Due to a frenzy of hype and dodgy business models (BananaCoin – anyone?) the reputation of the blockchain has been sullied.

Guess what?

It’s a powerful technology and there are money-making gems glittering in the mud.

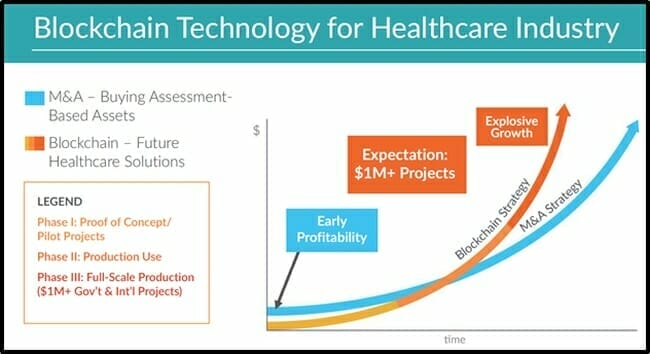

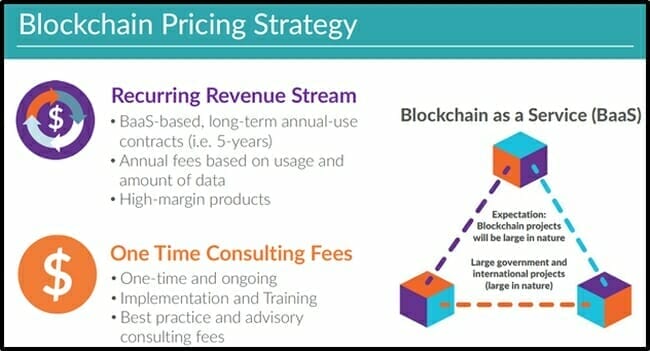

Vitahub (VHI.V) marries medical information networks with blockchain technology. The company’s robust two-pronged growth strategy, targets growth opportunities within its product suite while pursuing an aggressive M&A plan.

The “medical information network” status quo is – frankly – pathetic.

In an era when you can purchase CBD oil on a Smart-Phone, Philadelphia nurses are still faxing medical reports to their colleagues in other institutions.

Calling it “stupid” is a pulled punch.

Given that people’s health is at stake – it’s immoral.

The medical industry is crying out for a savior.

VHI’s CEO, Dan Matlow could be that savior; you can watch him on YouTube, being interviewed by James West, who runs The Midas Letter.

On November 26, 2018 VHI released its Q3, 2018 financials (ended September 30, 2018).

Q3, 2018 VHI Financial Highlights (figures rounded):

- Revenue of $2.1 million

- Revenue increase of 1,224% over the same period last year.

- Revenue increase of 14% over Q2, 2018

This increase is primarily the result of acquisitions and the inclusion of $1,613,362 of perpetual license revenue. Annualized Contract Value of Recurring Revenue (renewable software and maintenance license fees) was $4.2 million.

On July 31, 2018, VHI sold B Care Electronic Health Record to support William Osler Health System’s cardiac care program. Osler serves 1.3 million residents of Brampton, Etobicoke and surrounding communities.

On September 28, 2018, VHI announced the purchase of Roxy Software – a web-based software solution that helps manage programs, workload, and data more effectively. Roxy had approximately $288,000 in revenue in its last fiscal year.

VHI posted a Q3, 2018 EBITDA (Earnings before interest, taxation, depreciation and amortization) of $155,794. So, VHI is not profitable which is unsurprising for a brand new micro-cap company in the midst of an M&A blitz.

There is one particular category of patients for whom centralised records is definitely a matter of life & death.

According to Canadian Centre for Addiction and Mental Health, the economic burden of mental illness in Canada is estimated at $51 billion per year, including health care costs and lost productivity.

My own experience backs this up. I used to work at an 80-bed facility for the mentally ill, where I discovered that psychiatrists had almost zero awareness of previous diagnoses or treatments.

With the mentally ill, the need for centralised records is amplified, because the patients are usually incapable of summarizing their own clinical histories.

Mentally ill patients migrate from city to city and often don’t remember what medications they have taken, for how long, in what doses, with what results or contra-indications.

On August 21, 2018 VHI announced the sale of the TREAT EHR solution to a Toronto-based young adult mental health agency.

TREAT will replace the existing documentation, supporting the facility’s programming and reporting needs.

TREAT will capture the participant’s demographic and clinical data in standard modules; progress notes, assessments and interdisciplinary care plans.

“This sale of TREAT serves as further evidence of our leadership position supporting Ontario’s mental health providers,” stated Matlow, “We aim to establish VitalHub as the dominant provider of EHR solutions for mental health providers.”

According to the Decision Research Group, “Industry projections expect the global Blockchain Healthcare market to grow to $2.3 billion by 2021, up from roughly $340 million in 2017.”

“We continue to see increased revenues and improve our positive adjusted EBITDA,” stated Matlow about the Q3, 2018 earnings.

The question is not: “Can VHI succeed?”

The question is: “How big will the success be?”

VHI is trading at .14 with a market cap of $18 million.

Full Disclosure: VHI is an Equity Guru marketing client, and we own the stock.