DPW Holdings (DPW.NYSE) jumped 157% after its subsidiary, Digital Power Lending, completed their beta testing of its fintech portal today.

The fintech site is MonthlyInterest.com, an online portal that facilitates investments that pay monthly interest. The portal allows individuals to invest using portfolio criteria ranging from the sector to the investment length and interest rate.

“When DPW became a holding company, we envisioned the opportunity to fund our subsidiaries and partner companies. We believe MonthlyInterest.com will be disruptive by providing investors the opportunity to invest directly into companies and technology that will have a global impact, bypassing traditional banking and lending institutions,” said Milton Ault, III, DPW’s CEO and Chairman.

Red flags

Don’t be fooled by high percentage premarket leaps—this company has a serious illness contracted over the crypto-winter which it may not survive.

Officially, DPW Holdings is a holding company that makes money by acquiring undervalued businesses and disruptive technologies.

But DPW is considered to be a Bitcoin stock, meaning that the company’s values and fortunes are largely tied to those of Bitcoin, even though they have considerable holdings in a number of different industries.

Some of these include:

- defense/aerospace

- industrial

- telecommunications

- medical

- commercial lending

- blockchain technology and data center management

- crypto-mining

- textiles

The company also owns a portfolio of commercial hospitality properties and offers credit to select entrepreneurial businesses through a licensed lending subsidiary.

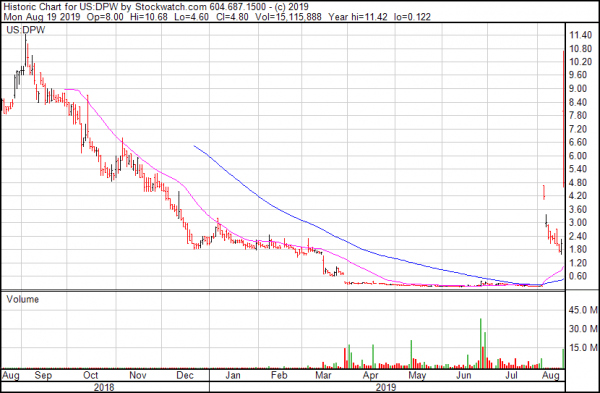

One of the problems of a company whose fortunes are tied so tightly to cryptocurrency is that when cryptocurrency suffers, they do as well. That’s why DPW collapsed by 99% during the cryptocurrency bear market in 2018 after a remarkable climb in 2017, suggesting that the “holdings” part of DPW holdings isn’t holding much.

Earlier this month DPW was noted as being one of the cryptocurrency oriented stocks that benefited from Bitcoin’s recent run over $11,000, but the boost wasn’t enough to catapult the company back into a healthy place. They have been too sick for too long, and illness runs deep in this company.

The company immediately followed with a 40 to 1 reverse split, causing the stock to tank 25%.

The reverse stock split will reduce the number of shares of Common Stock issued and outstanding from approximately 42,621,478 to approximately 1,065,537. The authorized number of shares of Common Stock will remain at 500 million.

The stock split came after the company received a noncompliance letter from the New York Stock Exchange regarding the relative deficiency of their stock price. DPW followed that with another highly dilutive financing to repay outstanding debts that shocked the stock down another 29%.

And then burned through even more paper later on in the month to pay for the loans offered through their Digital Power Lending fintech subsidiary.

…filed an amendment to its $50 million Regulation A+ Tier II note offering. The notes offered are not convertible, have a term of three years and bear interest at 12%.

The company’s one-year chart displays the downward trajectory of a company in a death spiral. Nevermind the bounce at the end, because it won’t be there for long.

—Joseph Morton