OPEC is cutting oil production.

OPEC and some non-OPEC partners—the most important of those being Russia—have agreed to cut oil production by 1.2 million barrels per day as of Jan. 1, 2019. OPEC members Iran, Venezuela and Libya are exempt from the reduction level.

Accordingly, the 5th OPEC and non-OPEC Ministerial Meeting, following deliberations on the immediate oil market prospects and in view of a growing imbalance between global oil supply and demand in 2019, hereby decided to adjust the overall production by 1.2 mb/d, effective as of January 2019 for an initial period of six months. The contributions from OPEC and the voluntary contributions from non-OPEC participating countries of the ‘Declaration of Cooperation’ will correspond to 0.8 mb/d (2.5%), and 0.4 mb/d (2.0%), respectively.

Russia is the world’s second biggest oil producer and, though not a member of OPEC, is vital to any type of production control OPEC hopes to put in place.

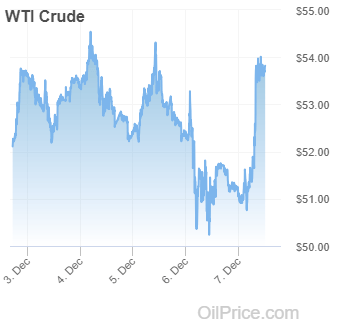

West Texas Intermediate crude prices jumped $4 when the reduction was announced.

OPEC will be responsible for a reduction of 800,000 bpd come Jan. 1 and Russia, along with other non-OPEC partners, will reduce production by 400,000 bpd. The intended goal is to stabilize oil markets after the biggest price dip since the 2008 financial crisis.

Wind down & round up

While OPEC was busy rounding down production, Equity Guru’s Greg Nolan was busy offering and an oil roundup.

Touching on most of EG’s oil-space clients, Nolan said massive opportunity for investment could be on the horizon.

US producers have felt the pressure of weak crude prices, but the ride has been especially turbulent for Canadian producers – their heavy crude and oil sands bitumen, aka Western Canadian Select, have hit lows never before seen. Prices have firmed in recent days/hours after the Alberta government stepped in with a hefty 8.7% production cut.

But lows offer a chance at highs. As Nolan continues:

Plumbing the lows – an opportunity…

We believe resource stocks warrant a serious look. The OILs we cover in our pages are currently plumbing absurdly low levels. This could be an extraordinary opportunity to pick up asset rich companies at or near multi-year lows.

The current chaos within the oil sector is in large part a result of the rift between Donald Trump and and the oil-producing community at-large.

When supply increases, prices go down and only the outfits which can produce cheaply benefit. When supply decreases, everybody benefits.

With OPEC slashing output, the increase in prices makes US and Mexico-based projects like IFR and ROE more viable. The oil companies we cover are laughing at $50/bbl. Its current price is USD$52.13.

Although prices may continue to drop, sooner or later a very enticing entry point into the oil space may appear.

Full disclosure: IFR, ROE, JCO and OIL are Equity Guru marketing clients.