On January 15, 2019 – at the somewhat unusual time of 6 p.m. EST, iAnthus Capital (IAN.C) and MPX Bioceutical (MPX.C) jointly announced that MPX holders had voted overwhelmingly to approve a deal whereby iAnthus will acquire all of MPX shares in an all-stock transaction valued at $835 million.

MPX is a vertically integrated cannabis operation providing “management, staffing, procurement, advisory, financial, real estate rental, logistics, and https://e4njohordzs.exactdn.com/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistrative services to medicinal cannabis enterprises across its holdings.”

The first public-to-public merger transaction in U.S. cannabis history – the combined company does not include MPX International.

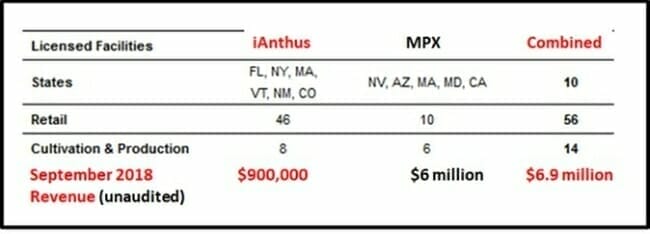

iAnthus is scooping up the MPX U.S. operations – which instantly expands business activities to 56 retail locations and 14 cultivation/processing facilities in 10 U.S. states.

Arizona, Maryland, Nevada, California and Massachusetts are now added to New York, Florida, Massachusetts, Vermont, Colorado, and New Mexico, forming “super-regional footprints in both the eastern and western United States.”

The merger adds significant cash flow to iAnthus bottom line.

“We nearly double the size of our national footprint in the U.S,” stated Hadley Ford, CEO of IAN on the day the merger was announced, “iAnthus has been strategically focused on building scale, and this crystallizes our position as one of the largest multi-state operators in North America.”

Assessing who got the better of this deal involves trying to predict future drug laws in the U.S.

If the U.S. legalises recreational cannabis at the federal level in the next three years, iAnthus swollen footprint may seem like a bargain (it’ll be relatively easy to scale operations).

If the U.S. remains a regulatory patchwork of state laws, and MPX and sets up shop in another country easier to do business in – MPX shareholders may feel that they dodged a bullet.

At the MPX shareholder meeting, 40% of the total issued and outstanding MPX Shares were voted in person or by proxy.

99% of all the MPX shareholder votes cast were in favour of the deal.

Key assets not included in the merger include Canveda (a Canadian Licensed Producer), the Salus BioPharma Corporation agreement with Panaxia Pharmaceutical Industries Ltd. and 50% of a medical cannabis license application in Australia.

Had MPX terminated the arrangement in favour of an “unsolicited superior proposal”, MPX would have been forced to cough up $25 million to iAnthus.

By mid-morning trading, both MPX and IAN were up a few pennies.

No euphoria.

No despair.

The smooth execution of the MPX/IAN merger goes somewhat against the grain of the current landscape.

We predicted a month ago, that “as the investment community sours on the weed sector, some of these proposed mergers will go sideways.”

As we reported yesterday, GTEC Holdings (GTEC.V) and Invictus MD (GENE.V) have mutually agreed to halt their merger.

While some holders of GTEC and GENE may react poorly to the news Wednesday morning,” wrote Chris Patty, “the general consensus was the original deal was a win-win, so it’s unlikely either company will commiserate too hard over a reset.

Upon closing, MPX International (MPX’s spun-out company) will hold the non-U.S. assets of MPX, and will be focused on the global cultivating, manufacturing and marketing products which include cannabinoids as their primary active ingredient.

It is expected that the arrangement will be completed on or before January 30, 2019.

Full Disclosure: iAnthus Capital is an Equity Guru marketing client, and we own the stock.