A few days ago, I published a story about our friends from HIKU/Tokyo Smoke/Doja/Saxx who, having exited from their last company with a $400m+ acquisition by Canopy Growth Corp (WEED.T), were quietly gathering investors for their next deal, Stately.

That deal had closed quickly, with way more money looking to get in than they had room to accept. But I was swamped with emails and texts from folks who were disappointed they hadn’t got in and wanted to know if there was a chance to squeeze in belatedly in some way.

There isn’t. But I’ve got something else that will bare a good long look for those looking to get in on something early.

Behold, Isracann, with the pending ticker IPOT.C.

Isracann, Israel’s first pure-play cannabis firm to list in Canada, is focused on becoming a premier, low-cost cannabis producer. Isracann is fully funded for its 230,000 sq. ft. facility under development.

Located in the cannabis research capital of the world, Isracann has relationships with the research, scientific and medical community to identify opportunities and develop pipeline of drugs and devices.

The company is targeting an undersupplied domestic market and anticipates near-term expansion to major European marketplaces.

Israel, as anyone who has ever been on a kibbutz can confirm, has a long and happy history with weed – both the growing, and the consuming. And often the consuming while growing what you’re consuming.

When any Canadian LP wants to show they’re up on the latest research and tech in the cannabis space, they’ll often look to find Israeli experts to bring aboard, or companies to acquire, or JV with.

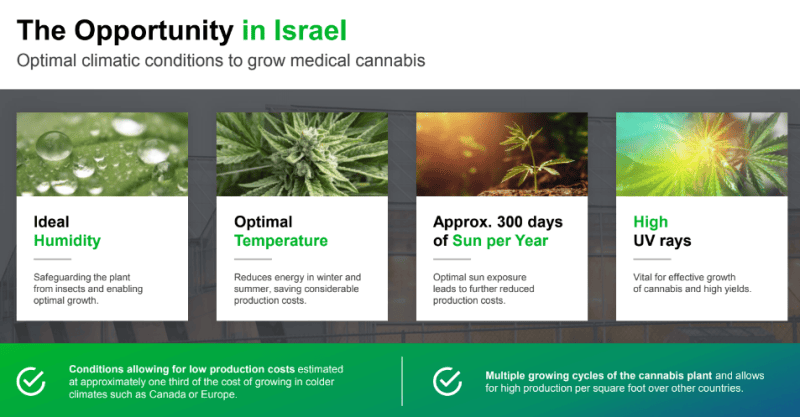

While Israeli tech is serious business, it’s the growing where things get interesting, because no western country has a climate more suited to the plant than you’ll find in Israel.

Two months ago, the government of Israel allowed exports to the European Union, which is the fat market everyone – including Canadian LPs – want access to.

But before you even get to Europe, the Israeli medical market is already in undersupply, with 10,000 locals on the waiting list. Patients purchase directly from pharmacies, and growing for research has been legal since 2007.

So investing in Israeli cannabis isn’t a dumb thing from the outset.

But who has the ability to grow there?

- You’d need a license – not an application, but a real actual license.

- And you’d need land you could build greenhouses on.

- And you’d need the money to build those greenhouses.

Isracann has all three. In fact, it has agreements with three Israeli license holding farms, and it has a fully funded greenhouse capacity of 232k sq ft, and 348k sq ft more to grow into later.

That’s enough to produce 23k kilograms of weed every year, at a ridiculously low cost of around $0.40 per gram.

That’s all well and good, but I want to back the jockey, not the horse, as I said in my previous piece about the team behind Stately. It’s nice to have a business plan, but I want to see runs on the board.

So who are these guys?

- Daryl Jones is President and CEO. You may recall him from being the guy who took True Leaf (MJ.C) public in 2014, and exiting three years later with a 15x profit.

- Marc Zegal is Chairman. He’s the local market knowledge, having founded and financed several Israeli pubcos, including the $120m market cap Rada Electronics (RADA.Q), and being a former member of the Chicago Board of Exchange.

- Israel Moseson is COO, and has been in Israeli cannabis for five years currently.

- Brett Allan, who was part of the team that brought Emblem Health (EMC.V), Organigram (OGI.T), and Green Organic Dutchman (TGOD.T) public, is an advisory board member.

- Deepak Anand is another advisor. He’s executive director of the Canadian National Medical Marijuana Association, a former VP of Cannabis Compliance, and knows everybody who’s anybody in Canadian weed.

That’s some lineup.

Where Allan’s association gets interesting is, the same playbook that TGOD ran in acquiring early investors, is being used again on Isracann.

This deal WANTS SMALL INVESTORS, and many of them, which is why it’s capping it’s financing at $10k per investor. It doesn’t want to go to big institutions and have three investors to deal with, and three to fear should one ever decide to bail. It wants a fat TGOD-like lead-in to going public, with a lot of you holding the stock and having a chance to benefit from early ownership.

Let’s be clear: Whether you’re fit to do so is something you need to decide, and preferably with an accredited financial advisor who will tell you all the reasons why going in on a private placement financing might not be for you.

If it IS for you, here’s what makes you ready from a paperwork perspective:

- You earn over $200k per year

- You earn over $300k per year with your spouse

- You have access to $1m in liquid capital – cash, securities and the like

- You have assets worth around $5m

- You have a brokerage account and are advised by your broker (and live in BC, Alberta, Saskatchewan, Manitoba, or New Brunswick)

Any of the above (there are others, but these are the main ones) makes you an accredited investor, which means you can get a subscription document, fill it in, send them money, and be a stakeholder in the business before it’s publicly available.

That comes with warrants – an agreement that you can buy more shares for a set price at a future date – and it also comes with risk. There’s a four month hold on the shares from the date it starts trading publicly, the company may never make it to public, though if the transaction doesn’t close by September 30th, 2019, you will receive your investment back. There is also a chance it shoots to zero during your hold, leaving you with no immediate way out…

But investing in a private placement deal, especially a pre-public deal, also comes with upside. Usually you’re getting a discount on market cap, as happened when TGOD’s early investors got in at $1.15, $1.55, and $3.65, before it went public and eventually hit as high as $10. It’s currently at $4.23, which still presented those early investors with a lovely win – and warrants priced in the money.

I’m not going to sit here and compel you to engage in this, or any other, financing. It’s not my job, and I’m not armed with knowledge of your own personal finances and risk profile.

Isracann is a client – full disclosure – but I like what they’re doing, I like who is doing it, and I’m going in personally.

UPDATE: While I was writing this, I received this email from Mr Jones:

“As some of you may be aware, I’m taking public a very exciting company called Isracann Biosciences (CSE pending: IPOT). The company will be the first pure-play Israeli cannabis firm to list in Canada. It’s certainly one of the most compelling opportunities of my career. Isracann will be a first mover in a brand new jurisdiction, which is the third country to allow medical cannabis exports behind Canada and the Netherlands. The company is fully funded for its initial buildout and will have [one of the largest cannabis footprints] in Israel.

Just recently the company attracted another world class cannabis advocate in Vivian Bercovici. She is the ex-Canadian Ambassador to Israel for Stephen Harper’s government [and now a member of IPOT’s advisory board].

I’m pleased to announce that the company has raised $9mm of a $10mm financing with over 700 + retail subscribers. I would draw a direct comparison to the successful launch of TGOD (The Green Organic Dutchmen) on their go-public.

Lastly, as many of you know, Canada has been a showcase for the rest of the world as far as creating billion dollar companies in the cannabis space. I strongly believe we are watching the same movie play out in Israel. The first movers will be the winners and Isracann is at the forefront.

I look forward to hearing back from you with any potential interest as this financing will be closing in short order.”

From IR:

We are through $10mm on the financing and still accepting orders for maximum $10k per subscriber. We expect to close the book by the end of April.

Financing:

- Non-brokered private placement of Subscription Receipts @ $.17 CAD for $10mm

- Each Sub Receipt will convert to 1 Unit (1 common share @ $.17 + 1 common share purchase warrant at $.34 for 2 years)

Post Change of Business transaction & 1 for 3 consolidation, effectively a $.51 common share + $1.02 full 2-year warrant. Financing will be Restricted. Trade Date plus 4 month hold.

If you want more information about this, contact the company at walter@invictusir.com, 604-343-8661, or djones@isracann.com, or talk to your broker, or a registered investment advisor.

— Chris Parry

FULL DISCLOSURE: Isracann is an Equity.Guru marketing client and the author is participating in this financing. Equity.Guru was not paid to promote this or any other financing, from this company or any other, nor do we receive any finder’s fee should a reader decide to make an investment. We provide the information in this story, as we have with non-client companies, as a service to readers who don’t have brokerage accounts and are usually not made aware of financing details, and may not even be aware that they qualify as an accredited investor. Equity.Guru encourages all investors to open a brokerage account so they can discuss opportunities with a broker, and participate in same. Any decision involving taking part in this or any other financing should be made with detailed due diligence having been done, adequate advice from an accredited professional, and knowledge of your own ability to navigate risk. This article was vetted by a securities lawyer, and by the company in question, to ensure compliance with all laws and regulations.