We believe the price of gold is going up.

Here’s why:

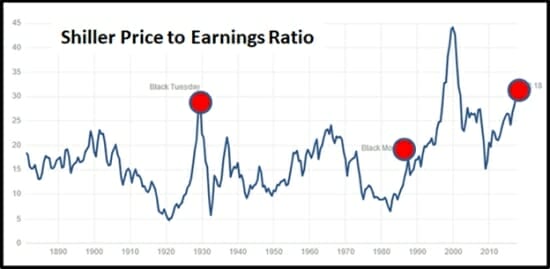

Those rising blue lines show investors cutting bigger and bigger cheques for diminished earnings. The P/E ratio of the major US stock markets recently passed the “Black Tuesday” level – which triggered the 1929 Great Depression.

Could it be different this time?

Yup.

Can we prove gold is going to $5,000?

Nope.

So let’s concentrate on what we do know, and what we can prove, and how you can profit from it.

There is a little African Country – pregnant with gold – that is finding its mojo, and finally opening up its arms to international investment.

Burkina Faso is one of the poorest nations in the world, but it is on a dramatic upswing.

The country recently built the biggest solar power generator in West Africa and gave a green light to a 2,000 kilometer fibre optic backbone.

There are some big gold companies operating successfully in Burkina Faso like Endeavour Mining (EDV.T) – a $2.6 billion gold miner – building the Houndé project with a projected annual production of 190,000 ounces at a cost of about $700 an ounce.

When the next stock market correction/crash/panic/disaster occurs, companies like Endeavour Mining will spike hard.

Smaller companies, like Nexus Gold (NXS.V) will spike harder.

NXS has 3 gold projects in Burkina Faso:

- The 178-sq km Niangouela gold concession where the company has delineated a 1km quartz vein and shear strike. Eight of the first nine diamond drill holes on the property returned positive gold results, highlighted by a 4.85m intercept of 26.69 g/t.

- The 38.8-sq km Bouboulou gold concession with historical drill results including 40m of 1.54 g/t. The property contains three distinct gold trends, each extending 5000 metres (5km) in length.

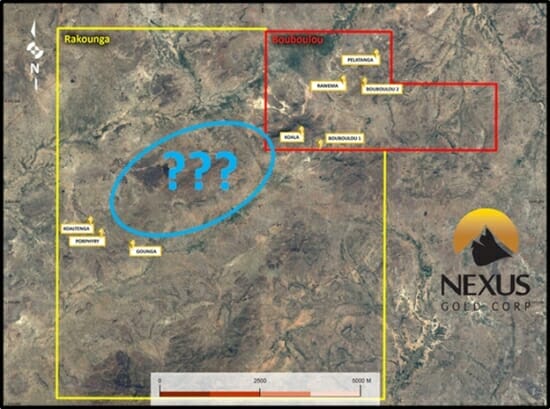

- The 250-sq km Rakounga gold concession contiguous to Bouboulou property, contains many artisanal mines.

We first wrote about NXS on March 7, 2017 commenting on a shiny drill program.

Nexus hit gold on eight of nine holes, with four of those being classed as ‘significant’. The best intercept was 4.85 metres of 26.69 grams per tonne. That’s almost an ounce per tonne across an almost 15-foot section at a depth of about 165 feet.

We also recently talked about the fact Nexus appears to have been the victim of some antagonistic trading patterns.

Someone made a move on Nexus to batter their stock sufficiently so they could either make an effort to buy it up cheap (hasn’t happened yet) and/or attempt to get a seat on the board (hasn’t happened to my knowledge), or it was a straight up personal assault looking to damage an insider’s holdings.

On October 31, 2017, Nexus announced the start of a 3,000 meter drill program on its 250-sq km Rakounga gold concession, targeting mineralized areas that were identified from a rock samples with gold values of 19.95 gram per tonne (“g/t”) gold , 2.57 g/t Au, and 1.175 g/t Au, respectively.

On December 13, 2017 Nexus announced assay results from the Rakounga gold exploration drill program. The news was significant.

According to the Nexus Geos, “Drill results now outline a trend of gold occurrences extending for 16 kilometres between the Company’s Rakounga and Bouboulou concessions.

Highlights include:

34 meters of 1.00 g/t Au, including 4m of 5.60 g/t Au

22 meters of 0.57 g/t Au, including 4m of 2.01 g/t Au

“The drill program at Koaltenga has successfully identified a broad zone of gold mineralization extending over 300 meters along strike and to depths of 80 metres below surface,” stated senior geologist, Warren Robb. “Three separate intercepts of near a gram over 30 meters is compelling.”

In the press release, Robb posited that “the workings at Koaltenga extend for at least another 300 meters to the northeast.” Given that, Nexus has decided that the workings to the northeast will constitute the primary target for phase 11 of drilling.

“Each of these board intercepts contained zones running 4 to 6 grams suggesting a prominent primary structure which has permeated out into the surrounding schists,” stated Robb, “Should we be fortunate enough to see this trend continue it would certainly enhance any potential economics to the project.”

The 1-year Nexus Chart is not pretty.

The original reasons we believed in Nexus are still valid. From a metallurgical perspective, the company has a greater underlying value than it did a year ago. And it’s cheaper.

Burkina Faso is the fastest growing gold producer in Africa. Eight new mines have been commissioned there over the past six years.

The country has a mining corporate tax rate of 20%, and a sliding royalty on gold production from 3-5%.

In the 2 years after the last big recession (Jan 2009-Jan 2011) gold went up 300% ($600-$1800), and the gold juniors soared.

When that happens again, Burkina Faso, the little African country that no-one talks about, will suddenly be very, very hot.

FULL DISCLOSURE: Nexus Gold is an Equity Gold marketing client, and we also own stock.