First Cobalt (FCC.V) is the Donald Trump of the battery space. Not because it’s conservative or confrontational. But because of its ability to dominate a news cycle.

The art of the deal

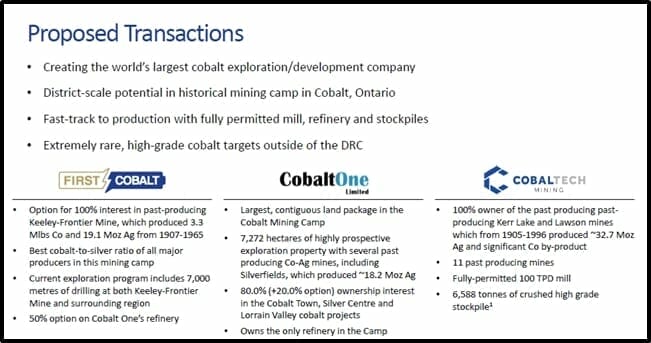

FCC recently announced a binding merger agreement with Cobalt One Limited (CO1.ASX). First Cobalt will acquire 100% of the share capital of Cobalt One. The total transaction value is about $140 million on a fully diluted in-the-money basis. Cobalt One will become a wholly-owned subsidiary of First Cobalt.

But that’s not all.

FCC is also acquiring 100% of CobalTech (CSK.V) giving FCC control of another 11 past producing mines near the town of Cobalt and a 100 tonne per day mill – complementing the Yukon refinery.

When the deal making orgy is over, Cobalt One shareholders will own 53% of “Merge-Co”, First Cobalt shareholders will own 35% and Cobalt Tech will own 11%.

It’s bigly!

These deals consolidate the largest land packages in the Ontario Cobalt camp into a single landholder with over 10,000 hectares. The new merged company will be the biggest cobalt explorer on the planet.

This news is not fake!

On Sept. 6, 2017 First Cobalt (FCC.V) revealed the results of its independent NI 43-101 technical report on its cobalt project in Ontario.

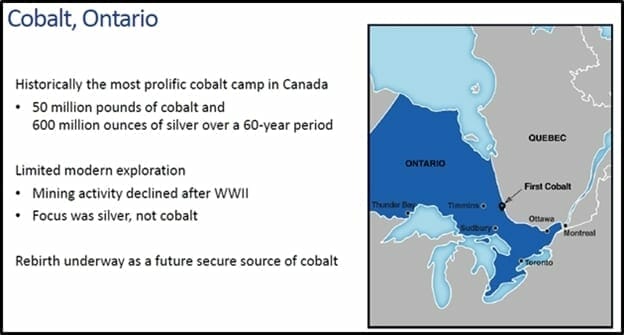

The Project area in the report covers 4,300 hectares in the old towns of Silver Centre and Cobalt, now commonly referred to as the Cobalt Camp.

Here are five key take-aways:

- Three historic mines within the Greater Cobalt Project (Keeley, Frontier, Bellellen mines) produced an aggregate of 3.3 million pounds of cobalt and 19.2 million ounces of silver.

- Provides a detailed list and map of all assessment work filed on the Greater Cobalt project

- Average feed grade from Keeley-Frontier was about 0.8% Co; possibly higher, due to unreported cobalt content in silver concentrates

- Cobalt Camp has potential to host additional arsenide silver-cobalt vein deposits warranting further exploration.

- Endorses the Company’s 2017 exploration program including use of modern geophysical and geochemical methods, as well as diamond drill testing of targets.

“The Technical Report supports our position that the Cobalt Camp has the potential to host new cobalt discoveries amenable to bulk mining,” stated Trent Mell, FCC President & CEO, “a 7,000 metre drill program at Keeley-Frontier and the surrounding region commenced August 8 and we look forward to announcing the first assay results in the near future.”

You can grab them by the production report

The report indicates that the cobalt content was about 0.2 lb. Cobalt for every ounce of Ag produced. Assuming that the Woods Vein accounted for 70% of cobalt production, this would give 2.3 million pounds of cobalt from 150,000 tons of feed.

That’s about $60 million of cobalt at today’s spot price, generated from an archaic mine that was not even looking for cobalt.

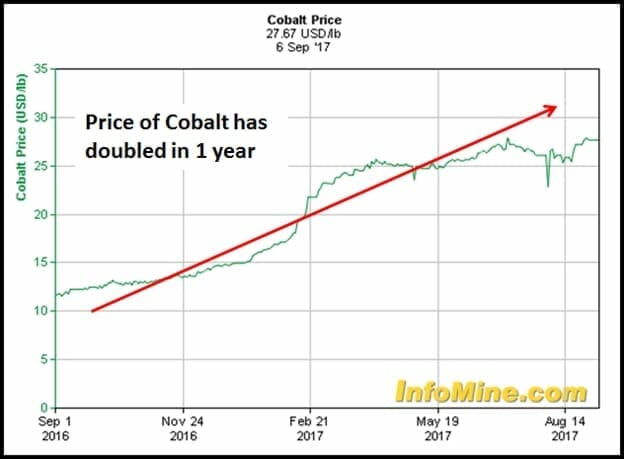

And yes – that $60 million figure is likely to keep drifting up. Cobalt is a critical ingredient in lithium-ion batteries. In the last 25 years – rechargeable battery cobalt consumption has increased 5,000%.

The 12-month cobalt spot price chart reflects that demand:

Historically, in this region, miners cared primarily about silver.

Cobalt, nickel, and copper rich veins were sporadically mined when metal prices were ideal. There was very little drilling within and cobalt was not routinely assayed in the holes, so the presence of Co-Ni-Cu in the veins is basically unknown.

First Cobalt’s 2017 exploration program is designed to provide a better understanding of the extent of cobalt as well as silver, nickel, and copper at the Keeley-Frontier deposit.

The current work program is focused on:

- Digital compilation of 50 years of historic Keeley-Frontier mine data to generate a 3D geological model

- Detailed and property-scale structural mapping of mineralized veins and host rocks

- Bore-hole geophysics and televiewer imaging of drill holes from the 2012 drilling campaign targeting the Beaver Lake Fault west of the former mine

- Systematic surface sampling at known prospects and occurrences throughout the property for assay analyses

- Detailed magnetic survey of the property

- 5,000 m of diamond drilling within the footprint of the Keeley-Frontier Mine testing targets from the 3D geological model

- 2,000 m of regional exploration drilling to identify new mineralized fault systems

You’re hired!

FCC’s management team includes resource legend Paul Matysek who served as CEO of Potash One, which was acquired by K+S Ag for $434 million in 2011. He was the founder and CEO of Energy Metals Corporation, a uranium company that grew in market cap’ from $10 million to $1.8 billion when sold in 2007.

First Cobalt has a market cap of only $34 million.

We think it’s significantly undervalued.

FCC has the right product (cobalt) in the right location (Canada) with the right people (Mell, Matysek).

It’s not just a frenzied news cycle.

FCC is getting stuff done.

Full Disclosure: First Cobalt is an Equity Guru marketing client. We are also investors in the company.