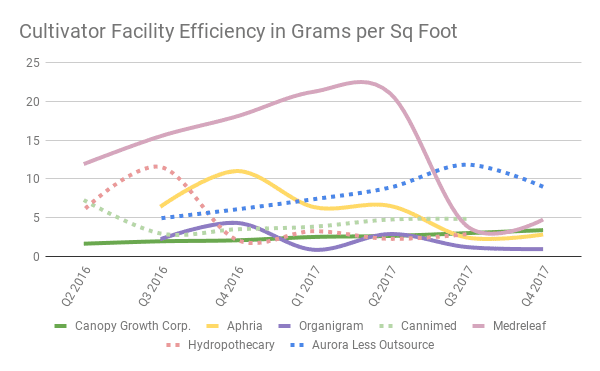

Previous instalments of Marijuana Data Jam looked at the size of the facilities being operated and built by Canadian marijuana cultivators and the their total production. It’s time now to bring them together and, through the magic of long-division, have a look at how they’re using their space.

“You Should See How Fit I’m Gonna Be This Time Next Year.”

Pot companies talk a lot about how much product they’re going to grow. They would prefer we measure their facilities (including the ones yet to be built) in terms of tens of thousands of kilograms of projected capacity. We’re not so sure about that.

The whole Canadian weed pubco universe sold 21,000 kilograms in the trailing 12 months. Health Canada has all private and public LPs selling 42,617 kg in fiscal 2016, 20,000 kg through Sept 2017. (They also report 171,000 kg in LP inventories, but market supply is a whole other discussion.)

It’s a popular strategy because it works. Give the people what they want. The market is a simple minded creature.

All things being equal, more square feet grow more product. But all things are never equal. Some of these companies are going to end up operating professional operations, and others are going to lag. Whether that’s going to make a difference is anyone’s guess, but since we have enough active facilities to find out, it pays to start looking at who’s getting the most out of what they have.

So let’s have a look:

It isn’t a peak and a dip, it’s new space coming on-line.

There’s some interesting separation in the company breakout that we think is going to matter once these companies have built out their full footprints, but first we have to explain what we’re up to.

Preamble

The practical facts of the Canadian cultivation licenses are as such:

After submitting an application, aspiring growers are responsible for showing Health Canada that they’ve assembled staff that can pass the required background checks, and that said staff will be producing cannabis in a facility that can be properly secured and surveilled.

That facility must also have the capacity to store product safely and securely, and destroy product that doesn’t measure up.

Such a facility having been built, the company is afforded the opportunity to produce a test crop for Health Canada. If it gets the thumbs up and, they’re allowed to sell what they grow to patients or other pot companies. As they produce, the goods are tested to ensure they aren’t poisonous. Batches that contain impurities or don’t measure up are subject to recall.

Insomuch as the LP is responsible for:

- making a facility that creates kilograms of high test dope whose production is

- limited only by the capacity available to store it, and

- the product being produced doesn’t do anyone any good until it is successfully sold,

we think it’s reasonable and practical to measure the efficiency of these LPs based on how much sellable product they are able to produce out of each square foot of facility they are currently operating.

A more pure way of valuing cultivation may be by grams produced per licensed square foot of canopy space. That was our initial knee jerk reaction. It lines up with the type of metrics we’re used to in resources, and it just seems fair. Besides the fact that it isn’t possible (not all companies publish their active canopy space), it doesn’t tell the whole story. Health Canada licenses whole facilities, not just grow space. And the configuration of those facilities are as much the responsibility of the producers as their operation is. By starting at the beginning (facility area) and ending at the end (grams sold) The Facility Efficiency Metric bakes it all in.

Facility Efficiency Metric

How It’s Calculated

Facility Efficiency = grams sold / square feet of active facility

For this first look, we’ve simply divided these companies’ quarterly production numbers by the square feet of their licensed facilities. We’ve only included here producers who have been producing and reporting for the trailing four quarters.

As the market matures, it’s possible that the way we value facility efficiency changes.

If it doesn’t sell, we don’t count it.

We’re not interested in the production numbers spit out by these companies. They aren’t verifiable, and they’re coming from the same people who are fond of telling us that they’re going to produce hundreds of thousands of kilograms out of facilities that are yet to be built. By tracking grams sold, we’re anchoring our data to something a little more tangible.

Simple, Right?

If only.

If it gets sold, does it count?

The grams that these companies are selling aren’t necessarily grams they’ve grown.

This revelation started with the great Organigram and Hydropothecary recalls of 2017. They still haven’t told the public how many grams were involved in their recalls, so we’ve been unable to account for them. To OGI’s credit, they do publish the volume of their sales that are filled by outsourced product, and we’ve subtracted those totals from their sales totals for the purpose of calculating efficiency.

Aurora bought and sold some of the Organigram product. The company told us that a) that was the only outside product that they bought and re-sold and b) it was about 4% of sales.

Initially, to account for the recall, we adjusted Aurora’s sales to 96% of what they reported for the purpose of calculating their facility efficiency… but that was just the start of it. If they were buying product from other LPs and re-selling it… how much? The company never could give us a straight answer. More on that here.

In an effort to standardize this process, we’ve done some reporting.

Some of these companies state quite clearly in their MD&A how many grams sold are actually re-sold. Others have replied to emails confirming that hey grew all of their grams all by themselves at company facilities. These companies have been graphed in solid lines. Other companies either couldn’t / didn’t answer, or allude to outsourcing but don’t say how much. We did our best to remove the outsourcing from these companies, but can’t be sure we’re right, so we’re representing them with dotted lines.

The first thing that jumps out is the fact that MedreLeaf appear to be almost playing a different game than everyone else. Immediately, the question becomes whether or not that efficiency will scale in the quarters that these companies are in full production on the properties that they’ve planned to expand into.

Here’s What’s Signal, and Here’s What’s Noise

This industry is still in the build-out phase. Those big dips like the one MedreLeaf had in Q317 have to do with them bringing more space on line, expanding their denominator.

If it were possible or practical, we’d weight the new space in the formula to account for how much of it is being used as it scales up. But, c’mon – we can’t even get a straight answer from these IR desks about outsourcing.

It’s reasonable to expect a company’s new facility to produce at a rate similar to their existing facility… eventually. Nobody really knows how long it takes to scale up or whether they’ll be able to get the same kind of rate out of the new space. We were close to a case study in scale-up with Cannimed, who brought 6,200 square feet up in Q2 2016, but it’s unclear if we’ll ever get to sort out what they did for sales in Q4 2017 now that the deal went through with Aurora.

“The Trend is Your Friend”

As stats people are fond of reminding us: it isn’t the data that counts, it’s the trend. In that context, the story may not necessarily be the numbers that we’re seeing out of Aurora and MedreLeaf, but rather the pitch of their climb. I re-made the chart without them so that we can get a de-cluttered look at the bottom.

Organigram aside, everyone appears to be headed in the right direction. OGI did bring on about 100,000 square feet of new floor space in the past 2 quarters, but it doesn’t look like they had been able to get all that much out of the 30,000 they had in the first place.

Cultivation is at the heart of the cannabis business. The growers that all of the ancillary businesses are able to operate. Sentiment is increasingly treating the prospects of recreational legalization and export as a parabolic demand curve and, as long as that’s the case, expansion will continue to be the order of the day. It’s unclear what kind of change the flicking of that switch will have on the output of these companies.

We’re going to keep tracking and reporting the facility efficiency metric, including looks at various ways to determine whether or not it matters.