You Can’t Keep A Good Bull Down

Two weeks ago, global equities markets fell out of bed right behind a cryptocurrency apocalypse. The combo hit market junkies hard, putting the poorly diversified on suicide watch.

I wrote at the time that the overbought bull markets don’t just straight up fall apart all at once and just because. Investors need to see the emergence of tangible, real-world events to anchor them in their fear and keep them from chasing the bounces en-mass as the greed pulls them back in. The prospect of interest rate hikes isn’t an ‘event’, it’s a rumoured adjustment that’s likely to become baked in. The messy derivatives products that had the dirty end of the stick pointed at them don’t appear to have caused any lasting damage to anyone writing them or trading them, and in any case: they got wound down. Nothing to see here. So we carry on for the time being. Steady as she goes.

The crypto-collapse-come-recovery that appears to be happening in parallel to the broader equities action had two real-world scapegoats. My personal favourite was the Facebook ban on crypto ads. Bubbles need inflation, advertising is the bellows that delivers it, and FB is the god emperor king of advertising. It left a wake of dead or lame newspapers and radio stations next to Amazon’s shopping mall carcasses, just to send a message.

The more direct line goes through a trading ban in South Korea. In a mid-January panic move, authorities in South Korea got all indignant and threatened to ban crypto exchanges. They walked it back yesterday. The actual exclusion of South Korea from the crypto markets at large would indeed put a direct choke on the buying, and the market knows it. Presumably, the South Korean financial establishment didn’t much care for the nuveau-riche crypocurrency crowd sucking up capital that’s theirs by right, so they got a bit reactionary. The walk back was like when dad realised that if he took your car keys for real, he was going to be the one driving your little brother to and from karate class. There’s no sense letting good investor appetite go to waste. Better to cut themselves in on it.

Much like the broader markets, with no real-world events to cement The Fear, it’s back to greed as usual and here comes the crypto-bounce. There’s been time to re-set. To re-evaluate the cryptocurrency universe and an investor’s place in it. It’s openly become the target of larger pools of more “sophisticated” money, who know media momentum when they see it and are ready to find their groove in it if only to keep from seeming stupid. Would a hype-chaser be buying a dip? Of COURSE not! This is a value play, Theodore.

Time to Re-Deal, So Here Comes The Shuffle

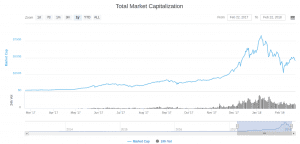

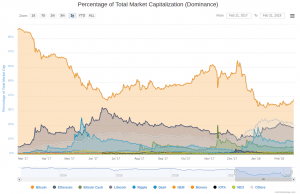

Thanks to coinmarketcap.com for the charts.

As a whole, cryptocurrencies have a market cap of $US449 billion right now. That’s slightly larger than JP Morgan Chase, and $70B smaller than Facebook. These charts make a case that money isn’t leaving the space, so much as it’s diversifying within it. There’s a clear move towards more modern tokens, each with their own angle, each trying to become part of the future.

This action makes Blockchain catnip flavoured crack for the smallcap world. Between the media-hype, ongoing legitimate mystery, and the ever-popular disruption narrative, it’s like something Howe St. cooked up in a lab. “Blockchain for [whatever]” is already a worn out joke, and that isn’t stopping anyone. Remember when it was “Uber for [whatever]?” Simpler times. People understand Uber.

This explosion of new tokens is an effective trial-by-fire to show us all what blockchain is and isn’t capable of and good at. Listed venture companies are going to be designed and floated to give us exposure to growth and revenue both real and fictional. In our next instalment, we’re going to give you an honest shot at telling them apart.