The $15 billion gold producer Barrick Gold (ABX.T) has projects in Argentina, Canada, Dominican Republic, Peru, Australia, Chile, Papua New Guinea, Saudi Arabia and Zambia.

Barrick also has a gold project in Nevada, USA that produced 2.3 million ounces in 2017 at and All In Sustaining Cost of $624/ounce.

It’s no surprise Barrick is looking to grow U.S. production, but a recent investment has raised a few eyebrows.

On May 16, 2018 Barrick took $38 million of its $2.2 billion petty cash and plonked it down on Midas Gold (MAX.T).

Barrick purchased 46,551,731 common shares of Midas at a price of CND $1.06 per share for gross proceeds of USD $38,065,907. Barrick now owns 19.9% of Midas Gold.

Barrick’s investment supports Midas Gold’s continued efforts to complete a feasibility study and permitting of the Stibnite Gold Project, a world-class mining operation that can address legacy environmental impacts and generate economic benefits for the local community.

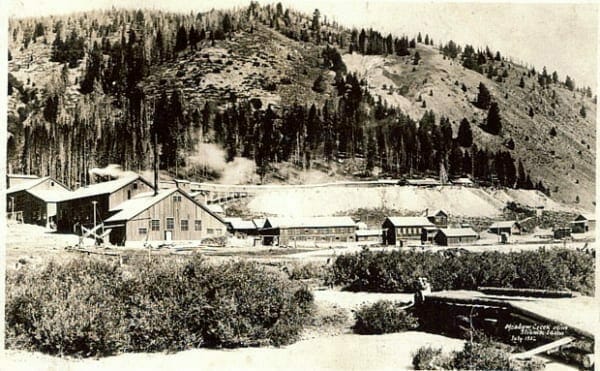

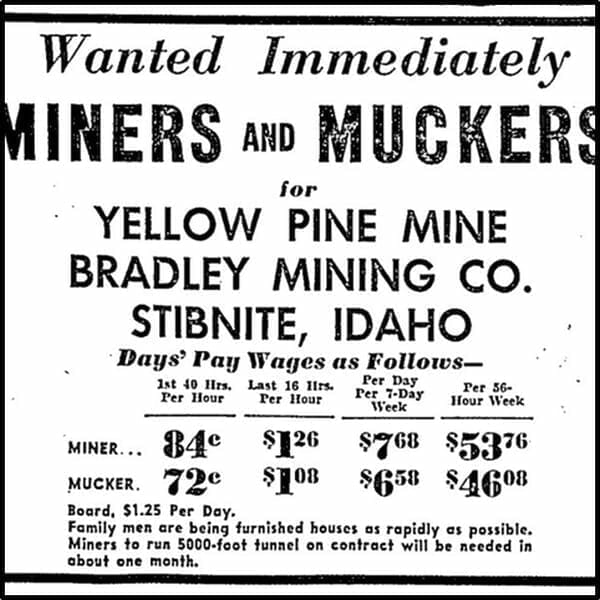

MAX’s Stibnite gold project first gained traction during the gold rush of the late 1800s. By 1938, the area was flooded with miners, and project operators were looking for more workers:

Miners were able to extract large quantities of gold from the Yellow Pine Pit area of the site. However, the operation blocked the passage of fish. Even now, 80 years later, fish cannot swim upstream past the old gold mine.

This is the problem and the opportunity.

As well as gold, there was antimony, which is used as a hardener in lead for storage batteries. China controls most of the global production. The U.S. wants to change that.

After the war, the miners went home to their families, leaving a lot of valuable minerals in the ground.

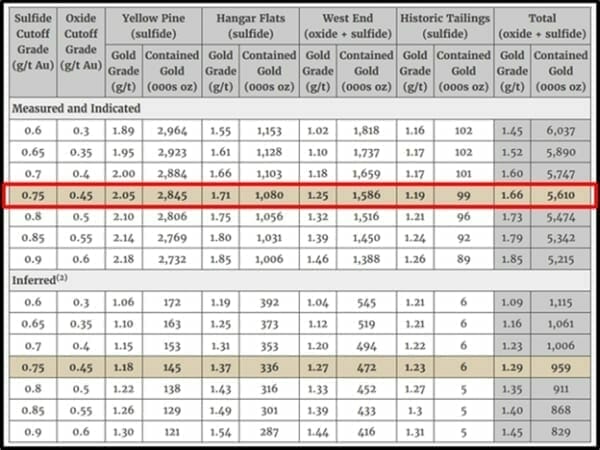

At a sulphide cut off of .75 grams/tonne of gold, and oxide cut-off of .45 grams/tonne of gold – there is 5.6 million total ounces of gold in the Measured & Indicated category – worth about $7.2 billion at current gold prices.

Midas Gold’s promise to Idaho – is: we’ll clean up this old mine site and bring back the beautiful fish – if you’ll let us build an ultra-modern gold and antimony mine.

John Kaiser of Kaiser Research Online is of the world’s leading experts on Midas Gold. He knows the grade, the ounces, the strip ratio, the price of antimony – and the name of the 17th governor of Idaho.

As Stephen Hawking was to Theoretical Physics – Kaiser is to Idaho bullion.

Kaiser recently discussed MAX with Gerardo Del Real of Resource Stock Digest.

“Old miners came in and created big heap leaches and when the ore was spent, they hauled it all up and spread it on top of the tailings,” stated Kaiser, “this is a project that needs to be developed for multiple reasons.”

“It restores this valley to being a salmon spawning area,” continued Kaiser, “It gets rid of the strategic vulnerability the United States has for antimony supply, and of course, it’s an opportunity to make money, to have an entrepreneurial operation fund reclamation work.”

Midas Gold Highlights:

IPO in 2011 Focused on advancing the Stibnite Gold Project, Idaho, USA

- ~US$166m spent on the Project since 2009

- Low geopolitical risk › Idaho, USA –a stable mining jurisdiction

- Brownfields site › Restoration of extensive prior disturbance

- Positive Pre-Feasibility Study › US$832 million NPV & 19.3% IRR @ $1,350/oz gold

- Mondo deposit › 8th largest gold reserve in USA

- Size: 4 million oz gold produced over 12 year mine life

- Superior grade › 1.7g/t gold; 4th highest grade open pit deposit in USA

- Scale › 388,000oz gold/year for first 4 years & 337,000oz gold/year LOM

- Modest capital intensity › US$242/oz life of mine production

- Low all-in sustaining costs › $US 526/oz for first 4 years (cash cost + royalties + sustaining capital)

- Strong after-tax cash flow › US$294 million/year (Years 1-4) & US$254 million/year (Years 1-8)

- Strategic by-products › Antimony + silver with production proven metallurgy

- Exploration potential › All deposits open to expansion and multiple exploration prospects already drilled

Midas Gold has a current market cap of $238 million. In 2012, MAX shares were changing hands for $4.75 each. The stock bottomed in 2015 at $.26. Despite the gloomy gold markets, MAX has almost doubled this year from .55 to $1.07.

That upward price momentum reflects a growing optimism that Midas Gold has won the support of the State of Idaho to repair of the environment with the profits from an economic gold mine.

On February 22, 2018, Idaho’s House of Representatives and Senate passed a joint memorial asking the President of the United States, Idaho’s congressional delegation and the EPA to “approve Midas Gold’s Stibnite Gold Project in a timely and cost-effective manner.”

“The Stibnite Gold Project will be an economic win for Idaho and provide a huge opportunity for many families in my district and across the state,” said Rep. Terry Gestrin, lead sponsor of the memorial. “The Project will be a $1 billion investment in Idaho and bring hundreds of well-paying jobs to rural communities. These are jobs and this is an industry that people in Idaho welcome.”

“Midas Gold is not going to build this project by itself,” stated Kaiser, “Its challenge now is to get the feasibility study done, get the permit, and then one of the big producers, Newmont, Barrick, ones with experience with autoclaves and roasting refractory. One of them will take them out and develop this project.”

Resource extraction projects have been responsible for more than a few ugly messes.

Midas Gold is an example of a mining company that is strategically positioned to palpably benefit the environment.

Barrick Gold just invested $38 million in this project. Check out the website. See what you think.

Full Disclosure: Equity Guru has no commercial relationship with Midas Gold, but the writer does own stock.