During a recent Okanagan wine tour, our tour bus operator told me he’d done extremely well with Shopify (SHOP.NYSE) and when he heard what it is I do all day, asked me where he should be putting his money.

Naturally, I asked him where his head was at: we were between the fourth and fifth different vineyard and I had imbibed anywhere between 12-15 glasses of wine. Did he really want my hot stock tips when I was barely able to see straight?

His response: “Good point.”

But after looking at Shopify’s chart, I should have asked him for some stock tips because this company is killing it.

That is a sweet growth trajectory with no sign of slowing down. Their share price has more than doubled since December, which means that my driver was actually downplaying just how well he’d done.

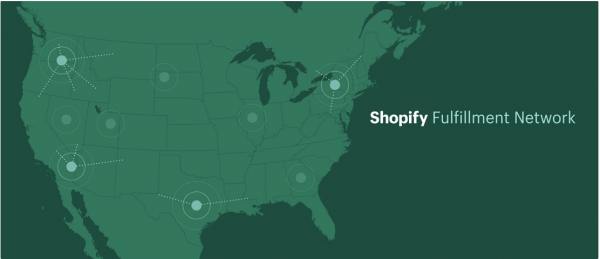

“It should be easier than ever to start a business, but entrepreneurship is still too hard. Our job is to keep innovating on behalf of entrepreneurs so they can compete in an ever-changing retail landscape. Every announcement we made at Unite, especially the Shopify fulfillment network, is designed to democratize commerce and make it easier for our merchants to reach for independence,” said Tobi Lutke, CEO of Shopify.

Shopify is an Ottawa, Ontario-based Canadian e-commerce company, and also the name of its e-commerce platform for online stores and retail point-of-sale systems. They offer online retailers options including payments, marketing, shipping and customer engagement tools intended to make it easier for entrepreneurs and other small business owners to make money.

The company’s reach has extended to 800,000 businesses in 175 countries by December 31, 2018, with a total gross merchandise volume of over $41.1 billion for calendar 2018.

Second quarter financial highlights:

- Total revenue was $362 million, a 48-per-cent increase from the comparable quarter in 2018.

- Subscription solutions revenue grew 38 per cent to $153 million. This increase was driven primarily by growth in monthly recurring revenue (MRR), largely due to an increase in the number of merchants joining the Shopify platform.

- Merchant solutions revenue grew 56 per cent, to $208.9 million, driven primarily by the growth of gross merchandise volume (GMV), as well as by growth in Shopify Capital and Shopify Shipping.

- MMR as of June 30, 2019, was $47.1 million, up 34 per cent compared with $35.3 million as of June 30, 2018. Shopify Plus contributed $12.4 million, or 26 percent, of MRR compared with 23 per cent of MRR as of June 30, 2018.

Shopify’s planned expansion

Earlier this year, the company hosted their fourth annual Shopify Unite conference, where it revealed an intention to transform commerce for merchants and consumers.

Their first plan included building more fulfillment centres, which would give merchants a wider distribution net and use machine learning to maximize delivery time and minimize shipping costs.

Also included was the new Shopify Plus platform, which helps merchants manage their businesses at the organization level.

Their financial outlook looks rosy as well:

For the full year 2019, the company currently expects:

- Revenues in the range of $1.51 billion to $1.53 billion;

- GAAP (generally accepted accounting principles) operating loss in the range of $145 million to $155 million;

- Adjusted operating income in the range of $20 million to $30 million, which excludes stock-based compensation expenses and related payroll taxes of $175 million.

For the third quarter of 2019, the company currently expects:

- Revenues in the range of $377 million to $382 million;

- GAAP operating loss in the range of $44 million to $47 million;

- Adjusted operating income in the range of nil to $3 million, which excludes stock-based compensation expenses and related payroll taxes of $47 million.

Just goes to show that sometimes even the strangest circumstances can yield unforeseen opportunities.

—Joseph Morton