Contrarians are a funny bunch.

When it’s raining they play outside.

In the winter they eat ice-cream, in the summer they slurp soup.

Preferred holiday destinations: Venezuela, North Korea or the Democratic Republic of the Congo.

When it comes to investing, contrarian investors like hoovering up unpopular stocks.

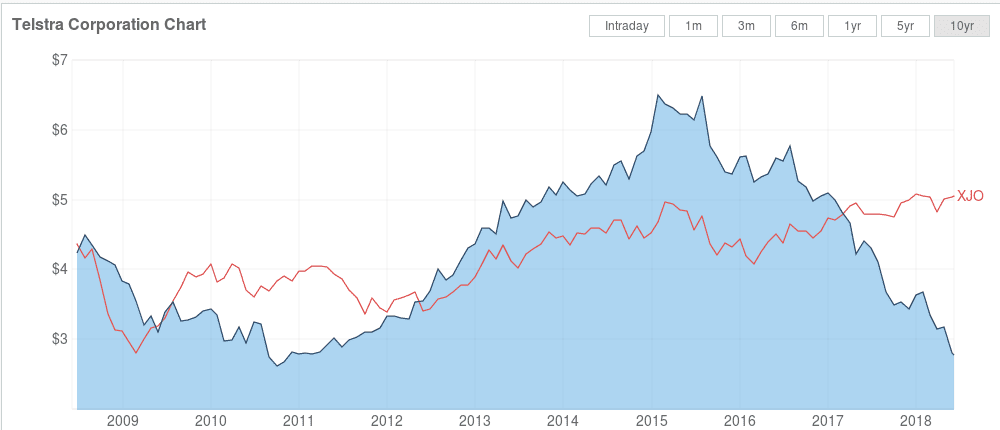

Telstra (TLS.ASX), the Aussie Telco bellwether, qualifies as unpopular as it is trading near 10-year lows even though the S&P ASX 200 (XJO) index is within striking distance of 10-year highs.

Peak pessimism has arrived at Telstra

Our spidey senses are just saying this is a compelling level to accumulate. For the record, we hated it back at 4 bucks but love it at $2.80.

So what’s changed?

Off hand, here are 7 things we can think of:

- The dividend is now a compelling reason to buy

The projected dividend of $0.22 for FY 18/19 represents a gross yield of 7.94% on the current share price of AUD $2.77

These days if you throw your bucks into a term deposit (CD) you’ll be looking at sub 3% returns. Hell, even Aussie 10-year bonds are only yielding 2.81%.

If TLS can put in a bottom here and the dividend is maintained at the projected level, it will easily outperform bank interest.

- Timing wise the next few weeks are a sweet spot tax-wise with the end of financial year fast approaching. Purchasing stock before June 30, 2018, with a view to holding for 13 months to minimize CGT, would provide additional tax deferral benefits with the capital gain not having to be paid until your 2019/20 tax return is filed.

- Thu August 16: Annual results announcement

- Wed August 29: Ex-dividend share trading commences

- Thu August 30: Record date for final dividend

- Thu September 27: Final dividend paid

- Tue October 16: Annual General Meeting

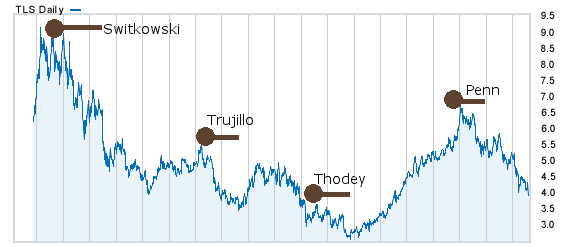

- If Penn departs, the stock would likely be re-rated

(L-R) Trujillo, Switkowski, Thodey, Penn When we last wrote about Telstra, we highlighted the CEO changes over the years and linked their tenure to the stock price. Let’s take a look at that chart again, shall we?

David Thodey’s timely exit from the executive suite is looking better by the day.

Meanwhile, Andy Penn has overseen a 60% drop in the company’s share price since taking office just over 3 years ago (1 May, 2015)

- 5G is on the horizon

The 5th generation of mobile broadband is significantly faster than 4G.There’s a lot of hype around it, but think of it this way – you’ll likely be able to download a full HD movie in a matter of seconds.

Everyone and their dog will want it, so any company that can offer it will have a significant first mover advantage

Telstra has already made some inroads in the 5G space, offering a 5G hotspot for use at the recent Commonwealth Games in Brisbane.

“Our 5G backhaul is capable of delivering download speeds of more than 3Gbps, which is capable of supporting around 1,000 HD movies being streamed simultaneously,” said Telstra’s Managing Director of Networks, Mike Wright.

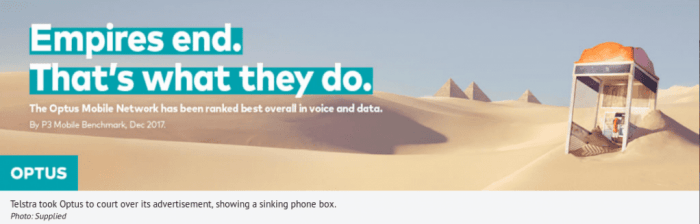

- The Optus ad stoush reeks of the ‘magazine cover’ contrarian indicator.

Telstra recently tussled with Optus in court over an advertisement (see below) Optus ran alleging “the advertisement made it appear there had been a “significant and permanent change in the relationship between the Telstra and Optus mobile networks” and that Optus was “undisputedly” operating a better mobile network than Telstra.”Telstra lost and had costs awarded against them. Ouch.

Surely they’ve got better things to do?

When your competitor tries to deliver the final coup de grâce then you can likely guess that all the bad news has been priced in.

- All eyes on the June 20 Telstra strategy update

A flurry of recent press has financial pundits pondering the telco’s next moves in an attempt to arrest the share price death spiral.

• Morgan Stanley is urging the telco to undertake siginificant cost cutting citing Telstra’s cost-ratio with that of its peers.

Telstra has been urged to make “significant” cost-cutting if it wants to see its share price recover from recent losses, according to analysts from Morgan Stanley.

The analysts said the telco’s relative costs are higher than other telcos around the world, and that investors may put pressure on Australia’s No.1 carrier to stay competitive amid increased competition and shrinking margins caused by the NBN’s rollout.

• Motley Fool is fence sitting (surprise!), but stated:

I am pessimistic on Telstra and have written recently that I would only consider buying the stock once management announces a dividend cut as that will trigger a re-rating in the stock, in my opinion.

The notion that Telstra can cut that much costs out of its operations is intriguing and could achieve the same outcome.

We will only know how realistic that option is when on Telstra’s Investor Day in three weeks. Stay tuned!• Elizabeth Knight, SMH uber biz journo, chimed in with the following when recently talking about Penn and Telstra: (there’s a magic gag in there somewhere but we’ll leave it alone)

But curiously the flurry of negative commentary from investment bank analysts that Telstra encountered in May has eased a little.

Only a week ago UBS upgraded its neutral recommendation to buy and Morgan Stanley also presented a bit of positive spin on the outlook. This can be explained in part by the fact that over the past three weeks Telstra’s share price has been sufficiently trashed that it is beginning to look like better value, or at least less risky.

But perhaps more significantly, there is a view emerging out in the investment ether that Penn will deliver a positive surprise at the June investor day update about the size of its cost-cutting program.

-

A downturn in global markets could be a good thing for Telstra

Here’s the theory:

World markets have been flying high for the past years on the back of the Trump trade.

That could change in an instant, or more likely, a tweet.

Money has to find a home, especially the billions of dollars of superannuation (retirement) funds which are compulsorily paid by Aussie employers on behalf of their employees.

Fund managers, who often run with the flock, would instinctively target defensive stocks such as TLS in the event of a market downturn, especially given its excellent dividend yield.

Key Dates for the remainder of 2018:

It’s not a sexy stock, but at these levels could turn out to be a great place to park some of your bucks for the next year or so.

Your ASX commentator,

–// Craig Amos

FULL DISCLOSURE: We have no commercial relationship with Telstra (TLS.ASX)