On August 30, 2018, Nexus Gold (NXS.V) reported results from its 105-line kilometer soil sampling survey on the Rakounga exploration permit in Burkina Faso, West Africa.

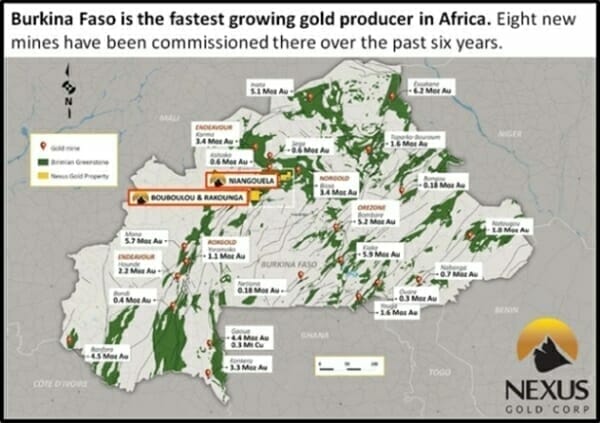

Burkina Faso is the fastest growing gold producer in Africa. The country has a mining corporate tax rate of 20%, and a sliding royalty on gold production from 3-5%.

Nexus has 3 gold projects in Burkina Faso:

- The 178-sq km Niangouela gold concession where the company has delineated a 1km quartz vein and shear strike. Eight of the first nine diamond drill holes on the property returned positive gold results, highlighted by a 4.85m intercept of 26.69 g/t.

- The 38.8-sq km Bouboulou gold concession with historical drill results including 40m of 1.54 g/t. The property contains three distinct gold trends, each extending 5000 metres (5km) in length.

- The 250-sq km Rakounga gold concession contiguous to Bouboulou property, contains many artisanal mines.

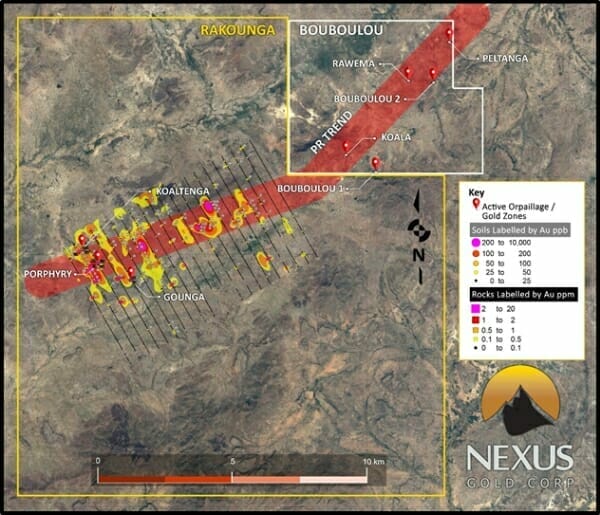

The Rakounga soil survey investigated the gold bearing potential between the Koaltenga gold zone, located near the western boundary of the Rakounga concession, and Pelatanga-Rawema gold trend on Nexus’ adjacent Bouboulou exploration permit.

Nexus’ geologists identified an “anomalous gold trend” which extends for approximately 7,000 meters.

The newly identified 7 km gold trend aligns with the 5 km Pelatanga-Rawema trend indicating the mineralized footprint at the combined Bouboulou-Rakounga concessions now exceeds 15km in length.

“The goal of the soil grid program was to establish continuity of the gold trends at Bouboulou onto the adjacent Rakounga concession,” stated president & CEO, Alex Klenman.

Senior VP of Exploration, Warren Robb noted that the geochemical data highlighted the gold trend coming off Bouboulou.

“We will combine this data with the regional geophysics data,” stated Robb, “to identify any coincidental anomalies, and then look to test those anomalies along the trends.”

These developments are bullish for Nexus shareholders.

But let’s discuss the elephant in the room.

What the fo’ is going on with gold prices?

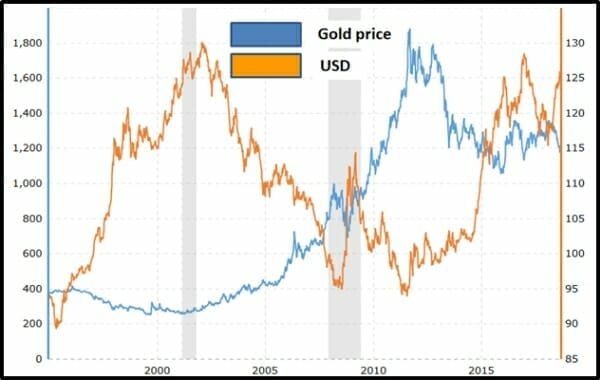

At $1,200 an ounce, bullion is hovering near 18-month lows.

A recent Equity Guru article equated the psychology of gold investors to Elisabeth Kübler-Ross’ 5 stages of grief.

- Denial – “Deep state manipulation!” “It’s not real!”.

- Anger –”Why me?” “Who is to blame?”

- Bargaining –“If gold goes to $5,000/ounce, I promise to stop vaping.”

- Depression –”My stack of American Gold Eagles makes me cry, why go on?”

- Acceptance – “It’s going to be okay – at least I own weed stocks”.

We can wax lyrical about the causes of gold’s demise but the most powerful and obvious reason is the strength of the US dollar.

Historically, the price of gold and the strength of the US dollar move in opposite directions.

Four key reasons the USD is higher.

- The Fed stopped printing money as the economy improved. Reduced supply of USD increased its value.

- The Fed raised interest rates, which strengthened the value of the dollar.

- European Central Bank lowered the value of the euro by lowering the interest rate. The USD gets stronger when the euro weakens.

- Forex traders used leverage to weaken the euro and strengthen the USD.

Should gold investors panic?

Possibly not.

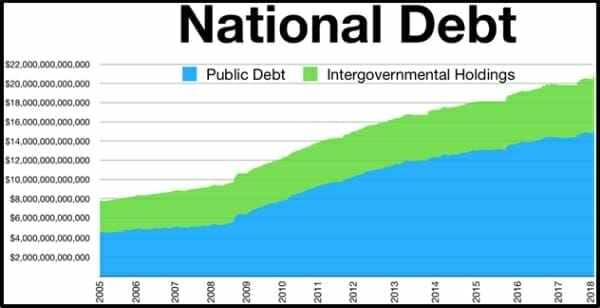

In Q2, 2018, the U.S. debt-to-GDP ratio was 104%. That’s $21 trillion U.S. debt divided about $20 trillion GDP.

According to The Wall Street Journal, “The Trump https://e4njohordzs.exactdn.com/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistration expects annual budget deficits totaling $7.1 trillion over 10 years.”

The US government clocked a budget deficit of $77 billion in July, up 79% over July 2017, MarketWatch reported.

For the first 10 months of fiscal 2018, the deficit is $684 billion, according to the Treasury Department — an increase of 21% compared to the previous year.

If you’ve ever tried living off your credit cards, you may recall a nasty ending.

Prior drilling at Koala includes 5.21 grams-per-tonne gold (g/t Au) over 3.05 meters, including 15.50 g/t Au over 1 meter and 4.41 g/t Au over 8.15 meters, including 23 g/t Au over 1 meter.

Prior drilling at Koaltenga included 1.01 g/t over 32 meters, and 1.00 g/t gold over 34 meters.

Sometimes you need to execute a “cathartic trade”.

Gold has been in a funk for almost a decade. If you want to throw in the towel now – zero judgement from the brain trust at Equity Guru.

For what it’s worth, we are loading up on Nexus Gold.

By mid-morning trading, NXS is up 7% to .21, with a market cap of $9 million.

Full Disclosure: Nexus Gold is an Equity Guru marketing client and we own stock.