So Donald Trump doesn’t like Libra, Bitcoin or cryptocurrency in general.

Does anyone remember when the United States President was someone to be admired and respected?

He cultivated an image of power, prestige, and even when caught being an affable goof as George W. Bush often was, he still had dignitas.

Dignitas is an untranslatable, one of those words from a different language that conveys a concept but lacks a direct translation into English. In this case, some approximate interpretations include “dignity” or “prestige” or “charisma,” but even they fall short.

Reagan had it, as did George H.W. Bush. Clinton oozed it (among other things), and even gaffe-prone George W. Bush had it at times. Obama embodied the concept, but Trump would probably need someone to help him spell it.

It doesn’t seem like that long ago when the president tweeting something out wasn’t covered by every news agency, scoured for its unintentionally comedic and/or racist content, and smeared across every social media outlet.

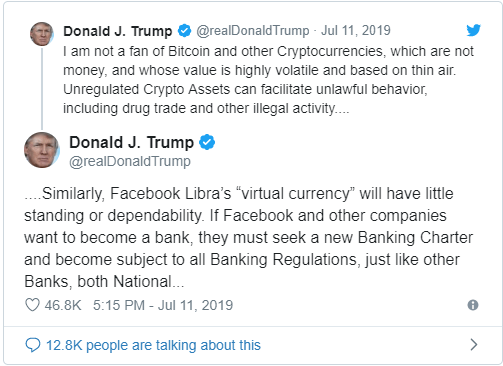

Here’s the Donald’s contribution to the conversation:

For a change, there’s nothing laughable or racist here. He’s not even wrong.

Everything he’s said in these tweets is factually correct, but one gets the idea that he still doesn’t get it.

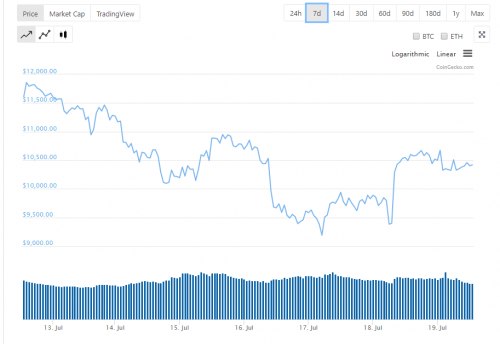

That’s why the market wasn’t immediately sure how to react when Trump blurted his displeasure over Bitcoin last week.

If it had have been any other President, Bitcoin aficionados might have shook a bit from the implied threat, but with this guy? Meh.

It took a few days before the Bitcoin market reacted.

And honestly, we can’t even point just at Donald Trump’s displeasure for the cause, because of everything else that went on this week. Now market correction seems to be afoot as the price of bitcoin has climbed back to over $13,000.

Here’s an overview:

Bull signal

Bitcoiners are an irascible bunch by and large. Warnings go unheeded, and punishments are met head on. We don’t comply with demands we disagree with, and any attempt to push us off our chosen course is likely to backfire.

We’re antifragile.

That’s why there are lots of dissenting voices out there in the cryptosphere that welcome Donald Trump’s attention.

But it’s somehow more than that.

There’s an adage in showbiz that there’s no such thing as bad press. It’s mostly true (although I wouldn’t want to be Jeffrey Epstein’s PR guy right now) and in cryptocurrency, it’s almost entirely true.

Here’s Jeremy Allaire, the co-founder and CEO of bitcoin and crypto exchange and payments group, Circle:

Possibly the largest bull signal for BTC ever. Crypto now a Presidential / Global policy issue. People everywhere will embrace a mix of sovereign and non-sovereign digital currency. https://t.co/PK79wmCddM

— Jeremy Allaire (@jerallaire) July 12, 2019

An Election Issue

Cryptocurrency has struggled for legitimacy since its inception with plenty of pundits short on information on what it is and how it works either ignoring the technology altogether, or launching scathing attacks.

But the mainstream is catching on.

Did you know there were two Democratic candidates accepting cryptocurrencies for platform funding?

Andrew Yang, founder of Venture For America, and Eric Swalwell, California junior governor.

Yang has been getting cryptocurrency donations for almost a year, and was the first candidate to formally announce a need for clearer regulatory guidelines on cryptocurrencies. He’s been called “the bitcoin candidate” and produced a popular Twitter hashtag, #YangGang.

“I believe blockchain needs to be a big part of our future. If I’m in the White House, oh boy are we going to have some fun in terms of the cryptocurrency community,” Yang said back in May at the at the annual CoinDesk Consensus conference.

That Yang is polling around 2% with Democrat primary voters, and Swalwell dropped from the race on July 8 are beside the point.

Swalwell’s campaign used The White Company, a blockchain payments firm that accepts bitcoin, bitcoin cash, bitcoin SV, ether, and stellar lumens.

All donations are subject to strict Federal Election Commission (FEC) regulations, regardless of the medium. For example, the most an individual can donate to a campaign for the 2020 cycle is $2,800. There is absolutely no allowance for the contributions of foreign governments, individuals or corporations domestic or foreign, so any prospective nominee needs to keep a tight rein on their finances.

Despite the hot press, though, we’d be remiss if we didn’t mention Libra’s woes.

Libra on the hot seat

Cryptocurrency markets run on pure sentiment, not logic. There are no high powered CEOs to put your faith in, and no companies building out assets having an affect on the price of Bitcoin; it’s all politics, passion and panic.

There’s been a fair amount of panic this week, and it’s tied to Libra, Facebook’s proposed cryptocurrency.

David Marcus, the head of Facebook subsidiary Calibra’s cryptocurrency division, had a turn on the hotseat answering questions from the U.S. Senate Committee on Banking, Housing, and Urban Affairs. He reiterated Facebook’s official position that it’s willing to work with regulators prior to rolling out their cryptocurrency to customers, but from all accounts, the committee wasn’t buying it.

“Facebook has demonstrated through scandal after scandal that it doesn’t deserve our trust. It should be treated like the profit-seeking corporation it is, just like any other company,” said Senator Sherrod Brown (D- Ohio).

It’s hard to disagree.

In fact, I didn’t:

For years Zuckerberg preached the value of sharing more information, touting the idealistic notion of the creation of a world that would be more open and connected. And then centred his entire business model around bundling our information and selling it to advertisers.

That’s pretty benign compared to what else he’s been doing.

We’re only going to focus on the more recent events, but the history of Facebook is a history of violations of privacy, including everything from unethical, non-consensual experiments on thousands of facebook users to interference in the political process.

This week we learned Facebook may be facing a $5 billion pricetag for their part in the Cambridge Analytica scandal.

But wait there’s more.

The company will be required to document every decision involving user data before the introduction of new products and services, and also be required to monitor third-party apps to make sure they’re not stealing your data. Facebook’s top execs will also probably have to pinky-swear and cross-their-hearts-and-hope-to-die to protect user privacy.

And, of course, we can’t forget crypto’s elephant in the room:

“This is indeed a national security issue. Cryptocurrencies such as bitcoin have been exploited to support billions of dollars of illicit activity like cyber crime, tax evasion, extortion, ransomware, illicit drugs, and human trafficking,” treasury secretary, Steven Mnuchin, told reporters at a press conference.

Marcus pledged Facebook’s complete compliance to combat criminal uses of their cryptocurrency, but given the size of the potential user base, that’s a tall order to fill.

Here’s how Marcus responded:

“The Libra Association is similarly committed to supporting efforts by regulators, central banks, and lawmakers to ensure that Libra contributes to the fight against money laundering, terrorism financing, and more. The Libra Association will also maintain policies and procedures with respect to AML and the Bank Secrecy Act, combating the financing of terrorism, and other national security-related laws, with which its members will be required to comply if they choose to provide financial services on the Libra network.”

His argument was that Libra should work to improve detection and enforcement, and not set it back. Facebook proposes regulated on and off ramps, basically government monitored exchanges, with proper know-your-customer practices giving law enforcement and regulators the ability to conduct on-chain investigations and analysis.

“I believe that if America does not lead innovation in the digital currency and payments area, others will. If we fail to act, we could soon see a digital currency controlled by others whose values are dramatically different,” Marcus said.

It’s a fair point, but it’s going to be a hard sell for this crowd.

Earlier this year, Senator Orin Hatch famously inquired to Facebook’s Mark Zuckerberg how he sustains his business model if his users don’t pay for the service. Naturally, Zuckerberg smirked and responded, “Senator, we run ads.”

If congress doesn’t understand that basic concept, then I can only imagine how hard it was for Marcus to explain a semi-decentralized stablecoin cryptocurrency like Libra.

Keep hodling.

—Joseph Morton