The executive team at Cannabis One (CBIS.C) may want to invest in some damage control experts going forward because shareholders are raging at them right now on social media over their actions (and inactions) of the past week.

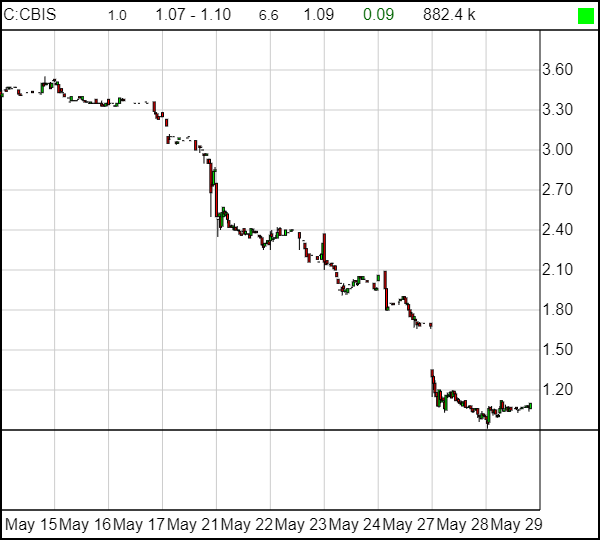

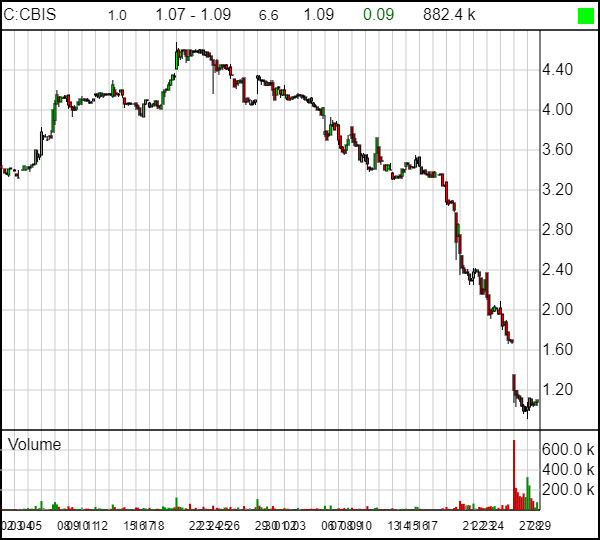

Despite ongoing newsflow that showed the company acquiring properties and closing deals, the CBIS share price has been absolutely hammered downward since May 21 with consistent daily selling.

That puzzled retail investors and appeared to puzzle the company too when they put out a news release May 27 that said:

CANNABIS ONE HOLDINGS INC. CONFIRMS NO MATERIAL CHANGE AND PROVIDES CORPORATE UPDATE

Cannabis One Holdings Inc., at the request of the Investment Industry Regulatory Organization of Canada, is not aware of any corporate development, news or undisclosed material change to the company or its operations that would account for the recent volatility in the stock market activity.

Quelle surprise!

That may have been more convincing if this news wasn’t released the following day:

CANNABIS ONE HOLDINGS INC. ANNOUNCES ACCELERATION OF WARRANT EXPIRY DATE

Cannabis One Holdings Inc. is accelerating the expiry of certain Class A subordinate voting share (SUB share) and Class B super voting share (SVS share) purchase warrants assumed by the company pursuant to the acquisition of Bertram Capital Finance Inc. [..] Pursuant to the terms of the Warrant Indentures, the Warrants are either exercisable to purchase: (a) SUB Shares for $0.50 or SVS Shares for $5.00; or (b) SUB Shares for $0.75 or SVS Shares for $7.50.

Fantastic.

For the new folks to the junior markets game, let’s give you a bit of warrant 101. Experts can skip ahead.

<book learning time>

A warrant is an agreement that, at some point in the future, an investor can buy stock in a company at a previously agreed upon price.

So, for example, if you were an early investor in CBIS and bought pre-public listing shares at $0.25, the company might also give you a half warrant for every share you have that allows you to buy more shares in future at $0.50. If the stock never rises, the warrant eventually dies, but if the stock goes to $2, that agreement to sell you more for $0.50 is a straight up deal.

Sometimes those warrants come with an acceleration clause, where the company can say, hey, the share price is up high enough that you need to use your warrants or lose them. That’s what happened here.

Now, here’s the problem: If you have a ton of large investors with large amounts of warrants, they’ll likely sell their existing stock to pay for the new, cheap stock.

That puts pressure on your share price, all the way down to that, in this case, $0.50 warrant buy-in price,so an acceleration is usually done if the price is still rising, which may absorb the downward pressure, or if the company is DESPERATE for the cash those warrants will bring.

</book learning time>

The notion that CBIS execs didn’t know they were going to accelerate warrants until after their ‘nothing to see here’ news release went out is flat out ridiculous.

Which gives weight to the growing theory that certain large investors may have also known the acceleration was coming before it was announced, and sold their shares for a nice profit while the price was still reasonably high so they could take out those cheap warrants.

Which also may be why the stock has been under selling pressure for a month now, even before the nuttiness of the past week, and even with positive news coming out fairly regularly.

But this is what really shits me:

Pursuant to the Warrant Indentures, the Company may accelerate the expiry date of the Warrants in the event that the closing price of the SUB Shares on the Canadian Securities Exchange (the “CSE”) is greater than $1.50 per SUB Share for a period of 10 consecutive trading days (the “Acceleration Trigger”).

From a shareholder’s perspective, pulling the ‘warrant acceleration if the share price is above $1.50 for ten days’ card JUST AS THE SHARE PRICE LOOKS SET TO FALL BELOW THAT PRICE for the first time since the public listing is some sociopathic bullshit. That just hurts everyone.

Accordingly, if all of the outstanding Warrants are exercised, gross proceeds to the Company will total approximately $5.9 million.

Does Marc Levy’s group really need the $5.9 million they say the acceleration will bring the company coffers so much that they’re okay with shredding $50 million in market cap? Because that’s what happened on the news.

CBIS stock dropped from a close of $1.66 Friday to a close of $1.00 the following Tuesday, good for shaving a $124m valuation down to $75 million.

Or, put another way, for every dollar the company can bring in for their warrants, shareholders lost ten dollars.

Interesting side issue of note: A lot of shareholders are focusing their ire on social media stock pundits that have talked up this company in months prior, rather than the executive team/board making the bad decisions.

Those individuals are taking it on the chin.

Yep, they could have done a financing and set a floor price…Instead it looks like they just messed it all up and had to set fire to the warrants…Just weak.

— jimrockfordatSH (@jimrockfordatSH) May 28, 2019

A few things on this: None of us know, when we start to cover a company on the public markets, especially brand new companies with no track record, where that company is going to go.

We don’t know if the execs will be boneheads, or crooks, or eccentric crazies (what’s up CUV Ventures), or be too smart by half (what’s up ASNT), or face large investors taking profits mid-run (hey CXXI), or just never catch a grip on the market at all (sup PURE), or do everything right at every turn but find there’s always a seller for every good piece of news (love you too, GTEC and FIRE).

Similarly, when things go great, we’re silly to take credit as a lot of things need to go right for a company to really catch a wave.

What we can control, as sharers of information with potential shareholders, and as journalists with advanced knowledge of the people behind deals, is that we check under the sheets before we climb into bed.

I’ve seen a lot of guys rocket to the top of our industry in the five years I’ve been covering this space, they come out of nowhere and they pick a couple of big winners, and they usually have a six month shelf life before they run out of juice as the odds swing back around the other way.

The reason for that is, if you take every deal offered, you’re mathematically going to be taking shitty deals that you’ll wear for a long time. When your readers eat a loss, they stop being readers, and you stop being relevant. We built our company with this understanding as our central tenet.

We reject as many potential clients as we accept, and we tell our clients we’ll kick them about if they deserve it, precisely because we want to be around for decades in this business, not months. They have to agree that, if they miss their milestones or break their promises, we’re coming after them. No refunds.

And if you want to see this in action, this podcast, with Lifestyle Delivery Systems (LDS.C) boss Brad Eckenweiler, is a good example of it.

Even though we make our clients run the gauntlet, we still find ourselves having to apologize for the occasional garbageco we didn’t see coming. Not many, thankfully, but when one shows itself we endeavour to be the ones breaking the news first.

My best advice for readers, and our competitors, is to play the long game. Invest in, and build, reputation over opportunity. If you want to be around for 25 years, don’t be dishonest – and don’t be duped. Question everything and everyone. Don’t buy a stock because a guy on Twitter tells you to, or because someone offers you a cheap deal or a stack of short term cash.

TL/DR: Don’t take a cheque just because it has your name on it.

PS:

$CBIS $CBIS.c $CAAOF sells down to $1.00 after they announce they’re accelerating 7M warrants at $0.50. 3 weeks after some investors were tipped off because that’s when the dumping started.

Still 40M cheap shares unlocking under $0.60 by August.

See you at $0.60. RIP.

— Amin Zee (@AminZadeh14) May 28, 2019

There’s a massive wedge of cheap CBIS stock coming free trading in August, so if you think this is a good time to catch a dead cat bounce, be brief with it and pray to your gods that you don’t get caught short.

— Chris Parry

FULL DISCLOSURE: No dog in the fight.

Chris, thought you liked Pure because they are doing business rahther than putting out shit NR’s. So they will get rewards for being best in class eventually. Do you still believe this?

There’s a fat line between putting out bullshit news releases and putting out no news releases.

Their last non-mandated release showing actual progress was in March. I mean, even if all you do is put out a corporate update to remind folks what you do and how, and that you’re still doing it, you can’t leave the markets in a vacuum for nearly a quarter and expect folks to buy.

To be clear: I own a bunch of it, just like you, apparently.

But I’m frustrated that they don’t appear to be concerned about realizing shareholder value. That needs to change, stat.

Hi Chris, I don’t understand your sentence about Pure. In all your previous articles about them, you were a big fan.

You said earlier, that they are just doing business, rather than putting out random and shitty NR’s. That’s the main reason why they have no grip on the market right?

I thought you liked this approach? Because you also said, in the long run, there will be rewards for being one of the best companies out there.

I still believe they’ll prevail, but I’m not of the opinion that a company has several years of shareholder patience to get there. They have to show their work at some point.

In everything I’ve written, this has been something I’ve touched on. I’ll give a company time to get their plans in place, but this is taking the piss.