On November 16, 2018 GTEC Holdings (GTEC.V) and Invictus MD (GENE.V) announced a plan to merge into one vertically integrated cannabis company.

Mergers can work beautifully. Example: Disney and Pixar combined their creative talents to produce WALL-E, Brave, Inside Out and Frozen – the fifth-highest grossing movie ever.

Mergers can also fail spectacularly. Example: Sears and Kmart combined two muddled business plans to ward off Target and Walmart – resulting in an “identity crisis” that lost $7 billion.

Successful or not – when two publicly-traded companies merge – the market typically declares one company a winner (the stock goes up), and the other a loser (the stock goes down).

Today, this didn’t happen.

By mid morning trading, GTEC is up 5% and Invictus is up 6%.

The merged company will “focus on producing premium flower, cultivated in purpose-built indoor facilities complemented with superior genetics.”

The structure will have Invictus acquiring all shares of GTEC in a transaction valued at about $100 million – creating “Western Canada’s largest indoor vertically integrated cannabis company”.

GTEC shareholders will receive about 40% of Invictus shares. Options and warrant holders of GTEC will receive “a proportionate number of options and warrants of Invictus.”

Upon completion, the issuance of Invictus shares to the current GTEC shareholders represents an approximate 25% premium to the 30-day volume weighted average trading price of the common shares of both GTEC and Invictus as of November 15, 2018.

Key Merger Highlights:

- 400,000 square feet of funded purpose-built indoor cultivation across BC, Alberta and Ontario;

- diverse galaxy of products and brands

- genetic portfolio of over 80 strains

- an EU-GMP certified facility can service domestic and European Union markets

- 30+ retail stores located across BC, Alberta and Saskatchewan;

- e-commerce website for Saskatchewan rec market

- two purpose-built state of the art extraction labs

- one analytical testing lab

Most significantly, the merger will create a combined senior management team with DNA from monster food & beverage, wine & spirits and tobacco companies, including Phillip Morris International, Diageo Plc and Saputo Inc.

For the six months ended July 31, 2018, Invictus generated EBITDA of $9.3 million, with $10.7 million in cash on hand.

For the nine months ended August 31, 2018, GTEC unaudited EBITDA of $7.2 million with $4.4 million cash on hand.

As the cannabis industry in Canada shifts into non-medical use, and medical markets expand globally, both companies see this merger as “synergistic and complementary”.

“Combined, we offer a much stronger team with aligned visions on executing a pathway to become a global leader within the cannabis industry” stated Norton Singhavon, Chairman and CEO of GTEC.

“This merger allows for both companies to leverage the combined core competencies to further execute our vision to be at the forefront of the Canadian cannabis industry and beyond,” stated George E. Kveton, CEO of Invictus.

The transaction requires the approval of at least 66.6% of GTEC shareholders, who will vote at a special meeting.

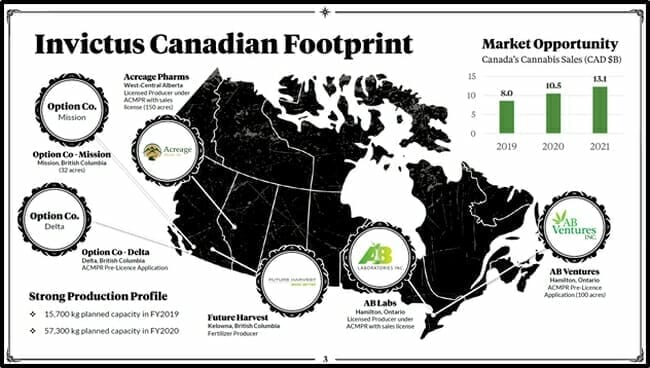

On November 16, 2018 Invictus also announced its intention to acquire 100% of Canandia – which features two properties located in Delta and Mission, BC.

The Delta Facility includes a cultivation, production and research facility, recently licensed under the Cannabis Act and Cannabis Regulations.

The Mission Location includes 32 acres of buildable land, expandable up to 1 million square feet of production capacity under one Cannabis Act and Cannabis Regulations license.

The Mission Location boasts “wholesale energy costs” and water supply from underground aquifers.

Invictus’ production portfolio includes licensed cannabis operations in BC, Alberta and Ontario.

“Each of our three purpose-built licensed facilities are designed with separate environmentally-controlled grow rooms to allow for maximum flexibility as we adapt to meet the needs of recreational consumers and medical patients,” stated Kveton.

With current supply shortages, it is no surprise that Invictus is focused on scaling production. In Q1, 2019 – 200,000 square feet of cultivation capacity expected to come online – contingent on Health Canada licensing & approvals.

“If the government warehouse is empty, it’s empty. There’s nothing you can do,” stated James Burns, the CEO of Alcanna, a company that owns cannabis stores in Alberta.

An Angus Reid poll indicates that an astonishing one in eight Canadians has used cannabis since legalisation of the rec market on October 17, 2018.

Health Canada says producers have shipped more than 14,500 kilograms of dried cannabis and 370 litres of cannabis oil to date, and have a reported inventory of more than 90,000kg of dried product and 41,000 litres of oil.

According to the Financial Post, “the supply of legal pot in Canada will only meet 30%-60% of demand after legalization, keeping the black market very much alive and stunting the government’s tax take.” Production shortfall is expected to be about 400 tonnes.

You can read Ethan Reyes recent coverage of GTEC here, and his also-recent coverage of Invictus here.

It is a maxim of business that every deal has a winner and a loser.

Since GTEC and Invictus are both having a green day – who’s the loser?

Maybe a humble news company, doing God’s work, that used to have 45 clients, and now has 44?

Full Disclosure: GTEC and Invictus are Equity Guru marketing clients, and we own stock.