The dazzling rate of adoption of blockchain technology raises a question: can you convert marital strife into controlled transactional sequences – increasing accountability and transparency?

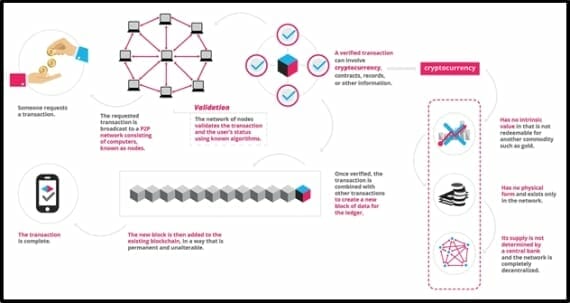

Blockchain is a shared — and continually reconciled — database stored across a network of computers. The transactions are public and verifiable in real time. Hosted by tens of millions of computers simultaneously, the data is accessible to anyone who owns a computer. For this reason, it is impossible to hack the system.

Put another way, the blockchain is a self-auditing ecosystem of a digital value.

Instead of rattling on about “cryptographic hash functions”, “specific integrated circuits” and “distributed ledgers” – let’s look at five innovative blockchain applications that have emerged in the last month.

- On October 20, 2017 Mastercard (MA.NYSE) announced news that it will be using blockchain technology for business-to-business (B2B) transactions, specifically to deal with payments that cross national borders.

Google and Goldman Sachs are also embracing this technology. In fact, in the last 3 years, 55 major financial services institutions have invested in blockchain.

The blockchain technology is integrated with Mastercard’s payment network, which includes 22,000 financial institutions.

“We have created a solution that is safe, secure, auditable and easy to scale,” stated Ken Moore, EVP, Mastercard Labs. “We want to provide choice and flexibility to our partners, where they are able to seamlessly use both our existing and new payment rails based on the needs and requirements of their customers.”

Mastercard has filed for 35 blockchain patents and invested in the Digital Currency Group, which is an incubator for cryptocurrency and blockchain start-ups.

- The Bill & Melinda Gates Foundation just launched Mojaloop – an open-source payment platform intended for people who lack access to traditional banking services.

Mojaloop’s mobile payment software, is powered by the Interledger technology.

According to the foundation, “it establishes a blueprint for connecting today’s financial services sector, and can be used as a solution to barriers that banks and providers have traditionally faced.”

Mojaloop is attempting to disrupt the stranglehold of traditional banks, “by crowding in expertise and resources to build inclusive payment models to benefit the world’s poor.”

- On October 21, 2017 Massachusetts Institute of Technology (MIT) released blockchain digital certificates to more than 100 graduates. The pilot project is a joint effort between MIT and Learning Machine.

The diplomas were issued via a special application which enables graduates to keep a “tamper-proof” and “verifiable” digital versions of their certificates with prospective employers.

“From the beginning, one of our primary motivations has been to empower students to be the curators of their own credentials,” stated Mary Callahan MIT registrar, “This pilot project makes it possible for the students to have ownership of their records and be able to share them in a secure way, with whomever they choose.”

- Shelita Burke is a successful Los Angeles pop singer who also happens to be data scientist and cryptologist.

“At an early age I knew, I need to learn how this world works and how to build things,” stated Burke in a recent interview.

Her latest EP has got 2.5 million listens on SoundCloud, her latest single “There” reached 1 million plays in its first day of release.

Burke is now attempting to use her data expertise to change the way musicians get paid. Previously, she was forced to wait more than six months to get royalties. She sees blockchain technology as a way to speed payment and ensure accountability.

She linked her album to her collaborators. The public can pay via bitcoin. When someone purchases the album, payments are sent – in real time – using an “Ethereum Smart Contract”. Incremental payments are sent immediately to her collaborators.

“People have always looked to artists as basically the way of the future, as influencers,” stated Burke. “It’s up to artists to move along technology in new ways.”

- Evan Prodromou founded Wikitravel and other influential tech start-ups. He is constantly being asked to consult with people he doesn’t know, usually to give them free advice. In an interview, he admitted he would rather give this time to his family and friends.

So he created “Evancoin” which has turned the consulting interactions into digital transactions. After Evancoin’s initial coin offering (ICO) on October 1, 2017, you can buy Evan’s time with Evancoins. Like other blockchain currencies, Evancoin can appreciate or depreciate, depending on the supply and demand.

“People wanted to know whether it was just a stunt,” Prodromou stated in a recent interview. “But I’m really serious about exploring how cryptocurrency is changing what we can do with money and how we think about it. Money is this sort of consensual hallucination, and I wanted to experiment around that.”

Still confused?

Don’t worry.

Blockchain technology is like automotive science. You don’t need to know how a car works to use it.

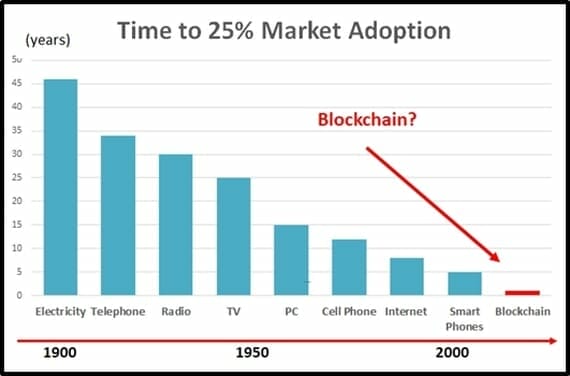

But here’s the reason every investor should pay attention: the rate of adoption has reached hyper-speed.

Blockchain is embedding itself into everyday life much faster than other destructive technologies, like PCs and Smartphones.

Credit cards, 3rd World banking, university credentials, song royalties and consulting fees.

Marital therapy?

Not yet.

But the block-train has left the station.

Very soon, we are all going to be on it.