Back in early 2017, iAnthus (IAN.C) needed money to fund its U.S. weed development and acquisition strategy.

In an offering stage-managed by Canaccord and Beacon Securities, IAN borrowed $20 million, agreeing to pay 8% yearly to the lenders, allowing them to convert the debt into common shares at $3.10 any time prior to February 28, 2019 – after a 4 month hold.

“In our view, the opportunities for financing leading cannabis operators in the United States is very strong,” stated Hadley Ford, CEO of IAnthus at the time, “This offering further strengthens our balance sheet to meet that demand.”

In this deal, iAnthus retained the right to force the conversion of the $20 million into shares if iAnthus traded higher than $4.50 for 10 consecutive trading days.

It did that.

And then some.

On July 16, 2018 – with IAN trading over $6 – iAnthus made the decision to force the conversion of the $20 million.

“The Common Shares have closed at a price higher than $4.50 for every trading day since May 7, 2018, stated the press release, “As of July 13, 2018, the Volume Weighted Average Price (VWAP) of the Common Shares for the previous 10 consecutive trading days equals $6.39. The Conversion is scheduled to be effective August 16, 2018.”

What does this mean for current and future iAnthus shareholders?

- iAnthus is no longer accruing interest (at 8%) on the $20 million.

- The dilutive event (new shares) is now completed.

In New York, Florida, Massachusetts, and Vermont, iAnthus “holds licenses to operate four cultivation and processing facilities and 34 dispensaries, it also has weed operations in Colorado and New Mexico.

The CEO of iAnthus, Hadley Ford is a banking/operations/healthcare-innovator.

Ford grew a network of cancer treatment centers to $100 million in annual revenue. He also spent 14 years on Wall Street, where he completed “over 150 transactions worth billions of dollars.

Ford is also a good communicator. Check him out in the video below (23:48) talking about “switching roommates” – when he abandoned one deal – and replaced it with a better one, over a weekend – dodging the inevitable share price slump after a company announces, “That deal we talked about? We can’t do it.”

Ford recently provided a detailed summary of the company’s current activities and Q1, 2018 financial performance.

iAnthus Q1, 2018 Financial Highlights:

- $3.2 million of revenues in Q1 2018, compared to $300,000 in Q1 2017.

- Net loss $0.01 per share, compared to Q1, 2017 loss of .07.

- Assets increased to $124.0 million at March 31, 2018 from $45.8 million at December 31, 2017 – due to the acquisitions of Citiva and GrowHealthy

- Received $5.1 million from The Green Solution, LLC

Business Update:

Massachusetts – Mayflower Medicinals Highlights:

- Began operations at its 36,000 square-foot Holliston cultivation and processing facility, with annual production capacity of 2,625 kg.

Florida – GrowHealthy Highlights:

- More than 25,000 square-feet of the cultivation and processing facility in Lake Wales has been built-out

New York – Citiva Highlights:

- Acquired 8.5 acres of land in Warwick, NY for the planned 39,500 square-foot modular cultivation and processing facility

Vermont – Grassroots Vermont Highlights:

- Facility-wide upgrade took 50% of the cultivation capacity going offline..

- Upgrades improved processing facilities, and additional grow space.

Colorado – Organix Highlights:

- Revenue in Q1 2018 totaled $1.5 million, representing a 17% increase from 2017.

- Achieved record sales of approximately $0.6 million in the month of March 2018; and

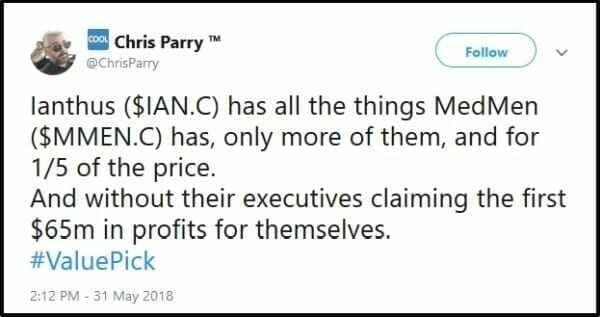

On May 31, 2018 Equity Guru’s Chris Parry tweeted:

At first glance, it appears the lenders to iAnthus made out like bandits.

Not only did they collect 8% yearly interest on the $20 million, they now own stock worth approximately $40 million.

Why in God’s name would iAnthus have struck such a deal?

According to Investopedia, “Convertible debentures are different from convertible bonds because debentures are unsecured; in the event of bankruptcy, the debentures are paid after other fixed-income holders.”

That means – if things go south – the investors get nada.

The weed business is not bullet proof. The bloated bodies of the weak swimmers are already floating face-down in the surf.

On May 14, 2018, IAnthus received a $50 million investment from Gotham Green Partners. Net cash proceeds were approximately $46 million after deducting various fees and structuring costs.

It’s always worth watching where the money is going, and if – and how – it’s getting paid back.

On July 15, 2018, iAnthus was down 7% to $6.10 on 112,000 shares traded.

Full Disclosure: iAnthus is an Equity Guru marketing client and we own shares.

Yes it certainly would be terrible if Sessions were to become President, particularly because he isn’t Vice President.

Venti Dark, thank you for correcting my blunder regarding Jeff Sessions pathway to the Presidency. I plead guilty. You are right. I am wrong. I appreciate the correction. The article is amended.

jeebus cripes I hope you have something coming regarding what’s happened this week in CANADA