We admire patience.

Warren Buffett is a God.

The ability to delay gratification is a signpost of adulthood.

That said – it’s no secret that here at Equity Guru, we ride hot trends like weed, blockchain, cobalt and precious metals.

Our principal, Chris Parry has generated significant wealth for himself and our readers by correctly anticipating where the action is – and more importantly – where it’s going to be.

On January 22, 2018 Parry introduced us to his new girlfriend.

Her name is Lithium.

The reasons for his affection?

“First, the Chinese are coming. Having already snapped up Lithium-X (LIX.V) at a 22% markup to the market, another deal was done just before that which I’m now hearing buzz suggesting it could be step one of an all-in takeover of Millennial Lithium (ML.V)”

“Spodumene is hardrock-based lithium, and Canada appears to have a bunch of it. This is good for several reasons,” explained Parry, “It’s easy enough to get at, as it shows up in big ass crystals close to surface. It’s also generally of a higher grade and needs less alchemy to process, in that you’re digging and crushing, not sucking and floating.”

On January 25, 2018 Quantum Minerals (QMC.V) updated its exploration activities at its 100% owned Irgon Lithium Mine Project, S.E. Manitoba.

Another pegmatite dike, has been located approximately 50 metres north of the east end of the Irgon Dike. During the initial examination, localized spodumene mineralization was noted.

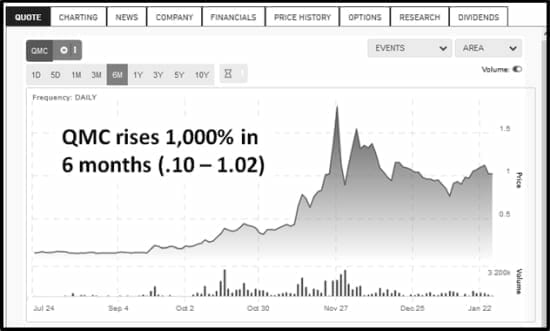

Since we first wrote about QMC, the stock has increased 10X.

QMC investors have reason to be optimistic about the spodumene-bearing Irgon Dike.

In our fall article we said:

“Spodumene is a major source of lithium, which can be extracted easily by acid fusion. Global production of lithium via spodumene is about 80,000 metric tonnes a year.”

“The initial work program at the Irgon Lithium Mine property will strip the overburden off the dike, exposing it along strike. QMC will then begin channel sampling to extend the known mineralized zone and confirm previous grab sampling, trenching and drilling results.”

“Officially, QMC is a grassroots project. Unofficially, it’s sitting on a mountain of historical data that, at the very least, offers a guide for modern day explorers.”

“You remember back when Samsung cellphones were being taken off airplanes?” asked Parry? “That happened because the current method of drawing varying grades of lithium from 70 different locations in China and tossing it all in one big bucket with graphite from who knows where and cobalt from child labour in the Congo… that’s apparently – who’d have guessed – not the best way to get your energy metals.

Weird.

Spodumene is in demand because nobody wants their cellphones blowing up and turning your crotch into a fireball not seen since the boys went on shore leave in ‘Nam.

But finding spod companies to invest in is kind of like finding spod itself; You’ve gotta look to Canada and you have to drill down.”

If you purchased Quantum Minerals in 2012, you watched the stock flat-line for half a decade.

That took patience.

Owning it now, in the midst of a lithium-ion battery revolution – doesn’t.

Full Disclosure: QMC used to be an Equity Guru marketing client. They aren’t anymore. Missed but not forgotten – we still own QMC stock.