We’ve taken a close look at Barrian Mining (BARI.V). We’ve talked with people in the resource arena, people we respect. We’ve talked with management directly to get a feel for things. We came away believing Maximilian Sali, Barrian’s CEO, is a man on a mission:

Equity.Guru podcast: Barrian Mining (BARI.V) goes public to bring gold mining to millennials

We are expecting strong newsflow over the balance of 2019 as the company aims to systematically probe its flagship Bolo project in Nevada.

On Friday, May 24th, after the market closed and brokers abandoned their trading desks for the weekend, Barrian dropped a key piece of news.

For those new to the markets, ‘post-session Fridays’ are normally reserved for crap news events as companies use the weekend to dilute the negative impact of whatever material affair they’d prefer to bury.

It’s a strange time to release positive news, but I’m sensing a trend change developing: some of the newer companies in the resource sector are shaking things up, claiming the post-session Friday time slot as a legit news dissemination window.

Perhaps it’s the new thing?

Barrian’s Friday post-session news drop

The company recently completed an induced-polarization (IP) and resistivity geophysical survey at Bolo. Multiple (high-priority) anomalies were generated from this work – anomalies that warrant immediate follow-up drill testing.

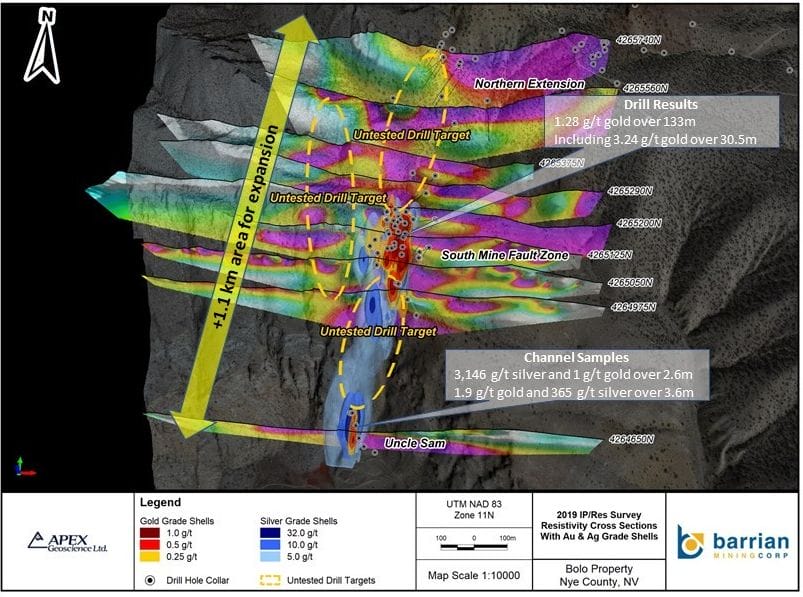

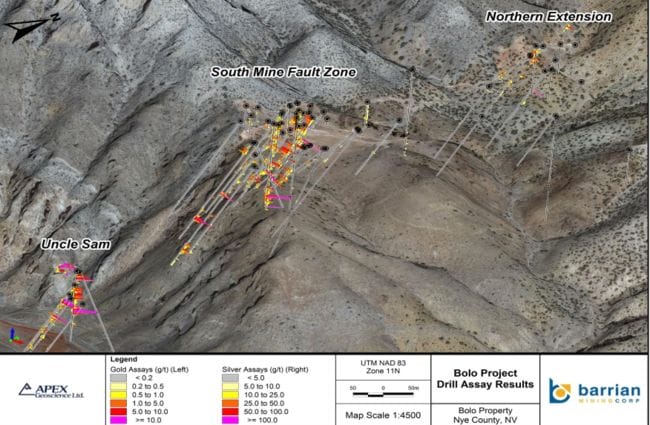

The new anomalies and drill-indicated zones produce a 1.1 kilometer (strike length) geophysical signature. These zones – Uncle Sam, South Mine Fault (SMF) and Northern Extension – which could be inter-connected, display features of multiple sub-parallel zones along the main trend.

Note the untested areas and the scale on the map below.

Successfully connecting the dots with the drill bit in these untested areas between the known mineralized zones would pay-off handsomely for current shareholders.

The IP/resistivity survey completed at Bolo comprised 10.2 line-km over 9 lines targeting the “Mine Fault” and other mineralized structures that host the Uncle Sam, South Mine Fault (SMF) and Northern Extension (NEX) mineralized zones. The survey extends 1,100 metres north to south, covering an area of approximately 135 hectares. The anomalous geophysical signatures have provided an essential tool for drill planning and positioning during the fully funded summer drill program. The program will include step-out and infill drilling to extend gold-silver mineralization across the 1.1 kilometre trend. All zones remain open in all directions and require drill testing.

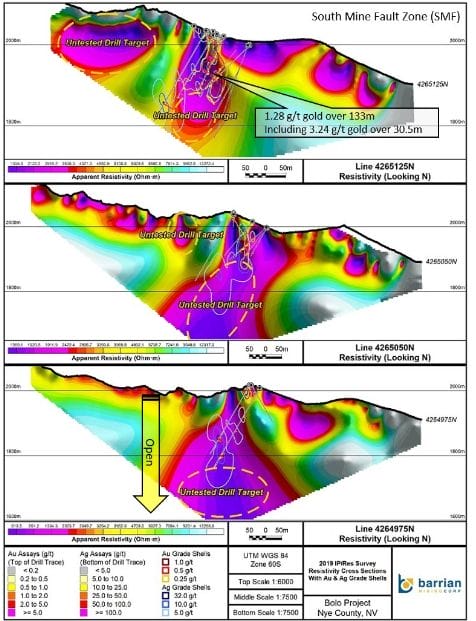

South Mine Fault zone (SMF)

The South Mine Fault zone (SMF) was drilled back in 2013 by Columbus Gold (CGT.T). Highlights from that program include:

- Hole DH-BL-38: 133 meters of 1.28 g/t gold from surface (includes 30.5 meters of 3.24 g/t gold).

- Hole DH-BL-39: 90 meters of 1.0 g/t gold from surface.

- Hole DH-BL-41: 52 meters of 1.27 g/t gold from surface.

- Hole DH-BL-54: 58 meters of 41.13 g/t silver from surface (includes 7.6 meters of 220 g/t Ag).

Merging the old with the new, drill hole DH-BL-38 is coincident with a 150 meter wide sub-vertical conductive anomaly that extends to a vertical depth of 250 meters – that is 100 meters below the deepest drill intercept.

The exploration upside – the potential to delineate a significant gold resource at Bolo – has to be considered excellent with this new data (map below):

This IP-resistivity survey reveals the presence of a well-defined linear conductive anomaly coincident with previously identified mineralized zones. This anomaly ranges in width from 100 to 200 meters, extending vertically from between 250 to 400 meters depth (where the geophysical inversion maxes out).

The geophysical survey defined numerous high-priority drill targets at depths below the SMF Zone; over the 600 metre untested strike length between the SMF and Uncle Sam Prospect; and along the largely untested 500 metre strike length area between the SMF and NEX zones. In addition, a number of untested conductive anomalies occur with the prospective west-side footwall of the Mine Fault.

Uncle Sam

The Uncle Sam zone, which gave up high-grade silver-gold channel samples (3,146 g/t silver and 1.0 g/t gold over 2.6 meters, and 365 g/t silver and 1.9 g/t gold over 3.6 meters) is associated with a 100-meter wide conductive zone representing the Mine Fault.

Looking at the geological model developed by the company, drill intercepts at Uncle Sam and SMF, located 600 meters to the north and 200 meters vertically above, indicate the presence of a distinct silver zone (offset 200 meters to the west by the footwall of the main SMF gold zone).

From the SMF footwall conductive anomalies occur on successive lines northward to the NEX beneath massive dolomite cover rocks. Importantly, north of the SMF gold zone the geophysical results indicate previous drill holes often failed to drill across or did not adequately test the Mine Fault conductive anomaly.

Max Sali, Barrian CEO:

“We are very encouraged by the positive results of the recently completed geophysical survey. The results have exceeded our expectations and define multiple high priority resistivity anomalies that warrant immediate drill testing at depth below the South Mine Fault Zone, and along strike towards the Northern Extension Zone“.

There’s a lot more to the Barrian story. Following links below will help bring you up to speed:

The overriding fundamentals underpinning the next upswing in gold

Barrian Mining (BARI.V): a new gold ExplorerCo grabs a chunk of prime Nevada real estate

Closing thoughts

As we stated in a recent Guru offering, this downturn in the mining cycle is getting a little long in the tooth. It is, without a doubt, the longest running downturn, ever.

When the cycle grinds out a bottom and the trend reverses, the upside trajectory is always awe-inspiring. I know, I’ve witnessed a few.

With a market cap of $6.03M based on its 40.19 million shares outstanding and recent trading patterns – not to mention its $2.5 million in cash – Barrian is dirt cheap.

Drill rigs will be mobilized in Bolo’s direction, soon.

We stand to watch.

END

~ ~ Dirk Diggler

Feature image courtesy of AllPennyStocks.

Full disclosure: Barrain Mining is an Equity Guru client. We own stock.