Aben Resources (ABN.V) has three gold projects located in:

- The Yukon

- Saskatchewan

- BC’s “Golden Triangle”.

If these 3 projects were cars: The Yukon Project would be a 2001 Mercedes C-Class.

The Saskatchewan project would be a 2018 Lexus.

The Forrest Kerr Gold Project located within BC’s Golden Triangle of British Columbia would be a 1964 Rolls Royce.

Looking under the hood, here the five key features of Aben’s Forrest Kerr Gold Project.

- The Neighbourhood (and the neighbours)

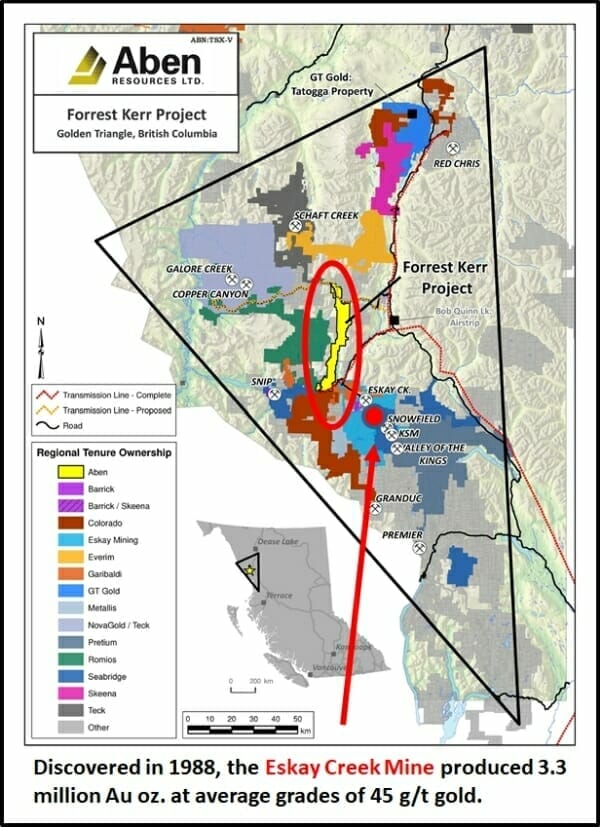

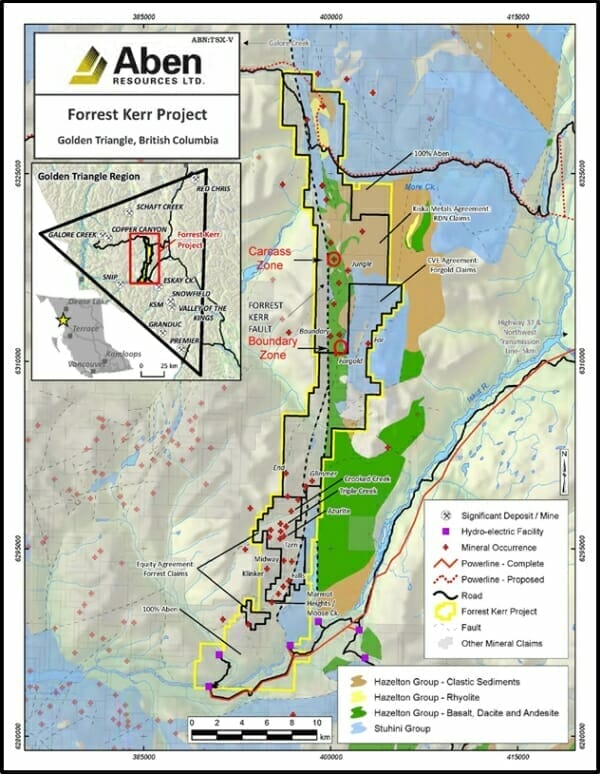

The Forrest Kerr Property represents a consolidation of multiple properties and Aben-controlled claims that now comprise 23,397 hectares in the Golden Triangle. Aben has the right to earn a 100% interest in the various properties.

In the last decade there has been an infrastructure re-build with the 277-megawatt Northwest hydro-electric facility, located on the southern portion of the property, all-weather road access spurs from the Stewart-Cassiar Highway #37.

In the 1990’s, the Eskay Creek discovery spurred an exploration boom.

Discovered in 1988, the former Eskay Creek Mine produced approximately 3.3 million ounces of gold and 160 million ounces of silver at average grades of 45 g/t gold and 2,224 g/t silver and was once the world’s highest-grade gold mine and fifth-largest silver mine by volume.

Forrest Kerr is also proximal to recent discoveries made by GT Gold and Colorado Resources.

- Money Flow

According to the EY Mining Survey, gold sucked up 75% of global exploration expenditure in 2017. Although retail investors may not be pouring into gold ETFs, big cap mining companies and the financial institutions that underwrite them are gearing up for a spike in gold demand.

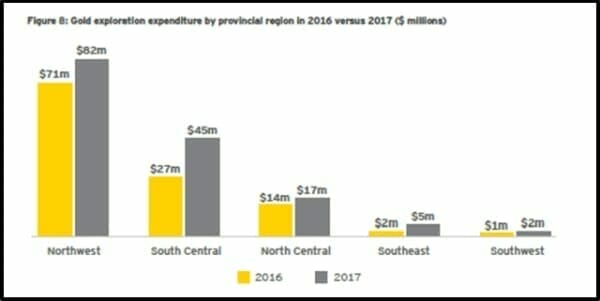

British Columbia’s gold exploration was up 32% in 2017 to $150 million. That’s about 87% of the total exploration spend in BC.

B.C.’s Northwest and South Central accounted for 80% of this. This area includes the Golden Triangle.

Gold projects have been significantly de-risked by the opening of a port shipping facility at Stewart and the completion of a $700-million high-voltage transmission line.

Most of the increase in gold exploration has been on existing projects rather than new ones.

- Geology

With a matrix of past-producing high-grade gold mines dotted around the area, there’s strong evidence of a significant gold district.

A data compilation study incorporated all historic data, so a “regional scale approach” to exploration is now possible.

According to a recent study by BC Geological Survey personnel, “there is striking evidence now available that may aid in the discovery process in the region.”

They conclude that most of the major deposits in the region occur within 2 km of the regional stratigraphic contact.

“If you are near that red line and there’s a clastic sequence coupled with large-scale faults (Forrest Kerr), then you might be in the neighbourhood of BC’s next big deposit, and knowing that is a big game changer for the explorers in the region, because it will get them closer to making a discovery.”

A perusal of the geological survey revealed that: “Early Jurassic, D3 deformation broadly warped the rocks into upright structures. Late Jurassic (D4) produced northeast-verging structures.”

This also describes our posture at Tuesday Toonie Shot Night, which also transforms from “upright” to a “northeast-verging” structure.

The key take-away is that some pointy-headed government geologists believe there may be a shite-load of undiscovered gold on the Forrest Kerr property.

- Macro Economics

Predicting future commodity demand is an inexact science.

Asbestos (the leading cause of workplace-related death in Canada) seems like a bad bet.

Cobalt (a key ingredient in EV batteries) seems like a good bet.

What about gold?

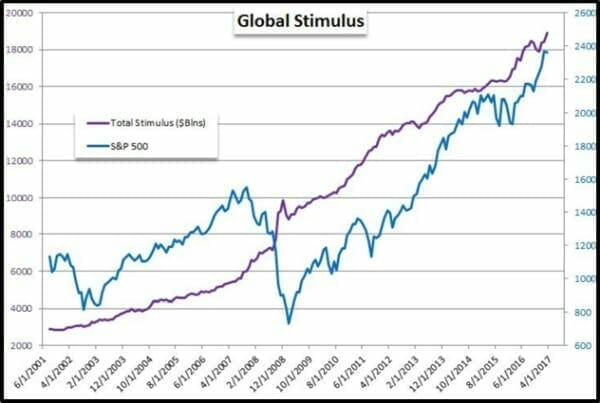

The key driver of gold demand is the gradual devaluation of paper money. Almost every country on the planet is living off its credit cards, and printing money to make the minimum payments.

You don’t need to be a chartered accountant to realise this may not end well.

As we’ve previously written, “The orgy of global money printing (The U.S Fed has printed more than $2 trillion since the global economic crisis began in 2008) – plus inflation – make gold’s come-back a foregone conclusion.

The spot gold price of gold is still depressed ($1,301 USD/ounce) making this an opportune time to load up on junior gold stocks.

When bullion explodes to the upside – junior explorers (with good projects) will go up in multiples.”

Steer clear of asbestos. Load up on gold. You heard it here first.

- Drill results

At some point the story (historical data, success of neighbours, airborne-surveys etc.) hits reality. That comes when the company drills employing modern techniques, and data recording protocols.

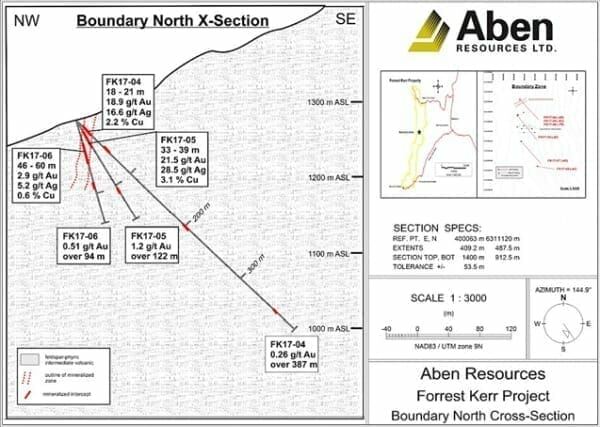

Aben’s 2017 drill results found, “Continuous mineralization at the newly discovered “Boundary North Zone”:

A broad intercept of 1.2 grams/tonne gold over 122 metres including 10.9 grams/tonne gold over 12 metres with a high-grade core of 21.5 grams/tonne gold over 6 metres.

Other holes returned 0.51 grams/tonne gold over 94 metres including 2.91 grams/tonne gold over 14 metres;

And 10 metres of 6.7 grams/tonne and 3.0 metres of 18.9 grams/tonne gold.

The Forrest Kerr Gold property, “displays a high degree of continuity for gold, silver and copper. 2017 drilling has shown that base and precious metal mineralization is combined in both a high grade core and across broad intervals.

In a recent Metal News Interview, Aben CEO James Pettit stated, “Last year we hit a major find. We’re calling it a discovery, but it is three holes that hit starting at 16 meters deep. We were getting 30 to 50 grams per ton on surface. And this is an extremely broad discovery. One hole was over 300 meters wide – down to 100 meters wide, well-mineralized but with high grade cores.”

To be clear, we’re not dumping on Aben’s Yukon or Saskatchewan projects. Those assets could probably be spun off into separate companies. We’ll test drive them another day.

But our eyes swiveled immediately to Forrest Kerr Gold Project (the Rolls Royce) – and now we can’t get this little beauty off our minds.

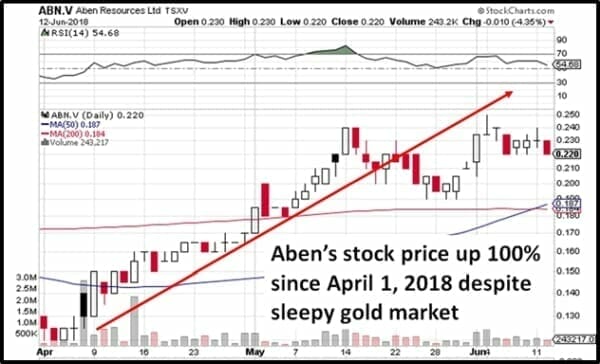

Aben is currently trading at .22 with a market cap of $17.8 million.

Full Disclosure: Aben is an Equity Guru marketing client and we own stock.