A mini tech-wreck with FANG stocks trading at 3-week lows. Amazon (AMZN.NASDAQ) breaking the 2000 buck sound barrier.

Are these things you should concern yourself with if you’re trading lithium or weed stocks?

Damn right you should!

As we head into what is traditionally a tricky part of the market calendar, being September and October, a stock swoon will likely take all players with it.

Protecting profits is one of the hardest parts of this game.

Is Amazon trading at 2,000 bucks a WTF moment?

Let’s start with the meme because, quite frankly, it never gets old.

Bezos is a machine and is drinking everybody’s milkshake. No question there.

But are AMZN shares, trading at 200+ times earnings, worth 2,000 bucks each? Ah, no, don’t think so.

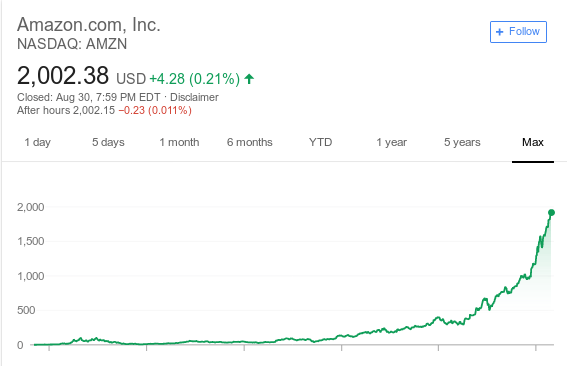

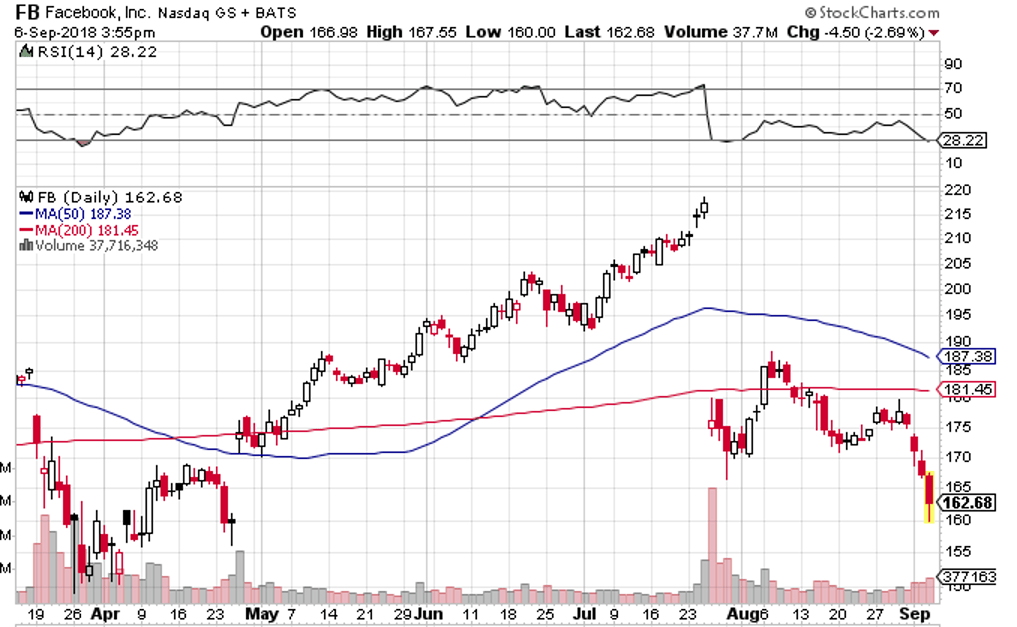

Look at the chart. There’s parabolic, then there’s parabolic. This is the latter.

The chart is a touch out of date, but I wanted to capture the moment AMZN broke the 2K barrier, even if just for prosperity. AMZN shares closed today at USD 1951.38

It’s WTF seminal market moments like these which need to be heeded when casting a lazy eye over portfolio profits.

Facebook vs Twitter trade humming along nicely

As 2017 came to a close, some of the writers here at Equity Guru chipped in their collective thoughts on the year past and gazed longingly into our much-loved crystal ball.

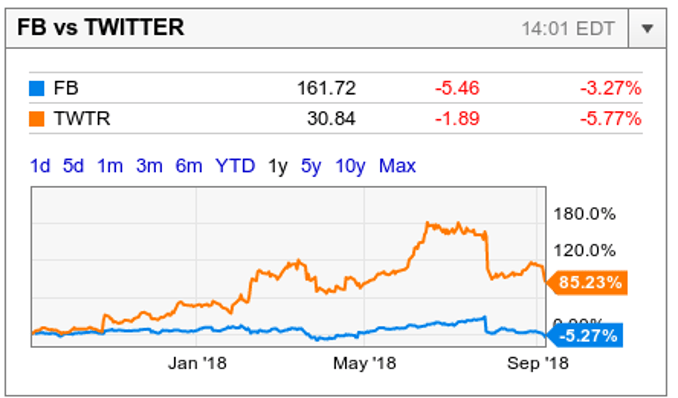

Yours truly threw out an interesting ‘pairs trade‘ – long TWTR (TWTR.NASDAQ) / short Facebook (FB.NASDAQ).

What’s a pair’s trade you ask?

It’s a market neutral trading strategy – one example is to go long one stock and simultaneously short another stock in the same sector with the expectation the long will outperform the short irrespective of market direction.

Another way to look at it is to bet on the difference (or “spread”) between two stocks with a high correlation either widening or mean-reverting.

It was a paper trade – we don’t short here, not our thing. But we’ve been keeping an eye on how this trade has progressed during 2018.

It’s doing well – FB is off 5% or so since then and TWTR has shot out the lights (up 85% in the past year) despite cooling off in the past few months.

That gap on the above chart is now screaming ‘mean reversion’. If this were a live trade I’d be looking to close it out about now and take profits, which are running around the 30% level.

Facebook a liability?

In these parts (Thailand), definitely. Just this past week the Bangkok Post reported that the boys in brown arrested nine of 12 people wanted for publishing or “sharing” a Facebook report about the alleged rape of a 19-year-old British tourist on Koh Tao.

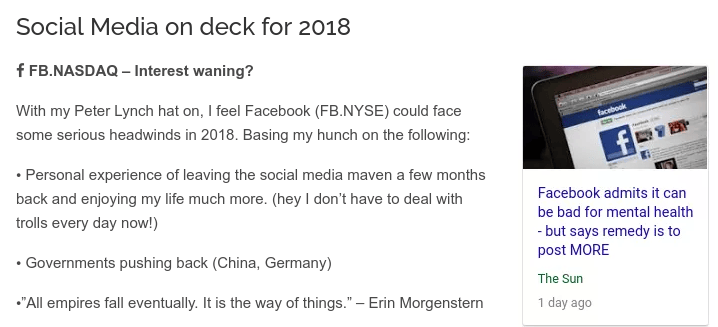

Look, I called peak Facebook back in late October 2017.

Then in the year-end piece, I put forth some reasons why the case was looking stronger

Equity.Guru article snippet

Recall the ‘call’ was a straight-up contrarian play, albeit a carefully considered one. At the time, FB shares were trading around USD 180 and suggesting a short was like stepping out in front of a freight train.

They would go on top out at around $215.

And that was after the Cambridge Analytica debacle when the stock cratered below USD 155.

For a while there, shorts who didn’t cash out looked liked idiots.

Thankfully, sanity has prevailed with Facebook stock collapsing after it’s July 2018 earnings report was released.

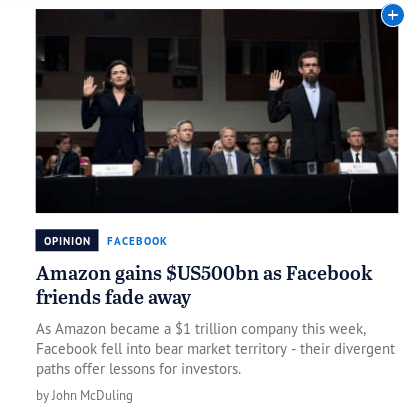

The Sydney Morning Herald has an interesting piece comparing the market trajectories of AMZN and FB. Worth a read.

Final thoughts

A lot has changed in the past 9 months. Social media is now well and truly under scrutiny by lawmakers across the globe.

Part of ‘protect ya neck’ – is getting out of the way of trouble and having some cash in the coffers so you can take advantage of market ‘fire-sale’ prices when they come along.

If your portfolio is showing some nice profits thru 2018 I’d suggest this is as good a time as any to think about taking some dollars off the table.

Your ASX (and sometimes US) commentator,

–// Craig Amos

PS: No ASX commentary this week. Next week I’ll take a look at Elixinol (EXL.ASX) and Zelda (ZLD.ASX) – two charts which have caught my eye recently.

FULL DISCLOSURE: None of the companies mentioned in this article are Equity Guru marketing clients