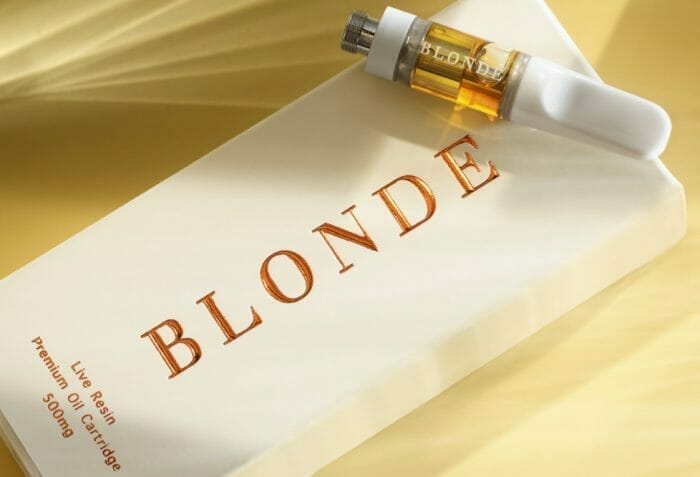

Blonde, a new high-end cannabis brand by 1933 Industries (TGIF.C), is making its debut in Nevada after successful implementation in California.

Alternative Medicine Association (AMA), a 91% owned subsidiary of 1933, signed a one-year agreement for the exclusive rights to “cultivate flower, manufacture pre-rolls, live resin vape pens and cartridges” under the Blonde brand for distribution to legal dispensaries in Nevada.

“AMA has built an outstanding reputation in this business and was selected for its exceptional approach to quality and consistency in its cultivation and manufacturing processes. AMA also offers an expansive distribution network in the state.”

–Tim Gavin, co-founder of Blonde

Blonde is a premium cannabis brand targeting the “luxury” segment of the smoking populace.

1933 at a glance

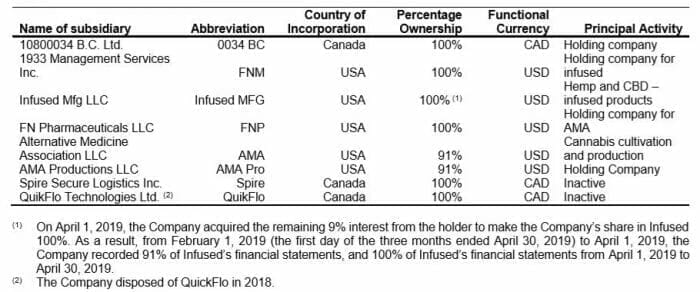

TGIF is a vertically-integrated, brand-centric cannabis company operating on both sides of the 49th parallel and the company has a number of subsidiaries to its credit.

Besides AMA, the company also wholly-owns Infused Mfg, a subsidiary focused on acquiring and developing CBD-infused products and brands.

The company also owns Spire Global Strategies, “a provider of customized security programs, compliance, information technology, buildout design, and due diligence services for the legal cannabis, mining and investment sectors,” though the subsidiary is now listed under discontinued operations on the financial statement.

TGIF’s recent performance

We’re in a slump, that’s for sure. I can name about four companies in the cannabis space off the top of my head who’ve managed to hold steady, and the rest have suffered.

Multi-state operators have also been hit hard as of late, and TGIF is no exception (they’ll be in California shortly, we’re told).

The company finished Q1 (ending April 30) relatively cashed-up: The company ended Q1 with CAD$14.6M in addition to USD$10M from the sale of their cannabis cultivation facility–never fear, this is a “sale and lease-back” maneuver.

What is concerning is the $9.8M in convertible debentures the company has. Although 1933 has considerable reserves to draw upon, the company had a net loss of $6.1M for the quarter and a net loss of $7M in the quarter prior.

If we assume the company will lose $6.5M in Q219, they’re still safe, but these convertible debentures mean one of two things is bound to happen:

- The stock gets diluted or;

- The money needs to be given back

Neither are ideal, but the good news is the company has a great Quick Ratio (QR), a neat little metric to determine if a company has enough liquid assets to cover its liabilities.

TGIF has an incredible QR of 6 when discounting the debenture, which is fantastic. Granted, the company doesn’t have the amount of moolah they did at the end of April but it’s still outstanding.

–Ethan Reyes

Full disclosure: 1933 Industries is an equity.guru marketing client.