Today we saw two pieces of news that may well illustrate what the next six months has in store for Canadian junior company investors:

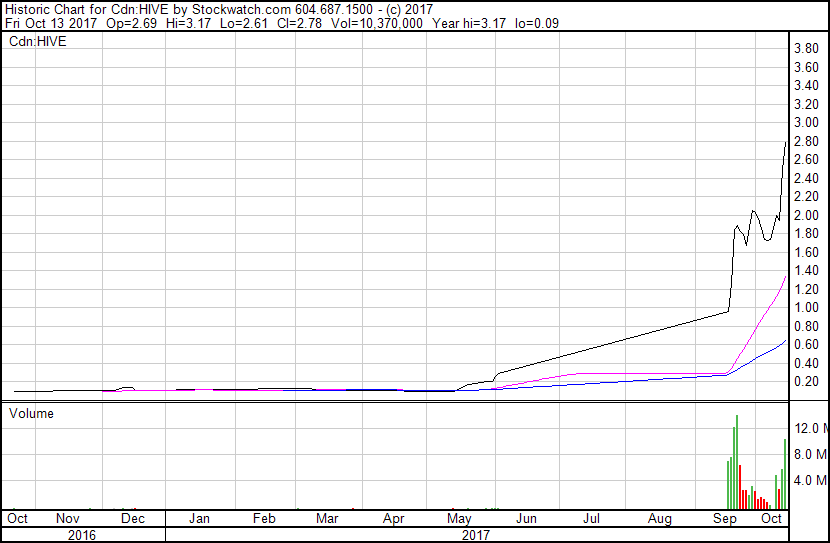

- HIVE Blockchain (HIVE.V) is going bananas

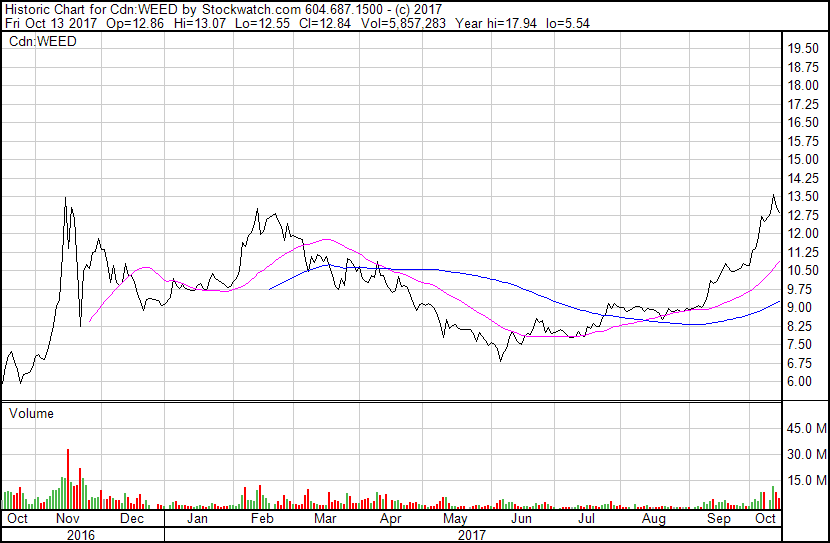

- Canaccord says it’s time to sell Canopy (WEED.T), hold Aphria (APH.T)

Boom. And just like that, HIVE takes off by 17%, climbing up to $2.93, just a day after it climbed from $2.01 to $2.50. That’s an almost 50% jump in just two days, after the stock had already doubled since it’s market listing a month back.

Canaccord also raised the target price of most other weed stocks, saying certainty in cannabis legislation moving to allow adult use had firmed, but that the two front runners were overpriced, and might struggle when the provinces start cutting into their retail margin.

Canopy’s most recent financials are not pretty. There’s a $5.3 million EBITDA loss on revenue of $14 million, which makes it tough to justify a $2 billion market cap especially as margins are about to shed. 58,000 patients is a nice thing, until the Ontario government tells you you’re not allowed to serve them directly anymore.

Aphria is showing a profit – the 8th straight quarter of positive EBITDA, and they’re making a big point out of lowering costs (currently $1.61 per gram all-in) to show they can do okay under a government distribution situation.

To be sure, if a licensed grower is currently producing at $3 per gram (or even half that), and selling to the patients they’ve spent millions acquiring for $10 per gram, and the provincial governments force those companies to instead sell to their proxies for $5 per gram, the big growers will need to sell a LOT more weed to come near profitability – or maintain their currently slim profits – under the new regime.

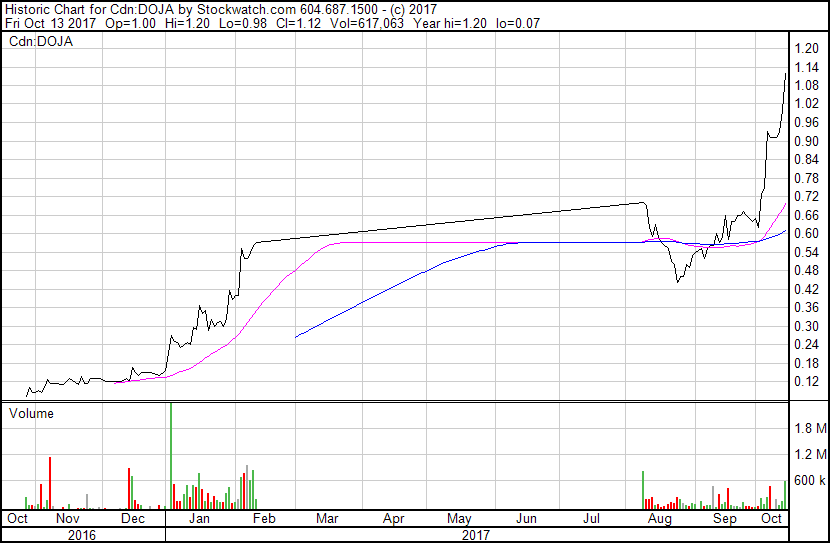

But not all weed producers are going to struggle with that concept, and certainly there are some that have a lot of valuation headroom left. Kelowna BC’s DOJA (DOJA.C) fell off hard after it debuted in early August, right in the midst of a sector fall-off. But from $0.45 to $1.20 in just under two months is a savage rebound that shows folks are still looking for value in a crowded space.

Among those buying DOJA stock over the last month have been the guys behind the company, deciding that if the market wanted to give them their stock back cheap, they’d be happy to take it. Trent and Maria Kitsch, and Ryan Foreman, grabbed a bunch of stock in the $0.50 range that has more than doubled in the weeks since.

Abcann (ABCN.V) had a similar early trading fade out when it landed on the markets in May, but has rallied from $0.82 to $1.19 in the last month with large volume daily.

Even little Canabo Medical (CMM.V), which couldn’t get arrested earlier in the year as the market favoured growing over researching, has gone from $0.30 to $0.48 in a month.

Canopy’s run has been similarly jacked, from $6.75 in June to $12.78 today, good for a market cap of $2.2 billion. Perhaps more concerning than the value of the company is the P/E Ratio of -100.54.

Multi-vertical player Cronos (MJN.V) has a market cap of $400 million, which Canaccord sees as much more likely to be good investment value.

New cannabis players continue to present themselves; Fincanna is a private outfit moving to public, which has a deal with Cultivation Technologies Inc (CTI) to finance a massive grow in California, where new regulations are about to radically tighten supply, with demand continuing to swell. Fincanna is at the tail end of a raise to complete their end of the deal, which looks kind of tasty in terms of what they’ll get in return.

- Investment of US$8.7 million in California marijuana grower facility

- Ongoing royalty to be paid based on 10% of revenue

- Minimum royalty of US$2m in first year and US$3.5 million each year thereafter

That’s a repayment of US $33.5 million over ten years, at a minimum, for that US$8.7 million down. Gotta like those numbers.

SIDE NOTE: If you wanna get in on that raise, let them know:

For Further Information or to Request the Accredited Investor Presentation please contact: Caleb Jeffries

VP Investor Relations

CALI@kincommunications.comTEL: 604-684-6730 | 1 866 684 6730

So while weed is trying to figure out if it has hit its apex, and weed investors continue to look for value at the peripheries, other sectors are also having a great time of it.

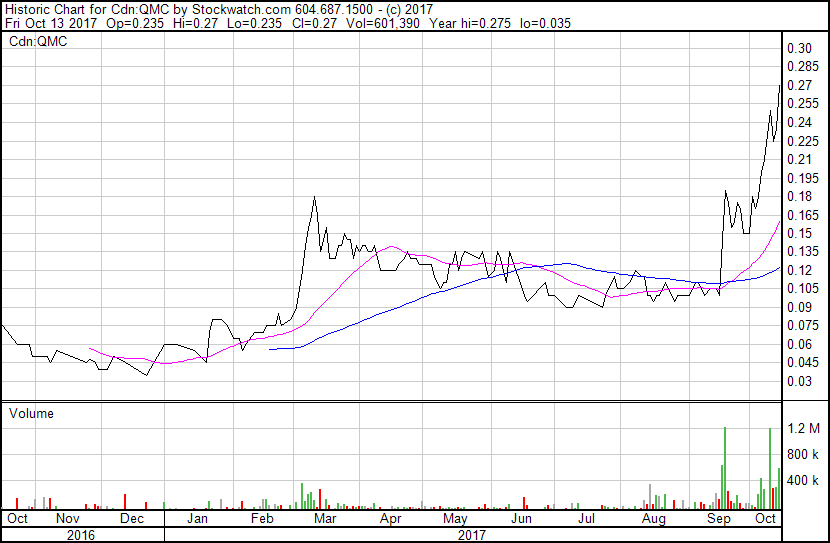

We noted QMC Quantum Minerals (QMC.V) was gearing up with a spodumene lithium play in the middle of Canada, and folks took notice. That stock has climbed so much, in fact, and with so little news coverage outside of ours, that the BCSC started looking deep at what we’d written about them, leading to an unprecedented conference call with their senior geos concerned that every word published be to the letter of compliance.

QMC is up from $0.095 to $0.25 at the time of writing, and is still short on actual news.

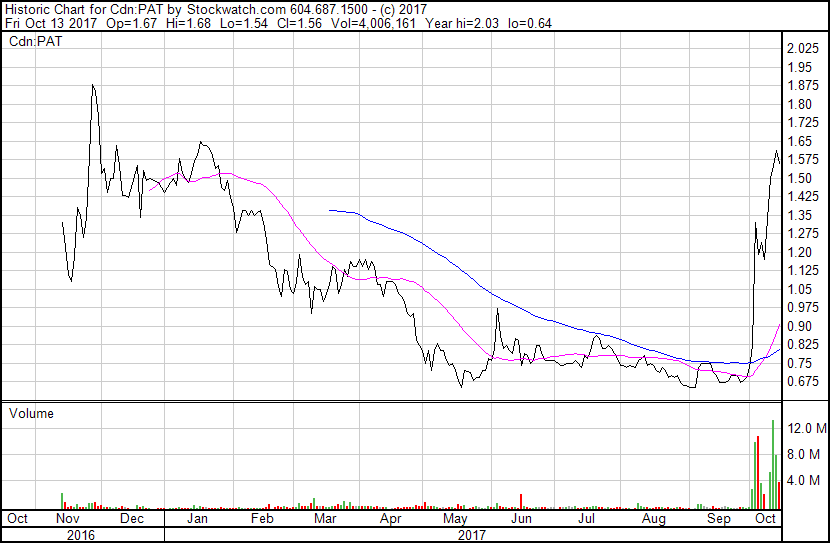

They’ll avoid saying so out of good taste, but the events in Las Vegas last week have had a major positive impact on Patriot One Technologies (PAT.V), which is developing tech that would have been real useful to figure out a guy was carrying bags of weapons up to his hotel room.

PAT.V was at $0.67 before Vegas. It’s at $1.58 now and couldn’t have timed the news that it’s Patscan CMR tech has received FCC approval any better. An $8 million bought deal financing was ramped up to $10 million within hours of its announcement, and there’s apparently an appetite for more.

This would be a good time to note that DOJA, ABCN, PAT, and QMC are Equity.Guru client companies, so congrats if you’ve been reading our coverage and thought it might be a good option to buy in on those. Fincanna is a recent addition to the EG family, so you’ll be hearing more about them in the weeks ahead.

So weed, mining, security – they’re having a moment.

But the buzz around blockchain companies is next level.

HIVE is the thin edge of the wedge. What’s coming in blockchain is going to dwarf what we’re seeing now.

I was at the centre of the mining-to-marijuana diaspora in early 2014. I saw how one company making the shift jumped in value exponentially and, by the end of the week, 40 more had joined in. This is now the situation with blockchain and cryptocurrency deals. I’m getting SO MANY CALLS about new blockchain companies, I honestly have to hire more people to keep up on the https://e4njohordzs.exactdn.com/wp-content/uploads/2021/10/tnw8sVO3j-2.png side.

New clients this week include Leonovus and DMG, with Calyx Bio-Ventures (CYX.V) looking to come back into the fold. There are maybe four others in the negotiation stage that may sign on soon.

We specifically positioned ourselves in the tech space in advance of this shift because we could see what was coming, and we feel that VR/AR will have a similar wave around Christmas.

But just tossing money at a hot sector is a sure fire way to lose said money.

The real problem for many? They don’t know what they’re investing in.

We’ll take care of that little problem next week when we start in-depth coverage of our new clients, and others in the space. Stay tuned.

— Chris Parry

FULL DISCLOSURE: Patriot One, QMC Quantum, Leonovus, DMG Blockchain, DOJA, Abcann, and Fincanna are Equity.Guru marketing clients. We hold investments in HIVE, DOJA, and Fincanna.

NB:

1. Doja Cannabis (“DOJA”) announced a name and symbol change on January 30th, 2018 as a result of its merger with TS Brandco Holdings Inc. (“Tokyo Smoke”). Effective 31 January 2018, the company trades as Hiku Brands under the ticker symbol HIKU.C

2. Pursuant to a resolution passed by the directors dated Nov. 27, 2017, Calyx Bio-Ventures Inc. changed its name to Calyx Ventures Inc. effective as at Feb. 5, 2018. The ticker symbol CYX is unchanged.