Beijing, China – I’m currently staying in a 400-year-old neighborhood, called 景阳胡同1号四合院 [Jingyang Hutong No.1 Siheyuan].

During the day, it’s a noisy, bustling hive of foot traffic.

At night, it’s silent – except for the constant hacking and coughing of my neighbours around the courtyard.

In a minute I’m going to explain how these hacking Chinese urbanites have destroyed China’s zinc production and how you can profit from it.

But first – let me fill in the back story so you understand this isn’t a surface ripple – it’s a tidal shift.

Researchers from Berkeley Earth estimate that 1.6 million Chinese die every year from pollution-related health issues.

The annual economic cost is about $700 billion – from medical expenses, hospitalisation and lost productivity.

The 2.5 PMI index measures the really harmful pollutants – the ones that get down into the lungs and never leave.

The World Health Organisation says anything above 40 is unhealthy.

At this moment – in real time – the pollution is 11 times worse in Beijing than my hometown of Vancouver, BC.

That’s hardly surprising.

But here’s what might be: today is a “clean air day” in Beijing.

The normally ubiquitous gas-masks are gone.

The PMI 2.5 index is often above 800.

Take this to bank: the Chinese government is motivated to reduce pollution.

No, they’re not gong to quit coal over-night.

No, they’re not going to forbid the swelling middle-class to purchase SUVs.

They are going to do what they can do, without derailing the economic train.

Example: In 2017, 60% of zinc mines in Sichuan province were shut down after failing inspections from the Environment Protection Unit.

Zinc is used to galvanize steel or iron, against rusting.

It didn’t take long for the effect to be felt: in January, 2018 refined zinc imports to China surged to 67,111 tonnes, up 287%.

The global market for refined zinc was in deficit by 485,000 metric tonnes over the first 11 months of 2017, with inventories plummeting by 320,000 metric tonnes over the same period.

China is now looking for cheap, reliable zinc imports.

That’s a game-changer for zinc developers, close to international shipping centers.

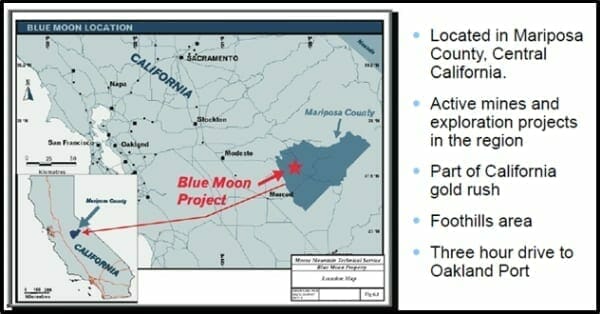

Enter Blue Moon Zinc (MOON.V) which own 100% of the Blue Moon Zinc deposit in east central California.

Main transmission lines and a hydroelectric power generation facility are both within one mile of the property.

Seaports, rail and trucking routes are all accessible. It’s a three-hour drive to the Oakland port.

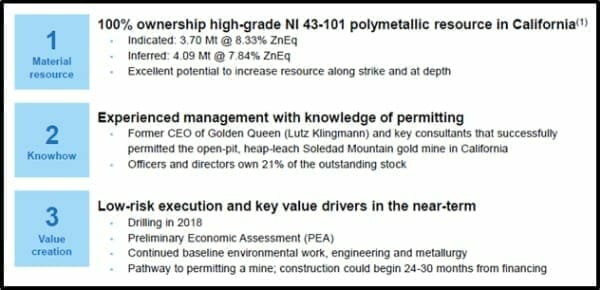

On October 2, 2017, MOON announced an updated NI 43-101 Mineral Resource estimate announced which saw a 20% increase in the indicated zinc resource to 377 million pounds of zinc.

There was also a 23% increase in the inferred zinc resource to a total of 395 million pounds of zinc, using a 4% zinc equivalent cut-off grade.

Last October, Blue Moon engaged a Reno Engineering firm (MDA) to begin a Preliminary Economic Assessment (PEA) of the Blue Moon zinc project in the foothills of California. Completion of the PEA is expected Q1, 2018.

In 2015 MDA co-authored a 2015 feasibility study for the Soledad Mountain mine in Southern California that went into commercial production the next year.

“We are confident in MDA’s experience to develop a high-quality technical report that will provide our shareholders with a preliminary analysis of Blue Moon’s economic potential,” stated Blue Moon’s CEO Patrick McGrath.

The updated Mineral Resource estimate is being utilized in the PEA.

A PEA is often a precursor to a bankable feasibility study. At that point things get real. The story-telling stops and the bean-counters take over. Assume, for the sake of argument, your mine has a capital cost of $100 million.

The bankable feasibility study will calculate the risk of the lender losing all or part of the $100 million.

That risk calculation is one of the reasons veteran mining men avoid countries with unstable governments or weak mining jurisdictions.

If an election result could torpedo your mine, it’s going to have to show a much higher level of profitability to offset that risk.

The Blue Moon zinc deposit had modest production during World War II with approximately 56,000 tons mined at 12% zinc. During the 1980s scoping, optimization studies, metallurgy testing and baseline work were completed.

In 1991 the local Californian County issued a permit to build a shaft for underground development. The permit has since lapsed but “past production and historical issuance of permits” signifies a history of pro-mining sentiment.

The MOON team “includes two members with comprehensive knowledge of mining in California including building and revitalizing mines.

Lutz Klingmann brought the Soledad Mountain mine into commercial production, and Lawrence O’Connor restarted the Mesquite mine as VP Operations of Western Goldfield (now New Gold).

MOON’s current Mineral Resource is open at depth and along strike and historical metallurgical testing indicates excellent recovery and a clean zinc concentrate.

Historically, China has always met its own zinc demand.

China importing zinc is like Jamaica importing pot.

It’s hard to wrap your head around.

But that’s what is happening.

MOON’s stock price has doubled in 2018.

Think you missed the ride and will be left standing alone without a dream in your heart?

It’s trading at .12 with a market cap of $11.7 million.

The butterfly effect: man coughs in China – a truck full of zinc rattles down a Californian highway.

Full Disclosure: Blue Moon Zinc is an Equity Guru marketing client, we also own stock.