People sometimes ask me for advice. The two questions I’m asked most are, ‘What stock is going up next’ and ‘Why should I listen to you?’

The answer to the second question is, you shouldn’t. I’m drunk as I write this and liable to walk into traffic any second. The girl dancing third at Brandi’s tonight has as much insight into the markets as any five pundits do, and far better legs.

The answer to the first question is another question; “What’s stock’s valuation is low enough that there’s a good chance it can double by this time next month?”

For the answer to that, you want to look at something called ‘market cap’. If you’re unsure of what that means, here’s an old random white guy to explain it to you.

Okay: So let’s say we have two companies we’re interested in. One is a giant cannabis multinational, and the other a local cannabis project that few have heard of.

We’re going to wheel the timeline back six weeks for this exercise:

Canopy Growth Corporation (WEED.T)

- Market cap: $11 billion

- Share price: $36.00

Heritage Cannabis (CANN.C)

- Market cap: $60 million

- share price: $0.15

Folks like Canopy because it’s the biggest of the big. It has a sprawling operation that spans the globe, it loses money but has way more in the war chest that gives it a lifetime of runway if needed, and if someone wants to invest in the sector but doesn’t know enough about specific companies, they’ll often tend to choose Canopy as their investment target because big is safe. Hell, everyone else is socking their cash into it, why not you?

Heritage, meanwhile, is little. It’s been putting together a nice executive team, it’s acquiring assets, and showing a little sass at the bottom end of the valuation spectrum. But at $0.15 per share, institutional investors (your banks and large investment corporations) will usually go elsewhere, and casual retail investors (you) will often see that low share price and veer away, figuring it means a lesser level of trust.

So let’s see how those two companies did over the last six weeks.

Here’s Canopy:

Not bad! $36 has become over $60 in quick time, bringing a near double for investors. Amazing.

Despite putting out financial results a few weeks ago that showed a massive $69m quarterly loss, and then having to restate those financials because, oops!, they forgot to include another $80m faceplant on top of that $69m, Canopy’s stock almost doubled around that time, mostly because, in the markets, the biggest balloon rises highest.

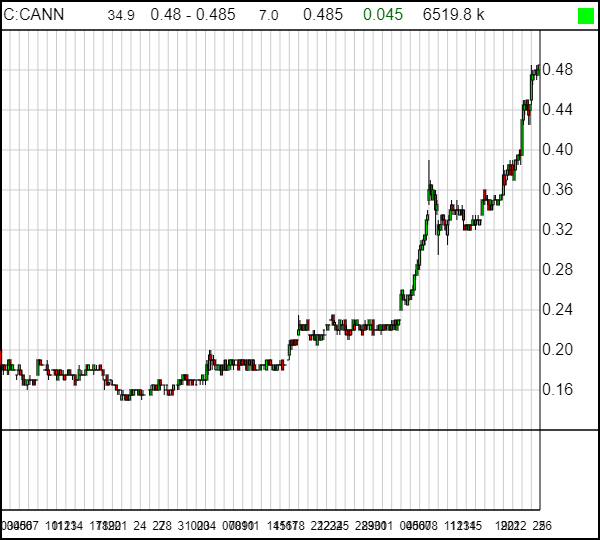

Now let’s look at Heritage’s performance in the same time:

Son, that’s a triple. Not a double, which would have been lovely, but a triple and then some. $0.15 to $0.48, and barely a hiccup along the way.

Now let’s do some back of a cocktail napkin math: If you’d put $1000 on Canopy six weeks back, you’d be sitting on about $1800 now.

But if you’d put $1000 on Heritage, you’d sitting on $3200. Easy win for the underdog.

Yes, Canopy has the higher share price, and more investors, and higher volume, but Heritage had the larger percentage increase because it started from a low valuation point.

In short, it’s easier to get from a $60m valuation to $180m than it is to lift $8b to $24b.

My question in every trade is, which company will be the easiest double? If you look at Canopy, and think today’s $18 billion price tag will be $36 billion before any other company they compete with can run a similar double on their own valuation, then buy it all day long.

But there’s some value out there among the little guys, if you look hard enough, and Heritage has hit a serious run by virtue of not just what they’re doing, but how low a point they started from.

There are others:

At the request of IIROC (Investment Industry Regulatory Organization of Canada), C21 Investments Inc. (CXXI.C) has provided this news release. Management is unaware of any material change in the company’s operations that would account for the recent increase in market activity.

Well, WE know what accounts for the ‘recent increase in market activity’… We’ve been telling folks CXXI was undervalued for MONTHS now, and that message is finally kicking off into the greater market. Hell, CXXI was a $40m company earning $30m a year in revenue, now it’s a $70m company, and that’s still cheap.

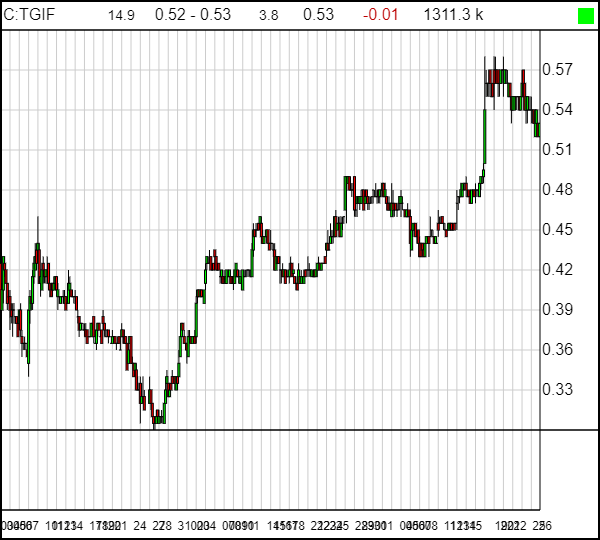

We said the same about 1933 Industries (TGIF.C), which was worth only $60m six weeks back but $129m now. TGIF keeps putting out news from their Nevada bunker, and the market is noticing.

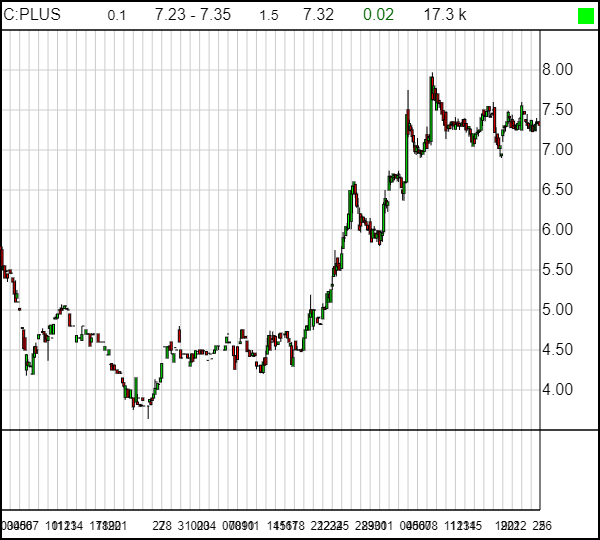

Then there was Plus Products (PLUS.C), the #1 edibles brand in California, that we liked at $4 and is now at $7.50, leveling off and forming a new base before, I dunno, another run maybe?

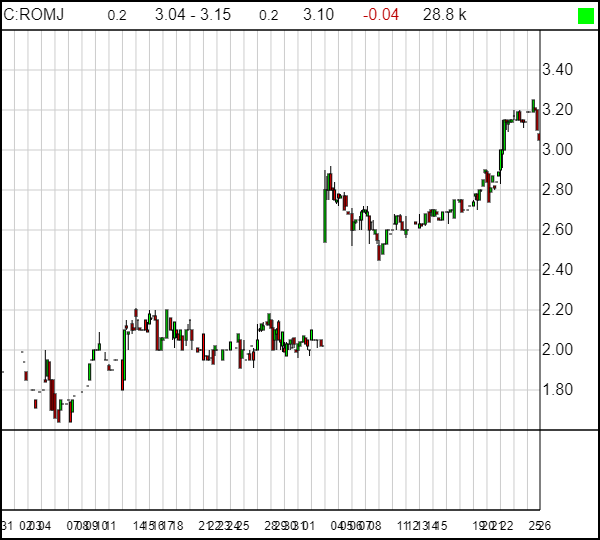

Or maybe you rode Rubicon Organics (ROMJ.C) from $1.80 to $3.20 as it picked up its cultivation license?

Whoa whoa now, wait a second. I know what you’re thinking.

“Motherfucker, EVERYONE IS UP A DOUBLE. Don’t be claiming you have some special wizardry in your fingertips when the whole market is doubling or better!”

Okay, first? Shut up.

Second, not everyone is doubling. Big dogs Aurora (ACB.T) are up, but only about 50%. Aphria (APHA.T) is up more than that, but mostly because they went through a short selling blitz following scandals related to their executives self-dealing properties to themselves. Following an executive shakeup, one would have expected them to fly higher.

And $6 billion US-listed Tilray (TLRY.Q) has a chart that only a mother could love, despite some big acquisition news.

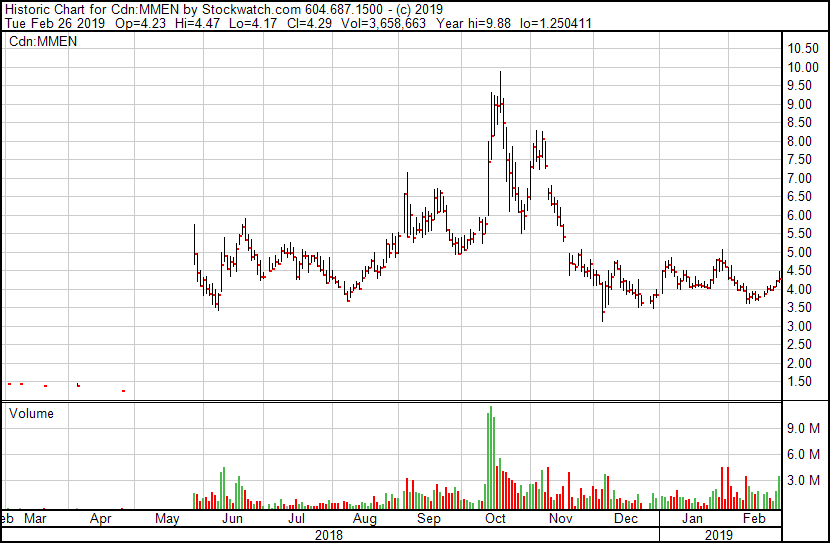

US pot retail chain MedMen (MMEN.C) haven’t had much love since it became clear, through court filings, that they’re blowing through money in ways that wouldn’t have looked out of place in a 1980’s Miami coke den.

MMEN has been up the last few days, after they announced they’d produced an extended commercial, directed by indie film auteur Spike Jonze, on the history of weed, which they’ll be running on all forms of media across the United States, from TV to online to cinemas – EVEN THOUGH THEY ONLY DO BUSINESS IN SIX STATES.

ianthus (IAN.C), in contrast, does business in 11 states. It’s share price is up nearly a double in the last six weeks while MMEN limps about, hops in and out of law courts, and spends dough on things the CEOs enjoy.

MedMen is paying millions to market in places there is no market, when they only have access to a bit over 10% of the country. COOL PLAN.

The ad is fine, I guess. But the price tag will be excessive for a company that loses big money and won’t drive any customers to their stores through 90% of their spend.

Shrug.

Then there’s the ongoing tragedy that is the Wayland Group (WAYL.C), which has seen a 39% drop over that last six weeks. WAYL has also shed two directors within a number of days of each other, and had to issue a note claiming some weird OTC promotional campaigns backing them in ways unseemly were actually nothing to do with them.

The stock sits at a near 52-week low, mostly because the CEO is ass.

SO WHO HAS A MARKET CAP THAT STILL SHOWS VALUE?

I’m glad you asked, friend.

Heritage Cannabis. Yes, the company we opened this story about has a real interesting little operation coming along, with a price tag that still shows room to grow. What’s interesting to us about the most recent run is it shows the company has graduated from the ‘forget-me-now’s to the big club, and now moves with catalysts, whereas it used to hover.

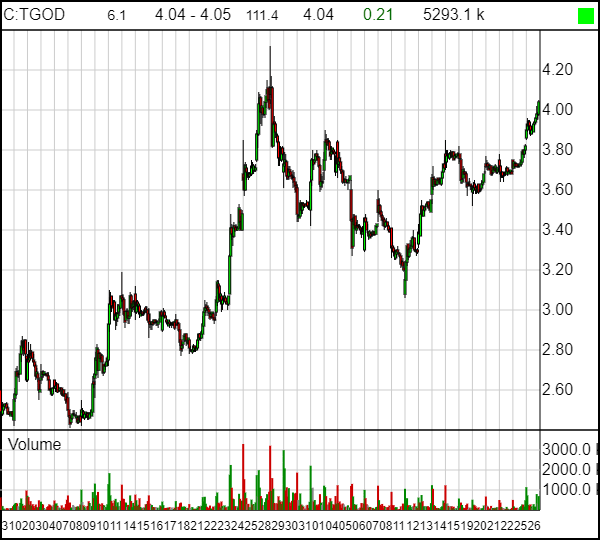

Green Organic Dutchman (TGOD.C). Whatever you thought of its arrival into the public space, with a ton of early investors cashing out all at once in a tsunami of free trading stock in late 2018 (as a hangover from a novel and widespread pre-listing financing), version 2.0 of TGOD is starting to really rev.

Without the concern that a big plop of shares will suddenly be dropped on the market, the wheels are starting to turn nicely and what promises to be a central player in the beverage space at some point is now earning attention.

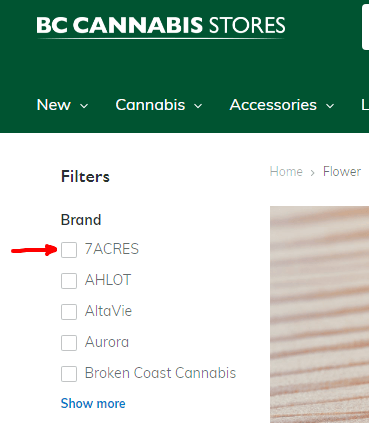

Supreme Cannabis (FIRE.T) isn’t exactly low on the market cap side at $500m, but with a quarterly loss of just $1.55m in Q2 (while Canopy’s loss was refiled from $69m initially to $155m eventually) and a war chest burning a hole through their pockets – and an EXTREMELY well reviewed slate of product offerings, Supreme looks like a freaking gimme.

Jean Guy from 7 acres is my new favourite!! I get so stoned it’s wonderful! That’s what it’s all about right?! Lol ♀️ #legalweed #welegalizedit #canadianstoners #jeanguy #7acres #thcdoll… https://t.co/eesxo3Beke

— thcdoll/allidabwa (@thcdoll) January 4, 2019

7 Acres, a subsidiary of $FIRE, has had perhaps the BEST reviews next to MedReleaf products. Jean Guy / Wappa perhaps top the charts. Great job @john_fowler_jd, your focus on quality is paying dividends. 2/3

— Hamzah Ali Khan (@HamzahKingKhan) December 9, 2018

My 3.5 of Jean Guy from 7 acres chimed in at 3.7

— Kevin Benson (@kev_in_the_shed) December 4, 2018

Also, the smart move to launch their brand as 7 Acres has meant they’re showing up first alphabetically on online stores.

Pure Global Cannabis (PURE.V), which we’ve pointed out was cheap so often that it was a relief to see it double up to $0.30 recently, remains cheap with just a $36 million market cap, despite the recent two-bagger. 3 Sixty Risk Solutions (SAFE.C) is making people take notice on the weed security services side, with volume ticking up noticeably, $35m Blissco (BLIS.C) continues to do interesting business without anyone in the markets noticing they exist, a situation that must change some day, recently licensed Matica (MMJ.C) continues to build while watching its stock price stapled to the couch. The $36m licensee has yet to be taken seriously but has all the paperwork in order to make it happen. Crop Infrastructure (CROP.C) bangs out news and makes new moves more often than I take showers, but their share price has been in stasis for four months, meaning they’ve separated from sector forces and may catch up quickly and without warning. California white label oils processor Chemesis International (CSI.C) had an amazing run before a big financing saw a sell-off by folks looking to buy back in at the cheaper financing price.

New pubco and California weed logistics play Transcanna (TCAN.C) is up a triple in the last month, from an opening $0.90 to just shy of $3.00, as it raises money relentlessly along the way. And, if you like beverages, sipper tech play Sproutly (SPR.C) is eerily quiet, with trading that’s been flat for months while volume slowly builds.

GTEC Holdings (GTEC.C), which recently decided against completing a merger with Invictus (GENE.V) is yet to gain benefit from its decision with its share price held down while it raised $8m for expansions. Biome Grow (BIO.C) is signing supply agreements with provincial liquor distributors that have significant real world financial benefits, now and into the future, but have had no recognition by the markets yet, something that will change when financials drop. Once fought over Newstrike Brands (HIP.C), players working with Canadian mega band The Tragically Hip to build an east coast brand, are doping smart things and getting no cred – yet. Listen to our podcast with them to get more info.

Even Ascent Industries (ASNT.C), which lost its license and is now being put through not just a fire sale, but also a boardroom takeover attempt, has value for the brave as it sits on just a $30m market cap, surely lower than the liquidation price of its assets – or the stock after it is fought over and accumulated by bullies at the table.

On the other end of the spectrum, once unloved Village Farms (VFF.C) got a NASDAQ listing and sent stupid. I can’t even.

The bottom line here is not that you have to run through fields of trash to find something to go up. If you’d tossed a rock in any direction over the last month and bought whatever stock your rock hit, you had a better than average chance of making bank.

But now it’s time to be judicious. Look at the market caps. Find value.

Don’t chase what’s risen. Chase what’s deserving of a rise. Find the next triple where others have yet to look.

— Chris Parry

FULL DISCLOSURE: Near every company mentioned in this piece is an Equity.Guru marketing client. It’d be easier to identify those companies we don’t do business with and/or have stock in:

Wayland, MedMen, Matica, Aurora, Aphria, Canopy, Tilray, Blissco, Village Farms, Newstrike. Everything else is a client.