US Treasuries YIELD, Blockchain & Gold Caught in the Draft

The US markets, who are obsessed with round numbers, largely steadied themselves after the fallout over 10 year treasury yield hitting 3% yesterday as the gold churn continued and the crypto / blockchain buzz just wouldn’t quit.

Annnnnnnnyyyyy Day Now

Gold closed at $1322/oz, and continues to bounce about in that $1320 – $1360 trading range, looking to either break out or fall apart. But in the context of the coming inflation that the 10 year Treasury market is telling us about, gold bugs are sure it’s going to break out any day now (but aren’t they always?)

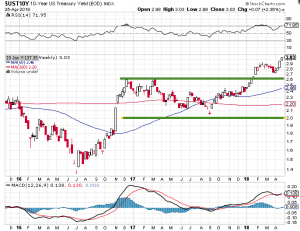

Here’s the yield on the inflation-barometer US 10 year treasury note, showing a clear breakout.

Gold is also an inflation barometer, though one that is impervious to the Fed’s rate setting.

It’s banging on the ceiling of that sideways pattern at the moment, deciding which way to break.

Thanks to Stockcharts.com for the charts.

Quality Gold Deals are Getting Traction

The gold bugs are acting like it’s a coiled spring.

They’re leaning in to clean, brand-name stories with news like K92 Mining (KNT.V) – up 6% on big volume today behind eye-catching gold numbers in drill results off of the expansion of their operating project in Papua New Guinnea.

Pacton Gold (PAC.V) also caught a lift today, trading up 20% on 2.6 million shares as the stock price eclipsed the subscription price of their recently announced $4M private placement. Look for that one to come back oversubscribed.

Pacton got new life last November after bringing on former Papilon Resources director Alec Pismiris as CEO. Papilion was a successful development story, acquired by B2 Gold. EG’s foreign correspondent from Down Under and ASX expert Craig Amos might have some insight on Pacton, who are developing some Australian gold properties that they picked up shortly after Pisimiris showed up.

Gold Is Old. Get Digital.

Many remain confused about why anyone would want to keep a bulky yellow metal when they could have a digital figment of their collective imagination.

The blockchain / crypto sector remained busy as crypto prices gave back yesterday’s gains and dot com-era tech types went on calling it a ponzi scheme, pump-and-dump Nigerian scam, lottery-hustle. (A colleague told me today he thought they did that more on drops than climbs. I contend that the direction doesn’t matter. Those post blizzards show up on swings.)

But viability has nothing to do with it. The blockchain and crypto stocks are showing lots of action in this market, but mostly standing still, price-wise. Much covered client company Hashchain (KASH.V) announced a very aggressive acquisition of an un-named target company that amounts to them buying a series of rigs and the staff and power that run them for an all-stock deal that doubles their outstanding shares.

Noted Hashchain shareholder and our site’s header model Chris Parry wrote a post that reads like he’s not quite sure what to think of it. By my count, if mining crypto is a company’s raison d’etre, an all stock deal for the gear they need to do it sounds like the move to make. But, just like everyone else, I have no idea what an operating rig is worth. Did KASH just set the price at $11,000 in stock per operating, powered, managed rig over 4 years?

KASH spent part of the day halted, released the acquisition news and a summary of the Feb financials, resumed trading half an hour before close, and finished the day down 8.8% on 6.5m shares, three times its average volume. It’ll be watched closely tomorrow morning.

Hashchain is called “KASH.V,” And There’s A “DASH.V”, Too

Recently listed crypto miner Neptune Dash (DASH.V) was among the top gainers today in the blockchain sector, up 11.4% to $0.395 on six times its average volume. No news on Neptune Dash, but we’d like to point out that their website is everything we’ve ever wanted out of a modern crypto-chain, block-currency stock. In a sector that suffers from perpetual confusion, this quick-loading, continuous scroll baby has a reader convinced they’ve got an expert’s gist of it by the time they hit the bottom of the page.

The millennial-driven digital money sector has to feel comfortable with a leadership team featuring a CEO and COO who are both named “Kale,” but spell it differently. Cale Moodie and Kalle Radage look like the type of guys who are good at instagram but, more to the point, this website shows they know how to get things across to investors.

Thanks to coinmarketcap.com for the charts

The breakdown chart is a good way to project a nuanced take about crypto and fake like you know something. Neptune Dash is all about mining DASH. I guess it’s easier or something, but I don’t really know. Go ask Khale or Qale.

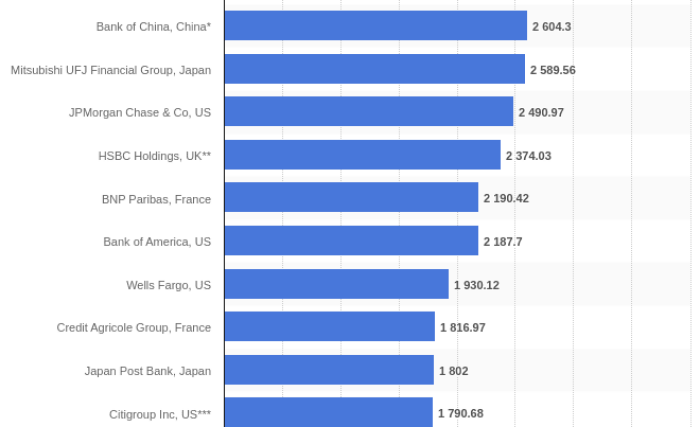

According to this, the biggest gainer of 2018 by market cap is “Other,” which sounds like it’s a proliferation of new, exotic tokens clocking ICOs more than money pouring into any one thing.

The Author does not presently own a stake in any of these companies. He may own these companies as part of a fund.