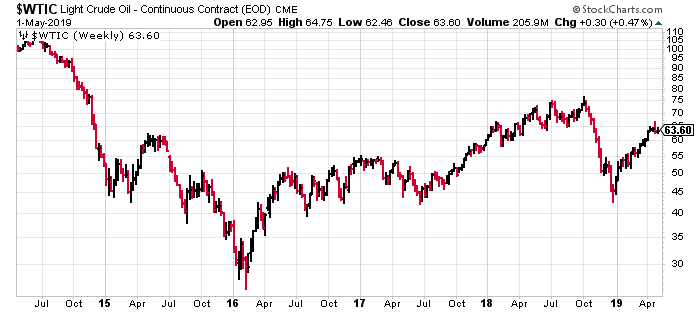

Crude oil has been on a tear in recent months, defying the expectations of many in the analyst community, tacking on gains, now consolidating well off the lows witnessed last December.

The above chart gives us a look at the extreme volatility that has been playing out in the oil arena over the past five years.

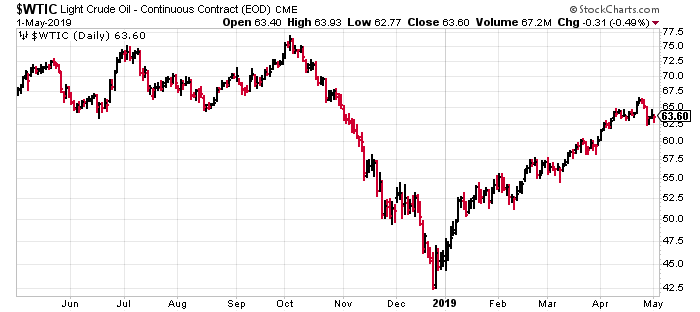

This daily chart (below) brings the drama of this recent move into better focus. That’s a 50% gain in only four months.

This is a welcome development for companies in the business of producing oil…

Renaissance Oil (ROE.V) released fourth quarter and full year results yesterday, recording record annual revenue.

A brief history of the Renaissance

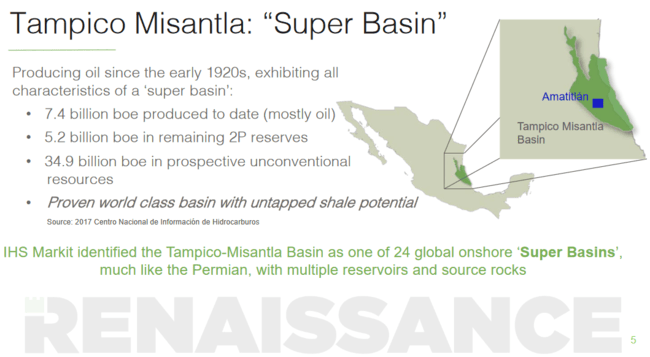

A first mover in Mexico’s recently reformed energy sector, Renaissance is on a journey to become a major Mexican oil producer, setting its sights on the country’s untapped world-class shale potential.

Mexico holds some of the worlds largest undeveloped oil and gas resources.

Positioned in the heart of Tampico-Misanlta Super Basin, the company’s 60,000 acre Amatitlán block is estimated to hold over 6 billion Barrels of Oil Equivalent within its subsurface shales.

In a recent Guru offering – Renaissance Oil (ROE.V): developing the world’s next premier shale play – we were eager to demonstrate the extraordinary potential in Amatitlán’s Upper Jurassic Shales:

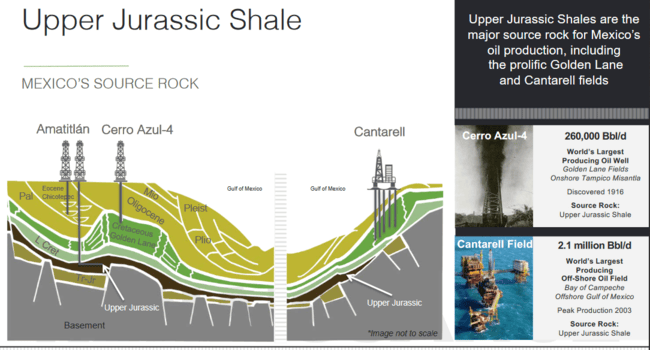

These Upper Jurassic Shales are the major source-rock for the worlds largest offshore oil field, not to mention THE most prolific oil well ever put into production – Cerro Azul-4.

- The Cantarell oil field peaked in 2003 producing 2.1 million barrels of oil per day.

- The Cerro Azul-4 well topped out at an astounding 260,000 barrels of oil per day.

Re Cerro Azul-4:

On Feb. 9, the well took a gas kick and water forced its way out of the hole. The next day, crews heard a deep rumbling and the ground began to shake. Suddenly, the drill line shot out of the hole, smashing the top of the derrick. Seven hours later, oil spouted out and formed a geyser nearly 600 feet into the air. By Feb. 15, flow was estimated at 152,000 barrels of oil per day. Workers capped the well on Feb. 19.

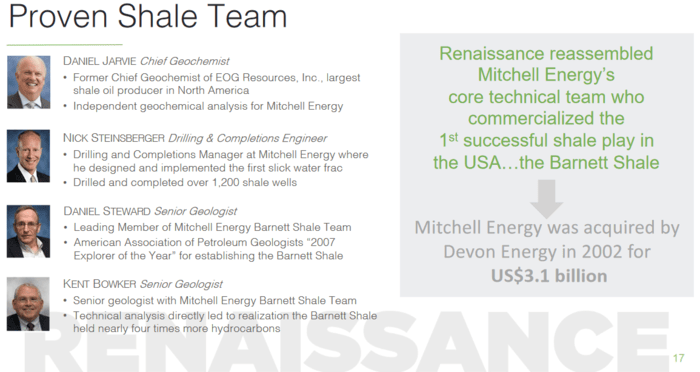

In the same piece, we also highlighted the technical talent behind this play:

The latent potential of this onshore block – estimated to hold over six billion barrels of oil – was enough to attract and reassemble an oil sector dream team: Mitchell Energy’s core group who commercialized the 1st successful shale play in the US – ‘the Barnett Shale’ (Mitchell Energy was acquired by Devon Energy in 2002 for US$3.1 billion).

Renaissance’s partner in Mexico is Russian oil giant LUKOIL, a monster in the oil sector boasting production of 1.7 million barrels of oil per day (BOE/D) in operations and subsidiaries in over 40 countries around the world.

Pemex, the state-owned entity that recently ended its 76-year monopoly over Mexico’s energy sector, is also along for the ride.

Importantly, Renaissance holds an option to increase its position in Amatitlán to 62.5%. It also holds a right of first refusal to acquire an interest in a 61,000-acre block adjacent and to the north of Amatitlán.

It’s not often a junior company wields this much control over a world-class asset with an industry giant as a partner. It says a lot about management, the skillsets they bring to the table, and the confidence they inspire.

The May 1 news

Renaissance Reports Fourth Quarter and Full Year 2018 Results

HIGHLIGHTS FOR THE FOURTH QUARTER & FULL-YEAR 2018:

- Revenue and operating netback in the fourth quarter of 2018 was $5.9 million and $0.2 million, respectively.

- On the 60,000 acre Amatitlán block, Renaissance, with its partner LUKOIL, completed a 17 shallow well drilling program targeting the Chicontepec tight sand formations and additionally, drilled and cored a 3,550 meter well to evaluate important deeper zones.

- Evaluation of the cores acquired from the Upper Jurassic formations at Amatitlán confirms the presence of the critical characteristics of a commercial play.

- Strong crude oil and natural gas prices resulted in record annual revenue of $25.0 million for 2018 compared with $22.7 million in 2017. Crude oil sales averaged $80.77/bbl in 2018 compared to $58.23/bbl in the previous year while sales of natural gas averaged $5.19/mcf compared to $4.26/mcf in 2017.

With its partner LUKOIL helping foot the bills, the company completed its US$45.5 million work program commitment on the Amatitlán block. This aggressive program included the drilling of 17 wells (intersecting the shallow Tertiary Chicontepec formations), all of which have undergone completion operations and have been brought into production.

This program also included the drilling and coring of a 3,550 meter well testing the deeper Upper Jurassic formations.

The 18 wells Renaissance drilled last year account for approximately 11% of the wells drilled in Mexico in 2018.

Evaluation of the cores and cuttings taken from four Amatitlán block wells – cores and cuttings that have all penetrated the Upper Jurassic Shales – have, according to the highlights noted above, “confirmed the presence of the critical characteristics of a commercial play.”

Renaissance management is being conservative in their language here. My read, fwiw (and please take this with a grain of salt): oil and gas are bubbling and oozing out of these Upper Jurassic Shale drill cores.

Renaissance and LUKOIL are planning an aggressive horizontal drilling program in the near future. The 1,417 BOE/D of production highlighted in this report represent very decent numbers, but it’s the horizontal drilling that’s really going to move the needle for this company.

Regarding future development work at Amatitlán, the May 1 release went on to state:

Renaissance and Lukoil are negotiating a development plan on the Amatitlán block for the commercialization of all prospective zones, with particular emphasis on the Upper Jurassic formations. Negotiations include the migration of the Amatitlán CIEP into a contract of exploration and extraction, pursuant to the constitutional amendments of December 20, 2013 reforming the Mexican Energy Industry.

Final thoughts

These are exciting times for the company.

Progress may seem slow, but it has been steady.

With 279.98 million shares outstanding, Renaissance has a current market cap of $40.6M.

If the company is successful in reaching its production goals at Amatitlán in the medium term, the upside could be substantial.

We stand to watch

END

~ ~ Dirk Diggler

Full disclosure: Renaissance is an Equity Guru client. We own the stock.