There’s been a fair amount of talk lately about how the bull-run in base metals may have overstayed its welcome. Volatility has ruled these arenas of late.

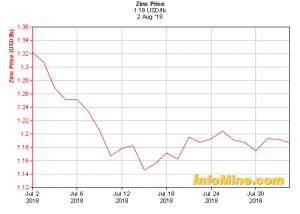

Out of all of these metals – these building blocks of society – zinc may have been dealt the worst blow during this recent rout.

The price of zinc has been driven down nearly 30% from its 2018 highs.

This recent price weakness is based on general anxiety over economic growth, zinc being the ‘hot dip‘ standard in the rust-proofing of steel. And of course, galvanized steel is heavily dependant on the construction and auto industry. The belief is that US tariffs on (galvanized) steel threaten to bring these sectors to their knees.

Not necessarily…

There are no sure bets in this apparent trade war, how it will play out; how it will impact some of the larger contenders like China.

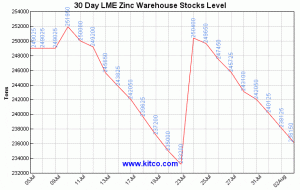

It’s quite possible that the zinc price has been pushed too far, too fast. And as you can see from the chart below, zinc stockpiles are rapidly being depleted once again.

The zinc market is still physically tight – visible stocks of the metal remain at historically low levels and this could carry on for several more years.

Typically, global stockpiles of zinc – metal ready to be hauled off to the smelter – have averaged approximately forty-two days of supply. More recently, those stockpiles have been reduced to fewer than twenty-days.

I wouldn’t be surprised to see zinc reclaim its recent highs in the weeks to come.

Meanwhile, the search for new supply continues… unabated.

The company…

Zinc One (Z.V): this is one of those rare zinc exploration and development companies that, as a matter of routine, pull core out of the ground that is chockablock with valuable metal. Much of the mineralization begins right at the surface. An enviable geological feature, this.

The Bongará Project…

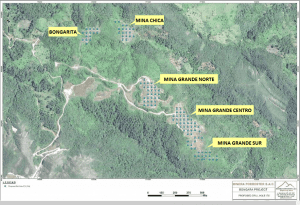

Located in mining friendly north-central Peru, Bongará is the company’s main focus. As you can see on the map below, the project boasts a number of mineralized zones: Mina Grande (Sur, Centro, Norte), Mina Chica, Bongarita, Campo Cielo and Crista.

The property is a past producer. It operated from March 2007 until the end of 2008. The mine was shut down during the financial crisis of 2008 after a sharp drop in zinc prices, from $2.00 per lb to a low of $0.50.

Potential pounds in the ground…

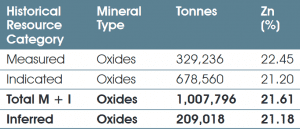

The project, the Bongará Zinc Mine, has a historical resource estimate (calculated by Corianta S.A. in 2011).

Note: the above historical resource estimate is NOT NI 43-101 compliant – the company intends to remedy that situation in the near term with a 43-101 compliant resource estimate due in Q3 of this year.

The grades at Bongará average 20%. If this doesn’t turn out to be the highest grade zinc deposit on the planet, its gotta be way up there on that short list.

I look forward to the release of that resource…

The Geology…

The Bongará Zinc Mine Project is classified as a Mississippi Valley-type deposit. These are generally high-grade lead-zinc deposits hosted in soft sedimentary rock such as limestone and dolostone. The name is derived from historic deposits discovered along the Mississippi River in the United States.

The zinc mineralization at the Bongará Zinc Mine project is classified as a Mississippi Valley-type deposit and is mostly hosted by strongly dolomitized brecciated limestones that are stratabound. The mineralization can also occur as tabular bodies with irregular boundaries, which is a characteristic of that mineralization encountered along the periphery of breccias. Hydrozincite (a zinc oxide mineral), smithsonite (a zinc carbonate mineral), hemimorphite (a zinc silicate mineral), and a zinc-aluminum-iron silicate are the primary zinc minerals that are hosted by soils, dolomitized breccias, heavily-weathered fractured and vuggy dolomitized limestones, and fine- to coarse-grained dolomitized limestones. At Mina Chica, the mineralization is typically zoned as either predominantly hydrozincite or predominantly smithsonite and hemimorphite, both zones with apparent variable amounts of iron.

The campaign to advance/develop Bongará…

Zinc One began drilling the project area back in January of this year. The goal is to define enough high-grade zinc to warrant bringing Bongará’ back into production. Thus far, the grades the company has been reporting have been exceptionally good.

Drilling has been focused on Bongará’s three main mineralized zones: Mina Grande Sur, Bongarita, and Mina Chica.

Below, a zone by zone sample of some of the more eye-popping assays reported over the past few months:

Mina Grande Sur zone:

- MGS18001 – 5.5 metres of 26.1% zinc, starting at 3.0 metres drill depth.

- MGS18003 – 4 metres of 32.5% zinc, starting at surface.

- MGS18003 – 15 metres of 21.5% zinc, starting at 15.0 metres drill depth.

- MGS18004 – 9.1 metres of 43.6% zinc, starting at surface.

- MGS18006 – 14.1 metres of 32.8% zinc, starting at surface.

- MGS18017 – 8.2 metres of 42.7% zinc, from 7.5 metres drill depth.

- MGS18020 – 20.5 metres of 34.3% zinc, from surface.

Bongarita zone:

- BO18005 – 11.5 metres of 16.0% zinc, starting at surface.

- BO18005 – 5.7 metres of 29.2% zinc, starting at 5.8 metres drill depth.

- BO18007 – 7.0 metres of 25.3% zinc, starting at surface.

- BO18022 – 2.4 metres of 38.1% zinc, from 1.5 metres drill depth.

- BO18033 – 2.4 metres of 42.8% zinc, from 7.9 metres drill depth.

Mina Chica zone:

- MCH18004 – 16.5 metres of 35.6% zinc, from 15.0 metres drill depth.

- MCH18005 – 18.0 metres of 31.0% zinc, from 20.8 metres drill depth.

New zone in the vicinity of Mina China:

- MCH18010 – 12.0 metres of 26.6% zinc, from 1.5 metres drill depth.

- MCH18013 – 19.8 metres of 46.8% zinc, from 1.9 metres drill depth.

- MCH18014 – 49.5 metres of 38.7% zinc, from 7.3 metres drill depth.

The above assays are extraordinary. Some are truly spectacular (note, true thickness of the above 49.5 meter interval is 35.0 metres from a vertical depth of 5.1 metres).

Recent News:

On July 30th, the company reported additional drill hole assays from the Mina Grande Sur zone.

Zinc One Reports Additional Drilling Results from Mina Grande Sur, Bongara Zinc Mine Project, Peru

Significant new intercepts from this round include:

- MGS18055 — 33.7 metres of 24.2% zinc, from 15.6 metres drill depth (true vertical thickness of 29.2 metres from true vertical depth of 11.0 metres).

- MCH18066 — 16.5 metres of 26.5% zinc, from surface.

- MGS18067 — 15.0 metres of 27.9% zinc, from surface (true vertical thickness of 10.6 metres).

- Mineralization at Mina Grande Sur includes zinc oxides, carbonates and silicates hosted by soils, highly-weathered carbonates, and fine to coarse-grained dolomites, most of which are brecciated.

Commenting on these new results, Jim Walchuck, President and CEO of Zinc One stated,

The most recent drill results from Mina Grande Sur confirmed and better delineated mineralization not only quantified, in part, by historic drill holes, but recognized by last year’s pit sampling as well. We look forward to receiving the remaining data from Mina Grande Sur. The drilling at Mina Grande Centro and Mina Grande Norte were completed earlier in the month with results to be reported over the coming weeks.

Results from an additional twenty-seven holes are pending…

For more insight into Zinc One and the zinc market itself, check out this article by yours truly, and this one by Equity Guru’s Lukas Kane.

Final Thoughts:

This is an extremely high-grade system. Management’s near term objective is to identify between 1.5 to 2 million tonnes of high-grade ore in the direct vicinity of the previous mining operation – this excludes Bongará (and Charlotte-Bongará’s) considerable blue sky exploration potential beyond that.

A resource estimate which will include recent high-grade drill assays is due in Q3 of this year. A Preliminary Economic Assessment (PEA) is also due in Q3.

If Bongará’s economics prove ripe, construction will begin in less than two years, production in roughly three.

This crew knows its rocks. Management and directors are proven mine builders. Their resumes speak for themselves.

Including the Private Placement announced back in May, the company current has approximately 116 million shares outstanding giving it a modest market-cap of roughly $21.5 M.

This company appeared cheap to me when it was trading 20% higher not too long ago. If you’re looking for exposure in the zinc space, and you’re looking for deep value, Zinc One should be on your shortlist of due diligence candidates.

END

~ ~ Dirk Diggler

Postscript: I’ve read a few reports recently about Short-sellers, traders in London and Shanghai, betting against zincs short-term price prospects.

Just exactly who are these Shorters”?

As mentioned above, they may have underestimated the tightness in this arena. These Shorters’ could be in trouble as they attempt to unwind their positions. This is could turn into your classic ‘Bear Trap’.

We stand to watch…

FULL DISCLOSURE: Zinc One is an Equity Guru client, we own the stock.