If you thought weed stocks were going to run when the new Canadian cannabis laws came in, guess again. Those had been baked into share price for over a year so, if anything, we at Equity.guru expected today to be the stock price yawner it has so far been.

But that’s not always going to be the case. The new rules have created winners and losers – we just don’t know who is who just yet.

So today we have all our writers working in one direction: to monitor the news, company PR, social media and more to see what’s working, what isn’t, who is claiming victories and who’s taking it in the ass.

ALBERTA:

We’re seeing long lines at liquor stores as consumers try what freedom tastes like. This one, reportedly, is around 500 people deep and not a new iPhone release in sight.

There are 19 stores selling in Calgary, Edmonton, Medicine Hat, Fort Saskatchewan and four others. You can find the Alberta cannabis stores website here: https://albertacannabis.org/

Annnnnnd someone running the Alberta website smoked too much already. #ab #legalizationday pic.twitter.com/tNCrS1vZGs

— Darcy (@Movietrailer) October 17, 2018

Additionally, the Alberta Gaming and Liquor Commision (AGLC) has put out a notice to all customers about the status of product deliveries in the face of a Canada Post employee strike.

AGLC will continue to monitor the negotiations between Canada Post and the Federal Government to ensure we are prepared in the event of a strike. Should Canada Post employees invoke their right to strike, Purolator will support AGLC but cannabis delivery times will be impacted.

BRITISH COLUMBIA:

BC residents are PISSED and getting moreso, as the BC government ruling NDP surrendered the business to unions pretty dark quick, setting up a BC Liquor Commission cannabis sales system that gives the retail store front market to liquor stores, only one of which is set up on day one to actually provide product.

Online sales are absurdly priced, with $10 postage on every sale, and a lot of LPs we’ve spoken to – quietly – say they’ve little intention to send their product to the government when they can sell to medical patients online.

Doctors may be seeing an influx of new patients in the coming days as consumers realize that’s the best way – still, and the grey market dispensaries continue to do business unhindered.

Many of the strains for sale on the BC Cannabis Stores are already sold out.

B.C. government launches online cannabis sales with some strains already sold out https://t.co/NzKMPN3IWO

— Lt Cdr S K Sharma (@ssharma68) October 17, 2018

You can find the BCLC Cannabis store online here: https://www.bccannabisstores.com

PRAIRIES:

Saskatchewan and Manitoba let private retailers open and sell online, with one third of the 51 licensed stores expected to hit the ground running today in Sask, and Manitoba showing stores run by Delta 9 (NINE.C), Canopy acquisition Hiku/Tokyo Smoke (HIKU.C), National Action Cannabis (NAC.V), and Tweed/Canopy (WEED.T).

The Manitoba Liquor, Gaming and Cannabis Authority (LGCA) has devised a consumer-targeted education campaign to coincide with recreational legalization.

The Liquor, Gaming and Cannabis Authority of Manitoba (LGCA) today launched the Know My Cannabis Limits campaign. The campaign teaches Manitobans who choose to use cannabis about strategies for safer use, such as “Cannabis and alcohol don’t mix”, “Look at total THC” and “Cannabis edibles take time”. Campaign messages are based on Canada’s Lower-Risk Cannabis Use Guidelines as well as evidence from LGCA research.

Don Morgan, Saskatchewan’s Justice Minister and Attorney General, hinted at the dangers of impaired driving, saying his government “is committed to public safety, and it’s important for people to understand there are limitations on what is allowed, much the same as with alcohol consumption.”

ONTARIO:

Don’t go to your local liquor store expecting to buy weed. They won’t be open for it until early next year.

Online, this is what it looks like: https://ocs.ca/

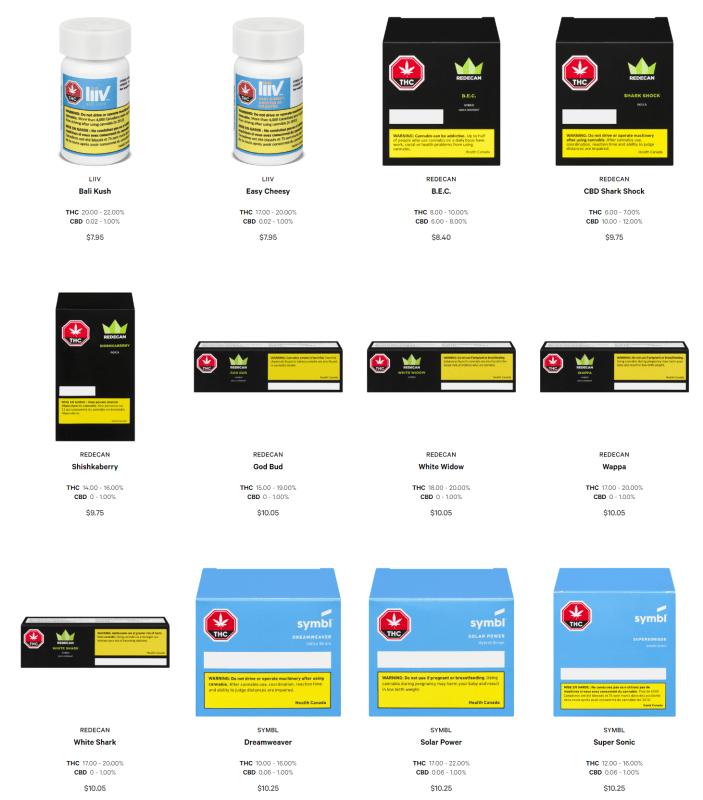

And with that, we can already see the first major problem for the US rules: Every single product looks like every other product. The cautionary warnings drown out all the ability to actually describe the product and help a consumer know what the actual hell they’re buying.

The cheapest option is CannTrust’s (TRST.T) Liiv 17% THC Bali Kush and Easy Cheesy at $7.95. The most expensive: Canopy Growth Corp’s (WEED.T) DNA Genetics’ Lemon Skunk, at 13% THC and a $13.25 price tag.

The OCS is also grappling with the very real possibility of a Canada Post workers strike and service disruption for deliveries.

As Canada Post prepares to strike, Ontario Cannabis Store considering alternatives to meet demands#canadacannabis #legalizationincanada #weedwednesday #legalizationdayhttps://t.co/giBZdECX86

— Amanda Connolly (@amandacconn) October 17, 2018

QUEBEC:

The French Canadians have established a decently spread out network of stores, with a website at https://www.sqdc.ca/en-ca/

The site is slow as all get out but currently lists Aphria’s (APH.T) Solei Harmoniser and Renouer as their cheapest options, at $8.50 per.

Tilray’s (TLRY.Q) Grail Rockstar and Headband are the priciest, at $35.30.

THE MARITIMES:

New Brunswick, PEI, Newfoundland and Labrador, and Nova Scotia are thick with retail stores, and their online stores are all operational. Nova Scotia’s store isn’t accessible unless you visit a local liquor store and get an access code, which is weird.

Cannabis NB: https://www.cannabis-nb.com/

PEI Cannabis Corp: https://www.peicannabiscorp.com/

Nova Scotia Liquor Corporation: https://www.mynslc.com/cannabis

Cannabis NL: https://shopcannabisnl.com/

#THCDistribution in Portugal Cove, NL. one of the 1st legal #cannabis retailers opened in Canada sold out this evening #legalizationday #cannabiscanada #signofthetimes

— Andrea (@Andrea_EE2) October 17, 2018

TERRITORIES:

It’s weird that BC has the same number of retail stores open as Yukon does, but good for them with their Whitehorse location. The NW Territories are open for business in Yellowknife, and four other towns, and Nunavut is selling online only.

Weirdly, in the NWT, you can buy Tilray’s Grail Rockstar for $17.50, about half what it costs in Quebec, but don’t expect much in the way of selection; you can get Grail products or Canaca, and that’s it.

Nunavut has basically decided to let Canopy handle it’s online orders.

Yukon: http://cannabisyukon.org/

NW territories: https://www.ntlcc-cannabis.ca/en/

Nunavut: https://www.nulc.ca/

THE UNITED STATES:

From the Globe and Mail:

A full-page ad in Tuesday’s Wall Street Journal, framed as a plea to the White House and its most prominent occupant, warns the U.S. is “rapidly losing” its competitive advantage to Canada, where recreational pot is poised to become legal at midnight.

“The cannabis industry is legal in 31 states, yet most domestic companies do not have access to traditional banking or institutional financing,” reads the ad that is signed by Derek Peterson, chairman and CEO of California-based Terra Tech Corp.“As a result, many U.S. companies are being forced to move to the Canadian public markets to access capital and build their businesses.”

The ad also warns that Canadian firms have tapped into U.S. investor interest in order to raise and spend money to acquire American cannabis assets.

“Regrettably, this will put what should be one of our homeland’s greatest economic drivers in foreign control.”

PRIVATE SECTOR REACTIONS:

Greg Engel, CEO of Organigram (OGI.V), said that, although his company welcomed the legalization of cannabis, the gray and black markets would continue to thrive until the Canadian government fully committed to cannabis in all its forms.

“It will take time for consumers to transition from the black market to the legal market. Two key factors will assist with this transition: the addition of retail locations and the addition of new product types. As we see the consumer experience evolve and the availability of products including prepared edibles and vape pens, the legal market will thrive,” Engel said.

David Lynn, COO of GTEC Holdings (GTEC.V), said the transition from ACMPR guidelines to the Cannabis Act was an easy transition for his company.

“There’s definitely changes that have happened over the course of the year but they weren’t timed specifically to today…we didn’t get any last minute changes to the federal or provincial laws or regulations,” Lynn said.

Lynn went on to say that stringent rules on packaging will most likely be a big issue for cannabis companies going forward: “In some cases there’s room for interpretation, especially on the marketing side. So everyone is going to see how the government enforces those laws and regulations.”

Meanwhile, medical cannabis companies like CannTrust (TRST.T) have vowed to shoulder the excise tax on certain products. “CannTrust wants to ensure that patients will not see an increase in the price of their medical cannabis. Excise tax will, however, apply on all recreational products.”

Excise taxation varies between provinces and territories. The tax rate, depending on location is either 5%, 13% or 15%.

What pubcos did best on Weed Wednesday? Look to the south…

A whole load of cannabis investors who’ve not yet heard of ‘buy on rumour, sell on news’ were left scratching their heads today, when Canada’s weed stocks didn’t suddenly triple in value after the federal government approved recreational use.

We’ve been telling you for a while that was how it was going to go down, but we’re not about to claim any level of genius for the prediction. Much like our story yesterday about Green Organic Dutchman (TGOD.T), it’s not rocket science to note that downward pressure is afoot after the manic upward runs we’ve been having.

What is rocket science is the strategy you employ going forward.

As we’ve noted, no pubco in Canada is going to make a fortune selling cut price weed to the government to sell on websites without branding and with generic packaging, where the only differentiator most customers will note is price.

In a market where LPs are already selling to distributors on the cheap, a fight to the bottom to get listed on the top of the ‘low-to-high’ price filter is a precursor to dark times.

The market was figuring that out Wednesday, as the top upward movers on the Canadian exchanges were distinctly US based.

US vertictal farmer Indoor Harvest (INQD.OTC) was up 10.% on solid volume, despite usually being ignored by local investors. US weed financier FinCanna (CALI.C) has had few better days than the 8.3% they jumped today as they continue their cautious habits of keeping things close to their chest.

Canadian based US dispensary/grow play iAnthus (IAN.C) picked up $0.54, good for a 7.6% jump on solid trading volume.

Quadron Cannatech (QCC.C) was an interloper in the top movers list, perhaps based on some traders feeling the explosion in cannabis oil products might help them contionue to sell extraction machines and associated LP-focused IP. They were up 6.7%.

Notable because of it’s ability to fight back against naysayers, Green Organic Dutchman (TGOD.T) showed that it’s not about to sit back and be wailed upon by cynics and shorters, marching higher by $0.23 to 4.2% up on the day.

Aphria (APH.T) climbed, perhaps on the back of a decent position in the ‘who’s selling the cheapest weed to government distros’ list, Choom (CHOO.C) went up on the back of receiving a Health Canada cultivation license, which puts them at a much higher altitude based on organizational worth, and 1933 Industries (TGIF.C), caught a little breeze with their Nevada-based hemp/weed branding play.

Industry leaders (on market cap) Canopy Growth Corp and Tilray did not kill it on day one, though both had serious volume. WEED traded down 4.3%, TLRY was down 6.4%.

Everything else dropped. Tomorrow is a new day.

— Chris Parry, with file by Ethan Reyes, Jamal Albayaa, and Samantha Kelly.

Full disclosure: GTEC Holdings, 1933, Choom, ianthus, and TGOD are Equity Guru marketing clients and we own stock in several of them.

Chris, can you please update us with an article on your views of what has been happening in the past 6 days since legalization? I am sure lots of loyal followers are confused and worried, like me! Any opinions and possible predictions would be great.