How about a couple of charts?

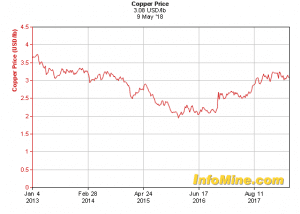

This first one is the copper price. It really seems to be getting cozy with the US $3.00 level. It doesn’t like spending much time below it. Not lately anyway.

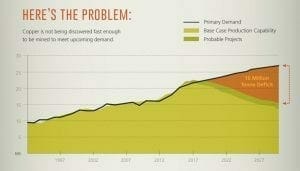

The reason for this recent strength is fairly obvious. In a nutshell, copper is in a supply deficit. This is mainly due to demand from EV (Electric Vehicle) manufacturers and global infrastructure projects.

(chart courtesy of Visual Capitalist)

(chart courtesy of Visual Capitalist)

Demand for the metal is expected to rise from the current 23 million tonnes to 25.1 million tonnes in 2022. It’s highly doubtful that future mining – mining scenarios plagued by low grades, massive capital expenditures and hefty operating expenses – will meet the increasing demand. An even more serious supply gap could develop. If that occurs, three-dollar copper will be a fond, distant memory.

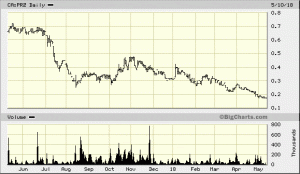

The next chart shows the price of a copper explorer with a large land package in a mining friendly jurisdiction with high-grade district-scale potential.

There’s something wrong with these pics (the first chart and the third). It’s the disparity between the two that doesn’t play.

I could see this level of disinterest if we were talking about a low-grade bulk tonnage deposit tucked away in the snow-capped mountains of British Columbia. But we’re talking about a high-grade deposit(s) in an area with good infrastructure, cheap power and experienced local labour.

The above chart depicts the recent price action of Prize Mining Corporation.

Prize Mining Corp (PRZ.V) released additional assay results yesterday from an ongoing channel sampling program on their Manto Negro Copper Project in Coahuila State, Mexico.

The results are consistent with what they have reported in the past, on February 28th, and then two weeks later on March 14th of this year.

The results – the current focus of this round of sampling – are from the Manto Negro Zone on the company’s El Granizo concession where strong copper mineralization is exposed on the surface for a strike length of 550 meters, dipping moderately to the southwest.

Fifty-one chip channel samples were taken across the width of the exposed mineralized beds along this zone.

Highlights from this current release include:

- 2.73% Cu and 58g/t Ag over 6.00 meters

- 1.78% Cu and 40g/t Ag over 5.20 meters

- 1.65% Cu and 36g/t Ag over 7.00 meters

Commenting on this latest batch of results, Michael McPhie, President and CEO of Prize Mining stated:

Our sampling continues to demonstrate consistent and strong copper grades and widths in the main showing areas. We are gaining a better understanding of the mineralization and using that information to define drill targets. Furthermore, reconnaissance sampling on five other prospects spread over a 2.4km by 1.2km area underscores the widespread and locally high-grade nature of the copper-silver mineralization. With almost 18,000 hectares of prospective ground and more than 35 known showings, we are confirming the district-scale potential of the Manto Negro Project.

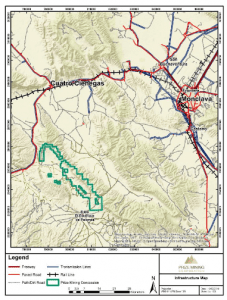

Some 16 kms to the north of El Granizo (the area hosting the above high-grade Cu results) lies the Don Indio concession.

This area hosts the historic Pilar Grande Mine. As you can clearly see on the above map, there are a number of copper-silver prospects scattered along this prospective stratigraphy, some of which contain artisanal workings.

This area is in the process of being systematically sampled in order to generate high priority drill targets.

Highlights from preliminary sampling in the area include:

La Cuchilla Mine:

- 0.99% Cu and 38g/t Ag over 4.20 meters

These ‘old dumps’ in the vicinity of the La Chuchilla Mine, approximately 1.2km along strike to the north-northeast of the historic Pilar Grande Mine, contain some noteworthy high-grade material as demonstrated in the following grab samples.

- 11.40% Cu and 622g/t Ag; 3.01% Cu and 436g/t Ag; and 2.80% Cu and 280g/t Ag

Note that ‘grab samples’ are generally considered biased samples. More often than not, the geologist will choose the best looking chunks of rock – those with the most striking patena – as their representative sample.

El Tajo Prospect:

- 1.26% Cu and 90g/t Ag over 2.50 meters

El Nopal Prospect:

- 1.10% Cu and 33g/t Ag over 5.90 meters

El Palmito Prospect:

- 0.81% Cu and 27g/t Ag over 3.65 meters

Las Palmas Prospect:

- 0.81% Cu and 78g/t Ag over 1.80 meters

The Plan:

Prize wants to put its Manto Negro Copper Project into production asap. It can be a long road to production, but the company believes they can expedite the process. Executive Chairman Somji stated recently that he envisions a speedy permitting process followed by a fast buildout.

In the meantime, they need to drill, and they need to keep drilling. That’s what the market is waiting for. That’s what I’m waiting for.

Cash:

The company currently has approximately $1.3M in its coffers. Of that total, a little over $800K is from a flow-through financing the company tabled in the 4th quarter of last year.

Due to the Canadian rules concerning how, when, and where flow-through funds may be used, those funds must spent in Canada, and they must be spent this year.

To that end, the company will run an exploration program, one which includes drilling off a number of high priority targets, on their Kena-Daylight Project in BC. Kena-Daylight is the company’s secondary asset. Greater discussion on the project can be found here, by Equity Guru’s Lukas Kane, and here, by yours truly.

The PP:

Drilling is expensive. In order to facilitate a proper poke to commence drilling Manto Negro, the company recently announced a private placement, a PP of $2,000,000.

The PP consists of 11,111,111 units priced at $0.18 per unit (the size of the offering may increase if the demand is there). Each unit consists of one common share and a half warrant (each whole warrant buys one share of the company at $0.30 for a period of twenty-four months).

The positive: the company will soon be cashed up and ready to drill the ass off of Manto Negro.

The negative: it’s a dirt cheap PP. If you go back to the price chart near the top of the page you’ll note that the company’s stock was recently trading closer to the strike price of the enticement warrants included in this offering. Not impressed with this deal. Not one bit.

Moving along…

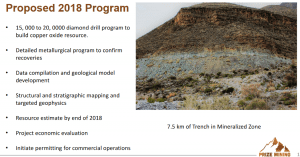

The company will soon have funds to meet their 2018 goals.

Prize’s plans for 2018:

The Not-So skinny:

Prize’s flagship asset, their Manto Negro Copper Project, has a number of positive attributes:

- it’s in a mining friendly jurisdiction.

- the company has a good working relationship and agreements in place with two local ejidos communities.

- there’s good access to skilled mining labour

- it’s proximal to mid-size cities with all of the conveniences.

- it lies in close proximity to a highway and rail

- a 240-kilovolt powerline runs just to the north of the property

- there’s good, safe road access leading into the project

- the company boasts 100% ownership of approximately 17,600 hectares of prospective ground

- the underlying geology at Manto Negro is that of Sedimentary stratabound oxidized “Red Bed type” copper deposits

- the project is analogous to the Kupferschiefer type and Zambian/DRC Copper Belt deposits – some of the richest on the planet.

- it sports high-grade copper with some areas demonstrating strong silver, lead and zinc credits – zones average 0.73% to 5.5% Cu, 19 to 793 g/t Ag

- pipes and veins of richer Cu-Ag oxide and sulphide mineralization outcrop at various locations (note the photos above)

- it promises to be a low Capex project (low capital expenditures)

- preliminary tests demonstrate good metallurgy (good Cu recovery rates)

I’d be remiss in not stating that Manto Negro is in the hands of a very competent management team. Their resumes speak for themselves.

Final Thoughts:

The company’s goal is to begin the development of Manto Negro in 2019, leading into initial production by 2020/2021. Some think this timeline is too aggressive. I’d like to think that this management team can pull it off.

We stand to watch.

END

~ ~ Dirk Diggler

Full Disclosure: The author does not own shares in Prize Mining.

Mike McPhie is buried deep with the BridgeMark group scam and stakeholders have been completely bent over. O/S has tripled and the vast majority of cash was flipped back to BridgeMark. This is VSE scammery at it’s very worst.