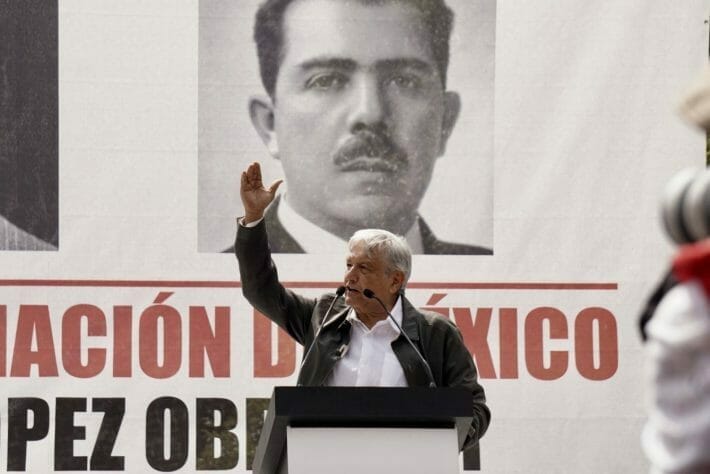

In July, the people of Mexico elected Andres Manuel Lopez Obrador to the presidency. Known to supporters and detractors alike as Amlo, Mexico’s president campaigned on fighting corruption and promises of ending the country’s longstanding war on its drug cartels, which has left hundreds of thousands dead.

Though he says he aims to roll back the militarization of Mexico’s drug war, Mexico’s president–who took office earlier this month–said he has no plans on capitulating to the ruthless drug syndicates which have ravaged the country for the last 12 years.

Instead, Amlo says better education, economic security and reforms to the country’s drug laws are crucial to denying the cartels the money and foot soldiers they need to fight.

Just as American prohibition of alcohol made bootlegging a way to finance organize crime, the crackdown on narcotics in the US and Mexico has enabled contemporary drug cartels to obtain enormous wealth and, by extension, the capability to openly contest control of Mexican territory with the nation’s federal government.

The National Regeneration Movement, Amlo’s political party, submitted a bill in November to legalize cannabis and greenlight its incorporation into Mexico’s legitimate industries in hopes of excising the criminal elements that currently control them.

“Today, the nation has taken the decision to change. We don’t want more deaths. It will be a major contribution to bringing peace to our beloved country.”

-Olga Sanchez, Mexico’s interior minister

For cannabis companies, the opportunity this legislation offers is undeniable. Mexico has a population roughly five times that of Canada, its climate allows for outdoor growing all-season and its labour force costs pennies on the dollar compared to Canadian workers.

Prohibition Partners, a market intelligence firm, published a report on potential size of Latin America’s cannabis market. “The LATAM Cannabis Report” found medical cannabis alone to be worth $125 million in 2018 and expects it to rise to $12.7 billion by 2028.

Although the country’s size and proximity to the rest of Latin America make it a tantalizing prospect for any company in the cannabis sector, Mexico is not without its challenges.

The Catholic Church still retains much of its political power and societal sway in the Spanish-speaking world. In 2006, the U.S. Department of State published a report that stated approximately 88 percent of Mexicans identified as nominally Roman Catholic.

Although there has been some support for medical cannabis by high-ranking officials within the Church, the legalization of recreational cannabis was loudly decried by the spokesman for the Archdiocese of Mexico City in 2015.

Then there are the cartels who will undoubtedly demand their cut. Far beyond being the stuff of petty street gangs, many of these organizations control vast swathes of territory and are powerful enough to drive out local police entirely.

For those clever enough to carve out a niche, however, the opportunities are endless. Mexico is the new frontier.

The pioneers of Mexican cannabis

“If we were a foreign company from Canada and the U.S. setting up our operations in Mexico, we’d be very, very worried,” said Chris Naprawa, president of the Colombia-based cannabis company, Khiron Life Sciences (KHRN.V).

Though less overcrowded than Germany–the industry’s gold standard export market–Naprawa will be the first to admit Latin America comes with its own challenges.

After spending the last two years focusing Khiron’s operations on Colombia, Naprawa said he understands the complexities of a country like Mexico. The company hired ex-DEA chief Matt Murphy as their VP of compliance in March to establish its security protocols both at home in Colombia and abroad.

Naprawa said he feels Latin America is a far greater investment than the German market. “There’s 620 million people in Latin America. That’s bigger than Canada, the US and Germany combined. Do I want to be the 125th LP competing for exports into Germany? Or do I want to be the dominant player in a 620-million-person market?”

Political clout is another form of security, according to Naprawa. On the company’s board of directors sits Vicente Fox, Mexico’s 55th president. The addition of Fox to Khiron’s leadership team is a valuable one, ensuring access to all the levers of power within Mexican politics and business.

With the specter of drug cartels hanging over Mexico, Naprawa said Fox’s protection is also a boon in a volatile region of the world: “If somebody wants to shake down the president, they’re going to have quite a bit of trouble.”

Naprawa said the legalization debate in Mexico was the most important news within the cannabis industry in the last five years. He cites Mexico’s size and its vibrant middle class and purchasing power as evidence to the country’s viability. As one example, Mexico was the largest consumer of carbonated beverages in 2016.

Counter to his enthusiasm over the Mexican market, Naprawa said he cautions others against over-investment into Germany–where so much of the cannabis industry is focused. He said cannabis legalization is a global phenomenon and German precision will lend itself to cultivation, once it happens.

“I took the train from Munich to Frankfurt for five hours through farmland which looked like it had been laser cut into perfect squares. They’re cultivating everything under the sun there. If they choose to cultivate cannabis, they will and they’ll do it very well.”

Khiron is currently expanding its operations throughout Latin America. Besides its operations in Colombia, the company signed a non-binding MOU in September to enter the Chilean cannabis market with Chile’s only LP, DayaCann.

On Nov. 27, the company entered the Peruvian cannabis market after receiving approval to commercialize four products in its cosmeceutical product line.

The company only has 80,000 square feet of cultivation space and isn’t overflowing with capital to fund expansions, but the company understands Latin America.

One of Khiron’s focuses is in the development of cannabis-infused ‘cosmeceuticals’. These products, which include cosmetic-pharmaceuticals such as anti-aging creams, are in high-demand in Latin America.

Market Research firm, Mordor Intelligence, found Latin America represented nearly 13 percent of the global cosmetics market with USD$80 billion in sales in 2012, the second largest after Asia-Pacific.

Though unable to disclose a location, Naprawa said his company has already chosen a jurisdiction within Mexico for their upcoming operations. “We’ve got a lot more than our eye on it. It’s not like we’re browsing. We are moving very very quickly.”

How Mexico will affect Canada’s cannabis sector

In April, Aphria (APH.T) revealed how much it spent on every gram of cannabis it grew in Canada. The company claimed its cost-per-gram was below one dollar, though a recent earnings call revealed Aphria’s all-in cost per gram was $1.83.

For comparison, the company’s CEO, Vic Neufeld, made an appearance on Midas Letter in July which indicated cost per gram prices between five and ten cents in Latin America.

Cost per gram factors in everything from the price of greenhouses–which require grow-lights, insulation and soils conducive for medical grade cultivation–to the wages of the workforce charged with growing and harvesting.

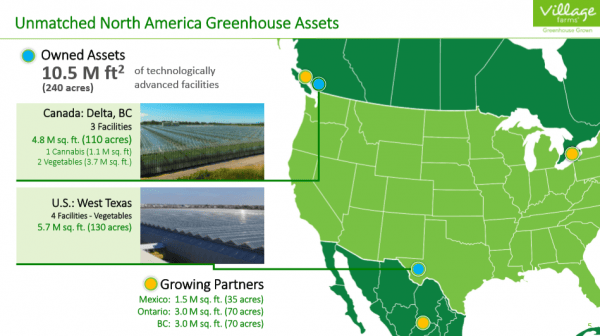

Whereas Canadian companies are spending millions of dollars to build-out their facilities’ square footage, growers in Mexico like Village Farms (VFF.T)–a recent entrant into the cannabis sector–may only need to change their existing agricultural crops from tomatoes and avocados to cannabis to become a threat.

Mexico’s comparative advantage encompasses vegetables (fresh and frozen) and fruit, where gains in land productivity are manifest.

-The World Trade Organization in “Mexico’s Agricultural Trade Policies: International Commitments and Domestic Pressure.”

Some experts already believe the Canadian market is over-saturated. Due to its relatively small consumer base, Khurram Malik, CEO of Biome Grow (BIO.C), said he expects a large-scale “die-off” to occur among Canadian LPs within the next two years during what he calls the ‘Day of Reckoning.’

You’re going to go from about 200 names to a dozen big guys and a handful of craft, niche-y guys. Everyone else is going to be bankrupt and gone. Canada only has 34 million people.

–Khurram Malik, CEO of Biome Grow

During a recent earnings call, when asked his opinion as to when supply will exceed demand for cannabis in Canada, the CEO of Canopy Growth (WEED.T) said the time was fast approaching.

“I think in Canada, if all the people who have been given all the money from the capital markets build all the things they say they’re going to build, which I think are some pretty crazy assumptions, there’s probably far more capacity that’s already been funded than is necessary for Canada,” Bruce Linton said.

The Mexican bill to legalize recreational cannabis and jump-start Mexico’s cannabis industry is expected to pass. The bill has bipartisan support and Amlo’s party has a majority in both houses in the Mexican legislature.

Much like with avocados and blackberries, sources who have spoken to Equity Guru believe that once the Mexican cannabis industry begins operations, Canadian cannabis companies will be competing against comparable product grown at non-competitive rates.

The survivors in Canadian cannabis

The brain trust at The Green Organic Dutchman (TGOD.T) disagree with Malik’s forecast about the size of Canadian cannabis once supply and demand normalize post-2020. They say the pool of LPs will be even smaller, even without the threat of low-cost cannabis making its way into Canada.

“I think it might be a half-dozen big players at most and 20 to 30 craft players,” according to Brian Athaide, CEO of TGOD.

Due to its singular focus on organic cannabis products and international expansion, the company may have insulated itself against the oncoming die-off predicted among its non-organic competitors by forecasters by Malik.

According to a 2018 Hill & Knowlton research study, 57% of Canadian medical cannabis consumers and 43% of recreational cannabis consumers prefer organic cannabis.

Speaking about the threat of low-cost Mexican cannabis which could someday be flooding the Canadian Market, Athaide said he believes Canada will “remain protected” by the Canadian government–meaning tariffs–given all the capital that has gone into the industry.

In October, TGOD announced its joint-venture with LLACA Grupo Empresarial (LLACA), a Mexican company which has established relationships with 4,500 pharmacies and 3,100 supermarkets within Mexico.

TGOD will be supplying LLACA with industrial hemp-CBD products from its Polish subsidiary, HemPoland, as well as organic cannabis from its Jamaican subsidiary, Epican.

“At this point, we’re not focusing on the cultivation in Mexico, which has historically been linked to organized crime, we’re bringing in product from elsewhere,” said Matt Schmidt, TGOD’s EVP of corporate development.

Schmidt said the company was continuing to pursue low-cost jurisdictions as they emerged.

“Although we’re later in Canada, internationally and in Mexico we will not be later. We will have an early mover advantage. On top of that, we have a team that has been there before,” Schmidt said.

“I spent six years in Latin America, Mexico was my biggest market and I was there every two months,” Athaide said, “and he’s still not trying to do it himself,” Schmidt added.

As Canopy goes…

The low-cost jurisdictions of Latin America offer undeniable value to the cannabis industry if the actions of industry-leaders are any indication. Canada’s largest LP, Canopy Growth (WEED.T), is busy expanding throughout Latin America.

In a November 2018 earnings call, Canopy’s CEO, Bruce Linton, outlined the company’s growing assets south of the US border.

“We’re in an execution of operations, exporting our intellectual property and cranking up medical outcomes to a very substantial middle and high-income class in a region with a huge population,” Linton said.

Canopy’s operation in Latin America are headquartered in Colombia, but Linton said the company has been active in Brazil for years. Canopy is also currently building up their capacity in Chile and is nearing the acquisition of a license in Jamaica.

[Canopy] expanded its focus on the emerging cannabis market in Latin America with the formation of its wholly owned affiliate Canopy LATAM Corporation, the acquisition of Spectrum Cannabis Colombia, which previously operated as Colombian Cannabis S.A.S and the acquisition of unowned shares in Spectrum Cannabis Chile SpA.

-Canopy, November 13, 2018 MD&A

Though Canada and Uruguay remain the only two countries to enact widespread adoption of cannabis as a government sanctioned industry, Mexico is nearly there.

Mexico’s legislation to develop its own cannabis industry is anticipated to pass, with legislators around the world fully aware of the economic upsides of regulating an enormous black market.

Latin America is not without its challenges: crime, corruption and stiff competition can stymie the most capable company’s plans. For those who can navigate this new green-frontier, however, the opportunities in Hamilton, Ontario pale in comparison.

Full disclosure: Biome Grow and TGOD are Equity Guru marketing clients.