Seven weeks ago (December 6, 2017) ago we gave you 9 strong reasons to invest in Zinc One (Z.V).

- Potential near-term production restart

- Drill-confirmed, exploration potential along 6 km corridor.

- Low risk due to past production

- Mature mining jurisdiction.

- Exceptionally high grade, at surface

- Massive exploration potential.

- Anticipated new resource estimate.

- Proven metallurgy

- Accomplished management team.

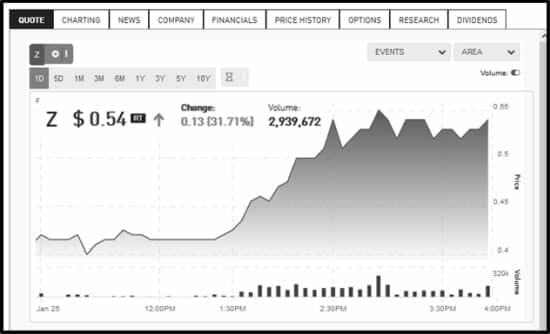

Since then, Zinc One’s stock price has risen 50%.

A move from .36 to .54 tells us others are catching on to this company’s potential.

A move from .36 to .54 tells us others are catching on to this company’s potential.

An anti-corrosive element added to iron or steel to prevent rusting – zinc is the metal equivalent of a Class 5 Italian plumber with a hairy bum crack.

It’s not beautiful to look at.

But what zinc lacks in sex appeal it makes up for in utility.

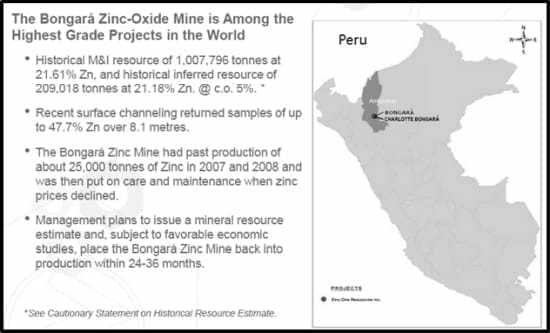

Zinc One controls the Bongará Zinc-Oxide Project and the Charlotte Bongará Zinc-Oxide Project in Peru – which lie at the end of a 6-kilometer trend of known zinc.

On December 19, 2017 Zinc One reported results from its surface-sampling program the Bongará Zinc Mine Project in north-central Peru.

Highest grades include “a surface channel sample with 31.92% zinc over 32.2 metres, a surface channel sample that yielded 28.98% zinc over 51.2 metres, and 36.50% zinc over a 6.0-metre depth in an exploration pit.”

To put that in perspective, Teck’s (TECK.NYSE) Red Dog Mine in Alaska produces an average head grade of 15% zinc. In 2016 Teck’s mine made a gross profit of about $500 million.

On January 25, 2018, Zinc One released more good news from its “ongoing surface-sampling program at its Bongará Zinc Mine Project in north-central Peru.”

After six hours of trading, this is what the market thought of the news.

Highlights include a surface channel sample with 45 metres of 27.7% zinc and 4 metres of 30.5% zinc from an exploration pit.

The high zinc values augment previous high-grade results from samples collected at Mina Grande Sur, Bongarita and Mina Chica.

“All three zones lie within a mineralized system that has been traced for over 1.4 kilometres,” stated Jim Walchuck, President and CEO of Zinc One, “The full extent of mineralization potential within this system has not been fully tested and remains open for the discovery of additional, high-grade mineralized zones.”

Unless you are familiar with geo-jargon like “dolomite breccia”, “anticlinal fold axis” and “plunging tabular bodies” – further deconstruction of the assay results may be fruitless.

Here’s what you need to know:

We believe there is a serious zinc deficit looming, a situation which began last year.

Fortunes can be made in zinc if you know how to play it.

The impending shortage of zinc is happening because two of the world’s largest zinc mines have run out of ore (Australia’s Century mine, and the Lisheen mine in Ireland).

Peru’s Energy and Mines Minister Gonzalo Tamayo stated that Peru is focused on, “the recovery of mining investment in 2018.”

According to Mining.com, Chinese year-to-date zinc production is down 1.3% to 5.65 million tonnes.

“Zinc prices have followed a 70% surge in 2016 with a nearly 25% gain this year to move comfortably above $3,000 a tonne.”

Despite Zinc One’s recent share price performance the market capitalisation is still only $30 million.

It’s early days.

Full Disclosure: Zinc One is an Equity Guru marketing client, and we own stock.