I still remember what it felt like to wake up and realize it was Friday when I was entombed in a corporate cubicle. Everything was sweeter – even the walk to work from Wynyard station was bearable.

In light of that, we’re launching the Friday Fumble, ready at the ASX open every Friday morning.

Short in nature, it will highlight a few things ASX-wise which have come across our desk during the week and is the perfect accompaniment for your morning coffee and bacon and egg roll while planning the weekend footy tips.

Let’s face it – Friday is never the most productive day of the week.

At least by reading this weekly missive, you’ll have achieved something worthwhile before heading to the pub for burgers and beers.

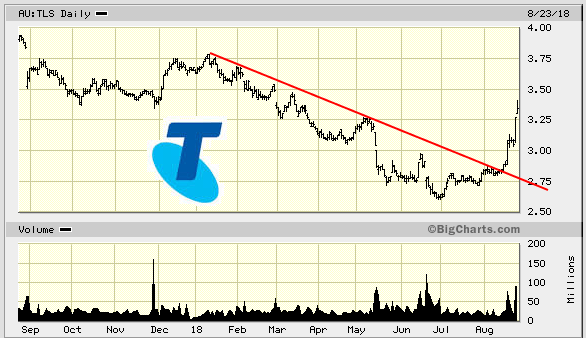

Telstra pops – hope you bought some

Our evil plan is coming together nicely. Just a few months ago we told y’all Telstra (TLS.ASX) was in the sweet spot value-wise.

Why Telstra (TLS.ASX) has contrarians spidey-senses tingling

You had plenty of time to back up the truck. In fact, the stock dropped as low as $2.62 in the weeks after our call.

Those prices are gone.

The stock has now catapulted to a respectable $3.34. A 20%+ jump from the $2.80 mark we considered good value.

And it’s happened even quicker than we thought possible.

See the red line? The downtrend which has plagued the stock for 2018 is finally dust. The chart has materially changed from the one traders were staring at 2 months ago.

Longs be like: “yeah baby!”

There’s an 11c dividend on deck. Not sure if it’s worth chasing at this level – might be better waiting for the stock to go ex-div and buy any weakness as short-term traders cash out.

NB: Telstra trades ex-dividend on Wednesday August 29th

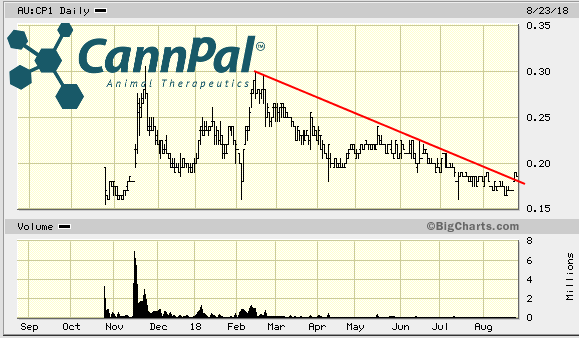

CannPal showing signs of life ; EverBlu initiates coverage

We covered the stock recently and called it one of the best value plays in the medicinal cannabis sector (ASX) that we could see.

Investors fret as CannPal Animal Therapeutics (CP1.ASX) awaits re-rate

Our article even caught the eye of CannPal MD Layton Mills, who was kind enough to drop a thank-you note in our inbox. Well played, sir. Appreciated.

CP1 popped a few cents this week, but the move was significant as it jumped the stock price above a downtrend line which has been in place for more than 3 months.

EverBlu Capital also released a paid1 research report on CannPal on August 23rd.

It’s a solid offering and worth a look for anyone interested in the CannPal story. EverBlu have come out with a 47c price target so we’re feeling pretty happy with our 40c dart throw we made just over a week ago 🙂

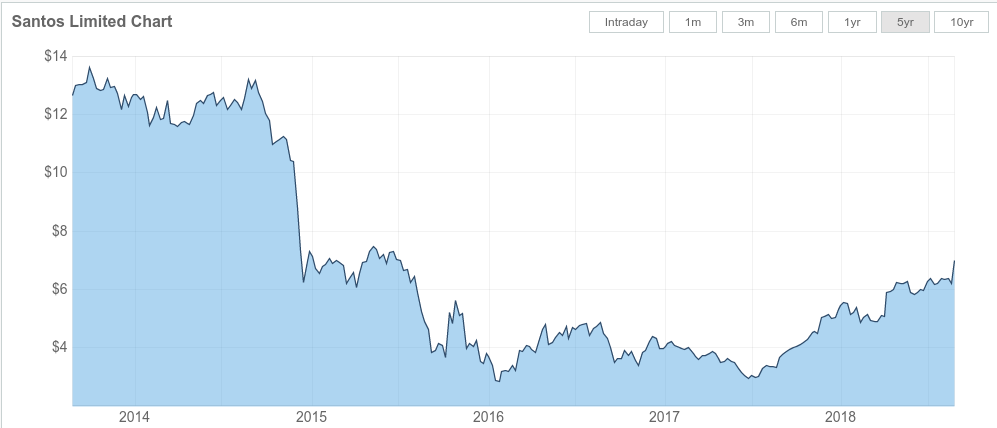

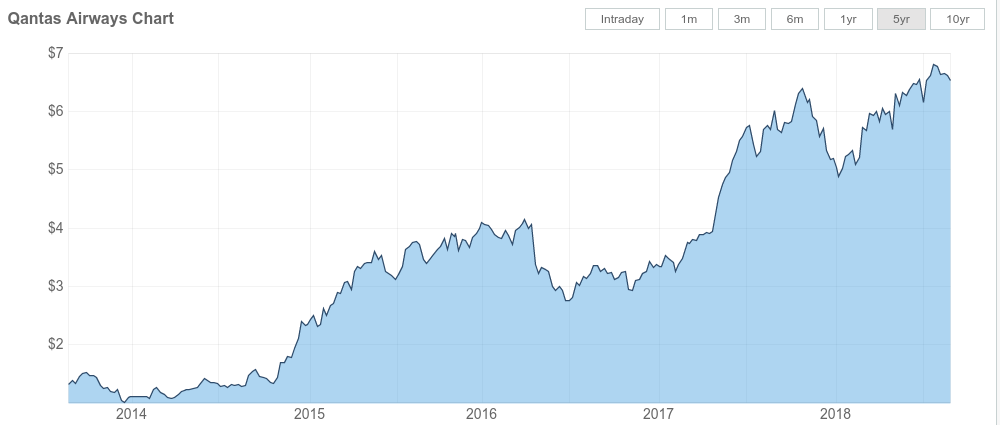

Qantas and Santos stallwarts rewarded

It’s reporting season, and Qantas (QAN.ASX) and Santos (STO.ASX) shareholders can expect a little extra in their pay packets thanks to management throwing them a bone in the form of dividends which have been in short supply for some years.

Not to mention the amazing capital growth shareholders have received over the past 12 months:

QAN +12%

STO +101% (not a typo!)

Santos turns the dividend tap back on

After deflecting a bid from Harbour Energy earlier this year, Santos has ridden the oil recovery wave and revived its dividend – paying out US3.5¢ (AUD 4.74c) to shareholders.

Reuters has more.

NB: STO goes ex-dividend on Tuesday 28th of August – only two trading days left to grab some if you want the dividend attached.

Qantas flying high

QAN shareholders can start planning their next trip with the proceeds of a 10c a share, fully-franked dividend which will hit their accounts in October this year.

That 5-year chart speaks volumes – it’s worth remembering QAN shares were changing hands for around a buck each back in early 2014.

Alan Joyce has well and truly left his critics in his wake.

Two great turn-around stories with charts to match.

And finally, #libspill

Please let it be Julie Bishop. Please ..

Your ASX commentator,

–// Craig Amos

FULL DISCLOSURE: None of the companies mentioned in this article are Equity Guru marketing clients.

Footnotes:

1. Source: EverBlu research report, August 23, 2018 (p27) : Conflicts of Interest: EverBlu Capital declares that it received financial compensation from CannPal Animal Therapeutics Limited for the preparation of this report.

2. Feature image and Dance party gif courtesy of GIPHY.COM