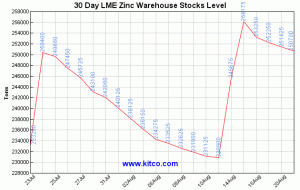

The zinc market is still attempting to grind out a bottom. The price of zinc has been driven down approximately 35% from its 2018 highs.

Global economic uncertainty, trade wars, and the rants of twitchy politicians may be weighing heavily on the metals future prospects, but the physical market – global stockpiles of zinc ready to be hauled off to the smelter – remain historically tight.

Typically, these readily available stockpiles have averaged approximately forty-two days of supply. In more recent days, stocks have been driven down to fewer than twenty-days.

The price of zinc may continue to grind lower, but it’s possible that it’s been pushed too far, too fast. Volatility in zinc and all of the metals which constitute the building blocks of society is bound to continue. But my guess is that any future volatility will carry an upward bias.

Keep your eyes on the $1.20 level. Technically speaking, $1.20 represents the next zone of resistance for the galvanizing metal.

Grade is King…

If you can boast a near-surface high-grade zinc resource, you’re more resistant to weak metal prices than the vast majority of your competitors.

Zinc One (Z.V) boasts high-grade zinc. Uber high-grade zinc.

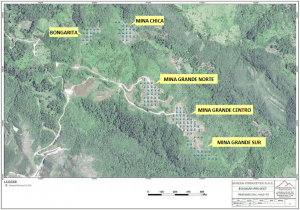

The company has just finished drilling off their Bongarita, Mina Chica, and Mina Grande Sur zones at their Bongara Project in the mining friendly jurisdiction of north-central Peru (results from the Mina Grande Centro and Mina Grande Norte zones are yet to come, due to be released in the coming weeks).

Once again, the truth machine has unearthed more high-grade core. This appears to be a recurring theme with Zinc One.

The high-grade zones…

The Bongara Project boasts a number of near-surface mineralized zones: Mina Grande (Sur, Centro, Norte), Mina Chica, Bongarita, Campo Cielo and Crista.

Previous assays results, spread out over the past five months, indicate the evolution of an exceptionally high-grade zinc project.

Below, a sample of eye-popping assays from this year’s drilling campaign…

Mina Grande Sur zone:

- MGS18001 – 5.5 metres of 26.1% zinc, starting at 3.0 metres drill depth.

- MGS18003 – 4 metres of 32.5% zinc, starting at surface.

- MGS18003 – 15 metres of 21.5% zinc, starting at 15.0 metres drill depth.

- MGS18004 – 9.1 metres of 43.6% zinc, starting at surface.

- MGS18006 – 14.1 metres of 32.8% zinc, starting at surface.

- MGS18017 – 8.2 metres of 42.7% zinc, from 7.5 metres drill depth.

- MGS18020 – 20.5 metres of 34.3% zinc, from surface.

- MGS18055 — 33.7 metres of 24.2% zinc, from 15.6 metres drill depth (true vertical thickness of 29.2 metres from true vertical depth of 11.0 metres).

- MGS18067 — 15.0 metres of 27.9% zinc, from surface (true vertical thickness of 10.6 metres).

Bongarita zone:

- BO18005 – 11.5 metres of 16.0% zinc, starting at surface.

- BO18005 – 5.7 metres of 29.2% zinc, starting at 5.8 metres drill depth.

- BO18007 – 7.0 metres of 25.3% zinc, starting at surface.

- BO18022 – 2.4 metres of 38.1% zinc, from 1.5 metres drill depth.

- BO18033 – 2.4 metres of 42.8% zinc, from 7.9 metres drill depth.

Mina Chica zone:

- MCH18004 – 16.5 metres of 35.6% zinc, from 15.0 metres drill depth.

- MCH18005 – 18.0 metres of 31.0% zinc, from 20.8 metres drill depth.

New zone in the vicinity of Mina China:

- MCH18010 – 12.0 metres of 26.6% zinc, from 1.5 metres drill depth.

- MCH18013 – 19.8 metres of 46.8% zinc, from 1.9 metres drill depth.

- MCH18014 – 49.5 metres of 38.7% zinc, from 7.3 metres drill depth.

The above assays should give you a good sense of the ‘Mississippi Valley-type‘ geology that lurks just below the surface at Bongara. I can only imagine the drill operator’s facial expressions as they pull this high-grade core outta the ground. The visuals must spark a fair amount of animated discussion.

Recent News…

News, just released, continues to expand the mineralized footprint at Bongara.

Zinc One Reports Remaining Drill Results from Mina Grande Sur, Bongará Zinc Mine Project, Peru

Highlights from this latest batch of assays include:

- MGS18077 – 18.0 metres of 36.0% zinc, from 21.0 metres drill depth.

(true vertical thickness of 15.6 metres from true vertical depth of 18.2 metres) - MCH18079 – 12.0 metres of 22.7% zinc, from surface.

(true vertical thickness of 9.2 metres) - MGS18080 – 11.5 metres of 32.0% zinc, from 43.5 metres drill depth.

(true vertical thickness of 8.8 metres from true vertical depth of 33.3 metres)

Commenting on these results from the Bongarita, Mina Chica, and Mina Grande Sur zones, Jim Walchuck, President and CEO of Zinc One, stated:

The Mina Grande Sur drill program delineated near-surface, zinc-oxide mineralization over a length of 350 metres in a north-south direction and as much as 200 metres in an east-west direction, open to the south and southwest. Along with the zinc-oxide deposit discovered at Mina Chica, we expect the success of this drill program to be manifested by a contribution to the total project’s resource estimate, which we anticipate will be completed Q4 2018.

I’m waiting, with baited breath, for the release of this resource estimate. The numbers should be good… good enough to drive the company forward to their next objective – mine construction.

A bit of Bongara history…

The property is a past producer. It operated from March 2007 until the end of 2008. The mine was shut down during the financial crisis of 2008 after a sharp drop in zinc prices, from the $2.00 per lb level to a low of $0.50.

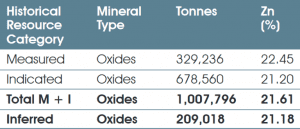

The company is already in possession of a resource estimate for the project (calculated by Corianta S.A. in 2011).

Note that this is a historical resource estimate. It is NOT NI 43-101 compliant. I show this only to demonstrate the potential of what might be coming down the pike.

Interestingly, the above historical resource factors in only a small portion of the Mina Chica zone, a zone the company has focused a fair amount of attention on lately. Drilling results released to date demonstrate a significant expansion of Mina Chica, not to mention exceptionally high-grade assays – 19.8 metres of 46.8% zinc and 49.5 metres of 38.7% zinc… just to refresh your memory.

The expansion and high-grade nature of the Mina Chica zone could impact the overall resource numbers in a very positive way. Once again, Bongara’s NI 43-101 compliant resource is scheduled to be released in Q4 of this year.

Final Thoughts…

We are still due for more assays here. Results from the Mina Grande Centro and Mina Grande Norte zones are on deck.

A resource estimate, one which will include all of the above noted high-grade assays, is due in Q4 of this year, as is a Preliminary Economic Assessment (PEA).

Zinc One management and directors are proven mine builders. If Bongará’s economics meet expectations, mine construction could begin in less than two years. Who knows where the price of zinc will trade at that point. My guess is higher.

With approximately 116 million shares outstanding and a very modest $0.15 share price, the company has a current market-cap of $17.4 M. This is a cheap stock. Damn cheap.

If you’re looking to dig deeper into Zinc One, Equity Guru has followed this rapidly evolving story from the get-go. Additional insights, courtesy of our own Lukas Kane, can be found here. My contributions to the subject can be accessed here and here.

As I suggested in an earlier article, if you’re looking for exposure to the zinc space, and you’re looking for deep value, Zinc One should be on your shortlist of due diligence candidates.

END

~ ~ Dirk Diggler

FULL DISCLOSURE: Zinc One is an Equity Guru client. We own the stock.