Cypress Development Corp (CYP.V) dropped news this a.m. At first glance, it may appear inconsequential, but in reality it’s quite significant.

We’ll dive into the nitty gritty a little further down, but first: a quick summary of what we’ve got here so far.

Clayton Valley’s resource:

All told, Clayton Valley boasts nearly 2 billion tonnes of claystone material.

- 3.835 million tonnes of lithium carbonate equivalent (LCE) contained in 831 million tonnes of material at an average grade of 867 ppm Li in the Indicated category.

- 5.126 million tonnes of LCE contained in 1.12 billion tonnes at an average grade of 860 ppm Li in the Inferred category.

Clayton Valley’s many attributes:

- Two claim blocks, Dean and Glory, totalling 4,200 acres.

- 100% owned (a 3% NSR which can be reduced to 1% for $2 million).

- Orebody is flat lying with no overburden (can’t stress enough how hugely important this feature is to the economics of a project… any project).

- Extensive volcanic-derived geological setting.

- Lithium is contained in illite and montmorillonite soft clays to a minimum depth of 120 meters below surface.

- potential significant rare earth element (REE) values exist for Scandium, Neodymium, and Dysprosium.

- No drilling or blasting required to liberate the ore (again… hugely important).

- Region is steeped in mining history – ample access to experienced labor and contractor services.

- A mature regulatory environment.

- THE best mining jurisdiction in the U.S. – currently ranked 3rd globally by the Fraser Institute’s annual Survey of Mining Countries.

- Good road access through and through.

- Rail system access is 90 miles by road.

- Easy access to power – electrical connection possible via the sub-station in Silver Peak.

- Water is available via the Silver Peak municipal water supply.

Clayton Valley’s 2018 PEA:

The company is building on the success of a positive PEA:

- Net present value of $1.45 billion at 8% discount rate.

- An internal rate of return (IRR) of 32.7% (after tax).

- Average annual production of 24,042 tonnes of lithium carbonate over a 40-year mine life.

- Capex of $482 million, pre-production, and an operating cost estimate averaging $3,983 per tonne of lithium carbonate.

- An estimated 2.7 year payback period.

For a more detailed look at the company and its Clayton Valley project, the following Equity Guru article should help fill in the blanks…

Read: Cypress Development (CYP.V): de-risking its Clayton Valley lithium project in Nevada

The Feb. 14 news:

“Cypress Development Corp is pleased to announce that Ausenco Engineering Canada Inc. has been selected as the lead consultant for the prefeasibility study (PFS) on the Company’s Clayton Valley Lithium Project. Cypress is also pleased to announce that Global Resource Engineering will continue to consult on project metallurgy, resource estimation and mine planning.”

A Prefeasibilty Study (PFS) is a huge step forward for the company as it continues to aggressively de-risk Clayton Valley.

We normally don’t fuss over press releases announcing consultant hires, but an exception is required here:

This Ausenco news is a big deal. Why?

Clayton Valley’s lithium is contained in soft clays, specifically illite and montmorillonite.

Ausenco is a highly respected global engineering firm that has experience performing economic studies on world-class clay deposits (Exempli gratia) Bacanora Minerals’ Sonora Lithium project in Mexico, one of the worlds largest clay lithium deposits with over 5 million tonnes in the measured and indicated category.

Ausenco Engineering has extensive experience in lithium projects. Selected projects include Bacanora Minerals’ Sonora Lithium Project (Mexico), Talison Minerals’ Minerals Conversion Plant (Western Australia), and European Metals Cinovec Tin–Tungsten–Lithium Project (Czech Republic).

Having a name like Ausenco attached to Clayton Valley will add heaps of validity to its PFS.

On the investment banking side of things, analysts and advisors require greater certainty (proof) before they’re allowed to get behind a project, mandates from their key investors and all – a positive PEA is a good start, it gets their attention, but it’s not quite enough for this sophisticated group.

A positive PFS delivered by the likes of Ausenco will likely mobilize these institutional funds from the sidelines, ushering in that rerating we’re all expecting here.

Cypress CEO Dr. Bill Willoughby on the Ausenco announcement…

“Ausenco’s extensive experience in plant design and construction of lithium projects will be a valuable asset as we move the Clayton Valley Lithium Project forward through our PFS. We are pleased to work with both Ausenco and GRE with the expectation of completing the PFS in the second quarter of this year.”

Did I mention that this is a big deal?

Next Up:

Results from metallurgical test studies are on deck.

This is another detail institutions will be looking closely at.

Last year’s met studies consisted of single stage bench tests using 100 – 250 gram samples.

An 81.5% extraction rate was obtained in these early studies indicating that the dominant lithium-bearing minerals present are not hectorite, a refractory clay mineral which requires roasting to liberate the lithium.

This year’s leach tests will incorporate a proprietary multi-stage leaching process using three-kilogram samples.

These large samples subjected to a multi-stage process will be far more representative of what Clayton Valley’s clays have in store.

The mobilization of a drill rig to the property last week, aside from upgrading the current resource to reserves, will provide substantial drill core samples to facilitate this larger, more comprehensive metallurgical program.

Once again, institutions will be watching the newsflow out of this program closely.

Final thoughts:

As I mentioned in an earlier piece, Cypress is backed by a solid management team. They know how to get things done, on time and on budget.

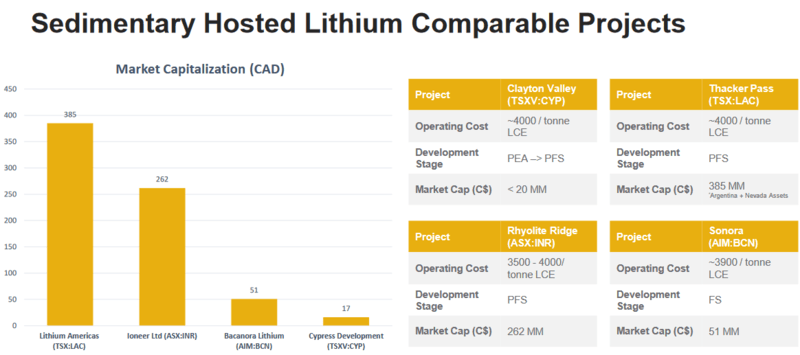

With 73.18 million shares outstanding, the company has a market cap of $14.64M based on its recent $0.20 trading range. That strikes me as ridiculously cheap.

On deck we have metallurgically and drill results. Positive met tests, due any time, could be a significant catalyst for this stock.

We stand to watch.

END

~ ~ Dirk Diggler

Youtube video courtesy of Ahead of the Herd (Rick Mills).

Feature image courtesy of the co’s i-deck.

Full disclosure: Cypress Development is an Equity.Guru marketing client.