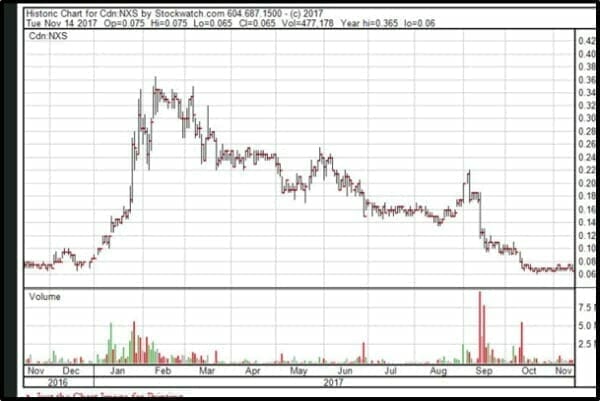

Nexus Gold rolled back its stock today. A “rollback” – or “share consolidation” typically occurs when a publicly traded company is in a weak market with

- A low share price

- A lot of shares outstanding

- Very little cash

With no help from a dismal gold market, Nexus Gold (NXS.V) met all those conditions:

• .025 stock price

• 146 million shares out

• Broke.

On Friday, Nexus executed a 10-1 roll-back. The company is now trading at .22 with 14.6 million shares outstanding.

If life was just math, this rollback would have zero effect on existing share holders.

[If you owned 17% of Nexus on Thursday – you still own 17% of Nexus – you just own a 10th the number of the shares – each share being worth 10 x the price.]

But life isn’t just math.

There’s other stuff.

Like music, Guinness and Vietnamese beaches.

Typically, post-rollback shares drift lower.

It partly the formal recognition of the 3 negative factors listed above. Also, the opportunity to quickly double/triple your money is diminished. If you own a .02 stock and the stock goes up a penny – you’ve booked 50% gain.

A higher share price makes big jumps harder to achieve – while protecting the shareholders – to some degree – against violent single-day drops. It also opens the company up to new investment funds (many funds can not invest in stocks below 10 cents).

On Friday, just hours after the rollback – we had a chat with Nexus Chairman and COO, Alex Klenman.

He wasn’t happy.

“We had a great first half of 2017,” stated Klenman, “second half, not so great and mainly because of the share dump on Sep 15 and Oct 11 – which we feel was a takeover attempt.”

Equity Guru’s Chris Parry weighed on that issue in an article titled, “Nexus Gold Got Shanked by Dark Money”.

“On three dates, millions of shares were dumped into the market at once, on no poor news, and for no apparent advantage,” wrote Parry, “If you’ve got $500k of shares in NXS and you don’t like what it’s doing…you might call the company and say, “Got anyone who might like to give me a good price for it?” If the CEO does, they’ll perform a ‘cross’, and the company stock stays high while the seller gets out clean.”

“In mid-September, Nexus got cratered twice in two days,” continued Parry, “This activity appeared to be the antithesis of smart trading, if you wanted to get the best price for your stock, and appeared destructive in nature, especially being as it happened “in the dark”. (untraceable trading).

The really strange thing about Nexus downward slide is that – from a geological and metallurgical perspective – Nexus Gold has been kicking butt in Africa.

NXS has 3 gold projects in Burkina Faso:

- The 178-sq km Niangouela gold concession where the company has delineated a 1km quartz vein and shear strike. Eight of the first nine diamond drill holes on the property returned positive gold results, highlighted by a 4.85m intercept of 26.69 g/t.

- The 38.8-sq km Bouboulou gold concession with historical drill results including 40m of 1.54 g/t. The property contains three distinct gold trends, each extending 5000 metres (5km) in length.

- The 250-sq km Rakounga gold concession contiguous to Bouboulou property, contains many artisanal mines.

We first wrote about NXS on March 7, 2017 commenting on a shiny drill program.

Nexus hit gold on eight of nine holes, with four of those being classed as ‘significant’. The best intercept was 4.85 metres of 26.69 grams per tonne. That’s almost an ounce per tonne across an almost 15-foot section at a depth of about 165 feet.

“In December the president/CEO informed a few of us on the board that we were essentially out of money,” stated Klenman.

The exploration burn rate was higher than projected – and the communication between the CEO/CFO was inadequate.

“So, they’re out,” explained Klenman, “We’ll get a new CFO, I will take over as president and CEO, and bring a senior mining executive on board to eventually be chairman.”

“The reality is we were between a rock and hard place,” Klenman continued, “Languish sub .05 cents, with little prospects of financing. Or, we make a tough decision and take the money contingent on a consolidation. Those with the dollars dictate the terms, unfortunately. As old as commerce, those are the facts. To remain a living, breathing entity, we had to make the tough call.”

On December 13, 2017, Nexus announced that “drill results now outline a trend of gold occurrences extending for 16 kilometres between the Company’s Rakounga and Bouboulou concessions.

Highlights include:

Hole RKG-17-RC-008 intersects 34m of 1.00 g/t Au, including 4m of 5.60 g/t Au

Hole RKG-17-RC-009 intersects 22m of 0.57 g/t Au, including 4m of 2.01 g/t Au

Burkina Faso is the fastest growing gold producer in Africa. Eight new mines have been commissioned there over the past six years. The country has a mining corporate tax rate of 20%, and a sliding royalty on gold production from 3-5%.

In the 2 years after the last big recession (Jan 2009-Jan 2011) gold went up 300% ($600-$1800), and the gold juniors soared.

When that happens again, Burkina Faso, the little African country that no-one talks about, will suddenly be very, very hot.

Klenman told us that “I plan on buying in open market and participating in the next financing. In the end, maybe we can get this into the 1$ range and provide profit for anybody holding at a higher average.”

Nexus rolled back.

New management, new financing, new focus.

Now it’s rolling on.

Full Disclosure: Nexus is an Equity Guru marketing client and we own stock.