On November 19, 2018 CUV Ventures (CUV.V) announced that it has signed an L.O.I with Nukondo to incorporate RevoluPAY into the Nukondo’s iOS and Android app and its website.

Nukondo’s app creates a marketplace for new condominiums – providing a platform for developers and brokers to aggregate real time project and inventory data.

The software standardizes and distributes the data globally so that buyers and their agents have tools to make informed condominium purchasing decisions.

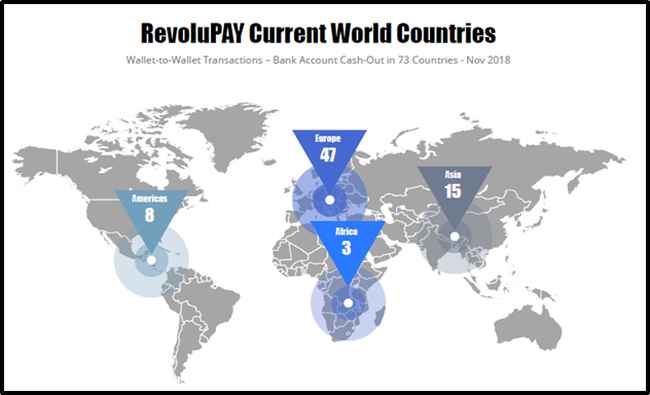

A couple of weeks ago, CUV announced that its RevoluPAY app is now live for instant withdrawals of e-Wallet balances, from the app to a user’s bank account in 73 countries.

Thirty-one of the 73 participant countries receive approximately 87.5 Billion USD in remittances.

“CUV is developing a banking network that will allow users in emerging economies to do business with the first world – knocking Western Union – and other clunky expensive services – out of the game.”

“RevoluPAY, as our payment hub for memberships and real estate transactions, is a natural fit,” stated Jorge Brugo, Nukondo Founder and CEO, “Speed and ease-of-use are what Nukondo users desire and, with RevoluPAY integrated, that will be the outcome”.

Key L.O.I Highlights:

- Incorporating RevoluPAY as a global payment mechanism for Real Estate and app Membership Transactions.

- Commissions on new property development sales in markets: Vancouver, Paris, Chicago, Barcelona and Madrid.

- Website to feature RevoluPAY payments.

- CUV Advisor, Patrick Murphy, to head-up eventual RevoluPAY real estate payment division.

- Mr. Ricardo Estrazulas Joins RevoluPAY Licensing Advisory Board

The LOI also outlines an agreement, under which CUV and Nukondo may collaborate to expand international real-estate transactions.

There is a 60-day term to conclude the definitive agreement

“Amongst our numerous RevoluPAY verticals, we believe the real estate industry is another enormous market,” stated CUV Ventures CEO Steve Marshall, “We look forward to working with Jorge.

In an ideal world, a publicly traded company does one thing, does it well, and makes money doing it.

CUV is not that company, and they have been punished for it – we think unfairly.

On February 2, 2016, CUV announced a proposed Change of Business, transitioning from a “Resource Issuer to a Technology Issuer”. Henceforth, CUV would own 432 web assets popularizing Cuban Culture, Music, Celebrities.”

Since then CUV has acquired new assets, developed new technology and made significant on-going adjustments to the business model.

These pivots can work beautifully. Example: YouTube started as a video-based dating service (slogan: “Tune in, hook up”) and then switched to video streaming, expanding the platform until Google acquired it for $65 billion.

These pivots can also fail dramatically. Example: AskMe was an ecommerce platform that raised a bunch of money, acquired non-core assets, kept changing its focus – eventually laying-off 4,000 employees in one day and shutting its doors.

According to the most recent corporate literature, “CUV Ventures is a multi-asset, multidivisional company deploying advanced technologies in the: Online Travel, Vacation Resort, Mobile Apps, Money Remittance, Mobile phone top-ups, Invoice factoring, Blockchain Systems, and Fintech app sectors.”

“Our flagship technology is RevoluPAY, the Apple and Android multinational leisure payments and remittance app, powered by blockchain protocols, and aimed at the worldwide + $595 billion family remittance market.

At Equity Guru, there are a number of us who are regularly frustrated by the challenge of moving money across international borders.

“I have a contractor who handles IT work for me. He lives in Thailand,” explained Equity Guru’s Chris Parry, “Every month, to pay him, I send a wire transfer from my credit union. It takes half an hour, at the minimum, and takes about 5 days to hit its final target.”

It isn’t just us bitching.

User “Faith 24” – on a Red Flag Forum, Best Way to Send Money Internationally, summarised the collective discontent: “Bank wire: expensive, Visa Direct: poor exchange rate, Western Union: high fees at both ends Discount bank direct transfers Poor exchange rate. TransferWise: insecure payment method…etc”

Bitcoin was supposed to solve this problem, it is too volatile to be a practical method of remittance.

Today, Bitcoin hit a low of $4,951 creating a 21% loss in the past seven days and more than 62% loss this year.

Bitcoin dropped 9% today. If I paid you $1,000 in Bitcoin last night and you woke up with $910 – you’d probably feel a spasm of affection for Western Union.

RevoluPAY news update:

- users now able to transfer complete or partial e-wallet balances to any bank in 73 countries from within the app.

- RevoluPAY Initial bank disbursement (cash-out) markets total $87.5 Billion USD in annual remittance flows.

- RevoluCHARGE instant mobile phone top-up service successfully launched on schedule, covering 240 countries and over 500 world operators.

- Top 40 major international bank negotiations continuing favorably for additional 16 Central/South American/Caribbean nations for approximately $71 Billion USD in potential supplementary remittance markets.

- CEO Steve Marshall featured on Uptick Newswire.

- Presentation Released – RevoluPAY Presentation Download.

Hundreds of billions of dollars are moving inefficiently around the world – subject to unreasonable delays and exorbitant fees – as matriarchs fund their children’s education, immigrant children give financial support to parents, or western start-ups try to pay collaborators in emerging economies.

Integrating CUV software with the international condominium sales market is a good thing.

From a messaging point of view, “Let’s kill Western Union” is even better.

Full Disclosure: CUV Ventures in an Equity Guru marketing client, and we own stock.