’ve turned greasy, with all sorts of usurious interest rates, floating convert prices, and insurance that the lender will never risk anything in completing the loan.

Those debentures will sometimes come with the borrower agreeing to lend their shares to the financier so the lender can short the stock. They’ll come with ‘floating convert’ floors, so if the stock drops in value, the number of shares given out to cover the repayment of the debt grows by leaps and bounds. They’ll come with insane interest rates that aren’t far off credit card levels.

When this is the only option for companies in a cash crunch, it’s a bad sign for the sector. It means the ‘free first taste’ their dealers gave them in 2016, 2017, and 2018 just became a dependency and, wouldn’t you know it, the price has tripled.

When Aurora takes out a credit facility for hundreds of millions that they’re going to use to repay the hundreds of millions they currently owe on earlier financings, that’s a bad sign.

When Wayland Group (WAYL.C) borrowed $25m from Alpha Blue Ocean to keep the lights on while the CEO packed his bags for Switzerland, and loaned ABO stock to short their own company, only for ABO to cover that short with stock they got from converting their debt at a far lower share price than initially agreed, that was a bad sign. Hell, that was a near death blow.

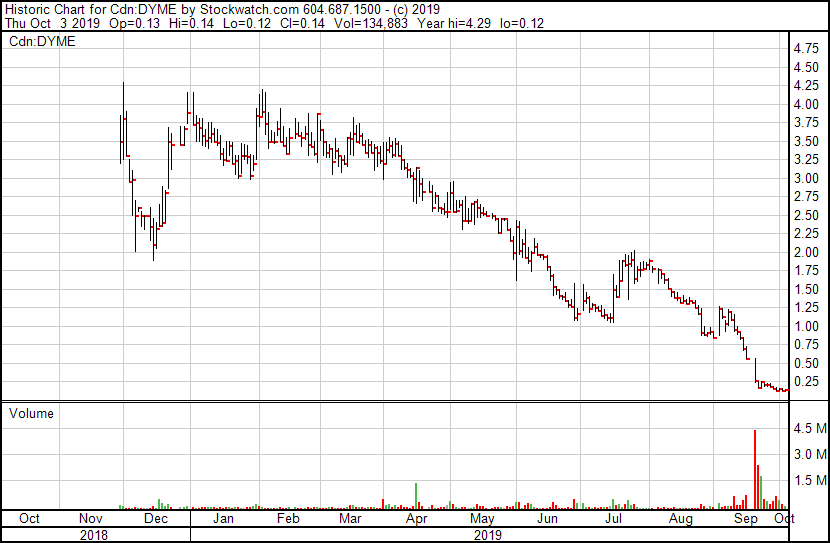

When Dionymed (DYME.C) restructured its debt, shifting it to what looks like a 17% interest rate in the process, and dropped its workforce by one third, because it couldn’t cover a $2m debt payment to a senior lender, only to be sued by another lender for $2m more, days after Gotham Green has issued a request for repayment of its outstanding balance of US$2.2m… that’s not just a bad sign, that’s an impending bankruptcy.

And then there’s Beleave (BE.C), which is selling its things that are worth something for a total of $9m, to pay off the debts it has accrued on the way to non-profitability.

From the opening statements of Beleave’s late financial filings:

During the year ended June 30, 2019, the Company had not yet achieved profitable operations, incurred a net loss of $1,531,217 (2018 – loss of $10,306,315) and, as of that date, the Company has an accumulated deficit of $60,643,474 (March 31, 2019 – $59,112,257) and is in default of the note payable to Auxly Cannabis Group

Auxly is suing them for $9m, so those asset sales cover that – but nothing else. Which leaves the bigger question.. what happens next?

Beleave quarterly financials: $1.5m net loss, $366k left in bank. Selling London, Ontario property and retail location to keep lights on. Net sales down 26%.

Woof. $BE— Chris Parry ™ (@ChrisParry) September 30, 2019

I’ll tell you what happens next: Death spiral financing followed by liquidation.

Beyond the terrible financings, there are the write-downs, which are coming thick and fast. Here’s MYM Nutraceuticals (MYM.C) tossing out the things it once announced as game-changers, now agreeing they have no inherent worth at all.

MYM Nutraceuticals financials are just a lineup of write-offs.

$1.8m for Budly software, written down to $0.

$340k for MJT, written down to $0.

$610k for Northern Rivers Australia, written down to $0.

$888k for HempMed Products, written down to $0.

$MYM— Chris Parry ™ (@ChrisParry) October 1, 2019

But that’s small potatoes: They also announced their $2.5m BioHemp deal was being reversed after it didn’t do as promised. Good news; they’ll apparently (hopefully) get their money back.

They’ll need it; dig deeper and you find the first guys getting paid at MYM weren’t the creditors, but the executive team.

The former CFO took home $348k for getting the financials together, and a company controlled by the new CFO took another $200k in the time since. Perhaps they could have spared a dime for the former CEO, who was apparently so in need of financing himself that the company is owed $50k by him personally.

Cannabis One (CBIS.C) has taken a sustained cholera dump on itself recently. They had a big deal announced April 22 of this year whereby they were going to take over Evergreen Organix for $47m in stock, cash, and debt covering.

That deal hasn’t closed. I’ll bet good money it won’t.

As at July 31, 2019, the Company has not yet paid any portion of the above consideration payable. The timing of which is being negotiated amongst the parties.

The stock part of that deal was originally announced when CBIS was priced $4.50, which meant it was going to cost CBIS 5m shares to close the deal.

Small problem now: CBIS stock is currently selling for $0.19, down 96% from the deal price. At today’s prices, if the deal were to close as I’m writing this, it would cost them 87m shares to execute.

There are currently only 78m shares in CBIS outstanding.

To put it another way, if the deal closed at the originally agreed upon price (which is $8m more than CBIS is actually worth today), the sellers would now own enough CBIS paper to have controlling interest in the company.

Not that you’d want it, because it appears that company won’t exist for long. Their last financials showed an $8m+ quarterly loss. An emergency financing in recent weeks to get $1.7m in the door is already 30% underwater. $2m of that loss was spent on marketing the stock and on share-based compensation.

I’m going to bet any taker a thousand dollars that Evergreen deal doesn’t close as originally planned, and when its reversal is formally announced, CBIS stock takes yet another hit.

It gets worse; the company is also facing two different lawsuits from three different parties, one from a builder who says he hasn’t been properly paid, another two from former partners who allege “breach of contract, breach of implied covenant of good faith and fair dealing, misappropriation of trade secrets, and fraudulent misrepresentation and concealment.”

If all of this has got you in a shorting state of mind, you’re not alone, but you’re probably not permitted to play that game.

The average cost to borrow stock at the big brokerage houses that might conceivably lend it to you is reportedly 26.3% for cannabis stocks right now, compared to 0.84% for the rest of the domestic equity market. (hat tip to Sharon Rideout for those figures)

Why might that be?

Because the brokerage houses are doing the shorting. If they’re going to let you borrow their stock, and limit their own ability to short, well, everyone, they’re going to make sure you cover their lost profits with a fat interest rate that, frankly, almost makes shorting untenable. I’ve been quoted 138% to borrow Canopy stock. That’s unprecedented, and insane.

The 4 largest short positions right now are Canopy, Aurora, GW Pharma and Cronos, with HEXO picking up steam. But Canopy is doing the most sector damage.

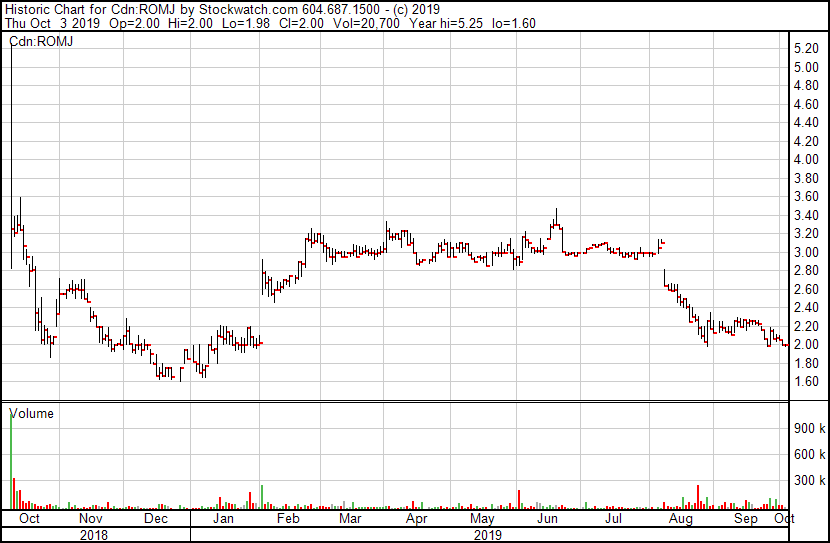

This chart tells a lot of stories. For example, it tells how, at the end of every year, weed stocks spike leading into year end (you’ll find this going all the way back to 2014), only to die during tax loss season, then come hot again in January.

It tells the story of how trading volume this year is more akin to what it was in 2017 than 2018.

It tells you how, as we told you it would, everything lost the floor under it in February of this year and has struggled continually since.

And it tells you that, for all the work Canopy has done since 2017, for all it has acquired and built, for all the marketing and hiring, none of that is worth a dollar on the markets right now because they built their company in a way that loses money on every gram they sell.

The Globe and Mail reports in its Tuesday, Aug. 27, edition that Constellation Brands said Monday it expects to record a loss of about $54.8-million (U.S.) in its current quarter from its billion-dollar investment in Canopy Growth. A Reuters dispatch to The Globe reports that Canopy chief executive officer Mark Zekulin said earlier this month the weed producer needs another three to five years to turn a profit.

In August, Canopy had a lot to say, putting out eight news releases before they announced a billion dollar quarterly loss. In June they had 14 pieces of news to talk about.

In September? One; a news release announcing the board of directors had been re-elected for another year. Giddy up.

Not that interim-CEO Mark Zekulin isn’t out there talking.

Two things I took away from the interview above:

1) Zekulin barely answered an actual question, without twisting himself into a pretzel

2) Why does Cramer sound like someone is twisting his pods whenever he asks a question?

But I digress. Canopy, right now, is a wreck, and it’s bringing down both those companies that fashioned themselves on the same ‘buy stuff to support your over-valuation, even if you’re paying way too much’ business model (what’s up, Aurora).

Those left in the stock are the grandparents who check their portfolios annually, the latecomers who bought at the peak, and the true believers, who continue to make the same excuses they did in March, and April, and June, as their portfolios shredded daily and their superhero CEO was shown to be incapable of figuring out how to just sell weed for more than he bought it for.

Aurora folks are no different. They’re still in there swinging for the home team, despite that company needing to go out and get fat financing to pay for the fat financing they took out before. If Canopy was built to grow market cap and not profits, as it appears to have been, Aurora chased that dream by following a similar path; buy things, pay above the odds if you need to, and the balance sheet will figure itself out later. We are now at ‘later.’

Aphria has held value over the past year, but only because it shredded so hard at the end of last year when it became clear how former CEO Vic Neufeld was using the company to buy things off himself at an inflated price. Neufeld has not gone quietly into the night in the time since; he and his family were recently found to be gaming the Ontario dispensary lottery system, as he had friends, family, second cousins, a guy he met on the 8th tee, and the guy who owns the bodega down the street all sign up as lottery applicants. This activity should firm up the widely held belief that Neufeld slithers when he leaves the room.

CannTrust (TRST.T) didn’t help the industry when it was revealed they were using their expensive, extensive, productive and legal weed facility to produce, process, and sell illegal weed. That demonstration of rank criminality in a facility that has video cameras wired to Health Canada HQ, for god’s sake, set the entire industry on its knees.

The problem here is, when the bigger companies in the weed space are found to be not exactly viable, or trustable, or legal, and the vast majority at the top don’t exactly appear to be, at this point, playing it straight, the assumptions within the halls of financial power will be that nobody is viable.

Let’s be clear: That’s a dumb assumption.

But when you were dumb enough to lend hundreds of millions to companies that routinely lose money by the hundreds of millions, and which duly require endless financing to keep the lights on, making dumb assumptions about others is expected.

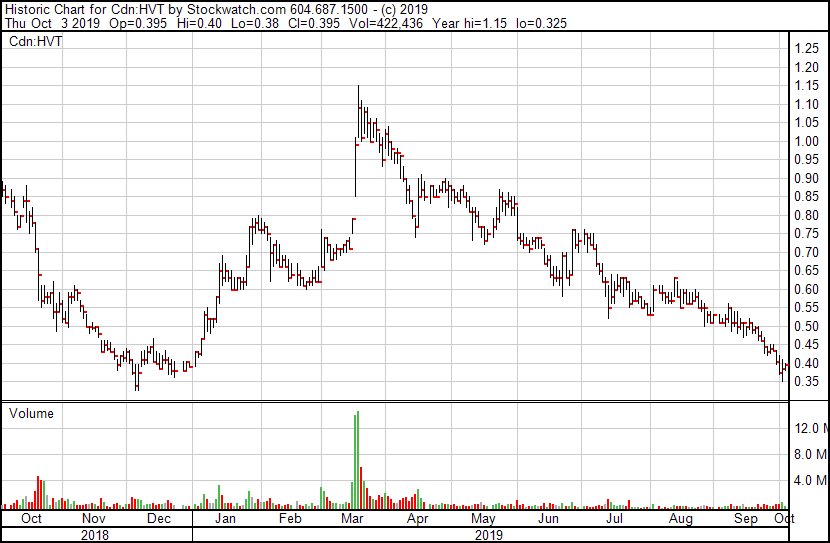

At the Cambridge House Investor Conference in Vancouver over this past weekend, a tech show that last year featured a dozen or so LPs, this time featured just three; Harvest One (HVT.V), Rubicon Organics (ROMJ.C), and 1933 Industries (TGIF.C).

Let me be really clear: I’d put money in each of those enterprises, even today. And I’ve had most of my money sitting in cash since February, as the cannapocalypse rolls on.

Harvest One has some genuinely good supply deals signed with grocer and pharmacy chains that deal in massive purchasing. Wal-Mart, Kroger, CVS, Shoppers Drug Mart, 7-Eleven, Loblaws, Rexall, Pharmasave… That’s going to be a big deal.

The chart’s not terrific, but the market cap now, at $84m, is a decent buy-in point for those looking for one.

Last financials showed a $3.3m Adjusted EBITDA loss, with nearly $30m cash in the bank. They have runway with which to get profitable that a lot of others don’t, with end user products on shelves now. That’s important at a time when balance sheets matter more than just about anything.

Rubicon Organics is traveling that organic road nicely, and their share price hasn’t been the trainwreck you’ve seen elsewhere. Rubicon has a 125k sq. ft cultivation and processing licensed facility in Delta BC, a 40k sq ft leaseback facility in Washington State, both of which should be good revenue producers. But they haven’t been without hiccups – their once touted California deal hasn’t worked out, though not at great cost to them, and a leaseback deal on a Washington State lab has been allowed to fall away.

One thing Rubicon has done is not blow out their share structure. At just 38m shares out, there are few surprises coming that you might see elsewhere. No ton of cheap warrants or absurdly flammable paper sitting about.

Steering clear of equity financing has meant the company borrowed its start-up funds, rather than using stock to bring them in. That’s not outrageous, the borrowing was mortgage-based and stable, no death spirals here. But while there’s no sales license yet in Canada, revenues are slim. The most recent quarterlies saw a $3m EBITDA loss with a bit over $2m left in cash. That was obviously a situation that needed to be addressed.

So Rubicon addressed it, raising $8.5 million at $2.70 a share. Runway achieved, and just in the nick of time.

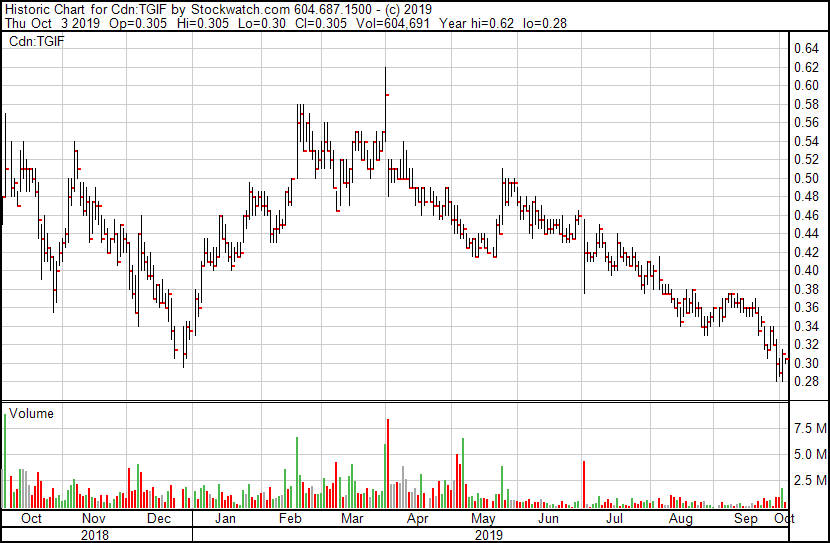

Harvest One and Rubicon aren’t Equity.Guru clients, but 1933 Industries (TGIF.C) sure is, and we’ve never been sad about it. I continue to maintain this group is one of the best undiscovered stories out there. The branding is impeccable, they’ve got products in stores across Nevada and sell among the product leaders across the state, and revenues are on the move.

These guys work. They’re at every trade show and there’s always a line of folks wanting to talk. Expansion into California is happening, their grow facility is nearing harvest, and their balance sheet isn’t horrible at all.

The company expects to report a cash balance of $18.6-million, an increase of $3.9-million from the previous quarter end. The company anticipates revenues for fiscal 2019 to total $18-million, marking an increase of 42.9 per cent over its fiscal 2018 results ($12.6-million).

Last quarter they lost $2.8m in adjusted EBITDA, while revs climbed nicely. If that loss rate continued indefinitely, they could stay afloat for over a year, but I expect profitability shortly, and, while their chart too has some warts on it, their $87m market cap is very defendable.

Then there’s Supreme (FIRE.T), which we think is still a client and will write about positively regardless (albeit more often if that contract gets sorted soon, natch), because it’s doing all the right things.

The stock, however, is hurting regardless of those right things, because there’s a bunch of early stage financing warrants out there at a cheap price that naysayers reason will put a lid on the share price for the forseeable.

Cheap $FIRE warrants coming due Aug 30 https://t.co/1YIGGfHg9v

— Amin Zee (@AminZadeh14) August 10, 2019

A few things here:

- That Supreme raised money cheaply (by today’s terms) several years ago, which created warrants that might still be out there today, is to be lauded, not complained about. They used that money to create a genuinely strong brand that is close to break even when others are far from that point

- Supreme has a war chest of tens of millions of dollars that can be used to buy good assets on the cheap without hurting the share count – or can be used to extend the runway to profitability as needed without further financing. That war chest came with warrants. I’d rather deal with those than be riding a low cash position

- I don’t know about you guys, but if I’ve ever had $0.50 warrants on a stock that is selling at around $3, as Supreme was not long ago, I’m taking those warrants down. Today Supreme has drifted to just $1.14 a share, but the idea that there are tens of millions of amazingly profitable warrants out there and the owners of them will wait until the last day of their validity to execute them is, to me, laughable. Chances are, most of that financing paper has already been taken down.

The Globe and Mail reports in its Wednesday, Sept. 25, edition that CIBC World Markets analyst John Zamparo commenced coverage on Supreme Cannabis ($1.31) with an “outperformer” rating, calling its strategy “simple” but “supremely effective.” The Globe’s David Leeder writes in the Eye On Equities column that Mr. Zamparo set a $2 share target. Analysts on average target the shares at $2.72. Mr. Zamparo says in a note: “We find Supreme’s strategy appealing because of its sharp focus on existing consumers, while its 7Acres brand is highly regarded. Future financing concerns are valid, but appear to be priced into the stock, and we deem it likely the company will be able to attain non-dilutive financing at reasonable terms.” The Globe reported on Feb. 1, 2018, that PI Financial analyst Jason Zanberg said Supreme was in a “strong” position to supply the recreational marijuana market. He rated the shares “buy” with a $4.50 share target.

The topic of cheap warrants has become a bit of a social media warhammer of late, something used by folks who don’t know much to claim heinous deeds and butcher a stock, sometimes for no good reason other than they feel personally affronted by it.

Case in point, Else Nutrition (BABY.V): Not a weed company, but a company I have an affinity for, being as they’ve developed a natural plant-based ingredient baby formula that closely recreates the nutritional profile of breast milk while maintaining soy-free, GMO-free, gluten-free, and dairy-free status. As the father of a kid who had real issues eating when he was born, I needed this product to exist and know many parents who’d be all over it.

But knuckleheads looked one level deep on the company and saw cheap warrants and lost their ever-lovin’ minds.

In case you were considering buying $BABY $BABY.v, DON’T!

They have over 30M warrants issued at $0.0001.

Yes, that is 3 zeros after the decimal. No, it is not a typo. https://t.co/8KlE3dnhCF

— Amin Zee (@AminZadeh14) September 26, 2019

Oof, that sure looks terrible, and plenty of folks jumped on, but nobody actually looked to see what those warrants were.

Turns out, they only exist when the founders hit some pretty lofty milestones with the company.

@001DanDan @AminZadeh14 @InvestwithPal

What he failed to show was the milestones to get these…. Disclosure…. I am long…. but pretty high bar to set for these performance based shares. If management can pull this off, they should get paid. pic.twitter.com/l0mPDhL6mQ

— SPACgod (@CgodSpa) September 27, 2019

What you’re seeing here is a company whose founders are aligned with shareholders. If they achieve their milestones, they get paid. If they don’t, they don’t, which is how it should be.

But ZOMG, THE CHEAP PAEPRS!

Here’s AMPD Technologies, public soon, getting the same facial for the heinous act of giving the founders some stock for what they’ve built, which they earn over three years as opposed to three months.

You can start the actual company?

This is a private company that had been in business for several years, bringing it forward to the markets as an ipo, not a shell with a business plan.— Chris Parry ™ (@ChrisParry) August 10, 2019

Look, I’m not going to sit here and tell you every RTO on the CSE is clean as the driven snow, but 7m cheap shares to the founders is not going to break the back of any pubco, especially as they’re released against milestones or, at the very least, several years of time having passed. A few million bucks in cheap warrants coming from a company having built itself into a $300m market leader is preferred to that group having never raised significant money and, today, looking for it under the couch cushions.

By all means, you guys need to keep digging on pubcos because they’ll cut a brother if you don’t, but you also need to know what you’re looking at. Not all debentures are created equal. Not all warrants are an overhang. Not all debt is bad debt. And not everything that can be a pubco killer, is.

MedMen (MMEN.C) coming public with a deal that handed the first $60m to the founders in executive retention bonuses was heinous. Wayland taking on death spiral financing while selling all of their foreign assets for another company’s freefalling paper was heinous. Beleave going to the Bridgemark scam twice was heinous. Abattis (ATT.C) hitting up Bridgemark while doing pretendsy deals was heinous. Isodiol (ISOL.C) doing deals with massive payoffs to senior investors, consultants, and execs was heinous. Vic Neufeld buying assets for pennies and selling them to his once-company Aphria for a massive markup was heinous. CannTrust (TRST.C) running an illicit drug ring out of its legal drug facility was heinous. Hell, the way Canopy Growth was constructed as a company was heinous, thanks Bruce.

But then we have the other end of things, like GTEC Holdings (GTEC.C), which recently agreed a deal with Canopy to buy up a cheap production facility the bigger company didn’t want. GTEC took no end of heat on social media for the deal which some claimed would see them ‘effectively bankrupt’, and others announced would dilute their share base like a firehose.

GTEC boss Norton Singhavon responded to those critics clearly, stating he wouldn’t dilute shareholders or take outrageous financing options out to close the deal, and duly announced a few weeks later, because financing options weren’t agreeable, that he was getting his deposit back and moving on.

That’s what one might call good management. No loss, no harm, no short term gain for long term hardship.

Not everyone agreed.

Couldn’t raise the money ? CEO cleary mentionned from the beginning that he wouldn’t raise any money at those ridiculous levels and wouldn’t create dillution for shareholders. Rather see him walk away than do this deal at all cost…

— maricom (@MariComIR) September 18, 2019

If the names of the folks making grand and often arguably wrong statements here are starting to get a little familiar, that’s not because I’ve searched them out specifically and looked to drag them. Rather, when I look back over the last month at those who’ve jabbed angrily at companies for crimes not actually committed, it just so happened to be the same dude over and over.

To him, I apologize for singling him out, as there are definitely others who see cheap paper and get the flop sweats. But when you’re wrong, you’re wrong.

From a few hours ago:

Strongly disagree. The increased interest here (As well as some sector strength) is the anticipation of the $4M debt repayment any day now.https://t.co/regTC9uksm

— All Streets Wolf (@AllStreetsWolf) October 3, 2019

Not a sign of desperation. It’s reshifting our corporate strategy to focus on where we have a competitive advantage, which is producing premium flower. I don’t want to compete with the big retailers. They have more expertise than us and I would rather support them as a supplier.

— Norton Singhavon (@nort604) October 3, 2019

Let’s be clear: AMPD, Else, Supreme, Harvest One, GTEC, and a hundred other companies all have things you could look at and pull out and say, “THIS IS TERRIBLES!” or “PUMPNDUMP!” because every public company makes moves that to one investor will be poison and to another will be pleasure, and everyone company works to tell their story to as many people as possible (OMG THE PUMP!) and sometimes stocks drop in value (ITS THE DUMP! RUN!) at a later date.

But not everyone is created equal, not everything that’s dark is evil, not every downward step is a tumble, and not every deal you’re not personally invested in needs to be kicked in the box.

The reality is far simpler:

- If a cannabis company is making a profit, good

- If a cannabis company isn’t making a profit but is close to it, and has enough cash in hand to get there, good

- If a cannabis company is far from making a profit but has enough finance to conceivably get there at some future growth point without financing, good

- If a cannabis company has one quarter of runway or less, they are in urgent trouble right now and will either make bad decisions, hard decisions, or even fraudulent decisions to carry on.

The reason the cannabis market is down is because more companies sit in the #4 category currently than don’t.

Your mission, if you want to not be sitting on cash for the coming months, is to find the companies with war chests that they’ll use to pick up assets cheaply as others fade (what’s up Supreme, Cronos, TGOD, and – surprisingly – Namaste), find companies that have done the work early to become profitable at the expense of insane market cap growth, and find executive teams like GTEC’s that stand up to their critics, talk openly about what they’re doing, who aren’t afriad to ditch a bad deal, and who will be around in a minute.

Profitability wouldn’t hurt.

Worth pondering on the micro side because, damn, that’s cheap:

- Biome Grow (BIO.C), revs up 290%, loss under $2m, market cap $30m

- Experion Holdings (EXP.C), revs just getting started, $10m in cash, loss under $2m, market cap $16m.

- Pivot Pharmaceuticals (PVOT.C), no revs yet, $4m loss last quarter, raised $15m in Q1, market cap of just $21m

- Vapen MJ Ventures (VAPN.C): US$4.7m in revs, $5.2m in cash, $1.3m in net income (profit!)

— Chris Parry

FULL DISCLOSURE: GTEC, TGOD, Supreme, Vapen, Pivot, Experion, Biome, 1933 Industries are Equity.Guru marketing clients. The author owns stock in Hemptown, AMPD, and Else.

How bout that vivo. .theres a winner eh?

You used to have a lot to say about Eureka 93?….corrupt to an extent that makes Aphria look like boy scouts (insider deals, stolen technology, blatant lies to shareholders and partners), combined with totally inept management; absolutely no surprise what happened to those rats.

What’s to say? There’s no news. The moment there is, I’ll look at it.

No news?..CEO, President and many other execs all fired, failed capital raise, law suits on both sides of border, trading in stock halted….

Yes, and we’ve reported on that. What else you got?

Sorry, must have missed it – where did you report on the execs getting the boot ?

Social media, livestream, etc etc.

Afraid of facts Chris – it’s actually pretty easy to check and verify.

Great article Chris, spot on! Alot of the mso’s seems to be more focused on having strong financials and executing a good company business plan compared to how the cdn lp’s went about it. Who on the American side do you see “doing it right”? Whos setting their company up for long term success?