CopperBank Resources Corp (CBK.CSE) is, in many respects, a ‘Copper Bank’. The resources this company holds – its pounds in the ground – represent a vault, a stash… a deposit that has the potential to be monetized when the going’s good. The catalysts here are intriguing.

First, why copper?

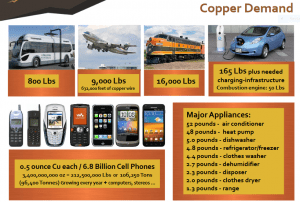

Electric vehicles (EV’s) are a big part of the WHY for this soft, malleable, ductile red-orange metal with crazy high thermal and electrical conductivity characteristics.

According to a report by IDTechEx (commissioned by the International Copper Association or ICA), EV’s are coming on like Montezuma’s revenge. The number of EV’s due to hit the street are set to fuel a nine-fold increase in copper demand by 2027.

According to the ICA, one single electric car holds up to six kilometers of copper wiring.

A car with an internal combustion engine uses up to 55 lbs of copper, whereas:

- a hybrid electric cars use 110 lbs of Cu.

- a plug-in electric cars use 165 lbs of Cu.

- electric buses use between 500 and 800 lbs of Cu.

Stepping out a little further into the future, vehicles that sport roof-mounted solar panels will also require copper.

Even the charging-station infrastructure for electric vehicles uses loads of copper.

“COPPER – COPPER – COPPER”! (Jan Brady voice)

At the risk of sounding like a simplistic twit: it would appear that copper is the key to creating a greener cleaner planet.

But seriously, perhaps NOW would be a good time for environmentalists to get onboard with large-scale copper mining projects…

Weak supply pipeline…

The fact that a number of major copper development projects were sidelined over the years has strained above ground supply. Mine disruptions via wage disputes, strikes, etc have exacerbated the situation.

The world needs more copper mines. Period.

Then there’s China:

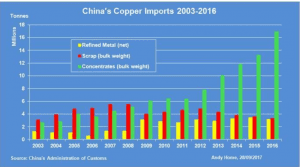

That country alone consumes over one-half of global copper production.

As China’s masses – hordes of hard-working agrarian types – continue to migrate to the nearest burg, all things electric will multiply with increasing demand. I know if I spent my entire youth stuck on the farm, and then one day found myself living in a big tall city, I’d buy things that plugged into the wall too… lots n lots of gadgety things.

China’s appetite for copper is best demonstrated with a chart.

Added demand for the metal can pop-up out of nowhere…

Wacky weather patterns – increasingly bigger, stronger, more frequent hurricanes – will also cut into supply as infrastructure, homes, and businesses rebuild. Earthquakes factor in too. Volcanoes?

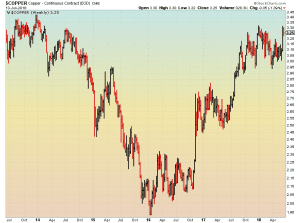

The Copper Auction Arena:

This is one helluv an active metals market.

It doesn’t take a hardcore Waver (a practioner of Elliot Wave Theory) to see that the copper price pattern is in the grip of a powerful uptrend, one which began in early 2016…

Clearly, we have some pressure building here. If all of the tight-supply / surging-demand intrigue plays out according to prophesy, current Cu prices will look damn cheap in the not too distant future.

Back to the Copper Bank: CopperBank Resources:

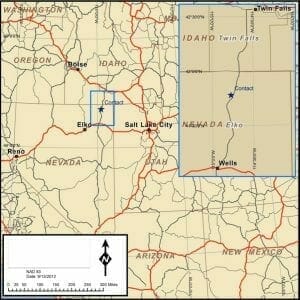

The company controls three projects: the Contact Copper Project located in Elko Nevada, and the Pyramid/San Diego Bay projects located near deep tidewater on the Alaska Peninsula.

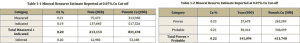

Both the Pyramid project in Alaska and the Contact project in Nevada sport significant copper resources, ‘pounds in the ground’ inventory if you will (Contact is a pre-feasibility stage project).

The San Diego Bay project shares a common boundary with Pyramid and is a highly prospective exploration target for Cu mineralization.

We’ll start with the pre-feasibilty stage project in Nevada first, then work our way up north.

The Contact Copper Project:

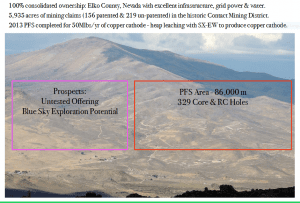

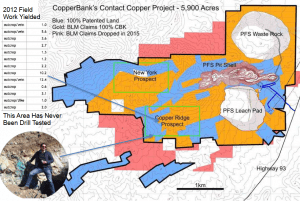

The Contact project is a 100% owned pre-feasibility stage copper oxide project located in the prolific mining district of Elko County, Nevada. This is elephant country. Truly.

Significantly, and to the company’s great advantage, U.S Highway 93 skirts the east side of the project along with a 138 KV transmission line.

Contact’s History…

CopperBank purchased the 2,400 hectare Contact Copper project from Enexco International back in 2014.

Enexco plowed considerable resources into this property back in the day. It would take in excess of $40 million to bring the project up to the stage where it currently sits today.

The Contact Resource:

This project, due to its prime location and ease of access, received a lot of attention in its time – more than 86,000 meters of drilling was performed between 1967 and 2012. Enexco was responsible for approximately 55,000 of those meters between 2007 and 2012.

Exploration upside…

The chances of tagging additional zones of mineralization in the region have to be considered excellent.

On the map below you can see the proposed pit design and mine layout as outlined in the pre-feasibility study. Approximately 1.6 kilometers to the southwest of the mine plan is the Copper Ridge Prospect where a suite of high-grade Cu samples were collected. Copper Ridge represents one such exploration target for resource expansion, a juicy target at that.

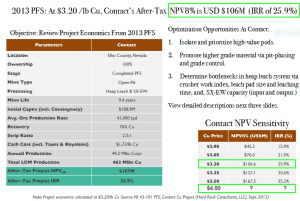

The Economic Study – the PFS:

Tens of thousands of drilled meters and multiple revised resource estimates laid the foundation for this pre-feasibility study.

The PFS shows a fairly modest Capex and a respectable after-tax IRR of 25.9%. I won’t go into the finer details, but it’s a solid study. Could it be made better?

Improvements, Undiscovered Efficiencies, Optimizations:

Management wants to improve on the above numbers. I know from having worked as a contractor in the resource sector the positive effect one basic improvement can have on a project. The bottom line impact can be dramatic.

Areas the company might look at to improve the PFS numbers include:

- employing a two-phase development plan (start small – scale up over time) which would lower the initial Capex.

- targeting high-grade zones within the resource.

- using mining contractors as an alternative to a homegrown workforce – greater efficiencies could be had.

- purchasing used equipment instead of laying out significant capital to purchase new.

- identifying bottlenecks in the heap leach system and working out the kinks to generate better flow.

Management is employing an entrepreneurial approach to Contact. They’re open to fresh ideas, including new technologies like Mine Sense…

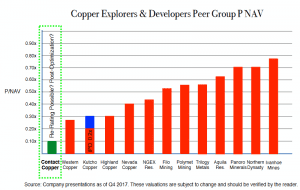

The goal: improve efficiencies in order to gain a re-rating from the market. A ‘re-rating’ involves proving that their asset is worth far more than they are currently given credit for.

The company obviously believes it’s not getting enough respect for these pounds in the ground. I’d have to agree, and am inclined to see that as an opportunity.

Moving along…

Exploration and Resource Definition Upside Further North:

The Pyramid Copper Project…

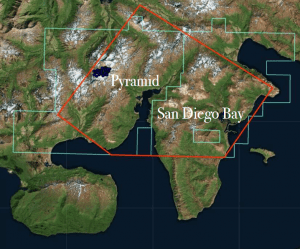

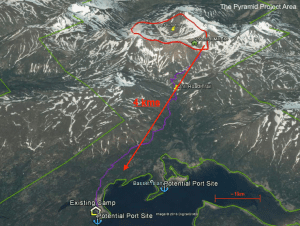

This 100% controlled project is located approximately 25 kilometers from the town of Sand Point on the Alaska Peninsula. Note its proximity to deep H2O, an important consideration when calculating project economics. Environmental considerations would obviously demand considerable attention here.

The Resource…

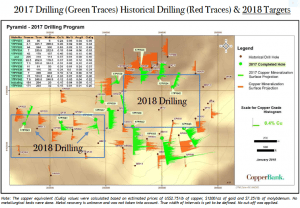

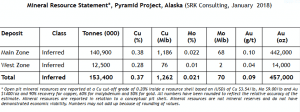

The Pyramid porphyry copper-molybdenum deposit is a quartz diorite porphyry and hornfelsed sediment hosted system, of calc-alkaline affinity. Antofagasta Minerals PLC drilled 30 core holes between 2010 and 2012 for a total of 7,458 meters resulting in a maiden inferred resource report authored by SRK on June 2013. The Inferred Mineral Resource was updated January 2018 to incorporate the 3,660 meters drilled by CopperBank during 2017. The updated resource estimate, using a 0.2% copper cut-off, is 153.4 million tonnes at 0.37% copper, 0.02% molybdenum and 0.09 g/t gold.

That is a significant amount of copper – its gold and moly are nothing to sneeze at either.

That is a significant amount of copper – its gold and moly are nothing to sneeze at either.

Exploration Upside…

There is a fair amount of exploration blue-sky potential at Pyramid. A 2,500-meter drilling program in 10 additional drill holes has been proposed to expand and further delineate the projects porphyry mineralization.

If the company meets success during this next phase of drilling, a preliminary economic assessment would be the next step.

The San Diego Bay Project:

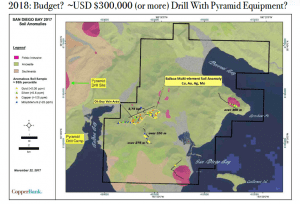

This one is pure exploration. The company conducted a program of prospecting and soil sampling last year. No drilling as of yet.

As you can see on the map below, the project is joined at the hip with the resource-bearing Pyramid project – they share a common boundary.

This could make for some good (cost-saving) synergies, including having the crews bunk in the same camp, sharing the same drill rigs, etc, etc.

The San Diego Bay Project is typified by an extensive 40 square kilometre area of gossan, strong hydrothermal alteration and intrusive rocks, consistent with porphyry systems such as the adjacent Pyramid deposit. All porphyry alteration facies have been observed, including zones of potassic, advanced argillic, phyllic and pyrite zones; previous landsat imagery has identified widespread zones of high-temperature clay alteration. Strongly anomalous precious and base metal values were collected by previous operators; an important consideration for exploration is that the adjacent Pyramid deposit hosts a leach cap of 10 to 100 meters in thickness, and underlain by a supergene enrichment blanket. Cobbles of copper oxide mineralization have been identified by local, Aleut shareholders on beaches adjacent to the alteration zone. Interpretations suggest that San Diego Bay may represent overlapping hydrothermal systems, including potential lithocaps. San Diego Bay represents a Tier-1 sized porphyry target with an excellent location.

San Diego Bay is huge: a 40 square km area of gossan and pervasive argillic, phyllic, potassic alteration. Alteration is what prospectors look for. It’s indicative of a mineralizing event.

Historic surface sampling on the project returned high-grade gold, silver, copper, lead and zinc.

Curiously, San Diego is the largest colour anomaly in Southern Alaska, granting it Tier 1 porphyry target status.

Moving Forward:

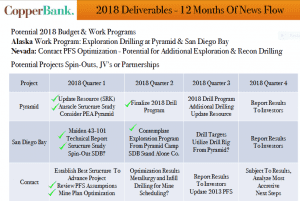

The company has work to do. Management is not content sitting idly by, guarding their pounds in the ground.

As you can see in the above chart, there is a fair degree of news-flow in the offing and a number of potential catalysts. Management wants that all-important re-rating.

Speaking of Management:

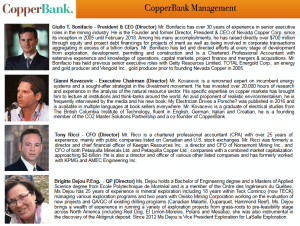

This is a highly competent group of men and women…

Final Thoughts:

CopperBank currently has 198.5M shares outstanding. At its current price of nine cents, it has a market-cap of < $18M.

Resource estimates from Contact and Pyramid show over 2 billion pounds of copper in the ground.

If further development of these projects yield positive results, the company might get that re-rating from the market. They may even draw in a predator, a suitor, a resource hungry producer desperate to top up its mineral inventory. In either case, CopperBank’s share price could respond exceedingly well, with multiple levels of elevational price-chart gains a distinct possibility.

The catalysts are detailed above. The real wild card in all of this?… copper going parabolic.

We stand to watch.

END

~ ~ Dirk Diggler.

(feature image of the US National Bank by flickr user Michael Wilson.)

Full disclosure: the author does not own shares in the company.