This week has been a big one in the cannabis sector. In this edition of Equity.Guru’s cannabis roundup, we’ll be covering the latest news from Livewell (LVWL.V), TransCanna (TCAN.C), Ascent Industries, The Green Organic Dutchman (TGOD.T) and iAnthus (IAN.C).

Transcanna Holdings

On March 25, TransCanna reported the results of a third-party evaluation of its recently purchased Northern California property.

GreenGrowth CPA, a Los Angeles-based firm, concluded that the 196,000 square foot facility, purchased for USD$15M, would be worth between $50M to $75M once up and running.

The facility sits on a land package of 5.567 acres of land, and includes institutional grade packaging and extraction equipment.

“The firm concluded with a valuation range of $50-million (U.S.) to $75-million (U.S.) using two different valuation methods to reach its conclusion.”

–TransCanna Holdings

The next day, IIROC imposed a temporary halt to the trading of TCAN shares.

TransCanna released a clarification about the property’s valuation a few hours later, explaining that the valuation methods used by GreenGrowth was the “discounted cash flow method and revenue multiples.”

GreenGrowth used factors like market share, timeliness on license approval and number of products set for launch to calculate the property’s potential value in comparison to other companies’ assets.

The company stressed that the assumption in the valuation have not been tested by GreenGrowth, nor have they been audited:

“The valuation does not constitute an appraisal of the value of the property and equipment on the forming the facility. A separate real estate appraisal performed by Valbridge Property Advisors was reviewed by the Firm which appraised the property at US$16.3 million including equipment.”

The property will be paid for in part by the company’s February 20 oversubscribed private placement.

TransCanna Holdings was up $0.06 today and came to rest at $4.37 by market close. The company has a market cap of $74.2M.

The Green Organic Dutchman

TGOD just signed a purchase agreement with EnWave for three additional large-scale, 120kW radiant energy vacuum (REV) machines to enhance its drying capabilities in Canada.

These machines come with robotic arms and optional support equipment.

“The addition of three 120 kW REV machines will increase its total royalty-bearing cannabis processing capacity to a combined total of 420 kW of REV machinery.”

–TGOD

The purchase agreement builds off the sublicense agreement TGOD signed with EnWave in January 2019 when TGOD purchased the initial 60kW REV machine.

EnWave also entered into an exclusive partnership with cannabis giant Tilray (TLRY.Q) in October 2017.

The company began domestic sales earlier this week. TGOD has a valuation of $1.3B and settled at $4.62 per share by market close.

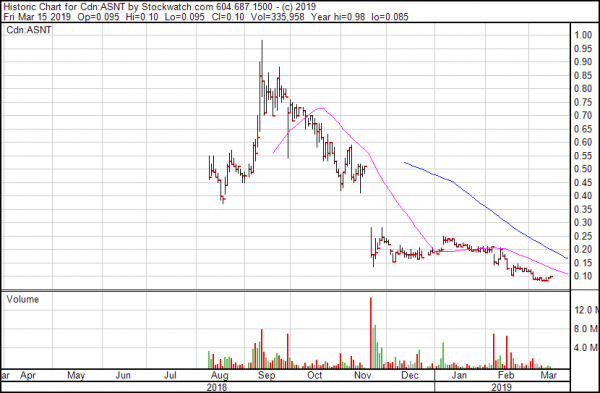

Ascent Industries

On March 26, Ascent Industries received approval from the Supreme Court of British Columbia to sell off its Canadian assets.

The aggregate value of the transaction is approximately $41.5 million, comprised of $29 million of cash consideration to be paid for the Canadian assets under the APA and the assumption of liabilities of approximately $12.5 million. Closing of the transactions contemplated by the APA are expected to occur on or before April 3, 2019.

BZAM Management, the purchaser, will be taking on the previously agreed upon liabilities of Ascent, including the company’s obligation to purchase a greenhouse in Pitt Meadows, B.C.

Ascent’s Canadian assets are limited to B.C. Agrima Botanicals, its wholly-owned subsidiary, which is in possession of a 25,000 square foot indoor cultivation campus sitting on five acres in Maple Ridge. Agrima Botanicals is currently suspended from operating.

Agrima Meadows is a 600,000 square foot automated cultivation warehouse located in Pitt Meadows, while Agrima Labs is a 40,000 square foot retrofit warehouse. The operational status of both facilities is currently “pending.”

Ascent says it will continue to own its assets outside of Canada. The company currently has a presence in the United States and Denmark.

Ascent Industries shares were halted on March 18, 2019.

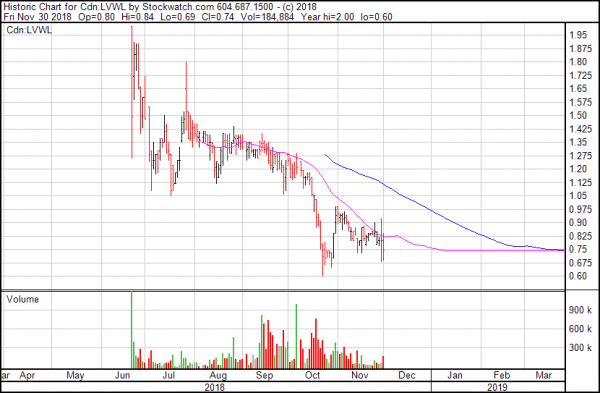

Livewell Canada

On the same day Ascent Industries received approval to sell its Canadian assets, Livewell closed its private placement offering for gross proceeds of USD$15M.

Livewell says the funds will be primarily spent on enhancing production at their Eureka, Montana, extraction facility. The funds will also be used to begin retrofitting their Las Cruces, New Mexico, facility and for “general corporate purposes.”

“Closing this private placement enables us to continue scaling our operations to meet the increasing market demand for high-purity CBD,” said David Rendimonti, Chief Executive Officer of Livewell. “With our strengthened balance sheet, we are now well-positioned to fully-optimize our Montana extraction facility as we continue to work towards exceeding our goal of producing 100kg/day of CBD isolate.”

The notes are secured against numerous company assets and will bear an interest rate of 10% payable monthly in cash or stock. Additionally, investors who bought into the PP will receive 6M common share warrants of Vitality CBD Natural Health Products.

Livewell announced its merger with Vitality CBD, one of the largest industrial hemp cultivators and manufacturers in North America, on Dec. 3, 2018.

Livewell was halted at $0.74 and has a market cap of $97.4M.

IAnthus Capital Holdings

Lastly, iAnthus has been given the green light to sell dried cannabis flower in its Florida dispensaries.

On my recent trip to Florida, the company executives I met down there, those who described the breakneck-speed at which state law moves, correctly predicted dried flower would soon be available for purchase.

Now that flower is legal to sell, the company says it will source its flower from its 240,000 square foot cultivation facility in Lake Wales, Florida.

IAnthus currently serves 246,000 registered patients through delivery and three open dispensaries throughout the state.

Additionally, iAnthus says it plans to release its audited Q4 financial report after market close on April 1, 2019.

IAnthus was down 0.52% today, coming to rest at $7.72 by market close. The company has a market cap of $1.06B.

–Ethan Reyes

Full disclosure: Transcanna, Livewell, TGOD and iAnthus are Equity.Guru marketing clients.