One of our favorite Golds – Nexus Gold Corp (NXS.V) – has just entered into a LOI (letter of intent) to acquire the McKenzie Gold Project in the prolific Red Lake Mining Camp of northwestern Ontario.

Just how prolific is Red Lake? Production is well north of 29 million oz’s making it the third largest gold camp in Canada.

The project suddenly became available when Enforcer Gold (VEIN.V) gave up its pursuit of the project after a proposed financing fell through.

Note the date on Enforcer’s corporate update (Jan. 23rd) and this acquisition news from NXS (Jan. 30th) – barely a week between events.

Read: Nexus Gold to Acquire McKenzie Gold Project, Red Lake, Ontario

This was a real heads up move on management’s part. And I’m guessing that 1082545 B.C. Ltd, the vendor of the McKenzie property, was being extra careful about who they partnered with next, not wanting a repeat of the Enforcer fail.

The price of admission? Six million Nexus common shares and a one-time cash payment of $150,000.

I find the terms of the deal interesting, that the vendor is willing to take NXS common in exchange for their Red Lake claim blocks. They must believe in the potential of the property AND the Nexus’ ability to execute.

1082545 B.C. Ltd doesn’t win unless NXS and its fellow shareholders win.

From where I sit, it looks like a damn good deal, especially when you consider the address.

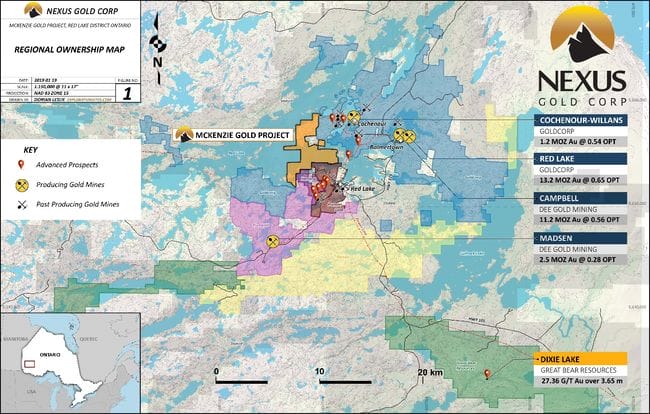

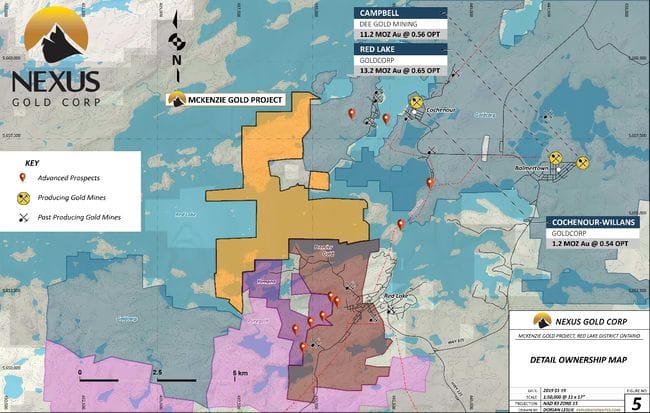

As you can clearly see, McKenzie’s 1,348.5 hectares is located in the heart of the Red Lake gold camp. The project is surrounded by the likes of Goldcorp (G.T), Yamana (YRI.T), Pure Gold (PGM.V) and Premier Gold (PG.T).

A cursory study of the claim map shows the property is divided roughly equally between land and water.

The liquid portion of the claims package is Red Lake itself – the lions share of the projects terra firma is McKenzie Island.

From the Jan. 30th press release…

“The highly prospective geological setting is analogous to several past producers. McKenzie hosts nine documented historical gold occurrences with limited exploration.”

McKenzie’s exploration history:

Drilling in 2005 by Cypress Development along the southern edge of the property encountered quartz veining accompanied by sphalerite, arsenopyrite, chalcopyrite and free gold. The best hit from this limited program cut 6.0 meters of 2.2 g/t Au.

This 2005 hit occurred within a strongly silicified, sericite-altered, east-west-trending mineralized zone up to 600 meters long and open along strike and to depth.

During a 2017 ground reconnaissance program on McKenzie Island, grab samples returned values of up to 313 g/t Au.

In the southwest corner of the island, a new showing – a 12 cm wide, low-angle quartz vein exposed from the shoreline over a length of 2.0 meters – was discovered. High-grade samples ranged from 9.37 g/t Au to 331 g/t Au.

Although this vein is narrow, and the strike length is unknown, it demonstrates the untapped potential of the area (Red Lake is known for its narrow high-grade veins).

This new discovery lies approximately 100 meters west of a historical showing that assayed up to 212.8 g/t Au.

Sampling along the north shore of McKenzie Island encountered quartz veining and sulphide mineralization which returned up to 18.02 g/t Au in grab samples.

The northeast edge of the Island is bounded by the Cochenour-Gulrock deformation zone, host to the Campbell and Red Lake mines.

Alex Klenman, Cypress president and CEO, stated the following re the acquisition:

The McKenzie Gold Project, with numerous high-grade showings, presents a compelling exploration opportunity for Nexus. This acquisition will give us two highly prospective Canadian-based projects with potential high-grade upside, that provides an excellent compliment to our active West African portfolio. Red Lake is a high-profile, well-established gold producing region that garners much market interest. By expanding our jurisdictional scope here, and elsewhere, Nexus can reach a much wider audience. Once this acquisition is completed, Nexus will have six projects on two continents, in some of the most prolific gold producing regions on the planet. We feel this puts the Company in an excellent position for growth, particularly in a stronger gold market.

Two things strike me as particularly insightful re Klenman’s comments above:

- “Red Lake is a high-profile, well-established gold producing region that garners much market interest.” Absolutely. The Red Lake Mining District is known as the “high-grade gold capital of the world”. It’s where Goldcorp launched itself from lowly cash-starved ExplorerCo to a mighty Senior producer.

- “We feel this puts the Company in an excellent position for growth, particularly in a stronger gold market.” That’s exactly what many of us here at Equity.Guru are thinking. We believe we’re on the verge of an epic rally in precious metals. Companies, like Nexus, holding highly prospective, jurisdictionally diversified project portfolios, are bound to attract a lot attention from the market.

It’s important to note that this is not a done deal, not just yet.

Completion of the acquisition of the Project remains subject to a number of conditions, including the successful completion of a due diligence review of the Project, the negotiation of definitive document, and the approval of the TSX Venture Exchange. The acquisition cannot completed until these conditions are satisfied, and there can be no guarantee that the acquisition will proceed as planned. All securities issued in connection with the acquisition will be subject to a four-month-and-one-day statutory hold period prescribed by applicable securities laws.

Nexus has entered into a LOI with the vendor.

For those unfamiliar with the term, a LOI is a preliminary agreement, a roadmap if you will, that lays out the foundation for future negotiations which could lead to a formal binding agreement.

Final thoughts:

Nexus Gold is perhaps best known for its extensive portfolio of projects in Burkina Faso. We’ve covered these projects in some detail:

Read…

Nexus Gold Corp (NXS.V) extends strike length at Koaltenga gold zone

Market operators and a new high-grade acquisition for Nexus Gold (NXS.V)

Nexus Gold (NXS.V): Is Burkina Faso the next African gold superstar?

Nexus currently has 42.29 million shares outstanding giving it a market cap of roughly $5.29M, based on its current trading range.

This is a smart and savvy crew.

The company’s recent Bridge River acquisition, and now Red Lake, shows preparedness, an inclination to seize an opportunity when one presents itself.

The low share count, modest valuation, and exceptional exploration potential make Nexus an intriguing speculation at current prices.

END

~ ~ Dirk Diggler.

Full disclosure: Nexus Gold is an Equity.Guru marketing client. We own the stock.

Feature image courtesy of NorthernOntarioTravel