Companies operating in the junior exploration arena, particularly those in the base metals space, have seen their market caps blown all to hell in recent months.

The negative sentiment surrounding zinc has been especially pronounced. Some might characterize the carnage as a medival battlefield at dawn.

But these ravaged landscapes can be viewed from a different angle.

The Chinese, always deep in thought and spirit, have a sage and insightful way of looking at such butchery:

While some are busy pulling out the last of their hair, blowing out the last of their base metals shares into a market with little to no appetite, others – contrarians at heart – view the negative sentiment as an opportunity to acquire shares in high quality companies at extremely attractive valuations.

“Be bold and mighty forces will come to your aid.” Someone ‘Almost Famous’ once said that.

This could be an opportunity to buy dollars for dimes.

Pistol Bay (PST.V), according to the companies home page, is “a diversified junior Mining Canadian Exploration Company with a specific focus on zinc and other base metal properties in North America.”

While that may be true, a recent acquisition gives the company control of a highly prospective vanadium project in mining-friendly Nevada.

First things first.

The zinc and copper

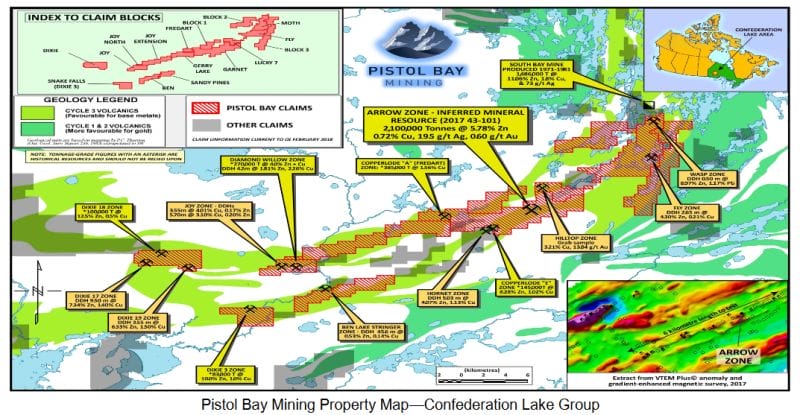

Pistol Bay is the dominant land holder in the Confederation Lake VMS Greenstone Belt of Red Lake, Ontario.

This 20,700 hectare land package is host to three significant zinc-copper-silver-gold deposits.

- 2,071,000 tonnes @ 5.92% zinc, 0.75% copper, 21.1 g/t silver and 0.58 g/t gold in the indicated category

- 120,550 tonnes @ 2.60% zinc, 0.56% copper, 18.6 g/t silver and 0.40 g/t gold in the inferred category

- 425,000 tonnes grading 1.56% copper (historical resource (non 43-101 compliant))

Ben Lake, Joy, Joy North and Caravelle

- 100,000 tonnes grading 12.5% zinc and 0.5% copper (historical resource (non 43-101 compliant))

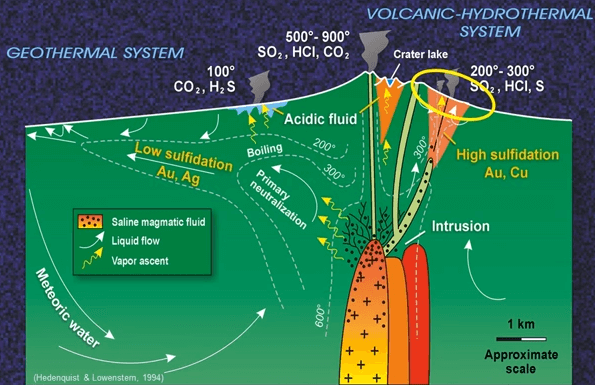

As noted above, Confederation Lake is a VMS type setting.

Those who know their rocks understand that VMS settings can be prolific – where there’s one deposit, there are often others.

Back in September of 2017, Confederation Lake was subjected to a deep-penetrating geophysical survey. The results suggest there is more. Much more:

- Conductive responses were confirmed at all historic showings, zones and mineralized drill intersections

- There are conductive extensions of several known zones, beyond sections that have been drilled in the past

- There are untested conductors on strike with known mineralized zones or occurrences

- There are new clusters of conductors, away from any known mineralization, that are in areas of favorable geology, and constitute new target areas

- Numerous IP effect anomalies have been identified, either as separate anomalies or as extensions of conductors

According to a Nov. 13, 2018 press release, Pistol Lake management is the process of negotiating joint ventures with multiple companies interested in certain Confederation Lake claims.

The press release also stated that the company is looking at drilling off certain projects on their own dime. I’m sure management is anxious to mobilize a drill rig to some of CL’s more compelling targets.

The vanadium

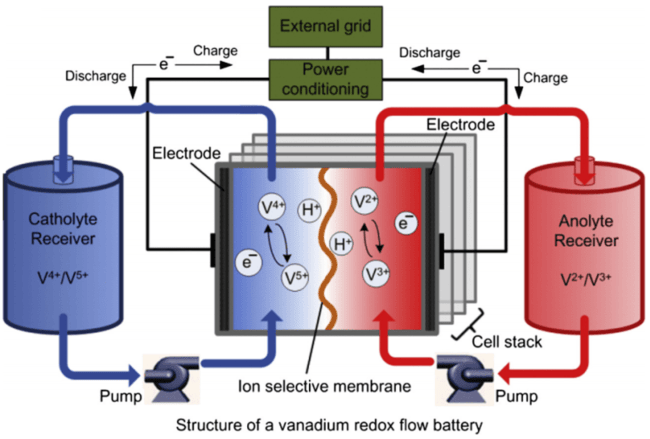

Vanadium is that hard, silvery-grey, ductile, malleable metal used in everything from surgical instruments to a new generation of energy storage technologies.

Some experts believe vanadium flow batteries will revolutionize modern electric grids the same way lithium-ion batteries are revolutionizing a global shift towards electric vehicles.

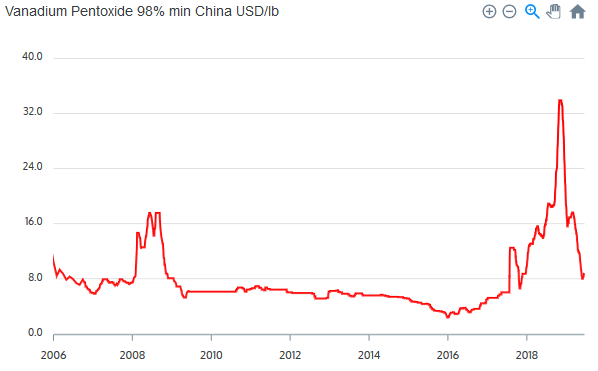

As a consequence, the price of vanadium has been on a real rollercoaster ride over the past two years as the forces of supply and demand square off.

On April 10, Pistol Bay announced a vanadium property acquisition in the mining friendly state of Nevada.

The market is looking for new opportunities in the vanadium space. Pistol Bay’s April 10 acquisition announcement generated a flurry of trading activity (note the April volume on the chart below).

The particulars of the Clark County deal

The acquisition involves 980 acres covering two properties known as the Vanadium Claims Group (VCG) project.

The VCG project is located in Clark County, Nevada, a historical mining district with 34 reported vanadium occurences.

This district was mapped by the United States Geological Survey (USGS) in the 1920s.

The USGS report stated that “Vanadates are uncommonly widespread in the district” and that significant concentrations of vanadium were shipped from the district in the form of mine concentrates and bulk shipments.

The report also noted a number of references to vanadium mineralization in the district:

- Concentrates reported to contain 15% V205

- 2.3 meters grading 3.75% V205

- A 3-meter wide zone estimated to run up to 10% V205

The USGS described the styles of mineralization within the district and recorded a significant number of vanadium occurrences containing vanadinite (19% V2O5), descloizite (22% V2O5), cuprodescloizite (17-22% V2O5), carnotite (20% V2O5), roscoelite (21-29% V2O5), and patronite (17-29% V2O5).

The report also noted that a number of outcrops within the project area contained vanadium mineralization and that “shipments of vanadium mineralization were made from one of the areas now covered by the VCG project.”

Charles Desjardins, president & CEO:

“We are excited to make this acquisition as it provides the Company exposure to the District Scale Potential of the area for high grade Vanadium mineralization, low cost exploration as well as potential for significant by-product credits ( lead, zinc, silver) from related mineralization in a district that not been systematically explored for vanadium.”

Geologically speaking:

The vanadium mineralization exposed within the VCG project belongs to the Exogenic type vanadium deposits characterized by typically higher grade (2-10% V2O5) mineralization; the vanadium minerals descloizite, cuprodescloizite and vanadinite and occur in oxidation zones of lead-zinc and copper mineralization.

I’m used to seeing vanadium values in the 0.10% to 0.50% range. This is some high-grade rock.

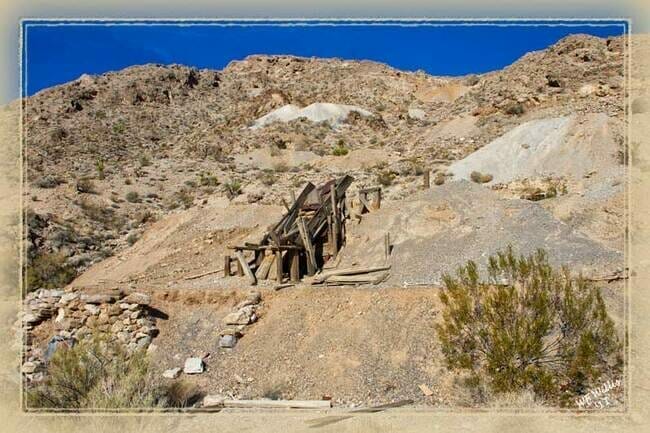

These claims surround the former producing Singer and Tiffin mines and are underlain by “Mississippian/Pennsylvanian age Monte Cristo Limestone, Birdsprings Limestone and outliers of Miocene age andesite/latite/rhyolite flows. Late north trending mica Lamprophyres dikes cross cut the limestone units.”

The Singer and Tiffin mines were former small scale lead-zinc producers that operated in the 1920’s.

The property covers the extension of the Sultan Thrust fault that dips to the south. The property is also host to several north-south trending west dipping faults.

The VGC project is divided into two claim groups:

Claim group #1 measures roughly 1.6 kilometers by 1.0 kilometers covering a number of reported vanadium showings exposed in outcrops and old mine workings.

Regarding this claim group, the USGS report states the following: “One mine (located within the claim group) however did ship 14 tons of material to the American Vanadium Company.”

Information on the vanadium content of the shipment is not available.

Claim group #2 has similar dimensions to claim group #1 with reported vanadium mineralization and a significant number of old workings.

No modern-day exploration has been completed on either of the two claim groups.

The USGS report is somewhat vague. It’s no wonder, it’s nearly a century old. Back in the 1920s the boys in the field were probably too busy fussing over their Tommy guns and fedoras.

But vague can be a good thing when it comes to these old geological reports. Vague implies that the area is vastly underexplored. It implies that the area could be ripe for important new high-grade discoveries.

Not to dismiss the VMS discovery potential of the company’s extensive land package at Confederation Lake, but I’m guessing VGC is now Pistol Bay’s flagship project.

Final thoughts

Don’t be surprised if the vanadium price kicks back into gear over the coming months. Demand is strong and supply is tight with China responsible for more than 50% of world output (that’s a problem in this era of tarrifs, trade wars and critical metal hording).

The company has a modest market cap of $2.01M based on its 50.33 million shares outstanding and $0.04 share price. Success on the exploration front could factor in large here.

END

~ ~ Dirk Diggler

Full disclosure: Pistol Bay is and Equity.Guru marketing client.