Part II of our Golden Triangle coverage will focus on a handful of companies a little higher up on the development-resource food chain.

Once again, this is by no means a comprehensive list. And the individual treatment is by no means an exhaustive forensic analysis. Broad strokes, these.

Back into the Triangle…

Ascot Resources (AOT.V)

- 174.38 million shares outstanding

- $155.2M market cap based on recent trading patterns (recent close = $0.89)

Ascot is a Gldn-Tri ExplorerCo transitioning into producer, focusing their energy on re-starting the past producing Premier gold mine.

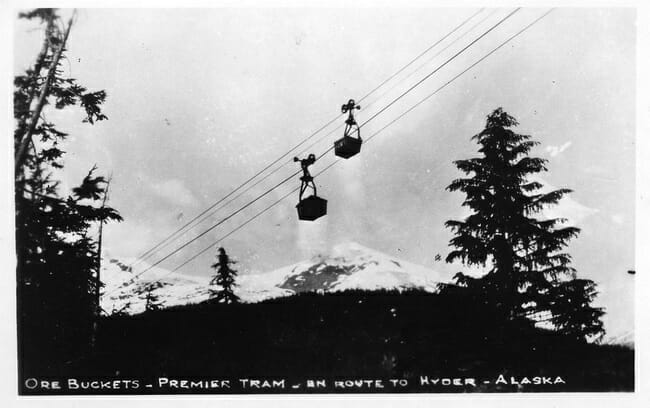

This project is steeped in mining history.

Hailed as one of THE greatest gold and silver mines on the planet in its day, Premier began production back in 1918, hitting its peak during the Great Depression.

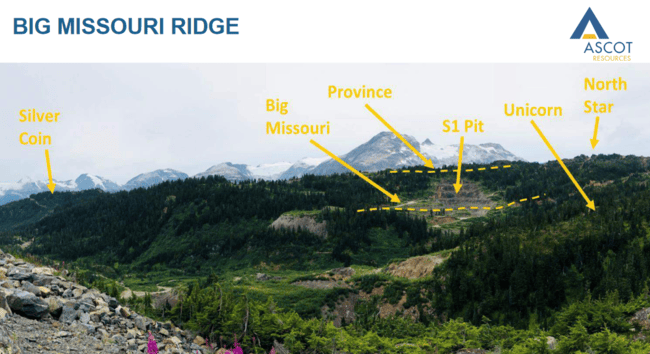

The 100% owned 3,082 hectare Premier-Dilworth Project is divided into two separate properties – Northern Dilworth and Southern Premier.

Roughly 628,000 meters of drilling, in some 6,110 drill holes, have targeted the Premier mine, the Big Missouri mine, the Martha Ellen and Dilworth areas of the property to date.

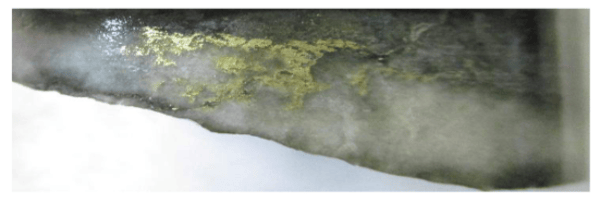

The quarry here is high-grade gold hosted in “quartz breccias, quartz veins and associated stock work around breccia zones within an envelope of quartz-sericite-pyrite alteration.”

Of those 6,100-plus holes drilled into the various structures around the property, one in 10 tagged over one oz of gold per tonne.

High-grade resources across the project currently stand at:

- 667,000 ounces of gold and 2.34 million ounces of silver in the Indicated category.

- 1.39 million ounces of gold and 4.65 million ounces of silver in the Inferred category.

In a recent development, the company took out Rob McLeod’s IDM Mining, and its 17,125-hectare high-grade Red Mountain project, consolidating the company’s interests in the Triangle.

Ascot Resources to Acquire IDM Mining to Create a Leading Gold Development and Exploration Company

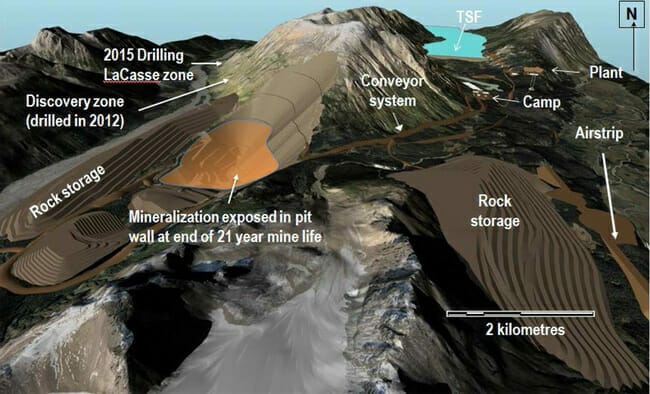

Red Mountain’s positive 2017 feasibility study presents a near term high-grade production option for Ascot.

The company’s $153M market cap is backstopped by a stable of solid assets and a growing high-grade resource base.

I like the company’s address too.

Auryn Resources (AUG.T)

- 90.48 million shares outstanding

- $178.25M market cap based on its recent $1.97 close

Auryn’s interest in the Golden Triangle might seem minor when matched against its Nunavut asset base – Committee Bay & Gibson MacQuoid. But that can change with one pass of the drill bit.

Auryn’s foray into the Triangle back in 2016 kinda messed up a play I had positioned myself in when they acquired Homestake Resources. I was expecting a fat return on my pile of Homestake common.

Instead, I was offered a measly 13% premium in a surprise deal that showed resourcefulness on Auryn’s part, benefiting its shareholder base in a major way.

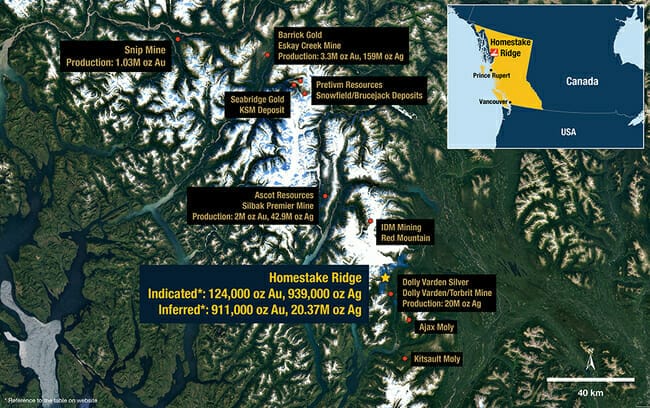

Homestake Ridge covers roughly 7,500 hectares within the Iskut-Stewart-Kitsault belt in the Triangle.

More than 275 holes totaling more than 90,000 meters have probed the Ridge’s subsurface to date. A good number of exploration targets remain untested.

Resources at Homestake Ridge currently stand at 1,035,000 ounces of gold and 21,300,000 ounces of silver, most of which are classified as Inferred material.

A 2017 summer drill program was carried out to test two of seven high-priority target areas across the property. The goal was to expand the South Reef zone as well test for extensions of the Homestake Main deposit.

Auryn drills 10m of 4.12 g/t Au and 30m of 2.00 g/t Au at South Reef, at the Homestake Ridge Project

Curiously, the company launched a 3,000-meter drill program back in mid-August at Homestake Ridge to further test gold mineralization along the high-grade South Reef zone. I say “curiously” because that was a good seven months ago and we haven’t heard back. Sup with your Gldn-Tri drill assays, Auryn?

Interesting company. One to watch.

Copper Fox Metals (CUU.V)

- 449.1 million shares outstanding

- $42.66M market cap based on its recent $0.095 close

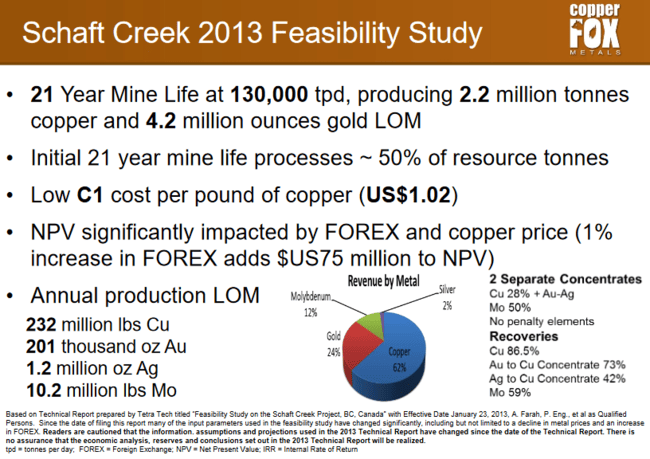

Copper Fox holds a 25% interest in Schaft Creek, a joint venture with Teck Resources (TECK-B.T). Teck is the operator of the project.

Measured and Indicated resources at Schaft Creek consist of 1,228.6 million tonnes grading 0.26% copper, 0.017% molybdenum, 0.19 g/t gold, and 1.69 g/t silver. Inferred resources stand at 597.2 million tonnes grading 0.22% copper, 0.016% molybdenum, 0.17 g/t gold, and 1.65 g/t silver.

A detailed summary of Copper Fox’s share of Schaft Creek’s reserves and resources can be found here.

The terms of the Schaft Creek joint venture are laid out as follows:

Teck will pay a total of $60 million in three direct cash payments to Copper Fox: $20 million upon signing the Joint Venture Agreement, $20 million upon a Production Decision, and $20 million upon the completion of the mine facility.

Teck will fund 100% of costs incurred prior to a production decision up to $60 million; Copper Fox’s pro rata share of any pre-production costs in excess of $60 million will be funded by Teck and the two remaining direct cash payments payable to Copper Fox will be reduced by an amount equal to 25% of the expenditure in excess of the initial $60 million.

Teck will fund any additional costs (in excess of $220 million) incurred prior to a production decision, if required, by way of loan (at an interest rate of prime +2%) to Copper Fox to the extent of its pro rata share, without dilution to Copper Fox’s 25% joint venture interest. Management of the Joint Venture will be made up of two representatives from Teck and Copper Fox with voting proportional to equity interests.

Teck has agreed to use all reasonable commercial efforts to arrange project equity and debt financing for project capital costs of constructing a mining operation upon a production decision being made; Teck has agreed to fund Copper Fox’s pro rata share of project capital costs by way of loan (at prime + 2%), if requested by Copper Fox, without dilution to Copper Fox’s 25% joint venture interest.

Schaft Creek’s economics:

The project has a pre-tax Net Asset Value of approximately $CAD423 million ($0.94/share) at an 8% discount rate.

A 2019 program at Schaft Creek, budgeted at $2.1M, will include:

- Environmental studies and associated data collection across the project footprint.

- Field studies to further investigate the geotechnical characteristics of the tailings management facility (tailing have become a rather large topic of late).

- Permitting and community relations activities.

Some might consider Copper Fox a long term call option on copper.

Skeena Resources (SKE.V)

- 97.85 million shares outstanding

- $43.05M market cap based on its recent 0.44 close

Skeena’s portfolio of projects includes the past-producing Snip mine, and the Eskay Creek mine – two properties that captured the imaginations of VSE (Vancouver Stock Exchange) speculators back in the day.

These past producing projects were acquired from Barrick (ABX.T) – Snip back in 2016, Eskay Creek in late 2017.

The company also completed a scoping study (PEA) on the GJ copper-gold porphyry project roughly two years back.

The fundamentals underpinning this extraordinary suite of assets:

Snip

- Reclaimed former high-grade Gldn-Tri producer.

- Produced 1.1 million ounces of gold at an average grade of 27.5 g/t between 1991 and 1999.

- Excellent infrastructure, including an airstrip, hydro development, easy proximity to power and roads.

- Ron Netolitzky, Chairman of Skeena, was instrumental in developing the deposit and is intimately familiar with the area and its history.

- 8,650 meters of underground drilling completed in 2017.

- A 9,583-meter Phase II surface and underground drilling program completed in 2018.

Snip sample drill results:

- 74.35 g/t Au over 2.00 meters.

- 19.26 g/t Au over 11.85 meters.

- 91.56 g/t Au over 3.82 meters.

- 12.37 g/t Au over 20.75 meters including 16.02 g/t Au over 12.25 meters and 141.50 g/t over 0.51 meter.

- 3.80 g/t Au over 18.00 meters including 42.84 g/t Au over 2.90 meters

Ongoing infill drilling will lead to a maiden resource estimate scheduled to be released later this year.

Exploration drilling is planned for this summer.

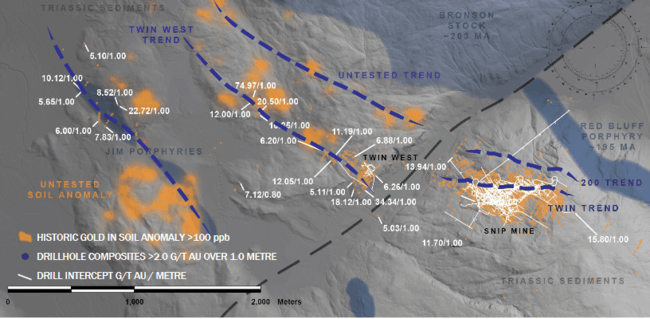

Note the scale on this map in relation to the dimensions of the untested areas:

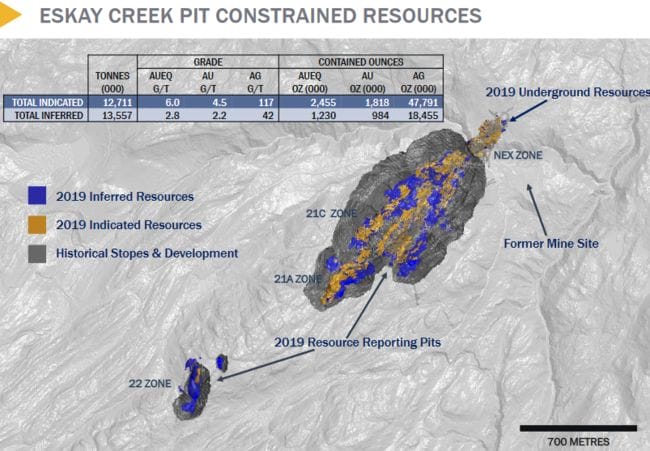

Eskay Creek

- Recently announced updated resource estimate.

- Option to acquire project was secured in December 2017 from Barrick.

- Produced 3.3 million ounces of gold & 160 million ounces of silver at average grades of 45 g/t Au & 2,224 g/t Ag from 1994 to 2008.

- Precious & base metal-rich VMS.

- Acquired a historical database containing 7,881 drill holes totaling 706,904 meters (surface & underground).

- 2018 surface drilling program completed totaling 7,732 meters.

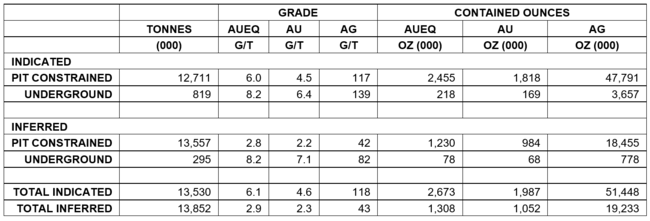

- Total Indicated resource includes 2,673,000 AuEq ounces, 2,455,000 of which are pit constrained grading 6.0 g/t AuEq – 218,000 ounces underground grading 8.2 g/t AuEq.

- Total Inferred resource stands at 1,308,000 AuEq ounces, 1,230,000 of which are pit constrained grading 2.8 g/t AuEq – 78,000 ounces underground grading 8.2 g/t AuEq.

Combined pit constrained and underground resources at Eskay:

A phase II drilling campaign will focus on upgrading current resources to the Indicated category for future economic analysis.

Exploration drilling will be focused on the rhyolite-hosted feeder structures, analogous to the 21C and 22 Zones (image below):

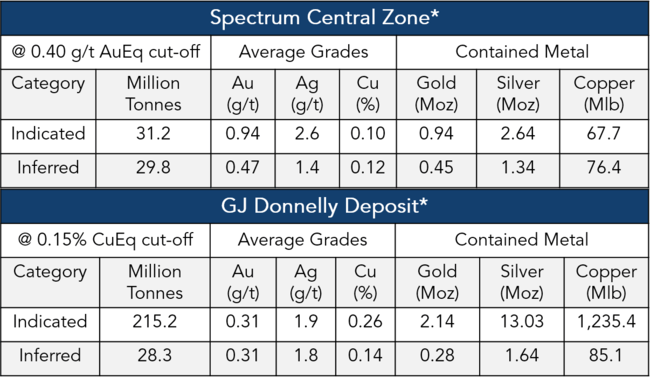

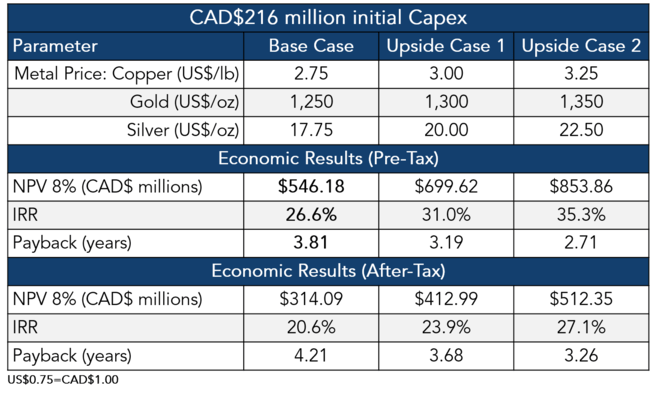

GJ

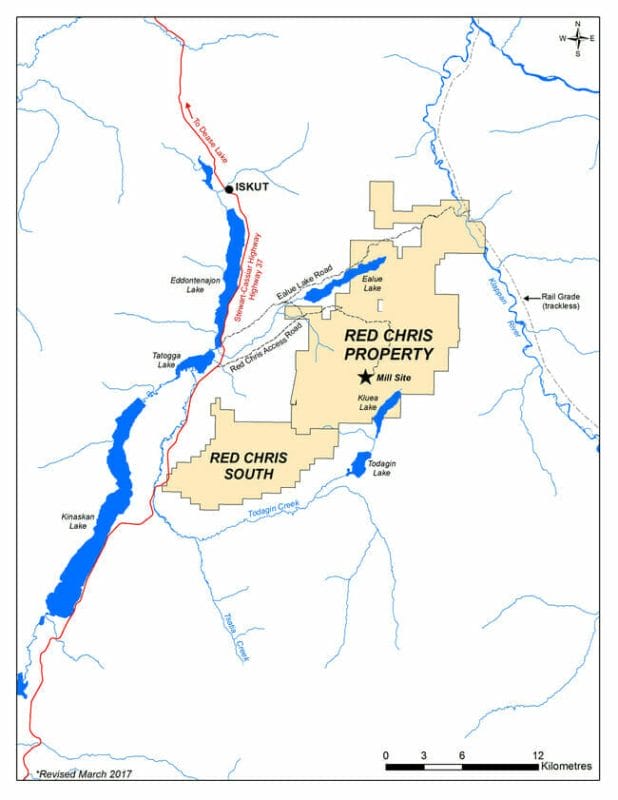

- 43,500-hectare gold-copper property situated approximately 30 kilometers west of Imperial Metals’ Red Chris Mine.

- Initial PEA results released in April 2017 shows a 25-year mine life with a low initial Capex of CAD $216 million, a pre-tax 8% NPV of CAD $546 million and a 27% IRR.

- Property consists of two separate mineral resource estimates roughly 14 kilometers apart – the porphyry copper-gold Donnelly Deposit, and the porphyry gold-copper Spectrum Central zone.

The resource:

The scoping study:

Clearly, this is not your ordinary Goldn-Tri ExplorerCo. It’s top shelf in every respect.

Imperial Metals (III.T)

Operations Overview – Exploration Projects

- 127.11 million shares outstanding

- $366.08M market cap based on its recent close at $2.88

Up until very recently, Imperial was the sole owner of the 23,142 hectare Red Chris copper/gold porphyry mine project.

Mineral reserves at Red Chris currently stand at 301.549 million tonnes grading 0.359% copper and 0.274 g/t gold for 2,386,638,000 lbs of copper and 2,656,000 ounces of gold. That’s good for 28.3 years of production.

Red Chris’ resources – this is where the numbers take on a life of their own:

Total Measured and Indicated (open pit + underground) resources = 1,033,700,0000 tonnes grading .35% copper, 0.35 g/t gold, and 1.14 g/t silver for 7,983,928,000 lbs of copper, 11,643,000 ounces of gold, and 37,924,000 ounces of silver.

Total Inferred (open pit + underground) resources = 787,100,0000 tonnes grading 0.29% copper, 0.32 g/t gold, and 1.04 g/t silver for 5,032,248,000 lbs of copper, 8,098,000 ounces of gold, and 26,318,000 ounces of silver.

Is it just me, or is that a lot of metal?

As alluded to above, the company WAS the sole owner of Red Chris…

Mar. 10th, 2019: Imperial To Enter Joint Venture With Newcrest Mining

“Imperial Metals Corporation announces that it has entered into an agreement to sell a 70% interest in its Red Chris copper and gold asset in British Columbia, Canada to Newcrest Mining Limited (ASX: NCM) for US$806.5 million in cash, while retaining a 30% interest in the mine. The Company and Newcrest will form a joint venture for the operation of the Red Chris asset going forward, with Newcrest acting as operator.”

Imperial needed this deal to alleviate its debt woes. This ensures Imperial’s survival going forward. It also satiates the appetite of an aggressive, resource hungry producer.

Obviously, there’s a lot more to the Imperial story. I’d recommend taking a close look at the company’s Operations and Exploration Projects page.

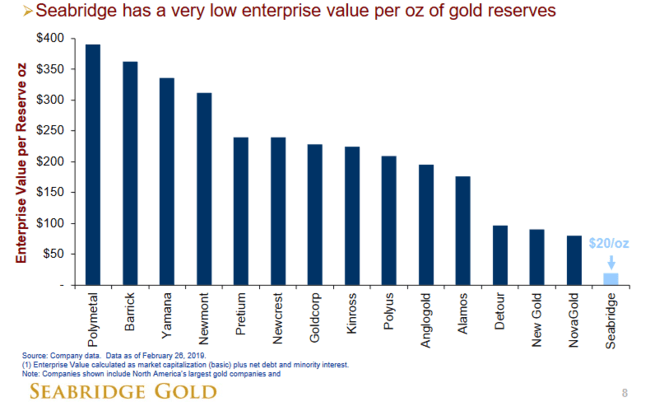

Seabridge Gold (SEA.T)

- 61.58 million shares outstanding

- $1.02B (yes, that’s a billion) market cap based on its recent $16.61 close

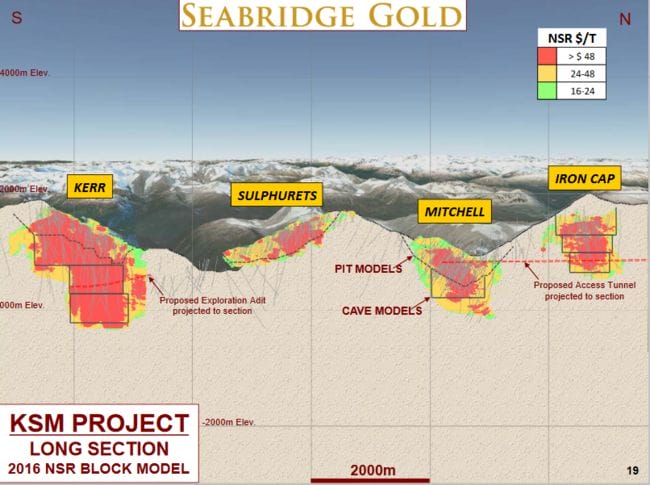

Seabridge’s KSM Project – a quartet of deposits know as Kerr, Sulphurets, Michell and Iron Cap – is a geological wonder.

Property wide, mineral reserves stand at an eye-popping 38.8 million ounces of gold, plus significant copper, silver and moly credits.

Current resources stand at (and I REALLY needed a calculator for this one) 49,694,000 ounces of gold in the Measured and Indicated category, plus a further 56,330,000 ounces in the Inferred category. All told, KSM holds over 106 million ounces of gold plus a massive amount of copper, silver and moly.

Incredibly, significant exploration upside remains.

Economic studies from 2016 outlined modest returns for KSM, but this is a project that will evolve with each phase of infill and exploratory drilling:

Exploration continues to produce major improvements in the economic and environmental parameters of KSM. From 2013 to 2016, Seabridge successfully targeted higher grade zones beneath KSM’s near surface porphyry deposits, resulting in the discovery of Deep Kerr (2013) and the Iron Cap Lower Zone (2014). These discoveries led to sizeable resource expansions of higher grade material configured for low cost block cave underground mining. This mining technique substantially reduces the project footprint and waste generation.

In the meantime, while shareholders are waiting for gold to assert itself with greater conviction on the daily charts, the ounces at KSM continue to grow:

Seabridge Gold Increases Gold and Copper Resources at Iron Cap

Seabridge is not a cheap stock, but the company’s enterprise value per ounce-in-the-ground (reserves) is roughly $20.00:

The main drawback to a project this size is Capex – gargantuan deposits, particularly those in remote areas, are tagged with hefty construction budgets. Initial capital costs for KSM are estimated at roughly US$5 billion.

Some might characterize SEA shares as the mother of all long term Call options on the price of gold.

Final thoughts

The 2019 Golden Triangle field season promises to be an active one with a number of companies following up on significant new discoveries.

Though we’re still a couple months away from seeing drill rigs mobilized to the area, many of the ExplorerCo’s featured here are firming up in price. The accumulation phase appears to have begun.

END

~ ~ Dirk Diggler

Feature image courtesy of Skeena’s photo gallery.

Full disclosure: Equity.Guru has no marketing relationship with any of the companies featured above.