I know what readers are thinking…. another junior miner jumping into the #cannabis space… give me a break! Believe me, I thought the exact same thing. However, after watching several junior miners move on to greener pastures, I’ve learned some things to watch out for. First, there must be an actual business plan. Most teams put out their all-important news announcing a change in direction with limited info of what segments, jurisdictions or products will be targeted.

Essentially, a lot of these, “coming out” press releases simply say that the ex-junior miner has decided to explore opportunities in the cannabis or hemp space and has retained a group to look at alternatives…. this doesn’t work for me, not even close.

I would only look at a company making a significant move like this if it had specific plans and had spent months, not weeks, carefully investigating opportunities. I would only consider a company that had a logical reason to move into a new realm and had actively engaged industry experts in the new area of interest. Finally, I would only consider a transitioning company with significant revenue & profit potential within the first year.

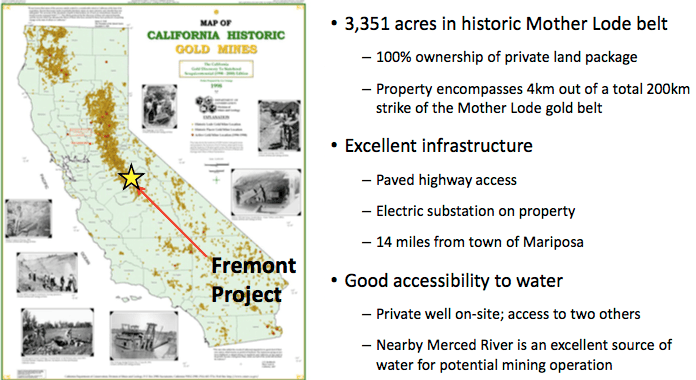

With that said, I’ve been following a junior miner (an advertiser on my website) that was approached (unsolicited) by a group about the opportunity to grow high-CBD content industrial hemp plants on the Company’s flat, fertile 100% owned land, located in a temperate climate in California. The property is well supported by existing infrastructure. {see press release}. Readers should note, this Company was pursued because it had something of value — owned land amenable to growing industrial hemp. Note: {Not all companies own or control their surface rights, have water & power and are situated on flat, fertile land in good climates, in safe places that allow industrial hemp to be grown}.

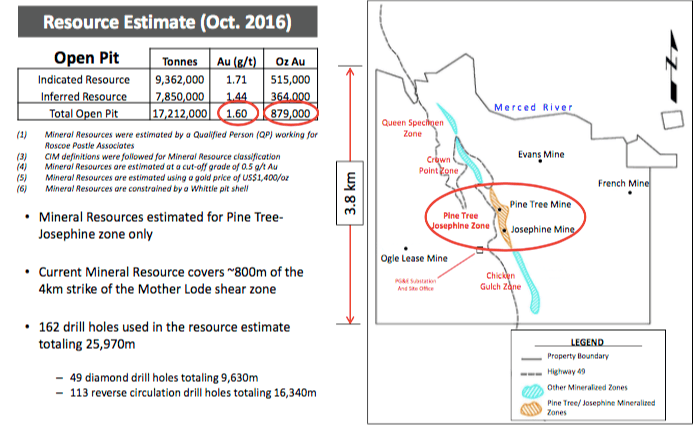

The Company I’m writing about today is California Gold Mining Inc. (CSE: CGM) / (OTCQB: CFGMF). Unlike most junior miners jumping into a new sector, leaving nothing of value behind, California Gold has a promising gold exploration project with 515,000 Indicated near-surface ounces @ 1.71 g/t gold, plus 364,000 Inferred ounces @ 1.44 g/t. Earlier this year, the Company announced high-grade assays. The best intercepts were 1.2m @ 27.6 g/t gold, included within 3.4m @ 10.6 g/t, plus 10.1m @ 3.3 g/t — all near surface. However, most junior miners are out of favor, and it would be years before any gold is ever produced, if at all, from this project. So, management is pursuing a nearer-term revenue opportunity.

This is NOT a pot smoking, getting high story….

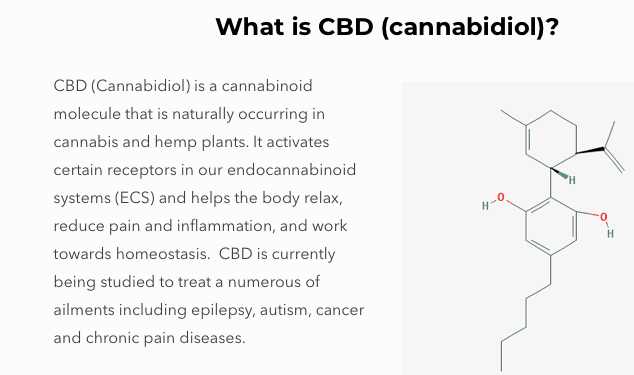

While marijuana & industrial hemp belong to the same plant family, the major difference is the presence of the psycho-active cannabinoid THC. Industrial hemp must have a THC concentration of less than 0.3%, making it virtually impossible to get high by consuming it. The THC level in cannabis / marijuana flower consumed with the intention of getting high, is more like 15%-30%. California Gold is only proposing activities in the high-CBD content industrial hemp arena. Importantly, this wasn’t a hasty decision. Management, the Board and industry consultants spent 10 months researching the industrial hemp space and perfecting their plans.

Cannabidiol (“CBD“)— is the real story here, a compound that has a significant and growing list of medical benefits, (but does not get people high). Scientific & clinical research points to CBD’s potential as a treatment for a wide range of conditions & neurological disorders. There are attributes being ascribed to CBD which may turn out to be untrue, but CBD is not harmful. One cannot overdose, nor would one be inclined to consume vast quantities because it’s not cheap, and, for the last time, CBD does NOT get you high!

Vishal Gupta, California Gold’s President & CEO was quoted in the press release,

“We believe California Gold is entering the cannabinoid-rich industrial hemp space that is in its infancy, with tremendous growth potential lying ahead. Our 100% ownership of the land, the availability of water & power, the highway connectivity, the close vicinity of skilled labor, and our location within the most populated State in the U.S., makes our Fremont property the ideal launch pad for CGM’s proposed high-CBD content industrial hemp operations.”

California Gold Prudently Retains Experts, is Starting out Small

California Gold, in close consultation with industry experts, plans to build a 27,000 sq. ft. greenhouse, at an all-in cost of ~US$2 M, for the purpose of high-CBD content hemp seed propagation. I called Delta Valley Hemp (“DVH“), the firm that CGM is using to build & operate the Greenhouse and sell (broker) the seeds. DVH is an industry-leader in hemp, with decades of cultivation, seed propagation, permitting, crop insurance & wholesale brokering experience.

According to a senior executive at DVH, the highly-specialized hemp seed that CGM proposes to propagate has stable genetics and is empirically proven to produce low-THC (< 0.3% concentration) and high-CBD (range 12% – 22% concentrations) an average of ~16%-19% CBD flower. Seeds with these attractive characteristics are in high demand, especially after the passage of the 2018 U.S. Farm Bill. The senior executive at DVH believes that high-CBD hemp seed demand could remain strong, for patented strains, for several more years. DVH plans to work with CGM to patent strains at CGM’s Greenhouse. Both parties would own the patents.

High-CBD Content Seed Propagation, a High Value, Niche Market

Make no mistake, this is a highly speculative investment, the plans could fall apart, or there could be significant delays. The Company, through DVH, is in discussions with customers that are willing to agree upfront to a volume of seeds (and pay at harvest time) based on a market-derived price, minus a modest discount.

If the Company could sell 1,000 pounds in year 1 at US$20,000/pound, for gross revenue of US$20M, (call it US$16M in net revenue assuming 20% is paid in fees/commissions & other deductions) that would be ~C$21M. Compare that to CGM’s market cap of ~C$20.5M (55 M shares outstanding). CGM would be trading at 1x forward net sales. In the chart below, I show annual gross revenue scenarios, in USD$. In the first year of operations, I imagine that gross revenue could range from US$5.0 to US$37.5 million, (in green), the average of the green scenarios is US$17.5 million. The other gross revenue figures represent year 2 or 3 possibilities, assuming just the one Greenhouse. Net revenues might be 20% lower than the figures in the chart.

Management rightly mentioned the risks of secondary permits & approvals that still need to be obtained from the County & State. So, the timing of getting the Greenhouse up and running is a risk. I would add to the risks column the price of high-CBD content hemp seeds. I would not count on prices remaining so high. There’s also execution risk of California Gold’s partner Delta Valley Hemp. The first harvests in the new Greenhouse will carry a degree of risk that readers (and me) can’t name or quantify. Obtaining funding for the Greenhouse is a risk, but management expects to have that lined up next month. These risk factors cause me to believe that the maximum number of pounds produced for sale in year 1 will be 1,500.

Conclusion

Even if it were to take 18 months to generate net revenue of ~C$21M, that would still be a good outcome. I’m guessing the profit margins would be good. California Gold has several hundred acres amenable to industrial hemp-related activities. There’s room to expand well beyond a single Greenhouse. Perhaps management could grow high-CBD hemp plants from their own propagated seeds and extract CBD oil…. but that’s a whole new business plan, a whole new set of risks. Still, growing the flower and extracting CBD oil would be a logical next step. With its own hemp seeds, (a very significant cost factor), California Gold Mining Inc. (CSE: CGM) / (OTCQB: CFGMF) could become a low-cost producer of CBD Oil. However, as far as I know, there are no plans to grow hemp plants at this time.

Perhaps simpler than moving into CBD oil extraction, would be to build more greenhouses. Although, as far as I know, there are no plans to build more greenhouses at this time. The potential upside seems to be substantial (with commensurate high risk). The capital structure is tight, just 55 million shares outstanding. If California Gold’s management team executes its high-CBD content hemp seed business, I will compare the segment’s valuation to that of other hemp-focused companies in the U.S. & Canada. Readers beware, this new chapter in the Company’s story will take time, patience is required. First revenue is not expected until the 4th quarter. I’m hoping to see at least 2 press releases per month going forward, starting in April.

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about California Gold, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of California Gold are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Peter Epstein owned shares of California Gold and the Company was an advertiser on [ER]. Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.