On Dec. 6, 2018 1933 Industries (TGIF.C) announced that it has been accepted for trading on the OTCQX, the over-the-counter markets’ premier tier.

The OTCQX is for “established, high-growth and investor-focused companies wishing to gain added exposure in the United States.”

“This is a significant milestone during our first year of trading”, stated Brayden Sutton, President and CEO of 1933 Industries. “It provides greater visibility as we continue to penetrate legal markets in the US.”

1933 Industries’ penetration of U.S. legal markets hinges on its projects in Las Vegas, Nevada.

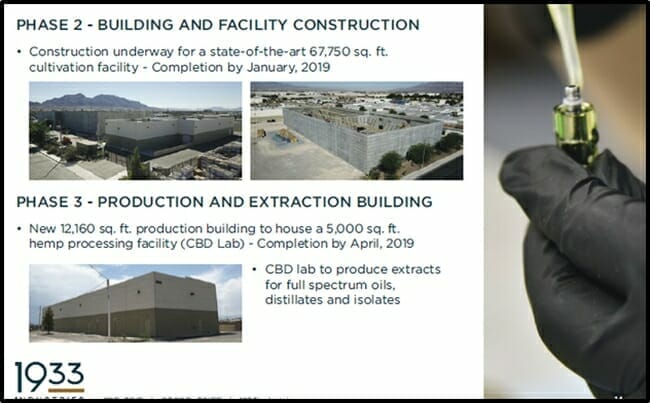

Construction on TGIF’s new 67,750 sq. ft. cannabis grow-op is about 75% completed and is on track to wrap-up next month. Plant clones are being readied for transfer into the new facility to ensure a smooth ramp up in cultivation.

There is also a 12,160 sq. ft. production Facility and CBD Lab under permitting, adjacent to the cultivation facility.

A license application for a retail cannabis store has been submitted to Clark County, which has jurisdiction over the entire Las Vegas Strip.

The State of Nevada Department of Taxation expects to issue conditional licenses to successful applicants later this month.

Key Nevada Highlights:

- First licensed cultivator

- Expanding real estate portfolio

- Strong foothold in CBD and THC products

- Hemp-processing and CBD extraction vertical

- New 67,750 sq. ft. cultivation-only facility

- Expanding production space to 12,160 sq. ft.

- CBD processing facility for oils, distillates and isolates

For cannabis growers and branders – Nevada is the holy grail.

Nevada’s 2.25 million residents love weed.

Nevada’s 46 million annual tourists love weed.

Guess who else loves weed?

The Nevada State Government!

The first year of legalized recreational pot raised nearly $70 million in tax revenue, including $27.5 million for schools and $42.5 million for a state “rainy day” contingency fund.

But 1933 is not exclusively Nevada-focused. It also owns 91% of both Alternative Medicine Association and Infused MFG. and 100% of Spire Global Strategy. It is expanding its footprint in California and Colorado.

On December 3, 2018 1933 Industries hired Josh Taylor to open new markets for expansion in North America. Taylor – a former pro-golfer has done biz development Red Bull’s exclusive distributor.

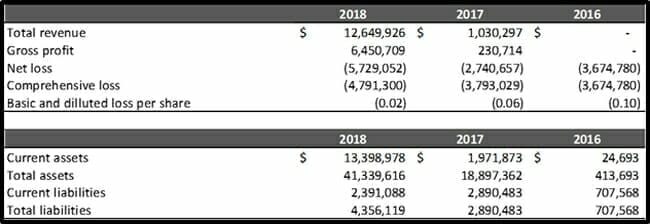

Complete Fiscal 2018 Highlights

- Revenues of $12.6 million for the year

- Gross margins of 49%

- Total assets increased to $41 million

- Product offering expanded to over 120 SKU’s

- Retail footprint expanded to 500 Stores

“We have experienced substantial growth through our operating subsidiaries,” stated Mr. Brayden Sutton, President and CEO, “Investing significant capital in building out our new cultivation and production facilities in Las Vegas, which will be operational in the new year.”

Breaking it down, 1933 recorded annual revenue of $8.2 million from the Alternative Medicine Association (91% ownership)

AMA highlights:

- Contributed 65% of total company revenue

- Gross margin of 37% ($3.2 million)

- The positive contributing income before tax $1.3 million

1933 recorded about $4.4 million from Infused Manufacturing (91% ownership)

Infused highlights:

- Contributed 34% of total company revenue

- Gross margin of 71% ($3 million)

- Broke even in 1st year of operations

Consolidated Results

Q4, 2018 Highlights

For the 3-month period ending July 31, 2018, revenue of $3.9 million from the sale of medical and adult-use cannabis and hemp/CBD infused products – an 18% increase from Q3, 2018.

1933’s advisory arm, Spire Global Strategy booked Q4, 2018 consulting revenue of $84,993.

Q4, 2018 Corporate Milestones

- purchase of 12,160 sq. ft. building adjacent to the future cultivation facility.

- 1-year licensing agreement with poker star, Mr. Scotty Nguyen.

- 1-year licensing agreement with Denver Dab Company to produce 1933’s line of products in Colorado.

- Purchased production building in Las Vegas

- Awarded an Industrial Hemp Handler Conditional Certificate from the Nevada Department of Agriculture

Net loss for fiscal 2018 was $5.7 million. The losses were “primarily driven by investment in future growth initiatives.”

Long time Equity Guru readers may recall that 1933 Industries used be called “Friday Night”.

Why the name change?

“Friday Night boss Brayden Sutton begun to realize that, as good a brand as Friday Night was, for partiers on the Vegas Strip, perhaps there was a bigger audience out there for people who were less into Affliction t-shirts,” wrote Chris Parry, who appreciated 1933’s “nod back to the year prohibition ended.”

Infused already has a strong retail foothold in the State of Nevada, and it is now building distribution networks in California – with a total of 500 retail shops in the US.

Further expansion targets include Oregon, Arizona and Canada. According to a recent press release, a foothold in the Canadian market, “could open distribution channels into the European markets”.

“Infused is adding an average of 50 new wholesale accounts added every month”, stated the press release.

Trading on the OTCQX, make is easier for U.S. retail investors to purchase 1933 stock.

The complete 2018 fiscal numbers make it clear that 1933 Industries is a real company, doing real business.

Full Disclosure: 1933 Industries is an Equity Guru marketing client, and we own the stock.