The story on FinCanna Capital (CALI.C) has always been, from day one, that they’re going to go out of their way to do things clean.

That’s cost early investors some short term profits, to be honest, because clean isn’t the preferred way to hit the markets for a lot of cannabis companies and their hype train-riding investors. It’s been all massive financings leaving companies diluted, big marketing campaigns that leave share charts looking like heart monitor readouts, day-trading craziness, acquisitions to buttress market cap, and hype… so much hype.

If the cannabis companies on the financial markets were guests at a house party, Namaste (N.C) is wearing a lampshade, CannaRoyalty (CRZ.C) is in the yard playing guitar ballads for co-eds, Aurora Cannabis (ACB.T) is inviting everyone to do a kegstand, and FinCanna… well, he’s holding the car keys.

FinCanna drives everyone home at the end of the night and is totally in every girl’s friend zone. He’ll help you move. He gets his security deposits back.

That’s okay. Because that guy, though he doesn’t do well at the party, eventually ages nicely into a good career.

Trust me on this.

FinCanna came to the markets with a simple story to tell. They wanted to help finance licensed California cannabis projects, which traditionally don’t have easy access to startup and expansion capital, in return for a piece of the profits.

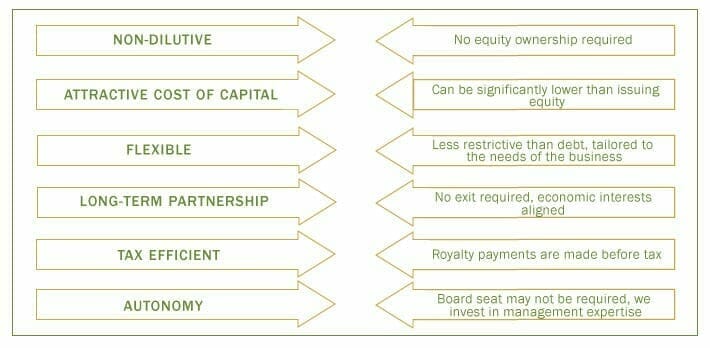

FinCanna’s royalty financing offering is an alternative or complement to debt and equity financing. It provides the advantage of allowing investees to maintain financial flexibility and control of their business as opposed to entering into arrangements that may include restrictive debt structures or giving up an ownership stake.

Their first deal was with the private Cultivation Technologies (CTI), which was building a licensed production facility and extraction facility in sunny Cali. FinCanna came in with some necessary funds that allowed them to hit the ground running.

To be located on six acres, the 111,500 ft. planned [CTI] Coachella Campus will include vertical grow cultivation, extraction and manufacturing, testing, distribution, and centralized processing, designed to employ innovative, best-in-class solutions.

FinCanna is entitled to complete its funding to CTI in exchange for a Royalty of 14% of CTI’s revenues from its Coachella Project.

FinCanna also has the right to finance CTI’s next 2 licensed cannabis facility projects on the same terms as the Coachella Project

That’s part I: For part II, CTI has helped finance an interim extraction facility for CTI, and not a small one.

Cultivation Technologies Inc. has established an interim medical cannabis extraction facility on the Coachella Property in accordance with CTI’s Conditional Use Permit. This lab will produce licensed medical cannabis products before the permanent extraction facility at the Coachella Project is completed. The Interim Facility can process up to 6,000 pounds of biomass per month which can produce approximately 3.7 million grams of raw oil per year, with room for expansion.

FinCanna is entitled to receive 50% of the profits from the Interim Facility.

It is expected that, upon completion, the Coachella Project will be able to process 30,000 to 50,000 pounds of biomass per month, or the equivalent of 18 million grams to 30 million grams of raw oil per year.

And there’s more:

FinCanna has entered into a royalty agreement with Green Compliance, [which] offers a state-of-the-art enterprise compliance and point-of-sale software solution (“ezGreen”) for licensed medical cannabis dispensaries and cultivators. Green Compliance helps its customers comply with both the Health Insurance Portability and Accountability Act (“HIPAA”) and State Laws by ensuring patients’ confidential data is being handled properly, helping to protect from possible security breaches and financial and criminal liability resulting from potential violations.

The deal: $3m in funding in return for a perpetual royalty of 10% of consolidated gross revenues.

That news didn’t really rock the richter scale, but it should have.

We dug into EZGreen and found:

Powered by one of the United States’ largest point of sale (POS) dispensing companies, ezGreen’s flexible platform has the ability to work with your Seed to Sale of choice.

Our software technology has allowed thousands of dispensaries to report through the PDMP, state and federal reporting standards with hipaa compliance for over 17 years in the pharmaceutical industry. Our open API will allow for integration with any seed to sale software.

We offer an anonymous customer database for recreational users which allows dispensaries to recall products if required.

The EZGreen deal only pays off for FinCanna if the company is making revenue. It appears that’s no stretch.

- 17 Years of Application Maturity

- Thousands of Current Dispensing Clients

When FinCanna hit the public markets, there was a lot of shrugging. Some folks didn’t feel California while the feds were talking about kicking in dispensary doors for a hot minute, others didn’t understand what CTI was, or see the value in the EZGreen deal. Others still had to be walked through the royalty model and understand how it makes sense over just getting your own license and building your own facility.

That was to be expected. If you bought FinCanna early and you’ve been sweating the drift down since, be chill.

You’ve invested in a royalty company. As such, your returns are not short term. You’re not going to rocket on news every second day. What you’re betting on with a group like CALI.C is that it’s run by people who know more than you, are closer to the Cali scene and know who the real players are, and understand how to invest in things with low risk and high upside. They’re the actuaries, while you’re running around like a toddler at a slip’n’slide party, screaming “WHARS MAH TRIPLES!”

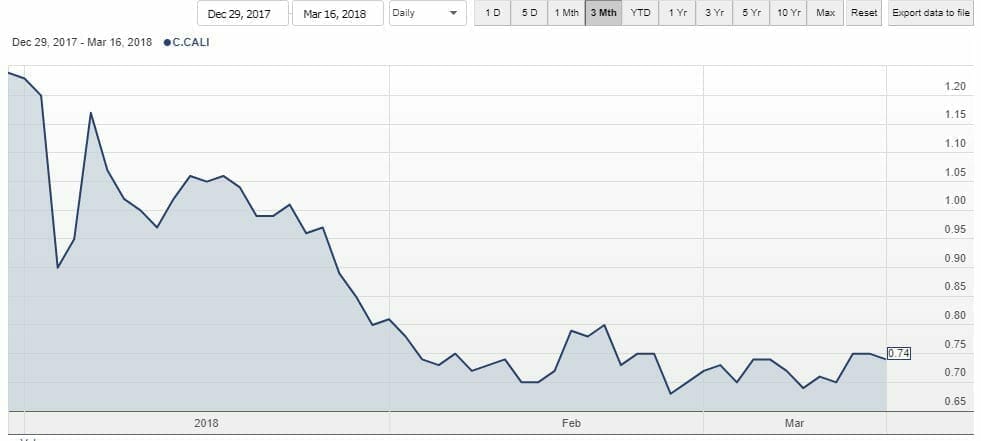

CALI’s life on the public markets has been one of downward pressure, but that pressure is made to look far worse than it is by the opening few hours of its public life.

That big pop on day one has tarnished everything in the time since.

In fact, if we take the three month chart as our exampe, it looks a lot more interesting.

I mean, still a down stretch, but not absurd.

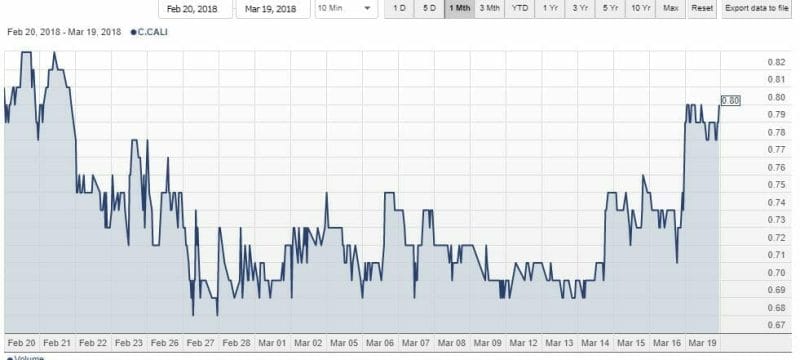

If we go down to one month, then it looks… good?

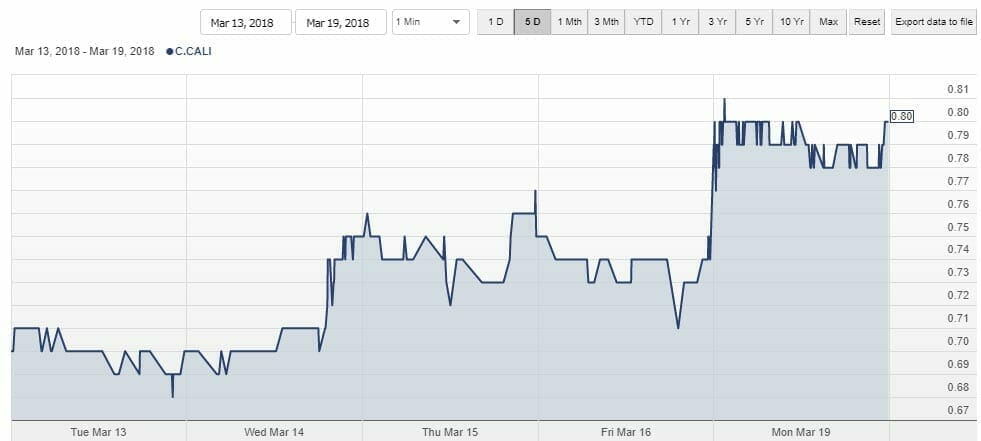

Huh. And the five day?

Well that almost looks like the stock is lifting off.

If you bought FinCanna on opening day at $2.25, frankly, I don’t know what to say to you. Ballads will be written about your great act of charity towards everyone else on the markets.

But if you bought at around a buck and it’s moving up to $0.80 right now, I think it’s a time to make some big decisions regarding the future. Lock in your losses, or plant roots?

Is FinCanna doing what it said it would? Are their deals fair and likely to be profitable at some point soon? Is California likely to expand its customer base markedly over the next so long, and will the black market shrink while the licensed facilities paying FinCanna royalties expand?

Today’s CALI corporate update was, for mine, a beautiful thing. No scariness, no unexpected changes to the landscape, no panic.

I mean, there are a lot of high points listed above, and they’re not even half of what’s covered in the release.

Others worth noting:

- CALI got its US ticker listing (FNNZF)

- CTI extraction facility is quickly moving to commercialization

- The extraction facility has a very large capacity (3.7m grams of raw oil per year)

- CTI’s new Coachella Premium vape cartridge product is going to market

- CTI is doing white label manufacturing and extraction at its facility for other companies without the permits to run solo

- CTI is building out its sales team

- The regulators are squeezing black market operators, which helps CTI grow quickly

- Tax changes are likely to positively impact licensed providers

There are a lot of cannabis companies on the various exchanges that you can look at and poke holes through. There are a lot of big dreams and big promises and risk-heavy scenarios and dependence on regulators bestowing companies with permission to operate.

FinCanna doesn’t have all that. It said it would do a thing, it’s now doing that thing, it’s operating responsibly and legally and successfully, and its partners are even doing what they said THEY would do.

That you can buy it near the bottom right now is a beautiful thing, if you believe in the business model and the people enacting it. That it’s starting to lift consistently now is a similarly interesting thing.

We can’t know what the future holds for a public company. Maybe the news is great, maybe it’s not, maybe it comes thick and fast, maybe you have to wait.

But I do know that risk is all important. And with FinCanna, the risk largely lives in the area of ‘people struggle to get it.’

Other companies, especially in the streaming/royalty/financing space, have experienced that same issue. What they’ve shown is, this is not a problem that will last forever.

A bet on FinCanna right now is a bet California will be a place of much cannabis business, that such businesses will make the sort of money we’ve long suspected they’ll make, and that CALI’s board and execs are trustworthy in their execution of their gameplan.

They’ve shown nothing but trustworthiness to date. This is the time to take FinCanna very seriously.

— Chris Parry

FULL DISCLOSURE: FinCanna is an Equity.Guru marketing client, and the author owns stock in the company.