To say there have been angry phone calls these past few days would be an understatement.

Folks who helped take MedMen Enterprises Inc. Class B Subordinate Voting Shares (MMEN.C) (hey, that’s the CSE’s label, not mine) to the public markets and were looking at making a great amount of cash doing so, aren’t so pleased that our revelations of the company’s amazingly horrible executive compensation and parachute package have caused folks to flee the stock like a herd of scared buffalo.

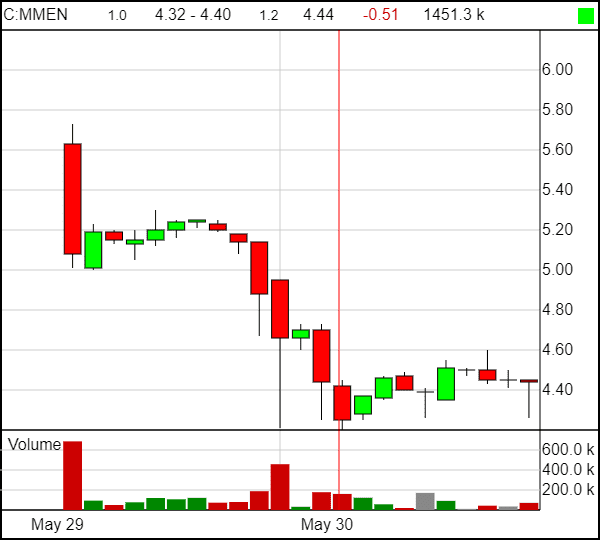

MMEN opened at $5.73 yesterday. It’s slid to $4.32 since.

To be clear, that’s not our job. A stock going up or down isn’t our job. It’s not why we do this. We could care less if you guys ride a good company or a bad one, our job is to shine a bright light on the details and you then make your own mind up. If you’re going to lose money, let it be after you’ve been completely informed on the deal. Is MedMen a good deal when the first $65 million it makes in profit will need to go to three executives, who have 99.3% of voting power? We don’t think so, but there are some who don’t mind.

[UPDATE: After pressure from the media and investors, MedMen updated their executive compensation structure so the above is no longer true. Now, the execs only share in around $30m in bonuses, unless they can get the share price to $10, $15, and $20, in which case they get everything outlined. While we imagine the company share price will get to that $10 point if it makes $65m in revs, it won’t necessarily be a fait acompli.]

It seems many others do, hence the stock collapse.

And boy, did we hear about it down the phone as it was happening.

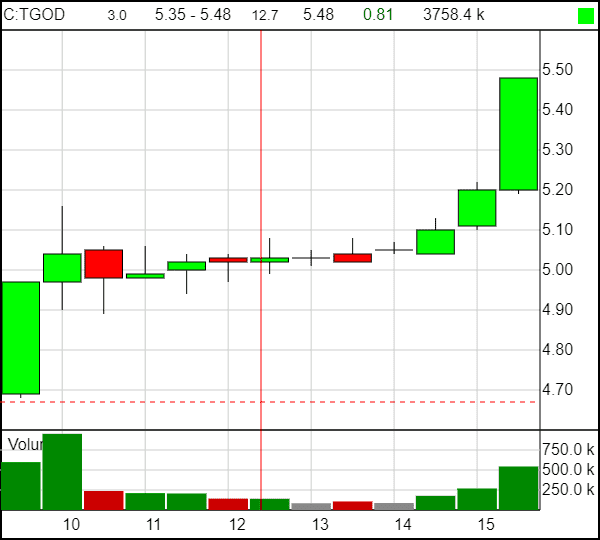

Meanwhile, The Green Organic Dutchman (TGOD.T), which we compared yesterday as an also highly valued company, but one that took investors with them on that upward ride, has gone the other way with a massive two day run upwards.

TGOD was aiming for a $3.65 debut, and it dipped over the first week, but it’s now blown through $5 without a problem and sits at $5.48 as I write this, which puts its value at over a billion dollars.

I’ll say it: That’s high. As someone who bought in at $1 and $1.65, I’d be tempted to sell at this price if I didn’t have a long trading hold to deal with. That big investor lift and the eventual selling when folks take profits is something the TGOD folks will eventually have to face.

But in the meantime, the deal was open to small investors, and those small investors have made BANK. If their executives also make bank, it’ll be because they hold the same voting stock as you and I do.

MedMen’s deal isn’t the same deal. It’s wired to benefit only three guys. And because we said so, apparently certain people will never do business with us again.

Okay. We’ve heard that before. In fact, we hear it all the time. Some folks just don’t get that if your company is set up poorly, that some people will say so, and that you should maybe not set your company up poorly.

“But we’re bringing three more companies to market, and you’re not going to be a part of that, so there!”

Cool story, bro. But we’re going to be a part of a lot of other deals, whose reps are calling me up all day, telling me they like our style and appreciate the honesty and our audience.

And you know what else?

We’re gonna be watching your next three deals, so keep it clean.

You see, that’s our marketing niche: Legitimacy. And it’s not for everyone.

It sure wasn’t for Lifestyle Delivery Systems (LDS.C), back in the day.

LDS was a shit show, a dog with many fleas, a festering heel blister on a day you’re wearing Fluevogs. It was six miles of bad road and a stomach full of bad Chipotle. It was waking up in a strange bed and checking the closet to find nothing but ‘Make America Great Again’ caps and Ted Nugent t-shirts. It was coming home to watch the Stanley Cup game 7 you thought you recorded and instead finding nothing but Guy Fieri shows. Buying LDS was like learning your girlfriend is a crackwhore, and she’s related to you. It was a routine visit to the proctologist that ends with the words, “Felicia, can you get me the chemotherapy guy’s number, because this one’s a doozy! Come here, feel this! Wow. It’s like Sputnik; spherical, but quite pointy in parts.”

Here was the issue with LDS when it landed: Everyone lied.

Everyone.

The company lied about what it had and when it would do it. The brokers lied that their clients were fistfighting in the streets to get their allocation, which was ten times over subscribed. The money guys lied when they said it would never do another raise. Then guys like me, who took their word as truth, looked like assholes for telling you something that, when it landed on the markets, turned out to be complete and utter bullshit.

It opened at $0.30, not $0.50, then slipped to under $0.10 where it sat for a year.

I haven’t had many companies I’ve worked with that I’ve regretted working with over the last few years. The shitty deals know to be wary of me, that, to quote execs at Abattis Bioceuticals (ATT.C) back in the day, “We’re not sure we can keep a leash on Parry.”

That’s by design. If you know I’ll cash your cheque and then say bad things about you, because you deserve bad things said, you tend to not offer me the cheque in the first place.

To be clear, I haven’t taken any money from MedMen, nor asked for any, and nor have I received money or stock or steak or curvaceous redheaded women from anyone who’ll profit from that company’s misery.

I just can’t watch executive larceny go down unmentioned, bruh.

But I did take money from LDS, and when the evidence became clear that everything was wrong, I went after them. Unsurprisingly, the cheques stopped coming.

Somewhat surprisingly, after a year of beating them up, the CEO walked into my office one afternoon and said, “Sorry about all that.” He made good on past debts and promised to answer any and all questions honestly and openly. He explained his side of things, that the best laid plans got away from them, that the regulatory landscape wasn’t what they thought it was, that delays and missed deadlines were inexcusable and that they’d learned from it and were better now for it.

You can read it all in this article from 18 months back.

Let’s be clear: I’ve been hard on this company, and for good reason, and [CEO Brad] Eckenweiler hasn’t always delivered on his promises, but a grown-up approach to this opportunity is FAR more interesting than the initial plan, which sought to shimmy around regulations with a routine whereby the company would license the packaging to marijuana players who could then use their machine for free. By selling the packaging and not the weed strips, the company figured it would be insulated from the feds kicking in their door.

This plan, of actually having licenses and partners and permits, is better. And Eckenweiler sitting forward in his seat, explaining details of the finer points of California licensing regulations and Nevada possibilities going forward, is a far sight better than the Eckenweiler of late 2015, when everyone was telling him how great his plan was going to be and waving fat cheques, and victory was considered a fait acompli.

You never know what’s going to happen when someone comes out with a mea culpa. Most CEOs would rather cut off their lead golf swing arm than apologize to shareholders or even admit they’d made errors in judgment.

Eckenweiler, however, is taking his hits and standing.

It hasn’t been smooth sailing since. There have been more delays. There have been missed milestones and promises walked back. There was a big financing that went through hellacious due diligence. Hell, there was even a Sheriff raid.

https://equity.guru/2017/12/01/lifestyle-delivery-systems-lds-c-facility-raided-sheriff-county-doesnt-recognize-city-permit/

But there’s a ‘there’ there now.

- Six months back, Eckenweiler went on the Equity.Guru livestream and walked investors around his facility in its pre-finished state. The reality of that scene led to a 30% jump in stock price the next day.

- Last week, Eckenweiler got on the livestream again and showed the finished product, with staff and oil being extracted and equipment humming and lights blinking, and answered questions from readers for 90 minutes, and the stock ran again.

- Today, LDS announced an LOI to deliver 1000 liters per month of extracted distillate of cannabis oil, which will require LDS investing in equipment upgrades. There were also revenue estimates that were subsequently walked back (cheeky, Brad).

The stock ran up 27.3%.

The LDS market cap is currently $82 million, which is defensible, and the CEO said on our livestream that he WILL have revenues in the next financials, which we made clear is long overdue. We asked prickly questions about not extending warrants, we made him clarify what LDS affiliate CSPA Group actually is and how much of its money comes to LDS, and we harked back to earlier misses.

This, for a company that PAYS US MONEY TO TALK ABOUT THEM.

If LDS is to thrive, it should do so having gone through the gauntlet of fire, because we’re not a fucking sales letter. It should repeatedly be asked to outperform its competitors and prove it’s worth, and when it does, that should mean something to investors. And when it doesn’t, it should take it’s fucking lumps and mow your god damned lawn.

MedMen has proved nothing other than that there was immense interest to bring them public and they have a nice interior designer.

BUT WHAT CAN THEY DO?

That’s a great question, thanks for asking.

- They can acknowledge the shitty deal the executives made to get public, and explain why that deal isn’t so shitty as it appears.

- They can voluntarily gear down their package and get on board with investors, making their millions not off the top, but off the bottom, where investors do.

- They can volunteer to forgo their bonuses until such a time as the company revenues can cover them.

They won’t do this, though. They’ll weather it. They’ll say nothing to you, their guys behind the scenes will rage at me, and they’ll hope by next week you’ll have forgotten their queazy deal and you’ll start thinking, “Hmm… dead cat bounce?”

Last week, the CEO of Namaste Technologies (N.V), Sean Dollinger, got on his own livestream and spouted off against guys like me (or maybe even me, he wasn’t prepared to name names) who ‘run these IR scams where they say mean things unless you pay them.’

https://equity.guru/2018/05/18/namaste-technologies-n-v-will-buy-beer-dont-sell-stock-blown/

It was a weak, ill-advised flailing of arms because his stock was being hammered by people who think it’s overvalued and that he buys random things to try to keep it up there, and dilutes his stock to do it.

The correct response from Dollinger would have been, “Hey Parry, a year ago we had a $40m market cap, and anyone who bought in then has made x10 their money, so if I’m doing something wrong, I’m gonna keep doing it.”

Of course, my response would have been that anyone who bought the stock in December has lost half their money, but at least we’d both be right and we could move on in the spirit of competition because, if we’re being real, Namaste has done a good job in building up their cap, and their investors have benefited.

The MedMen guys, instead, are barking down the phone and dangling future business as a reason for us to stop talking about how the only way investors will make anything from their company is on market moves, not revenue, not profits.

Don’t be like the MedMen guys. Be like LDS.

Fix your shit.

— Chris Parry

FULL DISCLOSURE: LDS is an Equity.Guru marketing client, but if they screw you guys, we’ll hand you the ball peen hammer and show you where to find their knees.

It’s like the old days of the Green Rush. I’m getting flashbacks to the FITX fiasco. Keep up the good investigating journalism.

Thanks R! It’s a target rich environment.

What are your thoughts on the founders forfeiting equity awards untill certain conditions are achieved?

It’s a half assed PR stunt. They’re still giving themselves the bonuses, just down line. They still have all the voting power. They still don’t own the dispensaries they claim to own.

Loving The MMEN take down. Most of Reddit trieys their first time shorting on it :D.

Don’t underestimate the weed stock community!

What are the options if you invested in this in earlier rounds? Your warrants are garbage, your convertible converted at 5.25 and any discount you had is washed out or in the red. Do you just take the bath and move on, or ???

What lessons can we learn to look for so we don’t end up screwed like their investors. Must suck to be those guys.

Parry..Can’t thank you enough man, wish this world had more real fckrs like you;) Love how you included their polar opposite TGOD, and I think the MedMen name stuck due to their subconscious drawn towards the two ‘Me’s’ in the name.. cheers mate