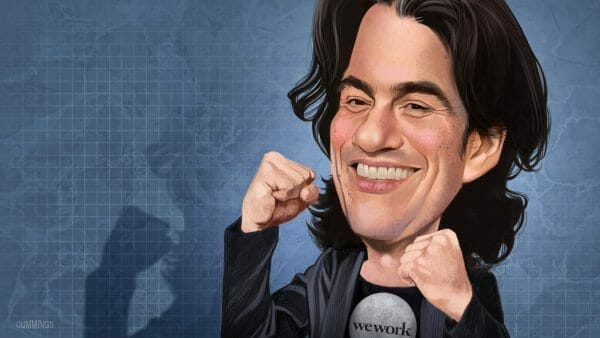

There’s something about Adam Neumann’s business model for WeWork that sounds familiar, and it’s not the model itself, but the thought processes behind it.

The familiarity cemented itself when coupled with the Financial Times article about him getting high on his private Gulfstream G650, and I realized: this guy was totally high when he came up with WeWork.

Let’s compare and contrast, shall we?

It was staff appreciation day a few Fridays go here at Equity.Guru and in appreciation for our diligent hard work, our boss picked up some choice THC and CBD so we could experience some adequate appreciation for a few hours. As Friday came to a close, I decided to try a little THC thinking I could have a warm fuzzy-bodied ride home on the skytrain, maybe enjoy another hour or two and then go out to our planned social engagement a bit more relaxed than usual.

Nope.

No onset for three hours. It kicked in when we were all sitting around the table at Boston Pizza discussing politics. One minute, I’m tearing apart Andrew Scheer’s voting record, and the next I’m analyzing all the molecules on a nearby doorknob and pondering what we can do for the gerbils in North Africa when the effects of global climate change ruin their natural habitat.

Now here’s how WeWork works:

It takes out long-term leases on buildings and rents them to businesses and individuals. It’s the Uber of shared-workspaces, catering to freelancers, startups and large corporations alike. The main problem, of course, is that it’s not even remotely recession proof. The first sign of an economic downturn and WeWork’s model is going to collapse under the weight of its own stupidity, as companies that can’t afford to pay their rent are going to default. Office spaces will go untenanted and Neumann will be stuck with the bill for these long term leases.

The difference between Neumann’s trip and mine is that I didn’t try to build a multi-billion dollar company off of my ramblings.

Here’s my favourite:

Mr. Neumann muses about the implausible: becoming leader of the world, living forever, amassing more than $1 trillion in wealth. Partying has long been a feature of his work life, heavy on the tequila.

Granted, he’s probably one hell of a guy to party with.

When I was growing up, my friends and I would always go over to this one guy’s place (let’s call him Daryl) to party. Daryl had the best weed, the booze always flowed, and he told the best jokes. Neumann, the more I learn about him, reminds me of Daryl.

Half-choked off of a bong hit, Daryl would jab his finger in my face and tell me about his plans for saving the rainforest. In an hour, the conversation would be all but forgotten, and any attempts to recall it when sober would be failures. But we were so sure they were awesome, and that these world saving ideas were great losses, and damnit, next time we were going to write them down.

We did once, and they were indecipherable garbage.

Kind of like WeWork.

Public investors are increasingly skeptical of the formula that has worked for Mr. Neumann so far: his pitch that We is far more than a real-estate company. With its rapid growth and use of technology, he argued, the company deserves rich valuations normally reserved for tech companies. Instead, many potential investors now see a fast-growing office subleasing company with losses of more than $1.6 billion last year.

Unfortunately, it seems Neumann is the worst kind of stoner: the asshole who leaves his people out to dry. During his Gulfstream flight to Israel, he got high with his friends and then left the plane. Afterwards, the flight crew discovered that he’d left his stash in a cereal box for the return flight. Now Israel’s generally lenient regarding marijuana, but other countries, particularly the United States, aren’t. If the authorities in the United States were to come across Neumann’s stash, then the owner of the jet would be liable.

That leaves stupid in the rear view mirror and takes the next offramp onto negligent.

And that, folks, is why you don’t give multiple billion dollar IPO’s to idiots, because they’re incapable of thinking far enough beyond their own myopic worldview to see the bigger picture. But self-awareness has never exactly been Silicon Valley’s strong suit.

Wall Street and Silicon Valley investors have been dismayed by the number

of potential conflicts of interest disclosed in the “S-1” IPO prospectus,

including Mr. Neumann leasing properties he owns back to the company and

borrowing heavily against his stock. Even some of We’s private investors said

they were angered to learn that an entity Mr. Neumann controls sold the rights

to the word “We” to the company for almost $6 million — before public pressure

led him to unwind the deal.

The company’s original valuation dipped from their anticipated $46 billion to around $10 billion because their underwriters, Softbank, J.P. Morgan Chase and Goldman Sachs, realized that the company was hemorrhaging money at a rate of $219,000 every hour of every day.

Now the company’s putting off their IPO until October.

I went back to see my old friend two years ago. He still lives in the same place and gets high every night. Except now instead of kids a few years younger than him, the kids are half his age and he’s exchanged his cool older kid vibe for that of a creepy old man. Naturally, none of his dreams and vast ambitions went anywhere, because he’s the self-sabotaging type who never could quite get out of his own way.

Kind of like what we’re beginning to see from Adam Neumann.

—Joseph Morton