On December 4, CUV Ventures’ (CUV.V) subsidiary, RevoluPay signed, an agreement to handle virtual credit card payments for bed and breakfasts and small hotels booked through Expedia (EXPE.Q) and Booking Holdings (BKNG.Q).

CUV Ventures deploys advanced technologies in the online travel, vacation, mobile apps, money remittance, invoice factoring, blockchain systems and cryptotoken sectors.

Booking Holdings and Expedia websites service a market of three million small hotel establishments, bed and breakfasts, and private houses that feature bookable accommodations. This number develops at a monthly rate as travelers gravitate towards B&B arrangements over the traditional hotel.

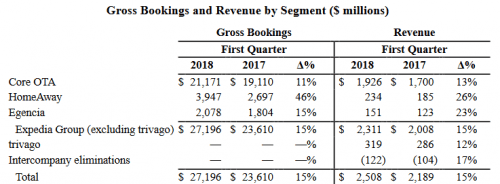

In 2017, Booking Holdings and Expedia made a combined revenue of $23.3 billion through their most popular brands. Booking.com brands include such names as Booking.com and Priceline.com, while Expedia’s most recognized brands are Expedia.com, Hotels.com, Trivago.com and Travelocity.com.

Over the past few years there has been a trend towards non-traditional places to stay like homes and apartments, and a move away from motels and hotels. In December 2017, the total amount of non-traditional bookings grew 53 percent from the previous year.

Expedia also reported their Homeaway division’s revenue increased by 40 percent in 2017. Homeaway is a vacation marketplace that has already proven itself globally, and possesses significant opportunities for improvement when combined with CUV’s RevoluPay and other products.

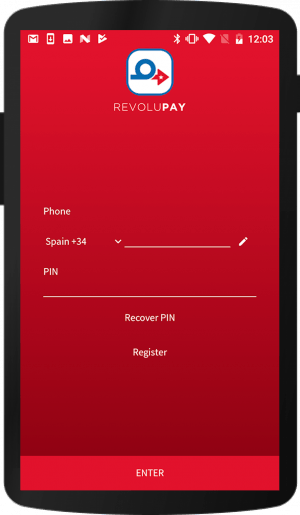

Now if operating costs were streamlined through one app, such as RevoluPay, then operating costs would drop, leaving room for more profit and development.

Traditionally, paying for B&Bs abroad can be challenging.

The owners of both Bed & Breakfasts and small hotels could ask Booking and Expedia to pay them by bank transfer, but this has a usual turn-around of about 30-to-60 days, depending on monthly or bi-monthly wire payment cycles and the destination country. Another option is through a virtual credit card (VCC) that allow for easy, secure and instantaneous payments.

Booking or Expedia generates a VCC per booking to the tune of the net amount for the property owner. The VCC generated includes both an activation and expiration date, unique card number and CVC. These come with their own problems: they’re complicated and costly to business owners.

If the cards aren’t present (such as with VCC), the average credit card processing fees average around 3.8 percent. Furthermore, the cost of having a VCC issued is roughly three percent. Combined, property owners are charged roughly 6.8 percent of any single transaction requiring a VCC.

RevoluPay intends to lower these processing fees for VCC payments to property owners to between 4.5 to 5 percent while ensuring a respectable revenue stream for shareholders.

A lot of places won’t take them because it requires more steps, and could spell a significant hurdle for property owners.

RevoluPay aims to streamline this process. Under a specific agreement, they offer the opportunity to permit property owners to immediately and instantly settle Virtual Credit Card (VCC) payments directly into their e-Wallet and forward these funds onto their bank account.

All of this carries a nominal cost.

In most cases, the charge will be three percent of the amount payable to the owner of the property. This is quite often less than the cost of an international wire. The average processing fee for merchants is anywhere between 2.87 and 4.35 percent per transaction.

Normally VCC’s come with issues of their own. While capable of instantaneous transactions, and therefore getting a leg-up on the wire transfer method, they require that the owner of the property has a viable method in which to collect the funds from. Also, most of the card merchant accounts don’t offer offer manual input of card data, nor VCC, therefore this could spell a significant hurdle for property owners.

Full Disclosure: CUV Ventures is an Equity Guru marketing client.